Factors To Weigh When Making Your Decision

First, there is no right or wrong answer and the important thing is that you contribute as much as you can. The maximum employee contribution in 2019 for pre-tax, Roth, or an aggregate combination of the two is $19,000 . It is also worth noting that any employer match you receive will always be pre-tax regardless of your election, so even if you are making 100% Roth contributions into the plan you will naturally have some diversification across tax profiles.

The election decision can be boiled down to two variables: 1) whether you prefer to pay taxes now or later, and 2) what your tax rate will be at both of those points in time. If you expect your income to increase in the future, which would likely increase your marginal tax rate, then Roth contributions are compelling because you are locking in your tax rate now. Additionally, if you believe income tax rates will increase in the future or you plan to move to a higher income tax state at some point, Roth contributions could be beneficial. By contrast, if you believe your marginal tax rate will decline in retirement, a pre-tax 401k contribution is a logical decision. Keep in mind that even if your contribution rate is held constant, your net paycheck will be lower if you are making Roth contributions, so you should plan for that within the context of your ongoing cash flow needs.

Wealthspire Advisors LLC is a registered investment adviser and subsidiary company of NFP Corp.

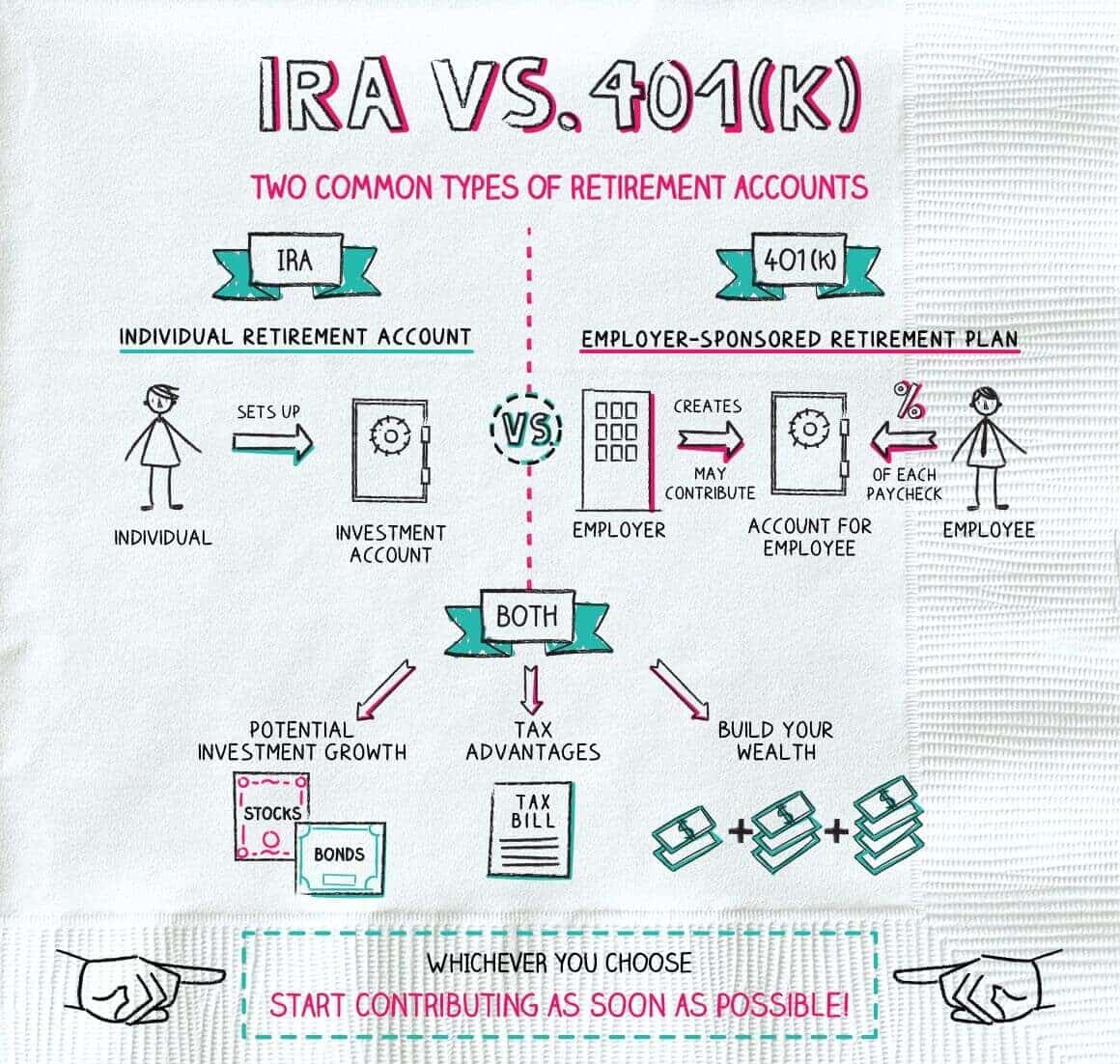

Roth Ira Vs : An Overview

Both Roth IRAs and 401s are popular tax-advantaged retirement savings accounts that allow your savings to grow tax free. However, they differ where tax treatment, investment options, and employer contributions are concerned.

Contributions to a 401 are made pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. The amounts are tax deductible, thereby reducing your taxable income. However, in retirement, withdrawals are taxed at your then-current income tax rate.

Conversely, there is no tax deduction for contributions to a Roth IRA. However, the contributions and earnings can be withdrawn tax free when in retirement.

In a perfect scenario, investors would use both accounts to put aside funds that can then grow tax deferred for years. However, before deciding on such a move, there are several rules, income limits, and contribution limits that investors should be aware of.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about Roth 401s versus traditional 401s and other investment options, its a good idea to sit down with an investment professional who can help. Remember, its never a good idea to invest in something you dont fully understand.

If you need help looking for a qualified investment pro, be sure to try our SmartVestor program. SmartVestor is a free way to get connected with local financial advisors near you.

You can start building a relationship with a pro who understands and can help guide your financial journey today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Read Also: How Old Do You Have To Be To File Taxes

Rmds: You Do Have To Take Them

There’s a difference between how annual required minimum distributions are handled for a Roth 401 compared to a Roth IRA.

Roth IRAs do not mandate RMDs during the lifetime of the account holder. Roth 401s do. The good news: The money is not taxable, unlike the money you take from a traditional 401. Even better, because Roth 401 distributions are not taxable, they have no impact on the taxability of your Social Security benefits.

The bad news: Once you take a distribution from your Roth 401, that money cannot continue to grow tax-free.

How Roth 401 And Pre

Lets look at a real quick example. Lets say were doing a pre-tax contribution, a traditional 401 pre-tax contribution, and you make $2,000 every couple of weeks, $4,000 a month. Lets just say that your tax rate is 15%. And we can run a thousand different scenarios, but lets just assume that your tax rate is 15%.

Now, if youre saving 10%, youre going to get that straight $200, because youre not paying tax on that $2,000 semi-monthly check on the contribution of that. So lets just say $4,000 a month, youre not paying that that 15% in taxes and then making the contribution. Youre actually getting that full $200 per paycheck, $400 per month, into the pre-tax 401.

Now, lets take a look at the Roth contribution. With a Roth contribution, that same semi-monthly paycheck is actually going to be the same $4,000. However, now youre paying 15% in taxes on that $4,000 that you just earned.

Youre paying your income taxes now. And so, that 15%, thats going to basically knock down that 10% that you can save, which leaves you $170 per paycheck that you can actually put into the 401. So its less money that goes in because you already paid your taxes.

So just keep that in mind. If youre playing apples to apples with the comparison, youre going to be saving less money into the Roth IRA because, all things being equal, you paid your taxes up front. So just keep that in mind.

Recommended Reading: Va State Tax Refund Status

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Roth 401 Vs Traditional 401 Withdrawal Rules

Early withdrawal rules are very similar for both Roth 401s and traditional 401s. The main difference is the income taxes you pay on your contributions.

With a traditional 401, you pay income taxes on any contributions and earnings you withdraw. With a Roth 401, income taxes only apply to your earnings since you have already paid up front on the money you put into the account. The 10% IRS early withdrawal penalty still applies to both plans.

You May Like: How Long To Get Tax Return

Withdrawal Plan In Retirement

You also have to look ahead to your retirement years and estimate what your income picture might look like. If you anticipate that you will need the same level in retirement that you have now, even though you might have a shorter time horizon to retirement, it may favor making Roth contributions because your tax rate is not anticipated to drop in the retirement years. So why not pay tax on the contributions now and then receive the earnings on the account tax-free, as opposed to making pre-tax contributions and having to pay tax on all of it. The benefit associated with pre-tax contributions assumes that youre in a higher tax rate now and when you withdraw the money you will be in a lower tax bracket.

Some individuals accumulate balances in their 401 accounts but they also have pensions. As they get closer to retirement, they realize between their pension and Social Security, they will not need to make withdrawals from their 401 account to supplement their income. In many of those cases, we can assume a much longer time horizon for those accounts which may begin to favor Roth contributions. Also, if those accounts are going to continue to accumulate and eventually be inherited by their children, from a tax standpoint, its more beneficial for children to inherit a Roth account versus a pre-tax retirement account because they have to pay tax on all of the money in a pre-tax retirement account as some point.

Beware The Pro Rata Rule On Conversions

If you have traditional IRA accounts with deductible contributions, youll need to factor that in if you convert any nondeductible amounts into a Roth IRA. Youll need to follow the IRSs pro rata rule, which forces you to calculate the tax consequences considering your IRA assets in total.

In effect, youll have to figure out what proportion of your funds have never been taxed that is, deductible contributions and earnings to your total IRA assets. That percentage of the conversion is subject to tax at ordinary income tax rates.

Its a complex calculation and can create significant confusion.

Also Check: California Llc First Year Tax Exemption

Converting A Traditional Ira To A Roth Ira

If you are strapped for cash, the Roth IRA option may be a tougher commitment to make. The traditional IRA takes a smaller bite out of your paycheck because it reduces your overall tax liability for the year.

Even if you feel that you have to forgo the Roth option for now, you might consider converting your account from a traditional IRA to a Roth IRA in a few years, when youre more financially comfortable. But be aware that all the taxes you were deferring in the traditional IRA will come due in the year when you do the conversion.

A Roth IRA is generally the better choice if you think you will be in a higher tax bracket after retiring. Income tax rates could increase. Or your overall income could be higher due to a variety of factors, such as Social Security payments, earnings on other investments, or inheritances.

If youre considering converting from a traditional IRA to a Roth IRA, you may be able to lessen your tax liability if you time the conversion right. Consider making the move when the market is down , your income is down, or your itemizable deductions for the year have increased.

The Choice Is A ‘tax Bet’

Taxes are therefore a primary consideration when choosing to save via pre-tax or Roth.

It comes down to this question: Do you expect your tax rate to be higher or lower in retirement?

If higher, it makes sense to save in a Roth account now and pay taxes at your current, lower rate. If lower, saving in a pre-tax account and deferring your tax bill generally makes more financial sense.

Consider this: If your present and future tax rates are identical, the pre-tax versus Roth choice doesn’t matter from a mathematical standpoint, said David Blanchett, head of retirement research at PGIM, an asset-management arm of Prudential Financial. You’ll end up with the same amount of after-tax retirement savings.

Of course, it’s impossible to know what your future tax rate will be lower, identical, higher due to unknowable personal circumstances and future policy adjustments.

“You’re really just making a tax bet,”Ted Jenkin, a certified financial planner and CEO of oXYGen Financial, said of the choice.

Don’t Miss: Do Retirees Need To File Taxes

Roth Ira Taxes On Withdrawals

The other thing about Roth IRA taxes is that you get the benefit of tax-free withdrawals in retirement although, technically, thats not so much a blessing as it is delayed gratification. While your investment earnings grow tax-free, its also true that with a Roth IRA you have to pay taxes upfront on your contributions.

That is, your Roth IRA contributions are made with money youve already paid tax on, and then you get entirely tax-free withdrawals in retirement.

Why is paying taxes now a good thing? Because if you think about it, retirement is potentially the worst time to be facing big tax bills. By definition, youre not working. So getting those taxes out of the way long before retirement, when youre still collecting a paycheck, is not a bad idea.

» Like the sound of tax-free retirement income? Find out how and where to open a Roth IRA.

Roth : For The Young The Big Savers And The Big Spenders

Its an underutilized retirement savings vehicle, so here are three scenarios to consider

Theres a good chance your workplace 401 gives you the choice of a traditional 401 or a Roth 401. And theres an equally good chance youre passing up a valuable way to create tax-free income for retirement because you didnt choose the Roth.

According to Vanguard, nearly 70% of the plans it administers offered a Roth option in 2017, up from barely half in 2013. Yet, Vanguard says just 12% of people who could be saving in a Roth are using one.

That could be a costly missed opportunity. Whether you are a 20-something just starting to save for retirement, or a boomer who has diligently saved for decades, using the Roth 401 has the potential to be a big win in retirement.

Traditional vs. Roth: A taxing question

The only difference between the two accounts is when you pay tax. With a traditional 401, the money you contribute each year is pre-tax. For instance, if you make $100,000 and contribute $12,000 to a traditional 401, your taxable salary will be reported as $88,000. With a Roth 401, theres no upfront tax break youre saving money that has already been taxed.

In retirement, the tax tables turn. Every penny you withdraw from a traditional 401 will be taxed as ordinary income. Every penny you take out of your Roth 401 will be tax-free. Having tax-free income in retirement can be financially wise in a variety of scenarios:

Read Also: Sales Tax In Alameda County

Is It Better To Contribute To A 401 Or A Roth 401

Both have their advantages. It depends on when you want to pay taxes. In a traditional 401, your contributions are deducted from your pre-tax earnings and you pay taxes on those contributions and any investment earnings years later, after you retire and begin making withdrawals.

In a Roth 401, your deductions are made from your net after-tax income, meaning you’ve paid the taxes upfront. However, when you do retire, your withdrawals will incur no income tax, since the contributions were already taxed years earlier.

Youll Owe Taxes But It Can Still Make Sense To Rollover

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Saving for retirement is an important consideration, and 401 retirement savings plans, offered by many employers, can make it easy. But what happens if you change jobs? You can always keep your existing account, but you also have the option to transferor rolloveryour account into an individual retirement account .

There are two main types of IRAs from which to choose. Traditional IRAs let you set aside some of your income, before its taxed, just like your typical 401. Youll pay taxes later, during retirement, when you make withdrawals. By contrast, Roth IRA contributions are made from funds that have already been taxed. When you withdraw those funds during retirement, you wont be taxed again.

Depending on the type of 401 you have, rolling over to a Roth IRA may have some tax consequences. Lets take a look.

Don’t Miss: How Are State Income Taxes Calculated

Understand Your Options For An Inherited Ira

The best option for a Roth IRA you inherit depends largely on your circumstances. If you dont have a pressing financial need, you may want to hold off on withdrawals for as long as possible to maximize the tax-free growth.

If youre a surviving spouse, you can avoid withdrawals altogether if you opt for a spousal transfer. Otherwise, if youre a surviving spouse or any other eligible designated beneficiary, taking lifetime distributions will give your inherited investments more time to grow tax-free.

Whether youre a spouse or non-spouse, withdrawing the money over a shorter period or in a lump sum makes sense if you need the money. Youll avoid the early withdrawal penalty no matter how old you are. You also wont be taxed, as long as youve met the five-year rule.

K: Roth Vs Traditional

A traditional 401k involves saving money when tax has been deducted from the paycheck. Although this leads to lower taxable income, you will have to pay your tax obligations in the future when you retire and start cashing out money.

A Roth 401k involves after-tax contributions, meaning tax is applied to your income before you take out funds to put in your Roth 401k. You have no tax break now, but you save that for later. When you retire and start cashing out income from your Roth 401k, you will not have to pay any taxes. Just make sure that you have held the account for five years or more by then.

Both types primarily vary on the tax benefit. The good news is that you do not have to choose one of the two options. You can contribute to both plans. If you take this route, see that the total contribution does not go beyond the maximum limit set for the applicable year. In 2021, the maximum yearly limit is $19,500.

Recommended Reading: Pay My Car Tax Online