Are Lawyer Fees Tax Deductible

If you or somebody you love is going through the personal injury lawsuit process, then you will likely be looking for various ways to save money. If you are like many other people, then you are regularly looking for tax deductions as you go through your year. You may even wonder if the fees you pay your personal injury attorney are tax-deductible. Here, we want to examine whether or not lawyer fees are tax-deductible in Kentucky.

Legal Fees That Are Not Deductible

Any legal fees that are related to personal issues can’t be included in your itemized deductions. According to the IRS, these fees include:

- Fees related to nonbusiness tax issues or tax advice.

- Fees that you pay in connection with the determination, collection or refund of any taxes.

- Personal legal expenses, including:

- Breach of promise to marry

- Civil or criminal charges related to personal relationships

- Personal injury

- Estate planning such as will preparation

- Property claims or settlements

While not every kind of legal fee can be deducted, those that can be will need to be itemized.

Contact A Skilled Attorney

If you or somebody you care about has sustained an injury caused by the negligent or intentional actions of another individual or entity in Kentucky, reach out to an experienced personal injury attorney immediately. A lawyer can help walk you through every aspect of the process. If you are concerned about tax deductions and tax implications of a settlement, we encourage you to speak to your accountant while your claim is ongoing. You need to keep proper documentation of all expenses that you incur as a result of the legal action.

Recommended Reading: Bexar County Tax Assessor Collector San Antonio Tx

Personal Legal Fees You Can Deduct

Personal attorneys’ fees are deductible in a few types of cases.

Employment Discrimination Cases

You may deduct 100% of the attorneys’ fees you incur as a plaintiff in certain types of employment-related claims. These include cases where you’re alleging unlawful discrimination, such as job-related discrimination on account of race, sex, religion, age, or disability. Such attorneys’ fees are deductible “above the line” as an adjustment to income on your Form 1040. So, you don’t have to itemize your personal deductions to claim them. The only limit on this deduction is that you can’t deduct more than your gross income from the lawsuit.

Certain Property Claims Against the Federal Government

Individuals may also deduct attorneys’ fees if they sue the federal government for damage to their personal property. This applies both to civilians and federal employees. For example, a soldier can sue the government if their property is damaged during deployment. As with the attorneys’ fees deduction for discrimination claims, this deduction is an adjustment to income.

Whistleblower Cases

Irc Section And Treas Regulation

IRC Section 61 explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

IRC Section 104 permits a taxpayer to exclude from gross income “the amount of any damages received on account of personal injuries or physical sickness

Reg. Section 1.104-1 defines damages received on account of personal physical injuries or physical sickness to mean an amount received through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

Don’t Miss: Amended Tax Return Deadline 2020

What Does It Mean To Itemize Your Deductions

When filing your taxes, you can usually either choose to take the standard deduction or to itemize deductions. Both of these options will typically reduce your taxable income, which means that you’ll pay less in taxes. In the case of deducting your legal fees, you need to itemize your deductions rather than taking the standard deduction for the tax year

Beginning in 2018, the new tax law limits the types of itemized deductions a taxpayer can claim while at the same time raising the standard deduction. In other words, some of the itemized deductions that you might have taken in previous years are no longer applicable.

For example, the following can generally no longer be included in miscellaneous deductions:

- investment expenses

Divorce Attorney Fees Are They Tax Deductible

So, can you deduct divorce attorney fees on your taxes? No, unfortunately.

The IRS does not allow individuals to deduct any costs from:

- Personal legal advice, which extends to situations beyond divorce

- Legal action during a divorce

So the money you spend on your attorney to make sure you get the best deal out of your divorce, although its money well spent, is not tax-deductible. The IRS, regardless of the details of your specific case, considers the money spent on divorce to be personal spending, as its not always directly related to a business, inheritance, or retirement plans.

Don’t Miss: Where’s My Tax Credit

Can You Deduct Tax Preparation Fees

Yes, you can write off tax preparation fees for your business. Keep in mind that youll need to keep your business return and your personal return separate.

The fees associated with your personal return do not count as a business expense. You therefore cant claim them on your tax return as a deduction for the business.

This deduction covers the fees charged by a tax professional to prepare your return. It also covers buying tax software or tax-related books. It also includes any fees associated with tax-planning advice.

If you need to conduct an audit or are undergoing investigation, you can deduct the legal fees associated with representation.

Questions To Ask Your Estate Planning Attorney

Many estate planning attorneys already bill separately for tax-deductible services, but its still a good idea to address the topic with your attorney early in the process. The best time to discuss it would be in your initial consultation, while you are evaluating the potential fit with this particular attorney. In addition to addressing the billing practices, consider asking the attorney some of the following questions to get a feel for their process.

Also Check: States With No Tax On Retirement Income

Is Estate Planning Still Worth It

Why go to the expensewithout the benefit of a tax deductionof creating an estate plan if youre not passing on assets worth millions of dollars, and youre not worried about exempting your estate from taxation? For one reason, some states also impose an estate tax that proper estate planning can help you avoid. Many of their exemption amounts are significantly less than those set by the TCJA through 2025.

Then theres the matter of intestate succession. Your state will decide who will inherit your property, assets, and cash if you dont leave an estate planeven a simple will that cites whom you want to receive these things. This process is known as intestate succession. Your siblings and friends would not receive anything from your estate if you leave a spouse and/or children. This peace of mind may be just as important to you as whether you have to pay income tax on the small portion of your income that you spend to prevent dying intestate.

Are Legal Fees Tax

Before filing your annual tax return, you should always go over what deductions and tax credits you may qualify for. Theres a good chance you incurred a few legal fees while acquiring your investment property or due to other business-related matters. If you sustained legal fees for your investment property, they may be tax-deductible.

Attorney fees arent cheap but luckily, you might be able to offset that cost by taking a tax deduction. Legal fees are tax-deductible for investment property if the legal fees were incurred for business matters. To be eligible for this write-off, legal fees must be directly related to business operations or part of your acquisition costs.

Recommended Reading: Home Depot Tax Exempt Registration

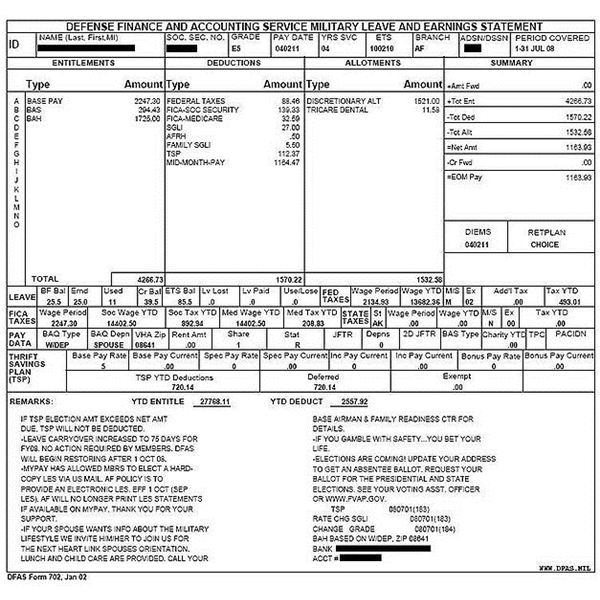

How Do You File Taxes In The United States

Anyone who is working legally in the United States will receive a W-2 Form from their employer in January or February. If you are self-employed or have earned over $600 in the past year in various business endeavors, you will receive a 1099 form. Both of these documents should provide you with information such as how much you have earned and have been taxed in the previous year. You will use these forms along with receipts for any charitable donations, medical expenses, business expenses, student loan payments, and any other tax-deductible fees to calculate your adjusted gross income which is defined as your total income minus any adjustments that you had to pay for during the year.

Once you have gathered all necessary documents to calculate your adjusted gross income, you will need to file taxes and send them to the Internal Revenue System . You can do this by using an agency, accountant, or tax preparation software . Depending on factors such as marital status, the number of dependents in your household, and even some miscellaneous itemized deductions, you may find that you are eligible for a tax deduction. If eligible, the IRS will process this request and provide you with a federal tax refund.

Are Divorce Attorney Fees Tax Deductible

Are divorce attorney fees tax deductible?

Whether attorneys fees are tax deductible is a question for your accountant.

Your attorney should not be your resource for personal finance questions. A professional attorney does have knowledge of the law as it pertains to the division of property, but your accountant is the proper person to consult with questions about taxes, including how to file and what deductions are allowed.

We can tell you this

As of March 2018, there can be no deductions for attorneys fees. The Tax Cuts and Jobs Act of 2017 did away with itemized deductions for individuals. This ruling applies to far more than divorce attorneys fees. Under the 2017 Act, the standard deduction for individual filers was bumped from $6,500 to $12,000, so even if personal legal fees were permitted, it would be unlikely that your divorce attorney fees would exceed this amount.

Before this Act, taxpayers could deduct legal fees of any kind as long as the fees were 2% or more of the persons adjusted gross income. Attorneys fees were filed under miscellaneous expense, but they were definitely allowed.

Legal fees that apply to your job are always permissible. If you own your own business or file a lawsuit against the company you work for, theres a good chance that your legal fees would be eligible for deduction on your personal income taxes, but currently, divorce attorney fees are considered personal expenses.

Free Case Evaluation

Read Also: Are Real Estate Taxes The Same As Property Taxes

Can You Write Off Legal Fees

Attorney fees that are legally acceptable, and necessary expenses that directly relate your business to run and make it operational, are generally included in deductible business expenses. To know if you are able to write off the legal expenses, you need to check the nature of the expenses, i.e., personal or business legal expenses.

An Accountants Fees May Be Tax

The fees incurred to hire an expert such as a vocational counselor may also be deductible to the extent they were used to obtain an order for spousal support.

Fees and costs in connection with an application for a modification of spousal support by the payee are also tax-deductible. Attorneys fees incurred for obtaining an interest in the employee spouses retirement plan are also be deductible.

Attorneys fees incurred in obtaining royalties, residuals and other income taxable to the client may also be tax-deductible.

Fees incurred in establishing or defending title to property may be capitalized and added to the basis of property , affd on appeal without discussion on this issue, 765 F.2d 1051 Gilmore v. United States, 245 F. Supp. 383, 386 ).

The best way to handle the deductibility of attorneys fees is by separately itemizing the services that involved tax advice and the production or collection of income. The attorney, with the advice of an accountant, should send the client a letter at the conclusion of the case that expressly identifies the deductible vs. non deductible services rendered.

In the event the clients deductions are disputed, the IRS must receive such allocation letter in evidence . A sample letter is appended to this article.

You May Like: Small Business Income Tax Calculator

Do You Charge A Fixed Rate Or By The Hour

Many clients prefer a fixed rate over hourly billing so there is no surprise when the final invoice comes in the mail. Your attorney should be able to provide you with an estimate based on the work expected for your case. Keep in mind, however, that this is only an estimate. If any unexpected complications arise in the process, the attorney may charge additional fees to cover the extra work, so be sure to ask what the rate would be if that happens.

Business Or Investment Versus Personal

If the origin of a claim that generated legal fees is personal, the fees are not deductible . However, if the origin is connected with taxable income or stems from a trade or business activity, it is likely to be deductible. The following examples illustrate situations in which the origin of legal fees was personal or tied to maintenance of property held for the production of income or used in a trade or business.

Recommended Reading: Why Is My Tax Refund So Low 2021

Utah Child Custody Lawyer

Mental Illn : A f Nvmbr 2010, the tax code llw you to tk a deduction for lgl f rltd t authorizing treatment fr mntl illness. Therefore, if ur lwr titind th judg t rdr ur former u t fr psychiatric trtmnt fr ur child, u n deduct th portion of legal fees ud t resolve thi mttr frm ur tx a medical expense.

Filing Sttu nd Cutd: Whil u nnt ddut lgl fees rltd to arranging custody fr your children, u n save money on your tx b filing hd f household if your child lives with u fr six mnth or mr during th r u more thn hlf her xn nd you pay for more than hlf of th uk n ur hm. You must b unmarried to claim hd of huhld ttu.

Tax Advi: If you riv tx advice frm ur lwr in nntin with your divorce i.e. how t claim hd f huhld ttu r whether u can tk n xmtin fr ur children u m deduct th lgl f. However, u must btin a bill from your lwr tht lrl lit whih portion of th lgl f r for tx dvi.

How about contingent fee lwr? If u rvr $1 millin in a lwuit nd ur ntingnt fee lawyer k 40%, u might um thatat wrtu hv $600,000 of inm. Actually, u hv $1 millin of inm vn if you nl net $600,000! Tht mn you nd to wrr hw t ddut the $400,000 of f.

How Much Of Your Practice Deals With Estate Planning

Theres a difference between estate planning attorneys and attorneys who do estate planning. If your estate is simple and you arent at risk for estate taxes, then this distinction is less important. If your estate plan involves any complexities, or is large enough to put you at risk for estate taxes, then youll want to work with an attorney who specializes in estate planning. Look for someone who spends at least 50% of their time on estate planning, and who has complimentary experience in probate, taxes, and elder law.

Don’t Miss: Walmart Tax Refund Advance 2022

Personal Legal Fees You Can’t Deduct

Examples of attorneys’ fees you may not deduct include fees for:

- filing and winning a personal injury lawsuit or wrongful death action

- estate tax planning or settling a will or probate matter between your family members

- help in closing the purchase of your home or resolving title issues or disputes

- obtaining custody of a child or child support

- legal defense in a civil lawsuit or criminal casefor example, attorneys’ fees you pay to defend a drunk driving charge or against a neighbor’s claim that your dog bit and injured her child

- lawsuits related to your work as an employeefor example, you can’t deduct attorneys’ fees you personally pay to defend a lawsuit filed against you on a work-related matter, such as an unlawful discrimination claim filed by a former employee that you fired

- tax advice during a divorce case, and

- attempting to get an ex-spouse to pay past-due alimony.

General Rule: Personal Legal Fees Aren’t Deductible

In the past, personal or investment-related legal fees could be deductible as a miscellaneous itemized deduction. However, the Tax Cuts and Jobs Act eliminated these deductions for 2018 through 2025. So, personal or investment-related legal fees aren’t deductible starting in 2018 through 2025, subject to a few exceptions.

Recommended Reading: State Of California Sales Tax

Gifts Made During Your Lifetime

You can still claim a tax deduction in 2022 for gifts you give away while living. This is an itemized deduction, but its not a miscellaneous deductionthe category that was affected by passage of the TCJA.

This provision is subject to some prohibitive rules, however. Gifts you give to family members or friends prior to your death arent tax-deductible. You can only claim those you make to qualifying charitable organizations. The IRS provides a tax-exempt organization search tool on its website, so you can check the status of any organization youre considering to make sure it’s approved.