Who Can Open An Account

Any U.S. resident can open a New Yorks 529 College Savings Account. You do not have to be a New York state tax payer or resident.

Moreover, you do not need any knowledge of mutual funds. Vanguard Inc. and Ascensus Broker Dealer offer several easy-to-digest investment options for you to choose from. The age-based investment path is one that stands out, but you do not have to choose it if you dont want to.

State Income Tax Treatment Of Qualified Withdrawals

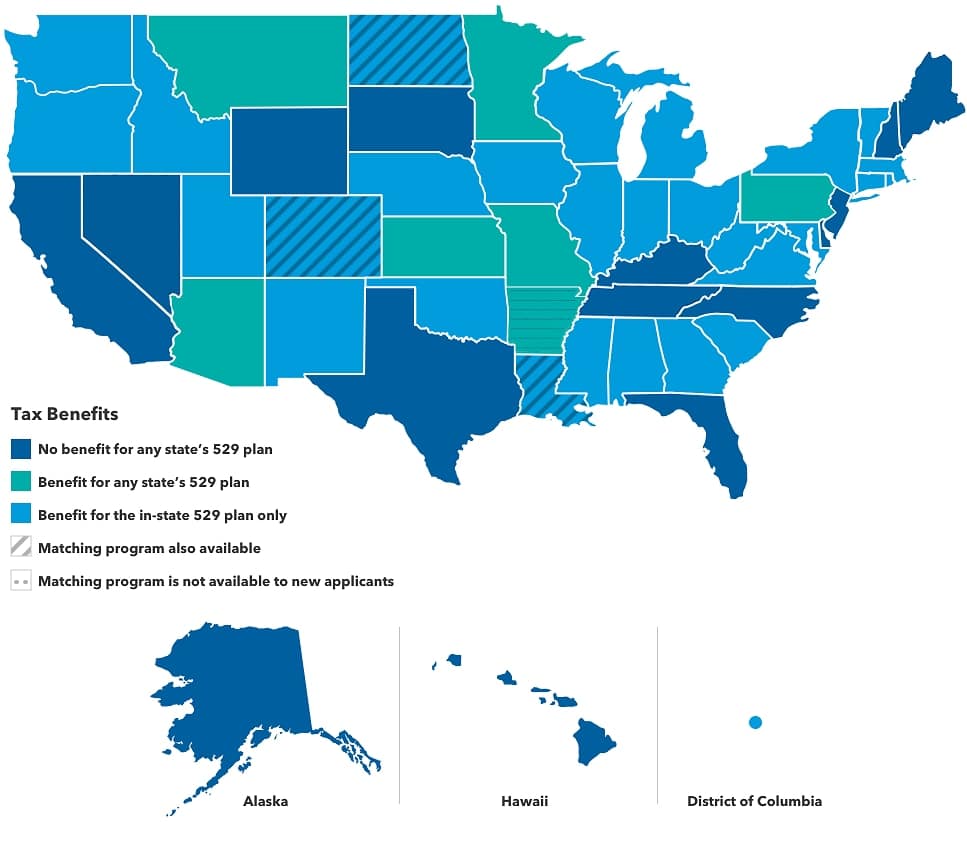

States differ in the 529 plan tax benefits they offer to their residents. For example, some states may offer no tax benefits, while others may exempt earnings on qualified withdrawals from state income tax and/or offer a deduction for contributions. However, keep in mind that states may limit their tax benefits to individuals who participate in the in-state 529 plan.

You should look to your own state’s laws to determine the income tax treatment of contributions and withdrawals. In general, you won’t be required to pay income taxes to another state simply because you opened a 529 account in that state. But you’ll probably be taxed in your state of residency on the earnings distributed by your 529 plan if the withdrawal in not used to pay the beneficiary’s qualified educations expenses.

529 account owners who are interested in making K-12 contributions or withdrawals should understand their state’s rules regarding how K-12 funds will be treated for tax purposes. States may not follow the federal tax treatment.

Your State’s Plan May Offer Additional Tax Benefits

If you are a resident or taxpayer of another state, you should consider whether that state offers a 529 plan with tax advantages or benefits that are not available through College Savings Iowa. Other state benefits may include financial aid, scholarship funds, and protection from creditors. Be sure to weigh all the pros and cons of a particular plan before you enroll.

Recommended Reading: Is Auto Insurance Tax Deductible

Does Texas Have A State 529 Plan

The state of Texas sponsors three different college savings plans: the Texas College Savings Plan , the Lonestar 529 Plan , and the Texas Tuition Promise Fund . All three options offer a tax-advantaged way to pay for education expenses however, the first two options, TCSP and LS529, allow families to invest in portfolios whereas the TTPF lets families lock in rates and pay off future tuition starting today.

Keep in mind that these are not the only two 529 plans available to you as you can shop from out-of-state plans that may have lower fees.

Income Tax Planning And 529 Plans

The income tax benefits offered by 529 plans make these plans attractive to parents who are saving for college or K-12 tuition. Qualified withdrawals from a 529 plan are tax free at the federal level, and some states also offer tax breaks to their residents. It’s important to evaluate the federal and state tax consequences of plan withdrawals and contributions before you invest in a 529 plan.

Also Check: What Percentage Of Tax Should I Withhold

What If Your Kids Are Already In College

The longer a 529 plan has to work, the better because the tax-free dollars compound and grow. If your son or daughter is already in college a 529 may not really help you all that much if you will need to make immediate withdrawals. But who cares? You can still use this same technique with a twist.

Hire your child to work for you maybe during breaks and vacations and have them use their salary to pay their own tuition. This accomplishes the same thing. They are still paying for college with your money but you get a deduction for those payments and your child probably wont have to pay much if anything at all on the income because they are in a lower bracket than you are. And it has the added benefit of getting your kid away from the video games and off of Facebook and learning how to make a buck. Score.

How Much Should I Put In A 529 Plan Per Month

What does this mean for you? Choosing a 529 plan could mean a much lower monthly contribution since the money grows over time. With a 529 plan, a solid monthly contribution amount for a child born in 2022 would be about $140 for a public in-state school, $215 for public out-of-state, or $350 for a private university.

You May Like: How To Pay Taxes Quarterly

How Do I Report 529 Contributions On My Taxes

Rather than reporting deductions on federal income tax returns, contributions to a 529 plan are not deductible thus exempt from reporting contributions. You can never see the investment earnings in your account again until after the withdrawals are complete. Among the billions of dollars that taxpayers save by investing in 529 plans, there are plenty of exceptions.

Federal Income Tax Treatment Of Qualified Withdrawals

There are two types of 529 plans savings plans and prepaid tuition plans. The federal income tax treatment of these plans is identical. Your contributions accumulate tax deferred, which means that you don’t pay income taxes on the earnings each year. Then, if you withdraw funds to pay the beneficiary’s qualified education expenses, the earnings portion of your withdrawal is free from federal income tax. This feature presents a significant opportunity to help you accumulate funds for college.

Qualified education expenses for 529 savings plans include the full cost of tuition, fees, room and board, books, equipment, and computers for college and graduate school, plus K-12 tuition expenses for enrollment at an elementary or secondary public, private, or religious school up to $10,000 per year.

Qualified education expenses for 529 prepaid tuition plans generally include tuition and fees for college only at the colleges that participate in the plan.

Read Also: Rental Property Income Tax Calculator

Managing Cash Flow While In College

Many parents stop making contributions now that their students have arrived at college. This is a mistake and a loss of opportunity. As long as it makes sense, you should still consider contributing to your students CHET 529 account.

If youre up in the air between contributing to your CHET 529 plan or using your cash flow to pay for college, keep in mind that you only get the tax deduction for contributions made to your CHET 529 account.

How A Grandparent Should Gift Money To A New York 529 Plan

Funding a grandchilds college education can be a beast: The amount of money that may have paid for your childs four year undergraduate education may only pay for one years worth of tuition for your grandchild. This coupled with increasing housing costs and other relentless modern-day living expenses, make it hard for your children to adequately fund a 529 Plan to pay for your grandchildrens college education.

Here are a few ownership and funding choices a grandparent may want to consider when funding a 529 Plan for a grandchild:

You May Like: Federal Tax Married Filing Jointly

Two 529 Savings Plan Options

The more you can save through a 529 plan, the less stress youll have when its time to apply for financial aid or search for scholarships. Through these tax-deductible plans, family members and friends can contribute to a childs college fund and get a tax benefit for doing so. Over the years, with regular contributions and compound interest, the plan can grow significantly to provide for the childs educational expenses.

New Yorks 529 College Savings Program offers two plan options:

- The Direct Plan, which is administered directly by the Program

- The Advisor Plan, which is sold through financial advisors

Who Is Eligible For A 529 Plan State Income Tax Benefit

States typically offer state income tax benefits to any taxpayer who contributes to a 529 plan, including grandparents or other loved ones who give the gift of college. However, in 10 states only the 529 plan account owner may claim a state income tax benefit.

Eligible taxpayers may continue to claim a 529 plan state income tax benefit each year they contribute to a 529 plan, regardless of the beneficiarys age. There are no time limits imposed on 529 plan accounts, so families may continue to make contributions throughout the childs elementary school, middle school, high school, college years, and beyond.

State income tax benefits should not be the only consideration when choosing a 529 plan. Attributes such as fees and performance must always be taken into account before you enroll in a 529 plan. In some cases, better investment performance of another states 529 plan can outweigh the benefits of a state income tax deduction.

Read Also: How Much Tax Is Taken Out Of Paycheck

State Income Tax Benefits

Withdrawals are exempt from New York State income tax when used for qualified higher education expenses. New York taxpayers can also deduct up to $5,000 of contributions on their state income tax return each year. If you are a resident or taxpayer of the another state, you should consider whether that state offers a 529 plan with tax advantages or other benefits that are not available through this Program.

Is Ny 529 Tax Deductible

4.5/5New Yorktax deductiondeduction529taxtax

Also question is, how much of 529 is tax deductible?

State income tax benefit: Taxpayers can deduct up to $15,000 for individuals in contributions to any 529 plan per beneficiary each year. Married couples filing jointly can deduct up to $30,000 per beneficiary each year, provided each spouse has a taxable income of at least $15,000.

Secondly, what states offer a tax deduction for 529 plans? However, there are seven tax parity states that offer a state income tax benefit for contributions to any 529 plan:

Likewise, how do I claim 529 on my taxes?

If youve simply been contributing to an existing 529 account you may not have to report anything on your federal income tax return. Unlike an IRA, contributions to a 529 plan are not deductible and therefore do not have to be reported on federal income tax returns.

Is the 529 plan worth it?

While a 529 plan remains a great way to save for college or private school, it lacks the flexibility of other accounts because you can only make tax- and penalty-free withdrawals for educational costs. Youre basically earmarking this sum of money for education only.

Here are five of the top 529 plans:

- Ohios 529 plan, CollegeAdvantage.

- New Yorks 529 plan, Direct Plan.

- Wisconsins 529 plan, Edvest.

- West Virginias plan, Smart 529 WV Direct College Savings Plan.

- Californias plan, ScholarShare 529.

You May Like: How Much Do I Pay In Taxes For Doordash

Read Also: Does The Post Office Have Tax Forms

Enjoy A Federal Gift Tax Incentive

You can contribute up to $16,000 per year without triggering federal gift taxes. Or you can choose a special election that allows you to treat a single $80,000 contribution as if it were made over a five-year period.***

Gifts in excess of these amounts may be subject to federal gift taxes. For more information, consult a qualified tax advisor.

Tax Advantages Of The Program

Significant tax advantages are an attractive feature of the Program.

- Unlike a taxable account, your assets compound tax-free, giving you better potential for growth over the long-term

- Your withdrawals are free from federal and New York State income tax when used to pay for qualified education expenses . For example, tuition, fees, room and board, books, supplies, and equipment required for enrollment or attendance at any eligible post-secondary school in the world.

- You can receive a New York State income tax deduction of up to $5,000 .

If you are a resident or taxpayer of another state, you should consider whether that state offers a 529 Plan with tax or other benefits that are not available through this Program.

Contributions to this program are not pre-tax and will not be reflected on your W-2 Wage and Tax Statement. However, tax deductions may be reflected when you file your New York State tax returns, and will not be reflected each pay period.

Also Check: Highest Paying Plasma Donation Center Near Me

Also Check: How Long Does My Tax Return Take

A Guide To Understanding The Maryland 529 Tax Deduction

Saving for your childs college education is a key part of family financial planning. Preparing for these important years in your childs life will help ensure you have the funds available to pay for college when the time comes. Ideally, one aspect of your planning will be to understand the tax benefits you may be eligible to receive for your contributions to certain savings accountsfor example, the Maryland 529 tax deduction.

In this article, well explore the basics of the Maryland 529 tax deduction and how you can leverage it, as well as the two types of Maryland 529 plans available to you.

Maximizing The Tax Benefits Of 529 Plans

You are here:

By Kelley Hope, Communications Officer, Virginia529

Tax benefits of 529 plans make them especially attractive to families and individuals looking to maximize their savings. However, thinking about those advantages only when choosing or setting up a plan can cause one to miss out on valuable account growth opportunities, possibly for years down the road.

While making contributions, consider these important questions each year : Am I taking full advantage of a state tax benefit for contributions to my 529 plan? Can I direct deposit a tax refund to my 529 plan?

If youve begun using your account for higher education, ask these questions about withdrawals: What expenses qualify for tax-free withdrawals? How does use of my 529 plan coordinate with other available tax programs, such as the American Opportunity Tax Credit?

Tax benefits for contributionsWhile there is no federal income tax deduction for contributions to a 529 plan, many states offer taxpayers a deduction or credit on personal income tax returns for contributions made to the in-state program. Some states allow a deduction or credit for contributions to any 529 plan.

About the Author

See more

Read Also: Irs Track My Tax Return

Many States Have 529 Tax Deductions For Contributions

Although you cant receive 529 tax benefits on your federal income tax return, you might be able to on your state tax return.

More than 30 states, plus the District of Columbia, offer a 529 tax deduction or credit, allowing you to write off 529 contributions and lower your state income tax burden. That can free up more money to save for your childs education.

Deductions vary by state, and some are more generous than others. Indiana, for example, offers a 529 tax credit equal to 20% of contributions up to $5,000, which means a maximum credit of $1,000. Vermont provides a 10% tax credit for contributions up to $2,500 with a maximum $250 credit per taxpayer for each beneficiary.

What Does This Mean

You May Like: How Long To Get Tax Refund 2022

Tax Benefits For Each State

In some states, contributions to any states 529 plan are eligible for a state income tax advantage. Out-of-state investors are not required to choose their home state plan to get the benefit but can select any states 529 plan, including the low-cost NEST 529.

NEBRASKA with the NEST Direct College Savings Plan taxpayers can deduct up to $10,000 in contributions from their Nebraska taxable income each year .2

Before investing, investors should consider whether their or their beneficiarys home state offers any state tax or other state benefits such as scholarship funds, financial aid, and protection from creditors that are only available for investments in such states qualified tuition program. Investors should also consult their tax advisor, attorney, or other advisor regarding their specific legal, investment, or tax situation.

Tax-Parity States include: Arizona, Montana, Minnesota, Kansas City, Missouri, Pennsylvania, and Florida

States that offer tax benefits for contributions to any states 529 plan.

Tax-Neutral States include: Alaska, California, Nevada, Washington, Wyoming, South Dakota, Texas, Hawaii, Tennessee, Kentucky, North Carolina, Delaware, New Jersey, New Hampshire, Maine

States without state income taxes or other state benefits for investing in that states 529 plan.

States where income tax benefits are only available for those who pay income tax in that state and own, or contribute to, that states 529 plan.

Recommended Reading: When Do I Get My Tax Return 2021

Tax Benefits Of 529 Plans

For both types of 529 plans, contributions are not tax-deductible for your federal taxes although some states provide a state tax deduction for contributions. As long as you make withdrawals only to pay for qualified higher education expenses, you won’t pay income tax when you put the money to use. Qualifying expenses typically include books, tuition, mandatory fees, room and board and any necessary equipment.

Don’t Miss: Walmart Tax Refund Advance 2022