What Is The 2021 Short

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period begins ticking from the day after you acquire the asset, up to and including the day you sell it.

- For 2021, ordinary tax rates range from 10% to 37%, depending on your income and filing status.

You May Like: Haven T Received Tax Return

Establishing The Rental As Primary Residence

You might find that an investment property you rent and plan to sell has spiked in value. It may be a good idea to move into the rental for at least two years to convert it into a primary residence to avoid capital gains. However, you wont be able to exclude the portion you depreciated while renting the property.

Youll lose primary residency status on your main home, but it can always be gained later by moving back in after the sale of the rental property. As long as you dont plan to sell the main home for at least two years, you can re-establish primary residency and qualify for the capital gains exclusion later.

Read Also: Income Tax By State Ranked

Hold Your Investments Longer

The long-term capital gains tax rate is usually lower than the rate for short-term capital gains. An individual making up to $41,000 in taxable income, or a married couple making up to $83,000, will pay no taxes at all on a long-term capital gain in 2022. These same people would pay up to 12% for a short-term capital gain. And the difference could be 20% for long-term capital gains versus 37% for short-term capital gains earned in tax year 2022 for very high earners.

Don’t Miss: How Does Tax Write Off Work

Tips For Lowering Capital Gains Taxes

Hanging onto an investment for more than a year can lower your capital gains taxes significantly.

Capital gains taxes also dont apply to so-called tax-advantaged accounts like 401 plans, IRAs, or 529 college savings accounts. So selling investments within these accounts wont generate capital gains taxes. Instead, 401s and IRAs are taxed when you take distributions, while qualified distributions for Roth IRAs and 529 plans are tax-free.

Recommended: Benefits of Using a 529 College Savings Plan

Single homeowners also get a break on the first $250,000 they make from the sale of their primary residence, which they need to have lived in for at least two of the past five years. The limit is twice that for a married couple.

For newbie investors, it might be helpful to know that you may deduct as much as $3,000 in losses from an investment to help offset the amount of taxes on your income.

How Are Capital Gains Calculated

Capital gains and losses are calculated by subtracting the amount you paid for an asset from the amount you sold it for.

If the selling price was lower than what you had paid for the asset originally, then it is a capital loss.

You can then use this amount to calculate your capital gains tax.

Don’t Miss: Short-term Rental Tax Loophole

Compared To Other Taxes

The maximum long-term capital gains taxes rate of 23.8% is lower than the highest marginal rate of 37%.

Proponents of the lower long-term capital gains tax rates say the discrepancy exists to encourage investments as well as risk-taking. It may also prompt investors to sell their profitable investments more frequently, rather than hanging on to them.

How Do I Calculate Capital Gain On The Sale Of Property

You must first determine your basis in the property. Your basis is your original purchase price plus any fees that you paid minus any depreciation taken. Next, determine your realized amount. Your realized amount is the price that youre selling the property for minus any fees paid by you. Finally, you need to subtract your basis from your realized amount. If the figure is positive, then you will have a capital gain. If the figure is negative, then you will have a capital loss.

You May Like: Rv Sales Tax By State

C In The Above Computation Indexation Means:

Indexation is the process that takes into account inflation from the time taxpayer bought the asset to the time taxpayer sell it. The way it works is that it allows taxpayer to inflate the purchase price of the asset to take into account the impact of inflation. The end result is that you get the benefit of lowering your tax liability.

Formula for calculating the indexation:

How Can You Minimize Capital Gains Taxes

There are several ways you can minimize the taxes you pay on capital gains:

Also Check: Live In One State Work In Another Taxes

Take Advantage Of Favorable Capital Gains Rates

The low capital gains rates are one of the major perks of earning income through investing. And regardless of the outcome of the 2020 election, these tax rates will remain in effect at least through the end of this year and likely for 2021. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president — which is not a speedy process.

The $16,728 Social Security bonus most retirees completely overlookIf you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

What Are Unrealized Capital Gains

Most of the time, when someone mentions a capital gain, they’re talking about a realized capital gain — this happens when you sell an asset and make a profit. An unrealized capital gain is what you have when an asset’s value has gone up but you haven’t yet sold it. If you buy a stock for $100 and the value goes up to $150, you have an unrealized capital gain of $50. If you sell it, you’ll then have a realized capital gain of $50.

Importantly, unrealized capital gains are not taxed.

You May Like: Texas Franchise Tax Instructions 2021

Etfs Index Funds And Mutual Funds

For diversified stock funds, the risk tends to be limited to short term volatility. Take an index fund pegged to the S& P 500 as an example. Even though the fund has up and down years, over the long-term, its historically averaged out to a gain. If youre planning to hold for the long-term, this short-term volatility wont be as much of a concern. As a result, diversified funds such as index funds and exchange-traded funds could be considered long-term investments.

» Not sure what an index fund is? Learn more about this easy way to enter the stock market

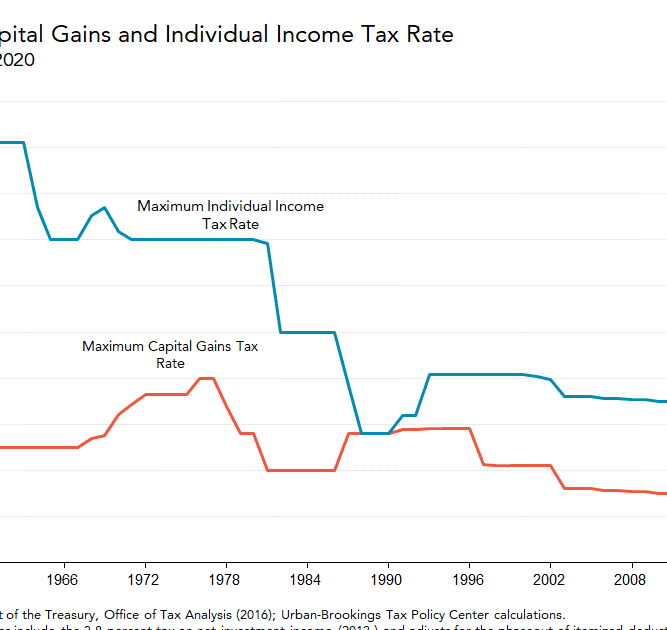

Compared With Historical Capital Gains Tax Rates

Because short-term capital gains tax rates are the same as those for wages and salaries, they adjust when ordinary income tax rates change. For instance, in 2018, tax rates went down because of the Trump Administrations tax cuts. Therefore, so did short-term capital gains rates.

As for long-term capital gains tax, Americans today are paying rates that are relatively low historically. Todays maximum long-term capital gains tax rate of 23.8% started in 2013, when the Obamacare 3.8% tax was added.

For comparison, the high point for long-term capital gains tax was in the 1970s, when the maximum rate was at 35%.

Going back in time, in the 1920s the maximum rate was around 12%. From the early 1940s to the late 1960s, the rate was around 25%. Maximum rates were also pretty high, at around 28%, in the late 1980s and 1990s. Then, between 2004 and 2012, they dropped to 15%.

You May Like: What Is Form 5498 For Taxes

Don’t Miss: What States Have No Income Taxes

Capital Gains Tax: Short

Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset.

Here are the differences:

- Short-term capital gains tax is a tax applied to profits from selling an asset youve held for less than a year. Short-term capital gains taxes are paid at the same rate as youd pay on your ordinary income, such as wages from a job.

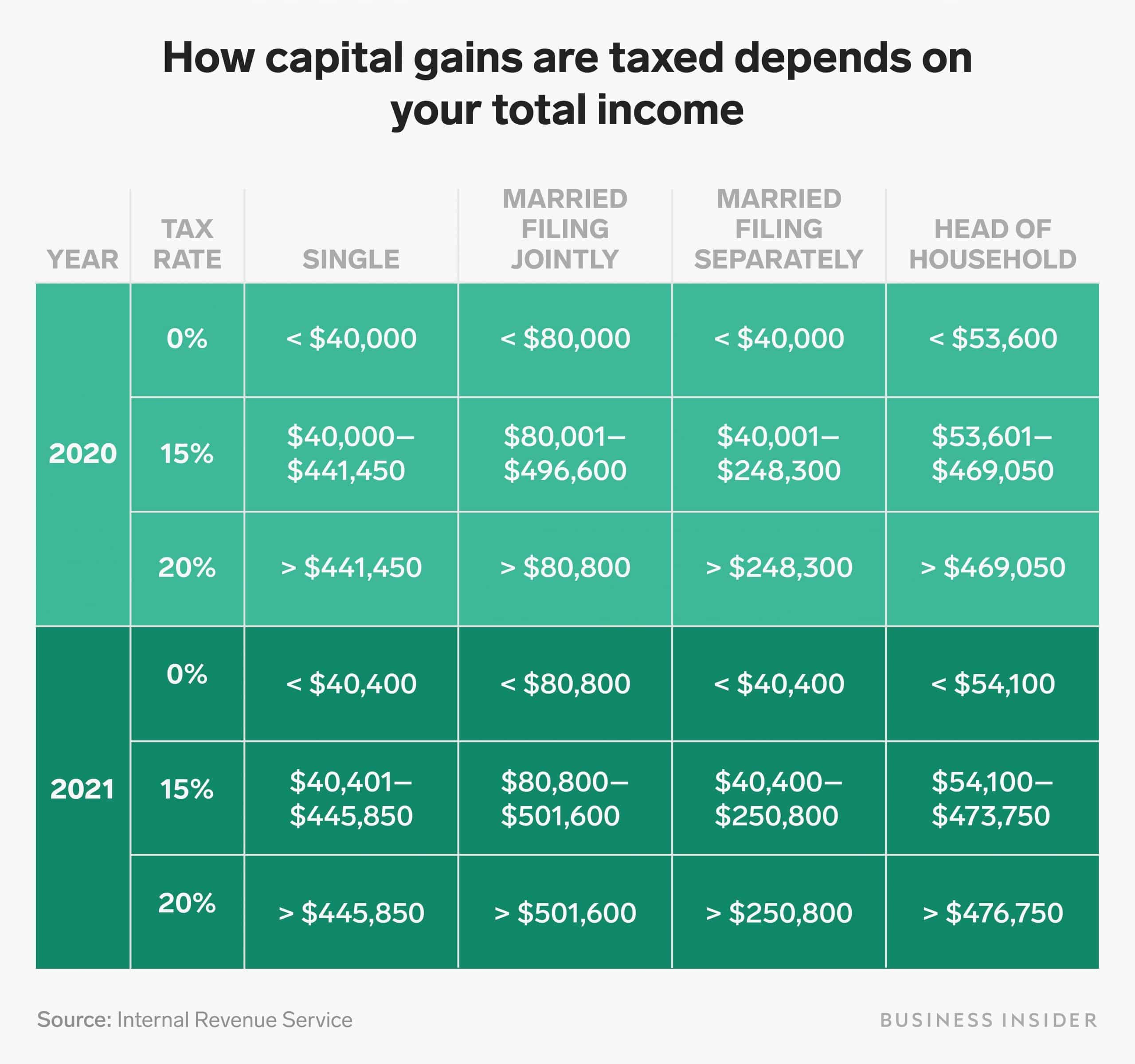

- Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate.

Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own set of rules .

How Are Capital Gains Rates Changing This Year

Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. When you sell an investment for more than you paid for it, you’ll have to pay taxes on your gains at either the short-term capital gains rate or the long-term capital gains tax rate.

The long-term capital gains rate is below the tax rate you’ll pay on most other income. In fact, long-term capital gains are taxed at either 0%, 15%, or 20%, depending on your income, and the threshold for each rate can change from one year to the next. Here’s what you need to know about the 2021 capital gains tax rates, as well as how you can minimize the money you pay the IRS when selling profitable investments.

Image source: Getty Images.

Read Also: When Can You File Your Taxes

Exempt Capital Gains Balance

When you filed Form T664 for your shares of, or interest in, a flow-through entity, the elected capital gain you reported created an exempt capital gains balance for that entity.

Note

Generally, your ECGB expired after 2004. If you did not use all of your ECGB by the end of 2004, you can add the unused balance to the adjusted cost base of your shares of, or interest in, the flow-through entity.

Example

Andrew filed Form T664 for his 800 units in a mutual fund trust with his 1994 income tax and benefit return. He designated the fair market value of the units at the end of February 22, 1994, as his proceeds of disposition. Andrew claimed capital gains reductions of $500 in 1997 and $600 in 1998. At the end of 2003, his exempt capital gains balance was $2,250. In 2004, he had a $935 capital gain from the sale of 300 units. This left him with an unused balance of $1,315 at the end of 2004. In future years, he can only add the unused ECGB to the cost of any remaining units.

1. ECGB carryforward to 2004

6. Unused ECGB at the end of 2004

The unused ECGB expired after 2004 so Andrew can add this amount to the adjusted cost base of his shares of, or interest in, the flow-through entity.

What Is The Capital Gains Tax On Property Sales

Again, if you make a profit on the sale of any asset, its considered a capital gain. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules.

For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly.

If youre just flipping a home for a profit, however, you could be subjected to a steep short-term capital gains tax if you buy and sell a house within a year or less.

Recommended Reading: Haven T Received Tax Return

Don’t Miss: State Income Tax By States

How Earned And Unearned Income Affect Capital Gains

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. It’s money that you make from other money. Even if you’re actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, “unearned” doesn’t mean you don’t deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

Capital Gains Tax Brackets

There are two main categories for capital gains: short- and long-term. Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%.

Remember, this isnât for the tax return you file in 2023, but rather, any gains you incur from January 1, 2023 to December 31, 2023.

The actual rates didnât change for this year, but the income brackets did adjust significantly due to rising inflation.

Also Check: State Of Ct Income Tax

When Do You Pay Capital Gains Taxes

You will only owe capital gains tax when you sell investments at a profit and realize your gains. If your stock value is rising on paper but you have not yet sold any shares, you won’t owe capital gains taxes until you sell. This differs from income on dividends and interest, which are taxed when they are paid out even if you reinvest the money.

Capital gains taxes apply to most investments, with some exceptions including jewelry, antiques or art, or other collectibles. Income from a business interest is not taxed at the capital gains tax rate if you are actively involved in the company.

Profits earned from the sale of real estate are also taxed as capital gains, even if you sell your primary home. However, there is a large capital gains tax exemption that allows you to avoid paying taxes on up to $250,000 in gains as a single filer or $500,000 as a joint filer if you meet certain requirements, including living in the home for at least two of the five years prior to the sale.

B Computation Of Long Term Capital Gain:

| Particulars | |

|---|---|

| Long-Term Capital Gain | XXXXX |

If the asset becomes the property of the assessee by way of gift, inheritance or will, by succession and the asset became the property of the previous owner before 01/04/2001, the cost of acquisition will be Cost to previous owner OR fair market value as on 01/04/2001 at the option of assessee

You May Like: Sales Tax Calculator For Tennessee

Some States Have Tax Preferences For Capital Gains

The federal government taxes income generated by wealth, such as capital gains, at lower rates than wages and salaries from work. The highest-income taxpayers pay 40.8 percent on income from work but only 23.8 percent on capital gains and stock dividends.

While most states tax income from investments and income from work at the same rate, nine states Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin tax all long-term capital gains less than ordinary income. These tax breaks take different forms. Typically, these states allow taxpayers to exclude some or all of their capital gains income from their taxable income, but others levy a lower rate than the state tax on ordinary income or provide a credit equal to a percentage of the taxpayers capital gains. In addition, a handful of states provide breaks only for capital gains on investments in in-state businesses, and a few states target preferences to investments in specific industries, like farming in Iowa and Wisconsin.