Are Medicare Premiums Tax Deductible In 2023

Medicare premiums are tax deductible however, they are not typically considered pretax, so theyre taken out of your paycheck based on the amount you make before the money is taxed.

For example, lets say your employer-sponsored health insurance costs $250 each month, and you earn $4,500 each month that $250 would be pulled for your insurance payment, and youd pay taxes only on the remaining $4,250.

Medicare doesnt work the same way as company insurance. Premiums arent removed from your income source before taxes, even if you choose to pay your premium by having the government remove it from your Social Security check. As such, youll want to deduct them when you file your annual taxes.

Did You Know: The Consolidated Appropriations Act of 2021, also known as the CARES Act, permanently lowered the eligibility for taking medical deductions from unreimbursed medical expenses to 7.5 percent.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Thanks for the great question and all the best to you.

% Of Americans Dont Know Medicare Premiums Are Tax

Taxes may be an overlooked expense when preparing for retirement. We ran a survey to see how much people know about tax rules and strategies. To help you stay on top of your taxes whether tax day is coming up or months away we also explain how medical expense tax deductions work and include tips on tax planning.

- Written by

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

-

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

A licensed insurance professional reviewed this page for accuracy and compliance with the CMS Medicare Communications and Marketing Guidelines and Medicare Advantage and/or Medicare Prescription Drug Plans carriers guidelines.

MLAWilliams, Lee. “91% of Americans Dont Know Medicare Premiums Are Tax-Deductible.” RetireGuide.com, 22 Jul 2022, https://www.retireguide.com/guides/tax-knowledge-survey/.

Don’t Miss: What’s The Deadline For Filing Taxes

Are My Medicare Premiums Tax Deductible

Tax Deductions Answer: Maybe!

The rules for deduction depend on your specific circumstances, including your income and employment status. Your income, possible deductions and other circumstances can also affect which Medicare premiums youre able to deduct.

In general, you can deduct:

- Medicare Part A premiums. After age 65, most people get Medicare Part A without paying a premium. As a result there isnt anything to deduct. If you do pay a Part A premium and arent getting any Social Security benefits, you can deduct the premium.

- Medicare Part B premiums. Medicare Part B premiums are tax deductible as long as you meet the income rules.

- Medicare Part C premiums. You can deduct any Medicare Part C premiums if you meet the income rules.

- Medicare Part D premiums. As with Parts B and C, you can deduct your Part D premiums if you meet the income rules.

- Medicare Supplement insurance . Medigap premiums can also be tax deductible.

For 2020 you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of AGI .

Do You Itemize Deductions? The Tax Cuts and Jobs Act nearly doubled the standard deduction amounts for 2018 through 2025. As a result, fewer individuals are claiming itemized deductions. For 2020, the standard deduction amounts are $12,400 for single filers, $24,800 for married couples filing jointly and $18,650 for heads of household.

% Of Americans Overlook Taxes As A Retirement Expense

Its essential to understand how your retirement income and savings will be taxed, so you know how much you will have leftover. This information can help you make a financial retirement plan.

When it comes to taxes, most Americans overlook taxes as a significant retirement expense. In fact, less than 6 percent of Americans reported that they consider taxes as an important factor when planning for retirement.

Although the current Medicare tax rate is only 1.45 percent of an employees salary, that will amount to thousands of dollars over someones lifetime. Travel, food and transportation will also add up to a large sum of money over time.

Recommended Reading: How To Become Tax Preparer

If You Need Help Paying For Your Medicare Premiums You May Be Able To Get Some Of It Back When Tax Time Rolls Around

If youre paying for your own Medicare premiums, you can deduct them on your taxes. This is true whether you pay the premiums directly or if they are withheld from your paycheck. It doesnt matter if the money came out of pre-tax dollars or after-tax dollarsthe IRS allows tax deductions for both.

The amount of deduction depends on several factors: The first is whether or not you have other medical expenses that qualify for tax deductions. For example, if you paid a portion of the cost of prescription drugs with after-tax dollars this year, then only those costs that were covered by Medicare would be deductible . You will also need to know how much income limits have been adjusted for any deductions when filing next yearthis number varies every year based on inflation and other economic factors affecting health care costs nationwide over time.

Finally, theres another thing to consider before claiming any deduction: if it’s going towards something like Medicare premiums which may not occur again in future years, should Congress continue its efforts to dismantle this critical program through cuts & privatization schemes.*

What Is A Medicare Benefit Tax Statement

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act requirements. Also called a 1095-B, this statement can be used if the IRS asks you to verify your health insurance coverage.

View Medicare Disclaimers

ValuePenguin.com is owned and operated by LendingTree, LLC . All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC , a subsidiary of QuoteWizard.com, LLC , a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. Licensing information for QWIS can be found here. QWIS is a non-government licensed health insurance agency. Not affiliated with or endorsed by any government agency.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year unless you qualify for a Special Enrollment Period. QWIS does not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Deductibles, copays, coinsurance, limitations, and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Recommended Reading: Cheapest Place To Get Taxes Done

What If Youre Employed

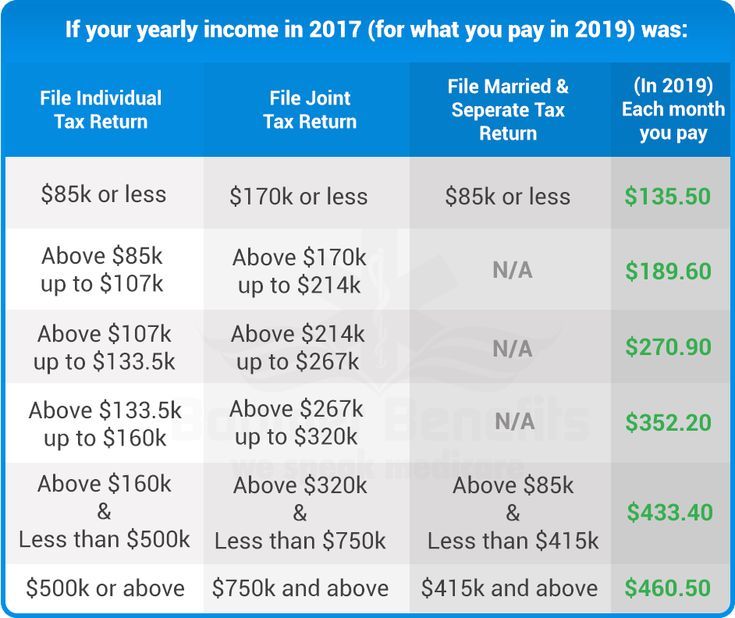

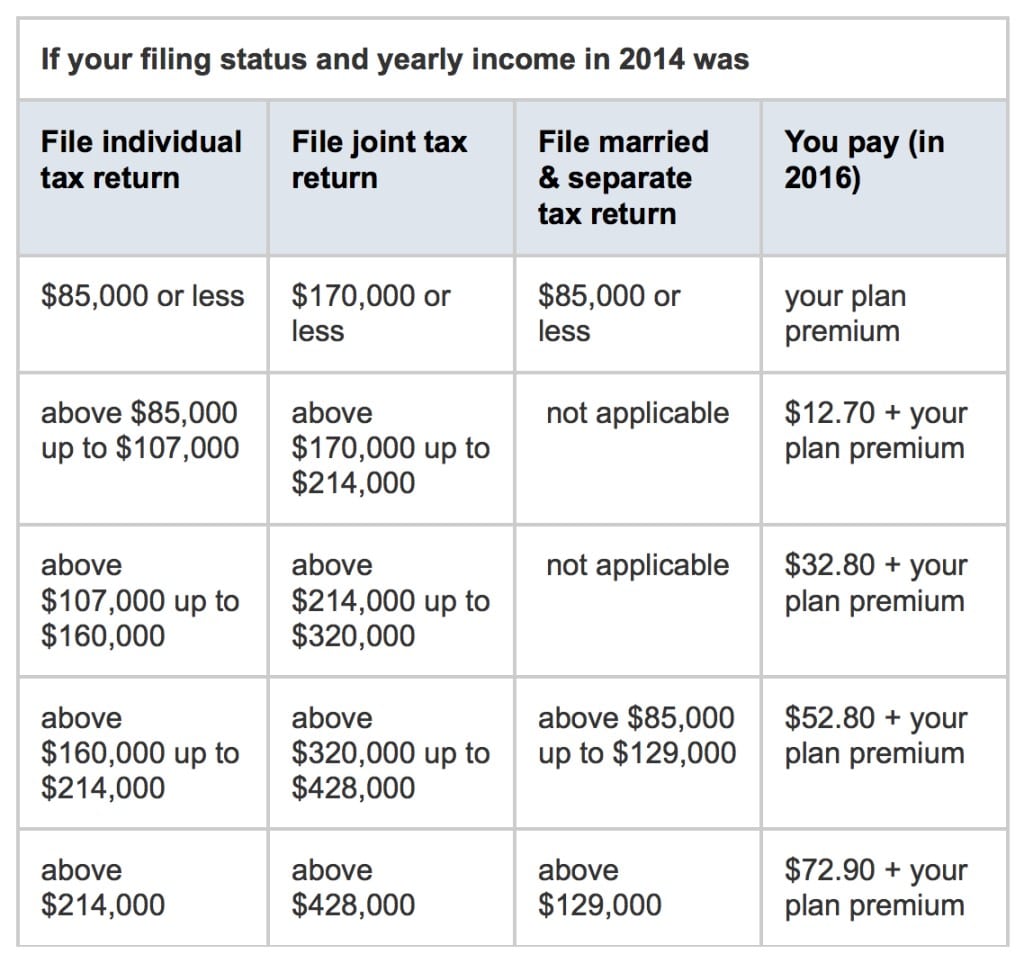

A Medicare members income can affect how their AGI is calculated. Higher income beneficiaries as determined by the United States Social Security Administration normally incur higher premium cost for Part B which covers any health-related apportionment of Medicare.

Medicare premiums are based on the members MAGI. The MAGI is the total adjusted income and tax-exempt interest income. If, for some reason, a life-changing event should occur such as a change in marital status or reduction of income due to job loss, pension, or variation of income-producing property members can request from the SSA an adjustment to their premium.

You Might Qualify To Deduct Your Medicare Premiums

You may be able to deduct your premiums if you itemize deductions, meet certain income and age requirements, and are either 65 years old or older yourself , blind or disabled. And if the person paying your premium is your spouse who has retired, you can take a deduction for his or her premiums as well. To learn more about this deduction, visit our Tax Deductions for Seniors page for more info on what qualifies.

Don’t Miss: Where.is.my Tax Refund

You Can Deduct Your Premiums Even If Youre Not Self

The self-employed health insurance deduction isnt the only way to deduct your Medicare premiums. You may be able to include them as an itemized deduction on your Schedule A instead. But you cant do both, as double-dipping is never allowed when it comes to taxes.

Taxpayers should look at them with and without, says Steber. Try it both ways and see which is a better bottom-line tax deduction.

If youre a small business making money, the deduction out front reduces your income. Thats usually the better tax benefit. But if your company is marginal and your Medicare premiums push you into a loss, then you can be limited , but you can itemize.

So you dont have to be self-employed to itemize your deductions, including medical expenses and your Medicare premiums count as medical expenses if youre itemizing. But if youre using the itemized deduction approach, you can only deduct medical expenses that exceed a certain amount, as explained below.

And its also important to understand that the Tax Cuts and Jobs Act, enacted in late 2018, increased the standard deduction significantly . This means that most people are unlikely to come out ahead with itemized deductions, and few tax filers choose to itemize their deductions. But if itemizing deductions is the more beneficial approach for you, know that you may be able to include some of your medical expenses among the deductions that you take.

Taxpayer Dollars Keep The Medicare System Going

All taxpayers are subject to paying a tax known as FICA, which goes directly into a trust fund, known as the Hospital Insurance Trust Fund, that keeps the Medicare system running. The Hospital Insurance Trust Fund is one of two trust funds that the Centers for Medicare and Medicaid Services oversees, and its funds pay for Medicare Part A:

- Hospital insurance benefits

- Skilled nursing facility care

The second trust fund is known as the Supplementary Medicare Insurance Trust Fund, or SMI. This fund pays for Medicare Part B medical coverage and Part D prescription drug coverage. Its important to note that the SMI fund is not supported by taxpayer dollars. It is instead funded by the premiums that beneficiaries pay for Parts B and D.

Though youre required to pay in to help keep the system going, you become eligible to deduct your premiums once you become a beneficiary. In essence, its almost like getting back what you pay out in more ways than one. Lets take a look at how and why youre able to deduct premium expenses from your taxes as a Medicare beneficiary.

Read Also: What Is The Tax Rate In Ohio

Preview 2022 Mediare Plans

What are the limits for deducting Medicare premiums and costs?

There are no limits to Medicare costs. Although in most Medicare Advantage plans, the out-of-pocket costs vary but vary depending on the particular Medicare carrier. In the majority of cases, a Medicare participant isn’t required to pay a Medicare premium because they have already paid the Medicare taxes in 40 quarters, equivalent to 10 years of employment.

How do you determine your AGI?

Medicare premium payments are calculated using an adjusted AGI of the individual beneficiary. In particular, if MAGI 2019 exceeds the ââ¬Åhighest income” threshold, members will be billed at the Medicare Part B standard rate in 2021. Part B Medicare is considered supplemental insurance and, for that reason, can be deducted from taxes. Part B premiums are tax-deductible based on age and tax year, which constitutes the total medical cost and must bypass either 7.5% of the member’s AGI or 10% of the member’s AGI.

What Documents Do You Need To Deduct Medicare Premiums

Tax Deductions Answer: SSA-1099

Most people have any Medicare Part A and Part B premiums deducted from their Social Security benefit. If you do, you will receive a form each year called SSA-1099. The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes.

In addition, you will receive a form from Medicare called a Medicare Summary Notice. This lists all the services you received, what Medicare paid for them, and the amount billed to you.

Medicare sends you a summary notice every 3 months. If you have a myMedicare account, you can get the same information at any time.

Read Also: What Is Gas Guzzler Tax

Social Security Tax / Medicare Tax And Self

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

In general, U.S. social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer. In limited situations, these taxes apply to wages for services performed outside the United States. Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Are Medicare Premiums Tax Deductible What To Know

Please note that this article is for informational purposes only and shouldnt be taken as tax advice. We recommend that you consult with a tax professional if you have tax-related questions or need assistance, as tax rules can vary based on your state, your income, your employment status, and your personal situation.

Many seniors already live on a fixed income, so every dollar saved goes a long way. This includes the deductions taken on your annual taxes, where you can deduct a variety of medical expenses.

Are Medicare premiums tax-deductible? Yes! Taxpayers have the option of deducting their Medicare premiums from their taxes, but theres a catch: you can only deduct expenses that exceed a certain portion of your income. Make too much, or not spend enough, and youre unable to take advantage of this deduction.

Below, well explain what you should know about deducting Medicare premiums from your annual taxes.

You May Like: Phone Number For Irs Taxes

Preparing To Deduct Medicare Premiums

Youll want to keep copies of the following each year in preparation for making your deductions:

- SSA-1099: You will receive an SSA-1099 form for each year you receive Social Security benefits. Along with the total of your Social Security benefits, the SSA-1090 lists any taxes withheld for the year. This includes your premiums for Part B, should you choose to pay by having your monthly payment deducted from your Social Security check.

- Medicare Summary Notification: This notification form typically comes from Medicare every three months and details all services you used, what Medicare paid, and payments you made. If you arent receiving these forms or prefer a digital version, set up or log in to your MyMedicare account. It will provide you with the same information.

- Bills or Receipts for Uncovered Medical Expenses: Per the IRS, you can include certain costs not covered by Part A or B when computing your medical expenses for the tax year. To do so, you must keep track of relevant bills and receipts, so you can add the correct information when tax filing season comes around. For example, youd want to hang on to financial information regarding expenses such as prescriptions, hearing aids, and dental or vision care.

These documents will provide you with the information you need to calculate your total medical expenses and the amount you can deduct during tax season. Then, if you opt to do so, you can file an itemized Schedule A deduction.

What Is The Additional Medicare Tax Used For

Even though it has Medicare in the name, the Additional Medicare Tax paid by high-income earners is used to offset the costs of the Affordable Care Act , according to the IRS. Funds are used for the provisions of the ACA, including providing health insurance tax credits, to make health insurance more affordable for more than 9 million people.

Read Also: How Soon Can I Get My Tax Refund