Take Home Pay Calculator

To see how your pre-tax contribution might affect your take home pay, enter the following information, then click on the Calculate button. For additional information, see How are these numbers calculated?

Is your bi-weekly pre-tax contribution to your retirement plan account.

Is an estimation of how much your bi-weekly take home pay will be reduced by.

You are solely responsible for the accuracy of any data you enter into this calculator and the calculations are based on the information you have entered. The simplified tax calculations also do not take into account any other pre-tax deferrals, such as your reimbursement accounts for health plan or dental insurance, or other payroll taxes, such as FICA.

Your circumstances are unique therefore, you need to assess your own situation and consult an investment professional if you feel you need more personal advice. Also, you should remember that the results you receive from this calculator do not account for tax effects of any kind. Therefore, the dollar amount of your actual plan contribution may be less than the estimate provided by the calculator. In addition, your circumstances will probably change over time, so review your financial strategy periodically to be sure it continues to fit your situation. All examples are hypothetical and are intended for illustrative purposes only.

When I Withdraw From My Ira Am I Withdrawing Money Or Shares

When you make a withdrawal from a mutual fund IRA, you withdraw shares and can then direct them to an eligible non-retirement Fidelity mutual fund account. You specify the mutual fund held in the IRA from which you want to sell shares, and the fund held in the account you are transferring to for which you want to buy shares.

When you make a withdrawal from a brokerage IRA, you withdraw cash from the IRA’s core account and can then direct it to the core account of an eligible non-retirement Fidelity brokerage account. In this case, shares in the IRA and non-retirement brokerage accounts do not have to be sold or purchased so long as there are adequate assets in the IRA core account.

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Don’t Miss: Federal Taxes On Capital Gains

Why Is The Federal Tax Withholding Percentage Online Different From The Percentage I Previously Elected

If you elected a federal tax withholding percentage for a previouswithdrawal request you entered online, that percentage only applies to that particular withdrawal, since online withdrawalsare treated as one-time, unique requests. If you elected a federal tax withholding percentage as part of setting up regularly-scheduledwithdrawals using Fidelity’s Personal Withdrawal Service , the withholding percentage is only applicable for the PWS withdrawals. Itdoes not apply to one-time withdrawals you request online.

This Tax Information Is Not Intended

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

You May Like: Tax Burden By State 2022

What Are The Irs Regulations For Ira Withdrawals

Based on IRS regulations, a withdrawal is considered either early or normal, depending upon your specific situation:

- If you are age 59 ½ or over, your withdrawal type is normal.

- If you are under age 59 ½ , your withdrawal type is early. You must specify ifyour withdrawal is early due to a disability. If so, you must satisfy the IRS definition of disabled.See What is an early distribution? to learn more.

- If you are the beneficiary on an IRA and you withdraw from your BeneficiaryDistribution Account following the death of the original IRA owner, the witdrawal type is distribution due to death,regardless of whether you are over 59 ½.

- Distributions due to death are not subject to a 10% premature distribution penaltyeven if you are under age 59 ½.

For all other withdrawals, contact a Fidelity representative at 800-544-6666.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

You May Like: Capital Gains Tax Calculator New York

Your Contributions To Your 401

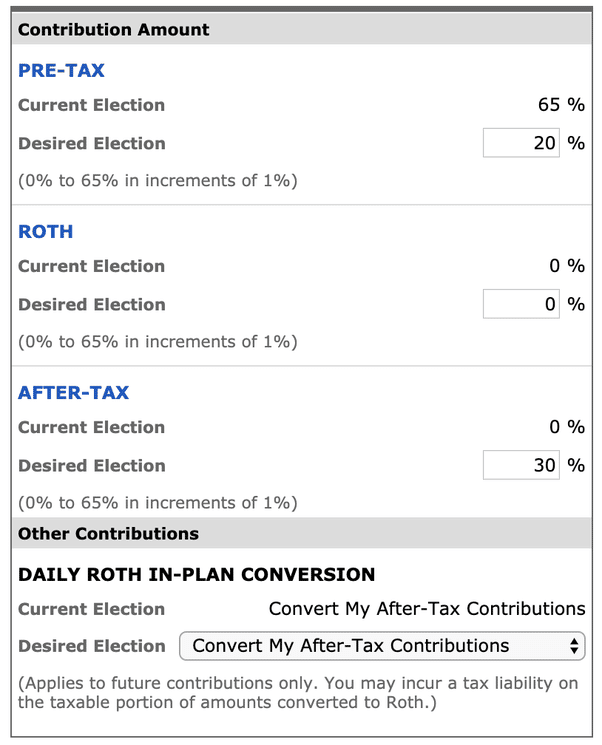

You have three ways to save: through pretax, Roth, and after-tax contributions to your 401.

- With pretax contributions, your money goes into your account pretax. This lowers your taxable income, and your money is taxed when its withdrawn in the future.

- With Roth contributions, your money goes into your account after you pay federal and state taxes on the amount contributed. When you withdraw it in the future, it is not taxed and as long as you meet certain requirements, your investment earnings are not taxed either.

- With after-tax contributions, your money goes into your account after you pay federal and state taxes on the amount contributed. When you withdraw the money, the principal amount is not taxed, but any investment earnings are.

You can contribute 2% to 75% of your eligible pay* to your 401, subject to IRS limits.

- Contribute up to $20,500 for 2022 to the pretax or Roth options.

- If you max out your pretax and Roth contributions and you want to save more, you can contribute after-tax, up to IRS limits.

*Eligible pay includes your base salary or wages plus certain variable pay compensation. Refer to the Savings Income Plan Summary Plan Description for more information.

Need Help Or Have Questions

Contact MIT Benefits or see the additional contact options below.

| Vendor |

|---|

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.

Read Also: Haven T Received Tax Return

Making The Most Out Of Your Savings

Thinking about large retirement funds may sound overwhelming. But dont feel discouraged. Big savings start small. And often, we have to address basic habits to boost our funds. While people think its about cutting expenses, the goal mostly involves prioritizing the right costs.

To help you build retirement savings, here are simple things you can start practicing today:

Arrange Automatic Money Transfers Once you receive your salary, a portion of your money goes directly to your savings account. If your employer doesnt have this set up, you can easily arrange it with your bank. Automated transfers ensure you never touch your savings or retirement contributions on pay days. Youll have dedicated savings while you only spend the money allocated for your monthly budget.

Prioritize Paying Large Debts Do you have high-interest credit card debt? Make sure to dedicate a substantial portion of your salary to reduce debts. The longer you take to pay them off, the more it will eat away at your savings. This is how compounding interest can work against you more interest accrues as your debt increases. Eliminating high-interest debt will free up your cash flow, allowing you to save more towards your retirement funds.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

You May Like: How Can Tax Identity Theft Occur

Explore Net Unrealized Appreciation

If you have company stock in your 401, you may be eligible for net unrealized appreciation treatment if the company stock portion of your 401 is distributed to a taxable bank or brokerage account. When you do this, you still have to pay income tax on the stock’s original purchase price, but the capital gains tax on the appreciation of the stock will be lower.

So, instead of keeping the money in your 401 or moving it to a traditional IRA, consider moving your funds to a taxable account. This strategy can be rather complex, so it might be best to enlist the help of a pro.

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Read Also: Are Funeral Expenses Tax Deductable

What Should I Know About The Transaction Amount Displayed On The Pending Transfer Page

The amount specified in the Quantity column on the Pending Transfers page is an estimated figure based on the distribution amount you requested. The amount includes any taxes withheld based on your tax withholding election or the government tax agencyÂs specified tax withholding requirements. However, the amount does not include any account or mutual fund fees that may be incurred when the transfer is executed. Once your transaction has settled you can visit account History and the trade confirmation on the statements tab, if applicable, for details on the amount of the final transaction.

Avoid The Mandatory 20% Withholding

When you take 401 distributions and have the money sent directly to you, the service provider is required to withhold 20% for federal income tax. If this is too muchif you effectively only owe, say, 15% at tax timethis means you’ll have to wait until you file your taxes to get that 5% back.

Instead, roll over the 401 balance to an IRA account and take your cash out of the IRA. There is no mandatory 20% federal income tax withholding on the IRA, and you can choose to pay your taxes when you file rather than upon distribution.

If you borrow from your 401 and neglect to repay the loan, the amount will be taxed as if it was a cash distribution.

Recommended Reading: State Income Tax In Kentucky

Sandias Contributions To Your 401

Sandia helps your savings grow faster by contributing to your 401 too.

- With our matching contributions, Sandia adds 66-2/3 cents to your account for every dollar that you contribute, up to the first 6% of earnings you contribute each pay period.

- In addition, Sandia makes an enhanced program contribution to your account if you are not eligible for the Sandia pension plan. The enhanced program contribution amount increases with your years of service with Sandia:

- In years 1 to 14 with Sandia, you receive an amount equal to 6% of eligible pay* each year.

- At year 15 and above, Sandias contribution increases to an amount equal to 7% of eligible pay* each year.

*Eligible pay includes your base salary or wages plus certain variable pay compensation. Refer to the Savings Income Plan Summary Plan Description for more information.

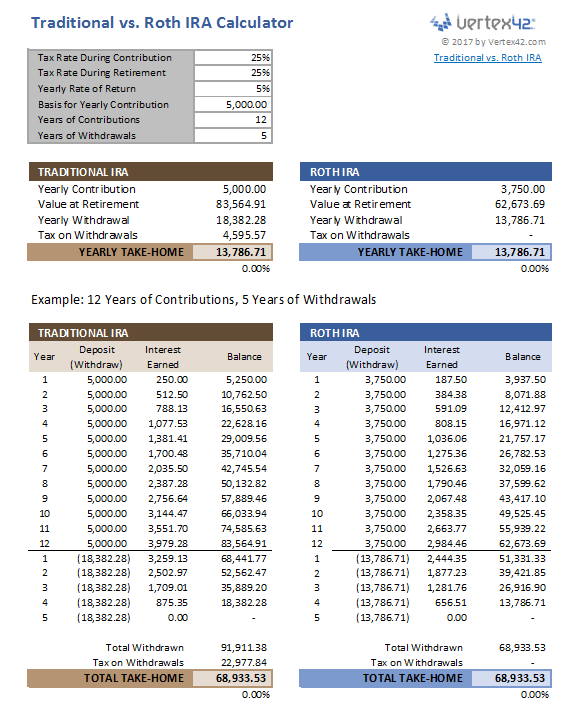

Using The Calculator And Comparing The Results

Using this 401k early withdrawal calculator is easy. Enter the current balance of your plan, your current age, the age you expect to retire, your federal income tax bracket, state income tax rate, and your expected annual rate of return.

With a click of a button, you can easily spot the difference presented in two scenarios. A lump-sum distribution may save you on future taxes but it definitely cuts into your asset at the time of distribution. If you roll over your 401k, on the other hand, you may have to shell out a lot of money in future taxes but the growth in the account will make paying those taxes a good problem to have.

Related:Why you need a wealth plan, not an investment plan.

Easy, simple, and straightforward that is what the 401k early withdrawal calculator offers. Unlike other calculators in the market, this calculator puts forward a detailed analysis of what you are getting into. It presents the taxes and penalties that you may incur as well as the opportunities each option brings.

Knowledge is power. Spending a few minutes contemplating the results of this calculator can lead you to make an educated decision resulting in thousands more saved at retirement.

Don’t Miss: New York State Tax Login

How Can I Take The Required Distribution

You can take your distribution in one withdrawal, or make withdrawals throughout the year. To set up scheduled, automated withdrawals use the ÂAutomated Withdrawals link, and follow the instructions. If you do not set up automated withdrawals, you can take your distribution anytime before the December 31 deadline please allow enough time for any trades to settle before the last business day of the year. You can make a withdrawal from your IRA online, or request a withdrawal by phone or at a Fidelity Investor Center.

Use The Still Working Exception

Most people know they are subject to required minimum distributions at age 72, even on a Roth 401. Please note that the RMD age was changed from 70½ to 72 at the end of 2019 through the Setting Every Community Up for Retirement Enhancement Act of 2019. But if you’re still working when you reach that age, these RMDs don’t apply to your 401 with your current employer .

In other words, you can keep the funds in the account, earning away to augment your nest egg, and postpone any tax reckoning on them. Keep in mind that the IRS has not clearly defined what amounts to “still working.” Probably, though, you would need to be deemed employed throughout the entire calendar year. Tread carefully if you’re cutting back to part-time or considering some other sort of phased retirement scenario.

Also, there are issues with this strategy if you are an owner of a company. If you own more than 5% of the business that sponsors the plan, you’re not eligible for this exemption. Also, consider that the 5% ownership rule means over 5% includes any stake owned by a spouse, children, grandchildren, and parents and may rise to over 5% after age 72. You can see how complicated this strategy can get.

Also Check: How Does Income Tax Work

At What Age Do Most Americans Retire

65 is the common retirement age most people aim for. But according to the U.S. Census Bureaus American Community Survey in 2019, the average retirement age varied for different states.

- In Washington, D.C., people retired at an average age of 67.

- In Hawaii, South Dakota, and Massachusetts, people retired at an average age of 66.

- Those living in West Virginia and Alaska retired at an average age of 61.

Retiring a bit early, say the age of 61, is an option for those who have saved enough funds. And for residents of West Virginia and other similar states, the general low cost of living may help you reach your retirement goals earlier.

Meanwhile, residents in the following states had an average retirement age of 65:

While others try to retire at 65 or earlier, many Americans, particularly Gen Xers and baby boomers, plan to work through retirement. Based on a 2019 article by Business Insider, some of these people simply want to work even if they dont need the money, up until the age of 72. And because retiring early has its disadvantages, it makes sense for some people to keep working especially if theyre still in good health.

How Long People Live