Contribution Limits To Candidate Campaigns

In the 2022 calendar year, a person can contribute up to a limit of $3,325.

This $3,325 limit applies across all registered candidates of any one registered party and to all registered independent candidates .

A registered candidate may make contributions to be used for the candidates own campaign, and out of the candidates own funds. These funds must not exceed $10,000 in total during the campaign period, combined with any period during which the candidate is registered.

Will I Get A Tax Receipt

Registered political parties and registered constituency associations can issue income tax receipts for contributions of money received at any time, but not for contributions of goods or services.

Candidates can only issue income tax receipts for contributions of money received after they have received their certificate of candidacy and before the return of the writ.

Leadership contestants and third party advertising sponsors can never issue income tax receipts.

What About Electing To Give $3 To The Presidential Election Campaign

You may have noticed or even checked the box on your Form 1040 that asks if you want to give $3 to the Presidential Election Campaign Fund. If you check this box, the money that goes to presidential candidates who elect to use those funds will not actually come out of your pocket. That $3 also doesn’t come out of your refund. If you want to support this process by checking the box, that’s your decision, but it does not affect your taxes or deductions.

Read Also: Average Percentage Of Taxes Taken Out Of Paycheck

Political Contributions Tax Credit

Disclaimer: This is intended to provide information respecting the New Brunswick Political Contributions Tax Credit in the Province of New Brunswick under the New Brunswick Income Tax Act . This should not be regarded as a replacement of the laws, regulations or administrative documents to which it refers.

What is the Political Contributions Tax Credit?

The Political Contributions Tax Credit is a non-refundable income tax credit. A taxpayer who contributes to a registered provincial political party, riding association or independent candidate for election to the New Brunswick legislature may claim this credit against provincial income taxes owing.

PLEASE NOTE:Effective June 1, 2017 the political contribution tax credit for corporations is eliminated. Political contributions made by corporations before June 1, 2017 will be eligible for the tax credit.

| Amount of Contribution |

Taxation Of Campaign Contributions

. Posted in MTF Articles.

The official campaign period for the May 2022 national and local elections will start soon and candidates will be, or perhaps have already started, soliciting campaign contributions.

The giving of campaign contributions is recognized under Batas Pambansa 881 or the Omnibus Election Code of the Philippines. Under Section 94 of the code, the term contribution includes a gift, donation, subscription, loan, advance or deposit of money or anything of value or a contract, promise or agreement to contribute, whether legally enforceable, made for the purpose of influencing the results of the elections. It does not include services rendered without compensation by individuals volunteering a portion or all of their time on behalf of a candidate or political party. It also includes the use of facilities voluntarily donated by other persons, the money value of which can be assessed based on rates prevailing in the area.

Not everyone is allowed to make campaign contributions. Under Section 35 of the Revised Corporation Code , a foreign corporation is not allowed to give donations in aid of any political party or candidate, to wit:

Section 35. Corporate Powers and Capacity. Every corporation incorporated under this Code has the power and capacity:

It should be noted, though, that candidates and their political parties have to comply with obligations imposed by the Bureau of Internal Revenue.

Tax implications

Also Check: How To Get Previous Years Tax Returns

What Is A Political Contribution

A political contribution is any money, property or service provided without compensation by way of donation, advance, discount or otherwise. It also includes:

- property or services provided at less than market value, or purchased above market value,

- membership fees for a political party or constituency association,

- fees to attend conferences and conventions of a party, including annual general meetings or leadership conventions, and

- fundraising function tickets purchased for more than $50, or where more than one ticket is purchased.

What Is An In

An “in-kind contribution” refers to any contribution other than a money donation, such as giving:

- Tangible goods,

Regardless of whether a political contribution is made in the form of money or an in-kind donation, it is not tax-deductible. However, in-kind donations of goods to qualified charities can be deductible in the same way as cash donations.

While political contributions aren’t tax-deductible, many citizens still donate money, time, and effort to political campaigns and to support political candidates. If you are one of those citizens, and you were hoping for a tax break, unfortunately, you won’t find one here.

If you’re looking to save more on your taxes this year, find out if you’re eligible for any of these 10 most overlooked tax deductions.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Also Check: Why Is My Tax Refund More Than What I Filed

Limits Set By The Citizen Initiative Act

Individuals ordinarily resident in Alberta can contribute a maximum of $4,000 to a proponent for an initiative petition.

Individuals ordinarily resident in Alberta, corporations that carry on business in Alberta and are not prohibited, Alberta trade unions, and groups with members made up of any of the above, can contribute any amount to initiative petition third party advertisers.

How To Maximize Tax Savings

For tax savings to be maximized, a financial advisor will be the best solution to solve all the doubts you may have. In this way, you can achieve the financial goals you are looking for, getting the greatest possible savings on tax returns.

If you pay a large amount of taxes each year, it is important to make adjustments in withholdings. It can help you keep a larger amount of money during the year. Note that large windfall gains can cause the IRS to ask you for a large amount of money in taxes, which doesnt sound very good either, so it is always best to apply as many tax deductions as possible.

Also Check: Efilemytaxes

Don’t Miss: Turbotax Premier 2021 Tax Software

Limits On Political Contributions

Note that even though political donations are not tax deductible, the IRS still limits how much money you can contribute for political purposes.

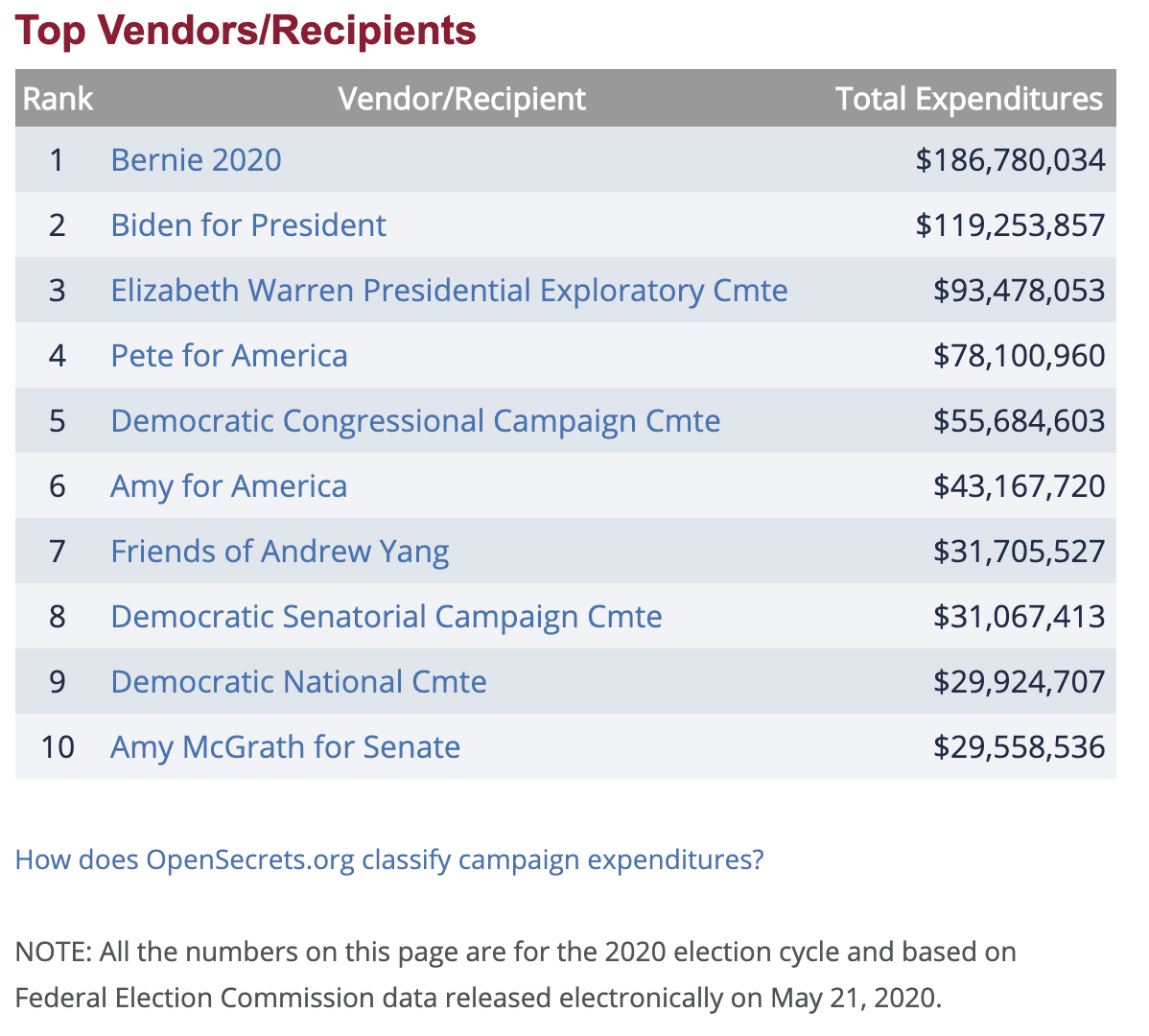

In 2022, an individual may donate up to $2,900 to a candidate committee in any one federal election, up to $5,000 to a PAC annually, up to $10,000 to a local or district party committee annually, and up to $35,000 to a national party committee annually.

How Is The Amount I Get Calculated

The amount of credit depends on how much you give. The rate is:

- 75 per cent on the first $437 of donations in 2022

- 50 per cent on the portion of your donation between $437 and $1,457 in 2022

- 33.33 per cent on the portion between $1,457 and $3,315 in 2022.

Don’t Miss: Filing Taxes As An Llc

Presidential Campaign Contributions: Are They Tax Deductible

The official tax season has passed, but the year is really just getting started. 2016 brings us so many activities to look forward to like the summer Olympics and the much-talked-about presidential election. Although the available candidates are dwindling down, the race for the White House is still heating up.

Candidates are hitting the campaign trail to vie for the chance to be the next POTUS. So since the presidential election in full swing, this also means so are the campaign budgets for the remaining candidates. If you belong to a political party, you may receive information on making a contribution to a campaign. The choice is definitely up to you and is not an obligation to cast your vote. However, there are many people who may choose to make a presidential campaign donation because they believe that it will go towards a tax deduction for themselves, but is this true?

If I Volunteer For A Political Campaign Can I Deduct My Expenses

Weve already covered the fact that money donated to political campaigns will not be tax deductible. However, you may be wondering how the IRS treats the time you donate to candidates. Are donations to political campaigns tax deductible if those donations are volunteered time? The rules are the same for donations of both money and time. So the answer is no: any time you donate to a political candidate, political campaign or political action committee is not considered a tax-deductible donation by the IRS.

You May Like: When Is Tax Returns Due

When Will I Receive My Money

The credit helps reduce or eliminate the amount of tax you owe. If you have an excess credit, it may be paid as a refund after your return is assessed even if you pay no income tax. In that case, you should receive your money within 6 to 8 weeks after the Canada Revenue Agency has assessed your return.

So What Can I Deduct On My Federal Tax Return

While you cant take a deduction on your federal return for political contributions, the federal government offers many other deductions. Some can only be taken when you itemize deductions, but others are available even if you dont itemize. Like all tax deductions, these write-offs can help lower your tax bill by reducing your overall taxable income.

You May Like: Short Term Capital Gains Tax Rates 2021

Political Campaigns From National Down To Local Rely On Contributions To Operate So You Might Feel That You Deserve A Tax Break When You Support The Democratic Process By Making A Campaign Contribution

But the federal tax code doesnt allow you to take a deduction for any political donations you make. And the same is true for most states that have a state-level personal income tax.

Lets look at why political contributions are largely nondeductible, and some alternative deductions that you might be able to take instead to help reduce your tax bill.

Recommended Reading: How Do Doordash Taxes Work

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How Much To Set Aside For Taxes 1099

What About Other Nonprofits That Promote Causes I Believe In

If you want to donate to most social welfare nonprofits, otherwise known as 501 organizations in the tax world, youll have to do so without receiving a tax benefit.

However, there are a couple exceptions.

Donations to veterans organizations with 90 percent war vet membership and volunteer fire departments can be deducted on your tax return.

Rules And Conditions To Claim Section 80ggb Deductions

Section 80GGB specifies the rules and conditions related to donations being made to political parties in India. Following are the essential points that you must remember:

- Cash contributions are not allowed under Section 80 GGB. Therefore, the respective contributions to political parties must be made through other modes of payments such as Cheque, Demand Draft or Electronic Transfer.

- There is no maximum applicable limit on the contributions made to political parties, under Section 80 GGB of the Income Tax Act. But as per the Companies Act 2013, companies can contribute up to 7.5% of their annual net profit . It is necessary that the respective company discloses the amount contributed and the name of the political party in its Profit and Loss account for the said financial year.

- If the amount has been contributed via electoral bonds, then there is no requirement for mentioning the name of the party in the Profit and Loss Account of the company. Only the amount paid has to be mentioned.

- There is no limit on the amount being contributed to a political party, but it is necessary for a company to pay the amount via an acceptable route and keep a documentary record of the same.

- There are certain exceptions to the contributions made under Section 80 GGB:

- A Public Sector Enterprise

Dont Miss: Doordash And Taxes

Recommended Reading: Travis County Tax Office – Main

Amount Of Deduction That Can Be Claimed Under Section 80ggc

Individuals who make donations to any political party can claim deductions of up to 100 per cent of their contribution to said party. By doing so, the total taxable income of the individual is lowered in proportion to the contribution he/she has donated to the concerned party. In other words, the entire amount of a taxpayer or assessee contribution to a legitimate political party will be allowed as a deduction from his or her taxable income.

How Do I Get The Credit

You claim the credit on your personal income tax and benefit return. Calculate your credit by using the chart provided in the provincial worksheet and then complete form ON479.

You or your spouse or common-law partner can claim the credit, but a contribution cannot be divided between the two of you if only one receipt was issued.

If you file your return electronically, you need to keep all your receipts and documents for six years. If you file a paper return, attach all official receipts for your political contributions to your paper return.

Also Check: Who Does Taxes For Free

What Are The Limits On Political Contributions

Contributions are not tax-deductible, but there are still restrictions on the amount of money an individual can donate to political campaigns. Individuals may donate up to $2,900 to a candidate committee per election, $5,000 per year to a PAC, and up to $10,000 to a local party committee.

However, if an individual is donating to a national party committee, they may donate up to $35,000. If these limits are exceeded, the campaign will not be able to use the donation funds.

Tax Credit For Contributions To Authorized Qubec Political Parties

You can claim this tax credit if you made contributions in cash or by cheque to:

- official representatives of municipal political parties or independent candidates authorized under Québec’s Act respecting elections and referendums in municipalities and

- financial representatives of municipal party leadership candidates authorized under this Act.

However, you cannot claim this credit if you were a candidate of an authorized party, an authorized independent candidate or a leadership candidate of an authorized party and you made contributions for your own benefit or for that of the party for which you were running.

For more information, see the instructions for line 414 in the guide to the income tax return .

You May Like: G Wagon Tax Write Off

What Are The Campaign Contributions Limits

The Federal Election Commission says an individual can only donate:

up to $2,700 per candidate per election, up to $10,000 to state, district and local parties combined each year, or up to $100,200 to a national political party, per account, per year.

If you want to contribute, but arent up to make a huge donation, you also have the option to set aside $3 of your taxes as a part of the Political Action Committees. This can be done on your 1040 federal income tax return.

Are Cryptocurrency Contributions Allowed

Yes. Campaign contributions of cryptocurrency and non-fungible tokens are allowed. The value of a contribution of cryptocurrency or NFTs is the market value at the time the contribution was made. The contribution rules under LECFA apply to contributions of cryptocurrency and NFTs, including contribution limits and the provision of required contributor information.

Recommended Reading: Where To Put 1098 T On Tax Return

Turbotax Has You Covered

Be sure to keep checking back here for updated information and tips on how to maximize your tax refund with tax deductions and tax credits that you may be able to qualify for, but dont worry about knowing these tax rules. TurboTax asks you simple questions about you and gives you the tax deductions and credits youre eligible for based on your answers. If you have questions, you can connect live via a one-way video to a TurboTax Live CPA or Enrolled Agent to get your tax questions answered. TurboTax Live CPAs and Enrolled Agents are available in English and Spanish and can also review, sign and file your tax return.

Elle Martinez contributed to this post.

Are Political Contributions Tax

With the 2020 elections behind us and tax-filing season now here, you might be wondering whether or not you can deduct political contributions you made last year. The short answer: No, political contributions are not tax-deductible.

Want to improve your tax management as an investor? Check out our free guide 5 Tax Hacks Every Investor Should Know.

You May Like: What Do You Need To Do Your Taxes