Calculate Magi For The Net Investment Income Tax

If you have capital gains income above a certain amount, itâs subject to an additional 3.8% tax called the net investment income tax . The exact income threshold for paying NIIT depends on your filing status and your modified AGI. Your MAGI for net investment income tax is your AGI plus income you excluded under section 911, plus adjustments for people who owned stock in certain controlled foreign corporations or passive foreign investment companies .

To find your exact NIIT liability, use the worksheets and instructions for IRS Form 8960.

Read Also: How To Find Employer Ein Without W2

What Is Agi And How Is It Determined

Your total gross income includes all of your wages, salaries, dividends, interest, gambling winnings, retirement distributions, unemployment benefits all of the money you bring in.

Your adjusted gross income equals all of that money minus income adjustments such as alimony, student loan interest payments and health savings account contributions. These income adjustments are not the tax deductions that determine your overall tax burden they are deductions to your income that set the standard level at which you can be taxed.

If you have adjustments to your gross income, you will record them in Part II of IRS Form 1040 Schedule 1. The IRS offers a thorough lesson on these adjustments to income here .

Also Check: How To Get An Income Tax Extension

Do You Pay Taxes On Adjusted Gross Income

There are a couple of more steps after calculating AGI before you can reach your taxable income.

First, youll need to subtract your standard deduction or itemized deductions. Next, you may subtract the qualified business income deduction if you have self-employment or pass-through business income.

Your tax bracket and income taxes is based on your taxable income not adjusted gross income.

Also Check: What State Has Lowest Property Taxes

Schedule : Adjustments To Income

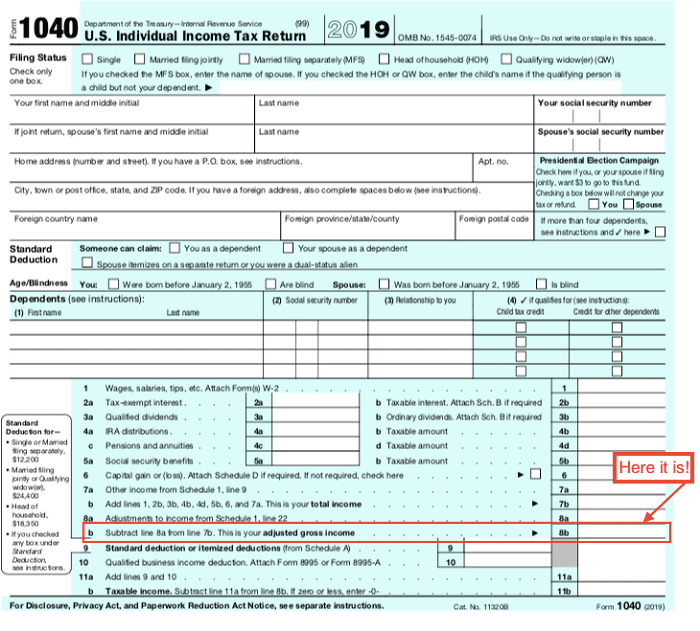

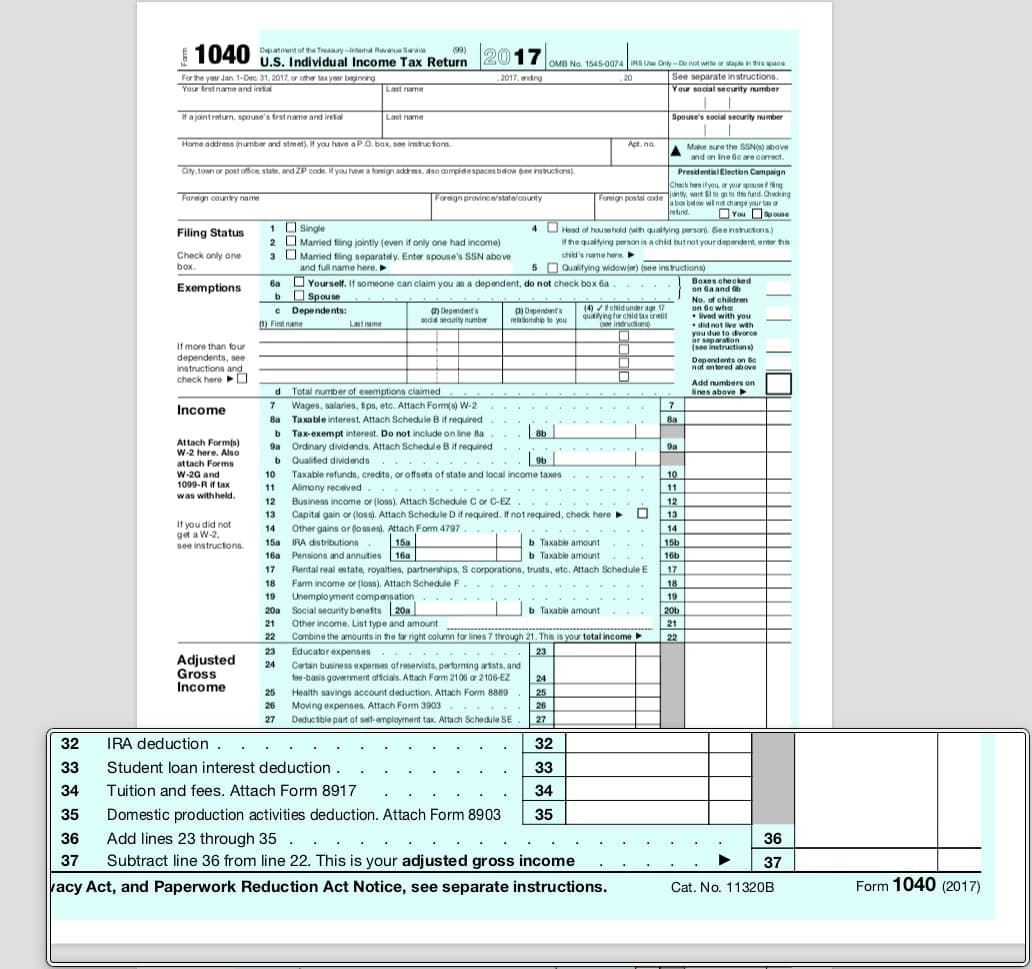

Your adjustments to income are entered in Part II of Schedule 1. These are the amounts that were previously referred to as “above-the-line” deductions, because they appeared on the first page of the tax returns that were in use in 2017 and earlier years. They were entered just above those forms’ final page on the line that showed adjusted gross income.

These adjustments/deductions include:

- Tuition and other educational expenses

- The traditional IRA deduction

The total of all these deductions is subtracted from your gross income to arrive at your AGI on line 10 of your 2021 tax return. You can then subtract either the standard deduction or the total of your itemized deductions from your total income to get your AGI.

You would then add your standard or itemized deductions and qualified business income, and then subtract the total from your AGI , to get your taxable income. This is the figure that’s used to calculate your federal income tax liabilityhow much you owe the IRS or the amount of a tax refund you can expect.

How Adjusted Gross Income Works

When filing your taxes, your adjusted gross income is your gross income minus any adjustments. AGI is used in many tax calculations and thresholdslike credits and deductions which is important because the lower your AGI, the less tax liability you’ll have.

To find AGI, after you have added up your full taxable income , you can take several “above-the-line” deductions to lower that taxable amount. These are called “above the line” because they apply whether you itemize your deductions or take the standard deduction. The standard deduction is an amount that the IRS sets each year that you can deduct from your taxable income, meaning a portion of your income isn’t taxed, lowering your tax bill.

In other words, if you had specific expenses or saved money to a qualified account, the IRS allows you to deduct the amounts from your gross income to produce your adjusted gross income . These deductions are also called “adjustments to income,” and they’re calculated on IRS Schedule 1.

Don’t Miss: C Corp Tax Rates 2021

How Do I Calculate My Agi

When you file with TaxSlayer, the calculation is done for you. This is one of the major benefits of filing your taxes online. If you are filing your return on paper, you will calculate your AGI right on Form 1040.

To figure out what your AGI is, youll want to find your gross income first. Thats anything you earned for the year, including wages, dividends, capital gains, retirement distributions, and so on. These amounts are added together on Form 1040.

Once youve added up all these and found your total, you will subtract any adjustment to income amounts that you have. These include:

Also Check: Efstatus Taxact Online

Taxes Rejected Due To Adjusted Gross Income

I am filing jointly with my spouse and did this last year as well. When e-filing my taxes they were rejected due to the Adjusted Gross Income that I entered not matching the IRS database from my 2018 return. When I click on the “Need Help” link next to the AGI it takes me to the video where it says to pull the information from “page 2, line 7” from the 1040. I did this and it was rejected. Now rereading the turbo tax prompt, it is specifically asking for only asking for only MY agi, listing my name, not asknig me and my spouses AGI.

Should I stick to the number on line 7, or should I just input my AGI?

You May Like: What Is The Small Business Tax Rate For 2021

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Add Back Any Deductions Or Expenses To Your Adjusted Gross Income

After calculating your adjusted gross income, add back certain adjustments to get your MAGI. These include excluded foreign income, adoption expense exclusions, passive loss and . Not many people have these deductions, so your MAGI and your adjusted gross income may be similar or even the same amount. Here are other deductions to add back to your adjusted gross income:

-

Partnership losses

-

Interest from EE savings bonds that you used to pay for your education

-

Deductions you took out for IRA contributions

-

Deductions you took out for taxable social security payments

Related:

Recommended Reading: Loudoun County Personal Property Taxes

What If You Cant Find Your Previous Federal Tax Returns

If you just cant find your tax return, you can find your AGI in two ways:

Method 1:Go to the IRSGet Transcript portal and choose Get Transcript Online. Youll need your Social Security number, date of birth, filing status and mailing address from your latest tax return. Youll also need access to your email your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan and a mobile phone with your name on the account. Once your identity is verified, select the Tax Return Transcript and use only the Adjusted Gross Income line entry. Youll be able to view or print your information here.

Method 2: If you dont have internet access or the necessary identity verification documents, you can use the Get Transcript portal and choose Get Transcript by Mail, or call 1-800-908-9946 to request a Tax Return Transcript. It takes about five to 10 days to be delivered to you.

Read Also: When Did Federal Income Tax Start

How To Calculate Adjusted Gross Income On W2

With some background knowledge about AGI and W-2, you can coast across the jumble of alphabet soup and get the tax terms clearer in your head. W-2 is a form used by employers to report your taxable income to you and to the IRS. You then use this information on Form 1040, 1040A or 1040-EZ to file your tax return. You will need information in addition to the details on your W-2 to calculate your AGI.

Step one in calculating your AGI is, to begin with the amount displayed in Box 1 of your form W-2 labelled Wages, Tips, Other Compensation. Step two includes adding any additional taxable income you have for the year in order to calculate your total taxable income. Most frequently, there is another form on which this taxable income is reported, it is known as 1099-INT for interest or 1099-DIV for dividends. The last step is to subtract any adjustments to income you qualify to claim.

Lets take a look at an example to help you understand better. If your W-2 shows that your taxable wages earned are $61,000 and there is an additional $1,000 in investment income and $500 in taxable interest, then your total taxable income is $61,000 plus $1,000 plus $500 which adds up to $61,500. However, say that you contributed $2000 to a traditional IRA and paid off a student loan interest of $1,200. You then find that your adjusted gross income is $59,300 after subtracting the $3,200 in total adjustments to income.

You May Like: How To Find Tax Rate

Gather Your Income Statements

The first step in computing your AGI is to determine your income for the year. Income can be in the form of money, property, or services you receive in the tax year.

Income includes your traditional salary and wages, which are reported on Form W-2, any earnings from self-employment ventures, and any other income reported on 1099 forms, like investment dividends and retirement income. Proceeds from broker and barter exchange transactions reported on Form 1099-B, proceeds from real estate transactions reported on Form 1099-S, any taxable interest reported on Form 1099-INT, and any investment dividends reported on Form 1099-DIV are all considered part of your taxable income.

In addition, you will also need to include these sources of taxable income:

- Business income

- Capital gains on the sale of your primary home

- Money received as a gift or other inherited assets

- Canceled debts intended as a gift to you

- Scholarships or fellowship grants

- Foster care payments

- Money rolled over from one retirement account to another

What Is Adjusted Gross Income

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Investopedia / Jiaqi Zhou

You May Like: What Percentage Should I Withhold For Taxes

Boost Your 401 Contributions

If you haven’t maxed out your workplace 401, there may still be time to boost your contributions for 2022, said Guarino.

The move may lower your adjusted gross income while padding your retirement savings, but “time is of the essence,” he said. With only one or two pay periods left for 2022, you’ll need to make contribution changes immediately.

Agi Rejected But Correct

If you needed to verify your tax return with last years AGI or needed your AGI to verify something else, you may get your AGI rejected even though its correct. The most common causes are:

- The IRS hasnt updated your AGI with your latest tax return. You can try your previous years AGI or wait for your new AGI to show in your online IRS account.

- You or the IRS adjusted your tax return after you filed. In that situation, your correct AGI may not be what was on your original tax return.

Steps to take:

- Check your online IRS account to make sure your latest AGI is updated and matches what you believe it should.

- If youre filing your taxes online, follow your tax preparation softwares instructions to verify your tax return another way.

- If the IRS is showing an incorrect AGI or hasnt updated your AGI more than four weeks after you filed, call the IRS.

Don’t Miss: How Do Deductions Work On Taxes

How To Make An Estimate Of Your Expected Income

Step 1. Start with your households adjusted gross income from your most recent federal income tax return.

Step 2. Add the following kinds of income, if you have any, to your AGI:

- Tax-exempt foreign income

Step 3. Adjust your estimate for any changes you expect.

Consider things like these for all members of your household:

- Expected raises

- Changes to income from other sources, like Social Security or investments

- Changes in your household, like gaining or losing dependents. Gaining or losing a dependent can have a big impact on your savings.

Now you have an estimate of your expected income.

Time Roth Ira Conversions With Transfers To A Donor

Another charitable giving strategy, donor-advised funds, may pair well with a Roth IRA conversion, Guarino said.

Donor-advised funds act like a charitable checkbook, allowing investors to “bunch” multiple years of gifts into a single transfer, providing an upfront tax deduction.

The Roth conversion, which transfers pretax IRA funds to a Roth IRA for future tax-free growth, is attractive when the stock market drops because you can buy more shares for the same dollar amount, he said.

Although you’ll trigger taxes on the converted amount, it’s possible to offset your liability with the deduction from your donor-advised fund contribution,” Guarino said.

“It’s a great one-two punch to be able to time both of those events in the same year,” he added.

Recommended Reading: Advance Premium Tax Credit Repayment

Adjusted Gross Income Vs Modified Adjusted Gross Income : Whats The Difference

Modified adjusted gross income is slightly different from AGI. Unlike your AGI which is one number, your MAGI may differ depending on the tax credit or deduction for which you claim. But similar to AGI, it can also determine which tax deductions or credits you might qualify for on your tax return.

Typically, your MAGI is your AGI adjusted for certain expenses and income. Generally, your MAGI calculation is your AGI but adding back student loan interest. However, the IRS may calculate your MAGI differently depending on the tax credit or deduction.

Here are a few examples of how MAGI determines certain tax deductions and credits:

Premium Tax Credits: Your MAGI for premium tax credits and other tax savings for is your AGI plus any untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Child Tax Credit: Your MAGI for child tax credit and advance child tax credit payments is your AGI plus some sources of foreign income.

The American Opportunity Tax Credit: Your MAGI for the American Opportunity Tax Credit is your AGI plus some sources of foreign income.

For many taxpayers, their MAGI total is the same or very close to their AGI, since the adjustments that some taxpayers make will only slightly change the final number.

What Is My Gross Income

Gross income is the amount of money you earn before any taxes or other deductions are taken out. It impacts how much someone can borrow for a home and its also used to determine your federal and state income taxes. Your gross income can be from a salary, hourly wages, tips, freelancing, and many other sources.

Also Check: Pay Nj Sales Tax Online

Differences Between Agi Magi And Taxable Income

Your AGI is not the income figure on which the IRS will actually tax you. Your final income number, or taxable income, comes from subtracting even more deductions from your AGI.

For the 2020 tax year, the vast majority of taxpayers will likely use the standard deduction rather than itemize deductions. Under current laws, the standard deduction will be $12,400 for single filers and $24,800 for married couples filing jointly.

Modified adjusted gross income, or MAGI, is another term related to taxable income and adjusted gross income. MAGI comes into play when youre trying to figure out whether you qualify for certain deductions. For instance, if your MAGI is above certain income limits and you have a workplace retirement plan, you may not be able to take the full deduction for contributing to an IRA.

To calculate your MAGI, you have to add certain deductions, such as student loan interest, back to your adjusted gross income. If you didnt claim any of these deductions, your AGI and MAGI should be the same.

Adjusted Gross Income Vs Modified Adjusted Gross Income

In addition to AGI, some tax calculations and government programs call for using whats known as your modified adjusted gross income, or MAGI. This figure starts with your AGI, then adds back certain items, such as any deductions you take for student loan interest or tuition and fees.

Your MAGI is used to determine how much, if anything, you can contribute to a Roth individual retirement account in any given year. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act .

Many people with relatively uncomplicated financial lives find that their AGI and MAGI are the same number or very close.

If you file your taxes electronically, the IRS form will ask you for your previous years AGI as a way of verifying your identity.

Also Check: Federal Tax Extension Deadline 2022