Which Is Best For You

This decision mainly comes down to how you want to put money into the account and how you want to take money out.

Lets start with today putting money in. If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401.

Youre also giving yourself access to a more valuable pot of money in retirement: $100,000 in a Roth 401 is $100,000, while $100,000 in a traditional 401 is $100,000 less the taxes youll owe on each distribution.

In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since it’s made after taxes rather than before. If your primary goal is to reduce your taxable income now or to put off taxes until retirement because you think your tax rate will go down, you will do that with a traditional 401.

Just know that:

-

Youre kicking those taxes down the road, to a time when your income and tax rates are both relatively unknown and might be higher if you advance in your career and start earning more

-

If you want the after-tax value of your traditional 401 to equal what you could accumulate in a Roth 401, you need to invest the tax savings from each years traditional 401 contribution. For more on this, see our study on the Roth IRA advantage, which also applies here.

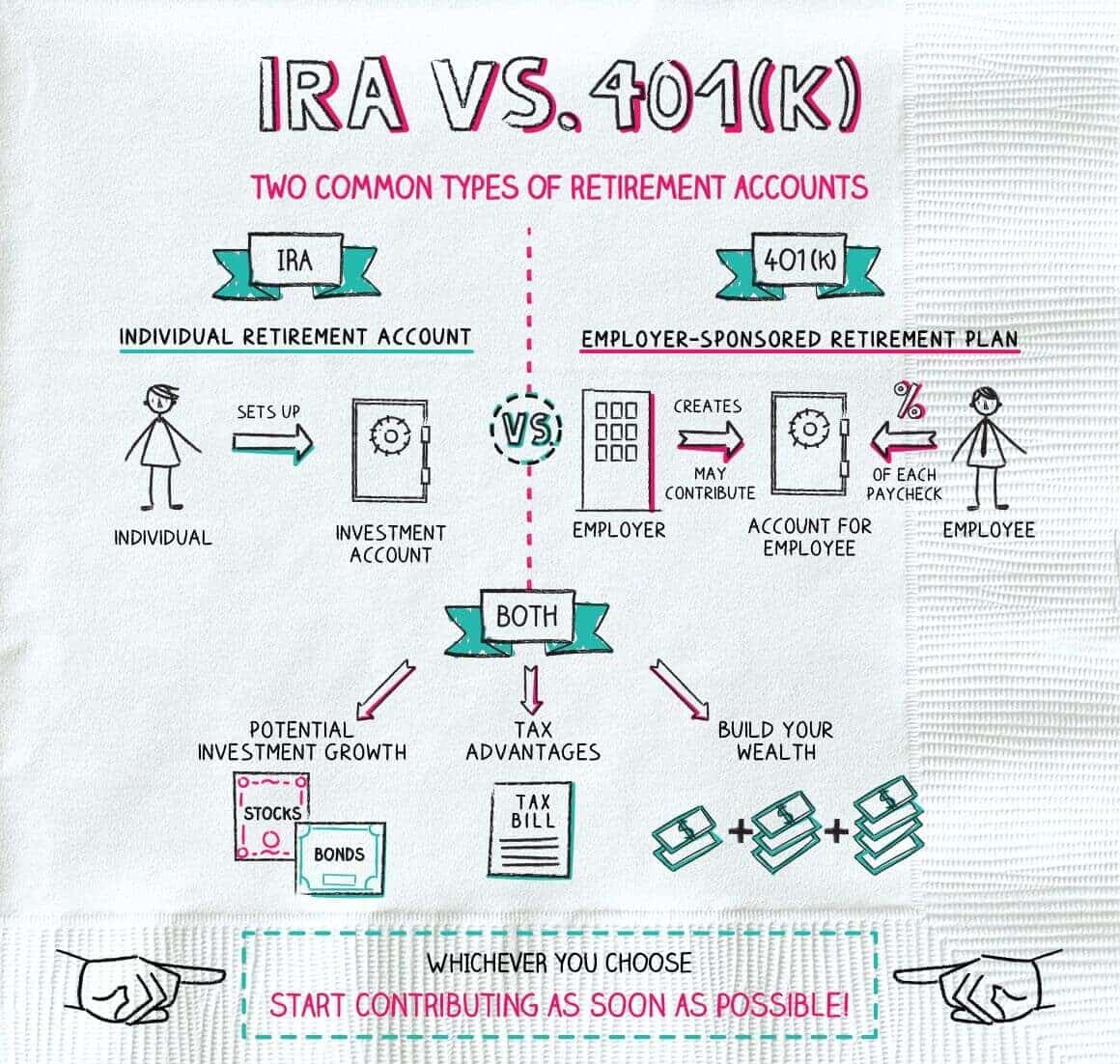

Is It Better To Do Pre

Your 401 at work is one of the best waysif not THE SINGLE best wayto save for retirement! The 401 makes it easy, quick, relatively painless, and forces you to dollar cost average into your investments over time. Your 401 may also provide employer matching contributions and lower costs than youd be able to get on your own due to economies of scale!

But, for all of their glory, the 401 can be difficult to navigate. There are rules and potential penalties. There are limits and restrictions on investments. Most importantly, most 401 plans today have the Roth or pre-tax option, making things even MORE confusing!

This short video explains the differences between the Roth 401 and the pre-tax 401 and will guide you towards which one is best for you and your retirement planning needs.

Hi there. My name is Greg Phelps and Im the president of Redrock Wealth Management here in Las Vegas. Im also your host to the RetireWire Blog and Podcast and webinars series, and a lot of other fun stuff that I put up at RetireWire specifically for retirement education.

Todays webinar video is going to tackle a question that I got from a 401 client. In the age of COVID since we cant see each other face-to-face quite as much and have the big group gatherings, we decided that doing a video and putting that out there on RetireWire would be very helpful as an education piece for the participants.

Table of Content

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

Also Check: Local County Tax Assessor Collector Office

Your 401 Is The Best Way To Save For Retirement

The very first thing that you need to know is, the 401 that you have at work is absolutely one of the best ways that you can possibly save for retirement. That being said, it can also be a little bit confusing.

There are a lot of moving parts. There are investments. Theres possibly employer matches. There are rules on contributions. There are model portfolios. And theres our topic of the day, which is, should you put your money into pre-tax or after-tax Roth 401 contributions?

So, were going to dig deep into that right now.

When Can I Take Withdrawals From A Traditional 401

You can make penalty-free withdrawals from a traditional 401 when you are age 59½ or older. Youll owe state and federal income taxes on the amount you withdraw.

In most cases, if you withdraw before age 59½, youll owe a 10 percent tax penalty on your withdrawal. And youll still owe income taxes on the total amount you withdraw. If you were 58 years old and in the 20 percent income tax bracket, youd owe $3,000 on a $10,000 withdrawal $2,000 in income taxes and $1,000 for the early withdrawal penalty.

You can, in some cases, take penalty-free withdrawals before age 59½ for unreimbursed deductible medical expenses that exceed 10 percent of your adjusted gross income, for example, or if youre permanently and totally disabled. You may also take penalty-free early distributions for health insurance and for the purchase of a first home. Youll still owe taxes on the withdrawals though.

You must start taking withdrawals by age 72, whether you need the money or not. Required minimum distributions depend on your age and the amount of money you have in tax-deferred retirement plans, including 401s.

Don’t Miss: How Much Is Property Tax In California

So Which Account Should I Contribute To

If you think you are in a low tax bracket compared to your future tax bracket, then a Roth 401 might make more sense because you are paying a low tax rate on your money today. Then in retirement, you will not pay any taxes on withdrawals.

When we retire, we have to live off of our retirement accounts and Social Security. Both pre-tax 401/IRA withdrawals and Social Security are included in your taxable income during retirement. If your taxable income in retirement is significantly less than your current income, you may benefit more from a pre-tax 401.

Ideally, you will save enough to maintain the same standard of living as you have when you are working. In that case, your tax rate may stay in the same bracket. This may result in no significant benefit for you regarding either 401 account type.

There is no single correct answer for everyone. The determination is based on many unknowns like your future career earnings, how future tax rates change, how long you live in retirement, how much income you need in retirement, and many others. All of these factors will change over your lifetime. A Roth 401 may be more ideal today but in a decade the pre-tax 401 may be better.

This post cannot tell you the correct choice based on your unique life. It is written to give you the information and the considerations you need to make a more informed decision.

The future is uncertain so you will not know if you made the right decision until much later in life.

When Can I Take Withdrawals From A Roth 401

You can take any contributions tax- and penalty-free if you are age 59½ or older and if you made your first contribution at least five years earlier. The five-year rule supersedes the age rule. If you violate either rule, your withdrawal is subject to a 10 percent tax penalty.

If you move your Roth 401 into a Roth IRA, the five-year clock starts ticking on the day of the rollover. Why would you roll over to a Roth IRA? Because Roth 401s, unlike Roth IRAs, are also subject to RMDs at age 72.

You can withdraw your contributions tax-free at any time. After all, youve already paid taxes on them. However, if you take an early withdrawal, the IRS will prorate your withdrawal between your tax-deferred earnings and your contributions. Unlike a Roth IRA, you cant just claim that your entire withdrawal is from your contributions. Suppose you withdraw $10,000 from a Roth at age 50. Of that $10,000, $7,500 was contributions and $2,500 was earnings. Youd owe taxes and penalties on the $2,500.

You May Like: Deadline To File 2020 Taxes

Roth 401 Vs : How Are They Different

The biggest difference between a Roth 401 and a traditional 401 is how the money you put in is taxed. Taxes are already super confusing , so lets start with a simple definition, and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they go into your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

What Is The Difference Between Pre

There are two primary differences both of them are tax related.

A pre-tax 401k has the opposite circumstances. Contributions are made with before-tax dollars, which lowers your taxable income for the given year. If your current marginal tax rate is 30%, a $10,000 pre-tax contribution to a 401k will generate a $3,000 tax savings as compared to a Roth 401k contribution, which has no tax savings. The trade off is that withdrawals taken from the plan down the road are treated as ordinary income.

Roth 401s technically have an RMD requirement as well, but that can be circumvented by rolling your balance into a Roth IRA. Regardless, distributions from either a Roth 401k or a Roth IRA are tax-free because taxes have been paid upfront.

Don’t Miss: Sales Tax In North Dakota

Factors To Weigh When Making Your Decision

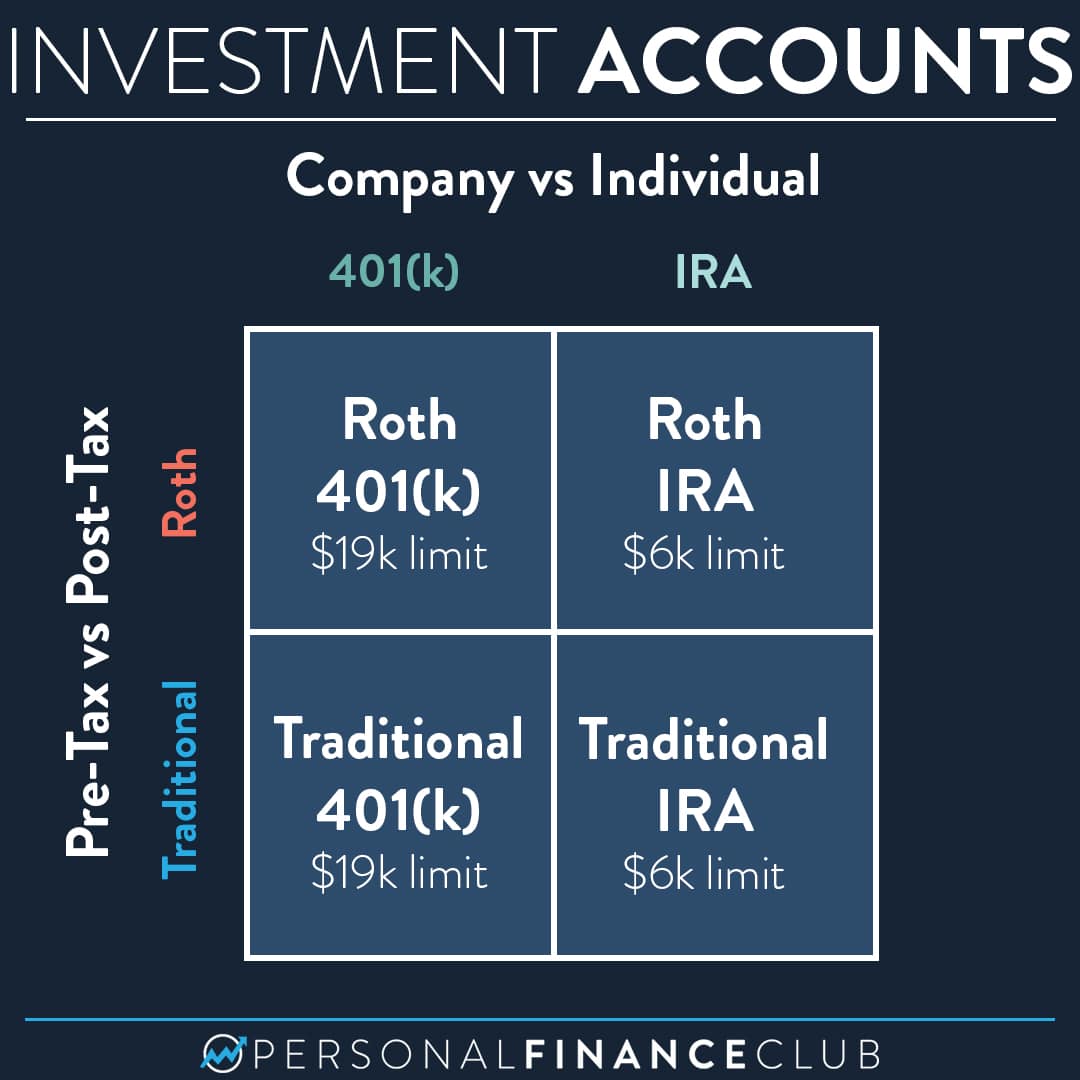

First, there is no right or wrong answer and the important thing is that you contribute as much as you can. The maximum employee contribution in 2019 for pre-tax, Roth, or an aggregate combination of the two is $19,000 . It is also worth noting that any employer match you receive will always be pre-tax regardless of your election, so even if you are making 100% Roth contributions into the plan you will naturally have some diversification across tax profiles.

The election decision can be boiled down to two variables: 1) whether you prefer to pay taxes now or later, and 2) what your tax rate will be at both of those points in time. If you expect your income to increase in the future, which would likely increase your marginal tax rate, then Roth contributions are compelling because you are locking in your tax rate now. Additionally, if you believe income tax rates will increase in the future or you plan to move to a higher income tax state at some point, Roth contributions could be beneficial. By contrast, if you believe your marginal tax rate will decline in retirement, a pre-tax 401k contribution is a logical decision. Keep in mind that even if your contribution rate is held constant, your net paycheck will be lower if you are making Roth contributions, so you should plan for that within the context of your ongoing cash flow needs.

Wealthspire Advisors LLC is a registered investment adviser and subsidiary company of NFP Corp.

Converting A Traditional Ira To A Roth Ira

If you are strapped for cash, the Roth IRA option may be a tougher commitment to make. The traditional IRA takes a smaller bite out of your paycheck because it reduces your overall tax liability for the year.

Even if you feel that you have to forgo the Roth option for now, you might consider converting your account from a traditional IRA to a Roth IRA in a few years, when youre more financially comfortable. But be aware that all the taxes you were deferring in the traditional IRA will come due in the year when you do the conversion.

A Roth IRA is generally the better choice if you think you will be in a higher tax bracket after retiring. Income tax rates could increase. Or your overall income could be higher due to a variety of factors, such as Social Security payments, earnings on other investments, or inheritances.

If youre considering converting from a traditional IRA to a Roth IRA, you may be able to lessen your tax liability if you time the conversion right. Consider making the move when the market is down , your income is down, or your itemizable deductions for the year have increased.

Read Also: Is Private School Tuition Tax Deductible

Read Also: How Much Medicare Tax Is Withheld

What Is A Roth 401

Like a traditional 401, the Roth 401 is a type of retirement savings plan employers offer their employeeswith one big difference. Roth 401 contributions are made after taxes have been taken out of your paycheck.That way, the money you put into your Roth 401 grows tax-free, and youll receivetax-free withdrawals when you retire.

The Roth 401 was introduced in 2006 and combines the best features from the traditional 401 and the Roth IRA. With a Roth 401, you can take advantage of the company match on your contributions, if your employer offers onejust like a traditional 401. And the Roth component of a Roth 401 gives you the benefit of tax-free withdrawals.

Can I Contribute To Both A Roth 401 And A Traditional 401

Yes. In certain situations, you can contribute to both a Roth 401 and a traditional 401. Mostly, it depends on the options available to you. But if you have a Roth 401 with good growth stock mutual fund options, you dont need to invest in a traditional 401. The benefits of tax-free growth and tax-free withdrawals in retirement are such a great deal, we recommend you invest your entire 15% in your Roth 401.

Here’s how we look at it: Match beats Roth beats traditional. Lets break it down.

See? Easy-peasy! Keep in mind that your employer match doesnt count toward your 15% income investment. Think of this as icing on that big, delicious retirement cake.

Again, youll want to sit down with an investment professional who can walk you through these options.

Recommended Reading: How To File Self Employed Taxes

What Is A Self

A Self-Directed Roth IRA is a type of individual retirement account that allows you to invest your funds in a variety of different assets. Your investment options are limited only by the rules of your plan administrator and any other restrictions that may apply. In this article, well take a look at what makes a Self-Directed Roth IRA unique and how it differs from other types of IRAs. If youre interested in opening one for yourself or someone else, this is what youll need to know about Roth IRAs and how they work.

What is a Self-Directed Roth IRA?

A Self-Directed Roth IRA is an individual retirement account that allows investors to make investments in alternative assets such as real estate, private market businesses, and precious metals.

A Self-Directed Roth IRA is also a retirement account which uses after-tax dollars for its investments. This means you can contribute to it without using tax-deductible contributions however, this creates the possibility of tax-free distributions from the account once you hit retirement age. This means that you can front-load the tax burden on these investments.

But even knowing all of this about Self-Directed Roth IRAs, what kinds of benefits do they offer to investors?

Self-Directed Roth IRAs Can Allow Tax-Free Withdrawals

You Can Use a Self-Directed IRA to Invest in Alternative Assets

Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and don’t pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you won’t pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Read Also: New Jersey Tax Refund Status