Determine If You Need A Self

You can expect to be classified as a self-employed borrower if you own 25% or more of a single business, or if you work as an independent contractor or service provider. A lender will also consider you to be self-employed if you work for a company that pays you as a gig worker instead of an employee, and provides you with a 1099 for your services rather than a W-2.

How much scrutiny you receive as a self-employed borrower will depend on the lender, the type of business you run and whether you have a co-borrower. Since your income isnt guaranteed by a traditional employment contract, a lender will ask for extra proof of income to make sure you can still afford a monthly payment. A lender may also consider you to be at higher risk of missing a payment if your earnings tend to vary from week to week. As such, it may ask for additional proof that your business is stable and that you have enough cash flow to handle a lower-earning month.

In general, a lender is likely to ask more questions about your business if:

- You receive 1099s for the income you earn instead of W-2s

- Your income shows up on the Schedule C section of tax returns

- You dont receive a guaranteed salary from your business

If You Received Money For A Down Payment

Finally, if you recently received a large sum of money that youre planning to use for your down payment, youll need to be able to document how you obtained that as well. If it was a gift from your parents or other relatives, youll need a gift letter from them stating the money is truly a gift and that you are not obligated to repay it.

If you sold a second car to raise the money, youll need to show the bill of sale. The key thing for lenders is making sure the money is truly yours and not part of an under-the-table financing arrangement reached with the sellers or a private loan you will be responsible for repaying, in addition to the mortgage.

Transparency is the most important thing when documenting proof of income, any way that might be. Lenders will need to take everything into consideration and any transparency is paramount to ensure no parties are involved in malpractises

What Is The Mortgage Approval Process

The mortgage approval process is one of the most vital steps to your home purchase.U nfortunately, it can also feel the most daunting. In general, there are 6 steps to the process, which can take anywhere from several weeks to several months.

Before you apply for a mortgage, make sure you have the required employment history that lenders look for and that you can provide suitable proof of income.

Also Check: How To Check If Your Taxes Were Filed

Does Every Lender Have The Same Policies For Self

Rules can vary based upon the lender and the type of loan you’re getting, so shopping around might be a little more difficult if you’re self-employed. This is because every lender has different policies in place regarding risk mitigation. As you look around, make sure you’re clear about what the lender will need from you.

Different Kinds Of Mortgages

If youre hoping to get your very first house in the foreseeable future, youre likely wondering about different kinds of mortgages that you might qualify for.

S good starting point is Net Lease 101, which was created to supply answers to basic questions regarding the web lease market.

In the majority of instances, a tenant chooses a rent-to-own option because he or she would like to be a homeowner, but isnt currently able to purchase, perhaps because of low credit or a scarcity of capital.

When you start looking for your first house begin searching estate agent websites online or Rightmove.

When the time comes, youll need to fill out the online application and upload income verification.

Don’t Miss: Do You Have To Pay Taxes On Life Insurance

Income Calculations For Self

Freddie Mac Self-Employed Mortgage With One-Year Tax Returns Income Calculations:

FREDDIE MAC Most mortgage borrowers and many loan officers are not aware of Freddie Macs one-year tax return guidelines. Depending on your automated underwriting system findings, you may only need to provide your lender with one year of income tax returns.

The general rule of thumb is if your business has been around for over five years. The borrower normally needs to have a decent credit score. AUS like strong borrowers. If the self-employed borrower has a strong history of being self-employed, you should only need to verify one year of income tax returns.

Gustan Cho Associates do not have additional LENDER OVERLAYS on their conventional mortgage products. Many mortgage loan officers are not experienced with Freddie Mac guidelines.

What Is The Most You Can Borrow If Youve Been Self

Typically, self-employed applicants can borrow pretty much the same as employed applicants , which is usually maxed out at 4.5x their income. In certain circumstances, those earning a higher wage are able to stretch this to a higher level if they can prove affordability.

Very occasionally, its possible to ask a lender to consider an income projection based on accounts that are to be drawn up before the year has ended. For instance, if youve been trading for say 20 months, you should have one years full accounts plus nine months of the second year .

If the most recent years first eight months are on track to show a much higher annual income, and youre looking to borrow more than 4.5x the previous years earnings then, depending on the strength of the rest of the application, a mortgage underwriter may consider using a qualified accountants projection and lend based on the anticipated income for the unfinished year.

For example Net profit Dec 2018- Dec 2019 = 22,000 Net profit Dec 2019 Aug 2020 = 25,000 An accountant may calculate that trading is likely to continue in line with the previous nine months. Therefore 25k / 9 months = £2.77kpm. £2.77kpm spread over 12 months would be approx £33.3k for the year.

A lender considering the 33.3k lending at 4.5x income would equal approx. a £150k mortgage, whereas if they only accepted the finalised accounts the max would be much less.

Important

Also Check: How Long Does Your Tax Return Take

What Documents Will I Need To Provide

Mortgage loan officers will want to understand the self-employed borrowers business, their expertise in their chosen field and their ability to earn a stable, consistent and ongoing income for at least the next 3 years.

While underwriting standards will vary based on the lender and the type of home loan youre getting, the same types of documents are likely to be required. Heres an overview of some of the common documentation used across the industry:

Learn The Alternatives To Self

If youve been told you dont qualify for a traditional mortgage or dont want the hassle of the documentation thats required, a non-qualified mortgage may be worth exploring. Non-QM loans dont meet the qualified mortgage standards set by the government, and theyre also sometimes called alternative or no income verification mortgages.

However, these arent the fog-a-mirror-and-get-a-loan products of the past new federal laws still require non-QM lenders to verify your ability to repay the loan.

Some of the more common non-QM mortgage options are:

- Bank statement loans. With this program, lenders calculate your income based on an average of your deposits over the last 12 to 24 months of your personal or business bank statements.

- Asset depletion. High-net-worth borrowers can convert assets into qualifying income with an asset depletion loan. For example, a non-QM lender offering a 20-year fixed asset depletion loan to a borrower with a $250,000 savings account might consider the balance to be equivalent to $1,041.67 per month worth of income .

Youll need a bigger down payment, and youll also pay higher closing costs and interest rates than you would with a regular self-employed mortgage. However, a non-QM loan may bridge the gap if your tax returns arent acceptable to traditional lenders.

Also Check: Can I Still File My 2017 Taxes Electronically In 2021

Are Draft Tax Returns Acceptable

Generally speaking, the lender will check to make sure the tax returns are signed and certified and backed up by notices of assessment. This is a simple fraud check to make sure that these are the tax returns you lodged with the Australian Taxation Office.

Draft tax returns are only accepted by some of our lenders if your accountant can write a letter confirming they are the final copy that will be lodged with the ATO.

You can find more information on how banks will assess your tax returns on our self-employed home loan page. Alternatively, make an online enquiry or call us on 1300 889 743

Will The Nature Of My Business Affect My Mortgage

The nature of your business is very unlikely to affect your mortgage chances. This is because lenders will make assessments largely on the income of your business. This is to assess the affordability of the mortgage youre applying for.

A lenders assessment is based on risk. Proving your business is generating a sustainable income is more important than the nature of your business. Its very rare that lenders will favour one business over another due to its business type.

You May Like: Federal Tax Married Filing Jointly

Using Business Accounts For Your Down Payment And Closing Costs

In some cases, you can use funds from your business accounts from your down payment.

Sometimes, though, the underwriter will ask you for a letter from your certified public accountant saying that taking money from the business wont jeopardize the ongoing health of the business.

Your CPA may or may not be willing to write this letter.

The underwriter wants to verify your business wont be short on cash and be forced to take out loans or shut its doors due to lack of funds. After all, your business is the source of your income, and if your income stream stops, you may default on your loan.

Any business funds used for closing costs or the down payment on a home should be excess money that the business will not need for the foreseeable future.

How Much Income Do You Need To Buy A Home

Your income is one of the most important factors lenders consider when you apply for a mortgage. But theres no minimum amount of income youll need to buy a home. Instead, lenders look at your debt-to-income ratio, which shows the percentage of your gross monthly income that goes toward debt obligations.

What the lender would be reviewing when issuing a pre-approval is what we call DTI, which stands for debt to income ratio, said Polina Solis, a Realtor in Texas. There are certain loan packages, such as conventional versus FHA, which have different DTI requirements. Generally speaking, you dont want to have your home monthly payment be more than 30% of your gross income.

There are two ratios lenders will look at. Your front-end DTI is your future monthly housing expenses compared to your gross monthly income. Your back-end DTI is all of your debt payments, including your housing payments, compared to your gross monthly income.

An acceptable DTI to purchase a home depends on other factors, including your credit score. But according to Solis, lenders generally require that borrowers have a DTI of no more than 45%. In some cases, they may be willing to allow for as high as 50% if the borrower has exceptional credit and additional cash reserves.

You May Like: Are Funeral Expenses Tax Deductable

Is It Possible To Remortgage

A remortgage is very similar to applying for a new mortgage, as in theory thats exactly what youre doing. The information in this guide can also be related to a remortgage with one years accounts.

The main difference when remortgaging when self-employed is that lenders will assess whether you have equity in your property. Youll need equity to remortgage, especially if you want to release equity. A track record of making repayments on time can also show lenders that youre in control of your finances. Remortgaging can be easier for these reasons.

Find Out What’s Happening In Petalumawith Free Real

Heres what one years tax returns means for loan qualifying!

Lets say you are commissioned employee. Lenders typically average the last two years of income taxes to average your income for qualifying purposes. While we only need the last years income, depending on what you earned that year you would not need to provide the previous years income tax returns for getting a home loan, enabling you to qualify more easily.

You May Like: Corporate Tax Rate In India

Competitive Rates: New American Funding

- Avg. Days to Close Loan31-40Get Startedsecurely through New American Funding Purchase’s website

New American Funding is a good choice for self-employed borrowers. It allows you to use bank statements to verify your income instead of trying to qualify with tax returns, W-2s or pay stubs, which you might not have with a fluctuating or lump-sum income.

New American Funding is also an excellent lender for first-time home buyers. You can opt for an FHA, USDA or VA loan. New American Funding also has educational resources to help first-timers understand the mortgage process.

New American Funding follows a standard closing process, meaning the time to close will depend on the client and loan type. You can choose to start with a prequalification or preapproval. Prequalification doesnt involve verifying your income. Preapproval means underwriters have reviewed your income and assets and are reasonably confident you will qualify for a home loan.

Requirements For Mortgage Without Tax Returns

Borrowers are typically self-employed The no tax return lender will need to verify this either with a business listing or a business license, a letter from your accountant, your website, etc. They may require one or more of these to prove that you are in business. 1099 borrowers may also qualify.

Down Payment Some no tax return mortgage lenders may ask for a 10% down payment, but it all depends upon your unique scenario. In most instances, the down payment may be higher. Other factors will impact your down payment such as credit score, assets, and more.

There are no specific credit score requirements, but your credit score will play a major role in what your down payment and interest rate will be. Let us help you to figure all of this out without having to run your credit.

No Tax Return Requirements Most of our lenders will ask for your last 12-24 months bank statements. The bank statements will be used as income verification. They will use the average monthly deposits and will treat them as income. They typically use 100% of the deposits from your personal bank accounts and a portion of your business accounts.

Other Assets It is important to list as many assets as possible to help with the approval of your mortgage application. Underwriters always look at compensating factors and assets is one of them.

Property Types Single family up to 4 units, second homes and investment properties.

Recommended Reading: Out Of State Sales Tax

Best For Bank Statement Home Loans: Angel Oak Home Loans

- Avg. Days to Close Loan30Get Startedsecurely through Angel Oak Home Loans’s website

Angel Oak Homes Loans offers a range of mortgage products from jumbo loans to FHAs, conventional and even investor portfolio loans. However, the hallmark of Angel Oak is its bank statement home loans. All you need to do is provide bank statements that prove your income so that you can skip over the mountains of tax returns and other documents that most lenders require.

Angel Oak allows you to get started online, shortening the process and allowing you to get the pre-approval youre looking for. You can also reach out to their customer service team at any time for additional support.

Required Documentation For Self

If you are a self-employed person applying for a mortgage, you will have to hand over more documents than a salaried or wage-earning employee would.

Depending on your personal finances, youll need to provide some of these extra documents:

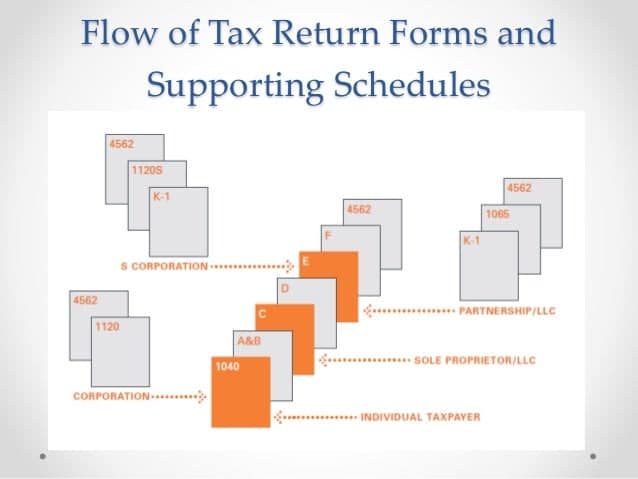

- Personal income tax forms: This includes two years personal tax returns along with all schedules you were required to file, including Schedule SE

- Proof of income: 1099 forms and/or W2s from your small business if you pay yourself a salary

- Business tax forms: These include K1s and forms 1120 and 1120S, if you were required to file those

- Profit-and-loss statement: This shows the current years finances and how they compare to previous years tax records

- Current clients: This list helps lenders see youre still earning the income reflected in tax statements

- CPA letter: This shows you are still running your self-employed business

- Explanation letter: To explain irregularities such as receiving most of your income at a specific time of year. Otherwise, the lender may think your profit-and-loss statement is off track compared to previous years income

If you are part of a business that has many owners, make sure all controlling parties agree that you can have access to business tax returns and can turn them over to a lender.

Read Also: Roth Vs Pre Tax 401k

Are Specialist Lenders Safe

Its important to remember that specialist lenders are designed for really tricky circumstances and are as credible as any other lenders available.

Our advisors have access to the whole market. We work with high street lenders in addition to specialist lenders too. Each lender, including specialist lenders, are registered and regulated by the Financial Conduct Authority .

Can You Get A Mortgage With No Tax Returns

Most people assume that you cannot get a mortgage unless you provide your tax returns for the last two years. However, there are mortgage options for people who cannot provide tax returns or if your tax returns do not show enough income to qualify for a mortgage.

The lenders who offer mortgages without providing tax returns typically design these loan programs for self-employed individuals. In most instances, they have a lot of business deductions lowering their net income to the point where the tax returns show very little income or even a loss.

Lenders who offer mortgages with no tax return requirement understand that the net income on your tax returns is not as important as the amount of money that you are bringing in each month. As a result, they are instead asking to see 12-24 months bank statements. It is a great way to finance your dream home without having to provide tax returns.

Contact us to find out more about your options or to get an idea what your rate would be. If you can just quickly complete the form to the right or at the bottom of your screen if you are reading this on a mobile device. We will get back to you right away.

Can you get a mortgage with no tax returns? There are lenders who have loan programs for individuals who cannot provide tax returns. They are designed for self employed borrowers who have not filed returns or show a very low net income.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Read Also: Personal Tax Return Due Date 2022