Is It Better To Collect Social Security At 66 Or 70

As you undoubtedly already are well aware, most financial planners recommend thatso long as you can afford to do soyou should wait until age 70 to begin receiving your Social Security benefits. Your monthly payment in such an event will be 32% higher than if you begin receiving benefits at age 66.

Can You Get Food Stamps On Disability

If you are receiving SSDI and also qualify for SNAP benefits because you have limited income and resources, you can receive food stamps under SNAP. If you are receiving SSDI, you will be considered disabled for purposes of SNAP, and you may be able to deduct some of your medical expenses from your income.

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Read Also: California Gas Tax Increase 2022

How Much Of Your Social Security Is Taxable

Its possible and perfectly legal to avoid paying taxes on your Social Security check. In fact, only about 40 percent of recipients pay any federal tax on their benefit.

But heres the caveat: To receive tax-free Social Security, your annual combined, or provisional, income must be under certain thresholds:

- $25,000, if youre filing as an individual

- $32,000, if youre married filing jointly

For married filing separately, the Social Security Administration simply says that youll probably pay taxes on your benefits.

Your combined income consists of three parts:

- Your adjusted gross income, not including Social Security income

- Tax-exempt interest

- 50 percent of your Social Security income

Add those amounts up and if youre under the threshold for your filing status, you wont be paying federal taxes on your benefit.

Even if youre above this threshold, however, you may not have to pay tax on your full benefit. You may pay taxes on only 50 percent of your benefit or on up to 85 percent of it, depending on your combined income.

- For individual filers:

- Combined income between $25,000 and $34,000, up to 50 percent of your benefit is taxable

- Combined income above $34,000, up to 85 percent of your benefit is taxable

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

Recommended Reading: Payable Doordash 1099

Read Also: How Do Tax Write Offs Work

Is Social Security Disability Taxable

You may need to pay taxes on your Social Security Disability Insurance benefits. This can happen if you receive other income that places you above a certain threshold. But, because SSDI requires you to be disabled and have limited income to be eligible, you might not have other income to exceed this threshold.

Common examples for when your Social Security Disability Insurance benefits may be taxable are if you receive income from other sources, such as dividends or tax-exempt interest, or if your spouse earns income. If this describes your situation, you will need to know the thresholds for when your SSDI becomes taxable.

The IRS states that your SSDI benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

- Single, head of household, qualifying widow, and married filing separately taxpayers: $25,000

For example, if you are married and file jointly, you can report up to $32,000 of income before needing to pay taxes on your SSDI benefits. If you earn more than these limits for these tax filing statuses, you have two different benefit inclusion rates that can apply.

For 2022:

- As a single filer, you may need to include up to 50% of your benefits in your taxable income if your income falls between $25,000 and $34,000.

- Up to 85% gets included on your tax return if your income exceeds $34,000.

For married couples who file jointly, you’d pay taxes:

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

Also Check: What State Has The Highest Property Tax

Reportable Social Security Benefits

Iowa does not tax Social Security benefits. While Social Security benefits are excluded from income when computing tax, some Social Security benefits are included as income in determining whether a taxpayer has sufficient income to file an Iowa return, and are included as income for purposes of computing the alternate tax on line 39. NOTE: This also affects you if you are single and use the Tax Reduction Worksheet. The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040.

You May Like: How Much Does 401k Get Taxed

Rep Frank Ryan Introduced The 314

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

A state lawmaker has come up with a revised version of a plan he first introduced three years ago that would not only eliminate school property taxes but would make it illegal for a Pennsylvania school district to impose one.

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

Of course, the plan calls for some tax shifting to generate the $16 billion needed to replace the lost property tax revenue for schools. It also includes new taxes on certain retirement income and food and clothing.

Rep. Frank Ryan, R-Lebanon County, on Thursday unveiled his a 314-page House Bill 13 that is the product of five years of work and pulls in the expertise of a bipartisan working group of property tax elimination advocates.

Everybody wants to get rid of property taxes as long as the other person is the one who is going to pay the replacement tax, Ryan said at a Capitol news conference flanked by members of his working group. It is clear that any solution will require sacrifice on the part of all Pennsylvanians.

His plan tries to spread that burden around. It would:

Ryan acknowledges applying the tax on retirement income makes the sales pitch for his plan a tough pill to swallow, but said he believes Pennsylvanians will face that eventuality anyway.

Recommended Reading: What Is Car Sales Tax In California

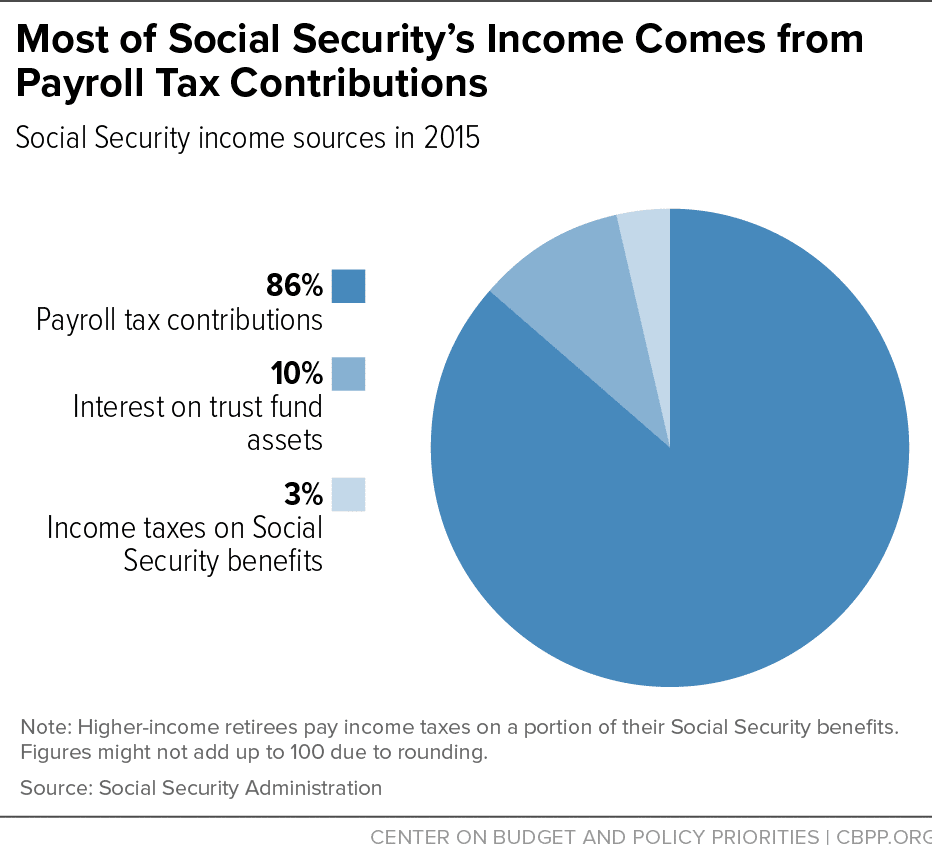

Taxing Social Security Benefits Is Sound Policy

Social Security beneficiaries with higher incomes pay income tax on part of their benefits. Those with incomes below $25,000 pay no tax on benefits, while those with the highest incomes pay tax on as much as 85 percent of their benefits. This arrangement is sound for several reasons:

- The substantial proceeds from taxing Social Security benefits are credited to the Social Security and Medicare trust funds, strengthening the programs financing.

- The taxation of benefits is broadly progressive, since people with low incomes pay nothing and the tax rate on benefits increases with income.

- As an earned benefit, Social Security should be subject to tax, like other earned benefits, such as employer pensions.

- Social Securitys tax treatment is more favorable than that of private defined-benefit pensions, primarily because of the protections for low-income beneficiaries.

Because Of A Current Or Former Spouse’s Work

If you’ve worked and paid Social Security taxes for 10 years or more, you’ll get a monthly benefit based on that work. Then, we’ll see if you’re eligible to get additional money based on a current or former spouse’s work.

If you haven’t worked and paid Social Security taxes for 10 years or more, we’ll still see if you’re eligible for a monthly benefit based on a current or former spouse’s work.

The requirements vary based on whether you’re married, divorced, or widowed. Once you apply and tell us about your current and past marriages, we’ll ensure that you get the highest monthly benefit you’re eligible for. You won’t have to talk to an ex-spouse if you’re divorced and we won’t tell them about your application.

You May Like: Nj State Income Tax Rate

Why Is My Social Security Tax Withheld So High

For tax year 2021, you’ll have excess Social Security withholdings if the sum of multiple employers’ withholdings exceeds $8,853.60 per taxpayer. You don’t need to take any action. We’ll automatically add the excess to your federal refund or subtract it from federal taxes you owe, whichever applies.

Social Security Division In A Divorce

Most working people in our country know that as part of the taxes taken out of your pay, part goes towards social security taxes. Fewer people realize that the amount of money we stand to receive upon retirement can be more significant if their spouse’s work record were to be taken into consideration instead of their own.

You can have both your work record and your spouse’s compared to one another by the Social Security Administration, and whichever results in a higher payout to you, then that is the one that will be applied.

What happens, then, if you get a divorce from your spouse? Are you still able to take advantage of your ex-spouse’s social security benefits and receive them instead of your own? Today’s blog post from the Law Office of Bryan Fagan, PLLC, will go over that subject and include some other pertinent information on Social Security and divorce in general.

Don’t Miss: How Much Taxes Do You Pay On Slot Machine Winnings

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

What Benefits Does Social Security Disability Insurance Offer

The amount you receive from Social Security Disability Insurance depends on your average lifetime earnings before your disability began. Generally, the more you earned over a longer period, the more you’ll benefit, up to a maximum amount. The Social Security Administration calculates your disability benefit based on the amount of your Social Security “covered earnings.” Generally, these are your past earnings that have been subject to Social Security tax.

Your benefits are determined by averaging your covered earning over the 35-year period representing your top earning years. The SSA sees this as your average indexed monthly earnings . The SSA then applies a formula to your AIME to calculate your primary insurance amount . This serves as the base figure for the SSA to calculate your Social Security Disability Insurance benefit amount.

To understand your entire covered earnings history, the SSA provides access to your annual Social Security Statement. If you receive other disability benefits from private insurers, this will not impact your Social Security Disability Insurance benefits.

The Social Security Disability Insurance program rules limit your overall benefit under certain conditions. The combination of Social Security Disability Insurance and other government-sponsored disability programs cannot be more than 80% of the average amount earned before you became disabled. If this happens, the SSA will reduce your payments.

Don’t Miss: When Do Taxes Need To Be Filed 2022

Irs Reminds Taxpayers Their Social Security Benefits May Be Taxable

IRS Tax Tip 2022-22, February 9, 2022

A new tax season has arrived. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include supplemental security income payments, which aren’t taxable.

The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

To determine if their benefits are taxable, taxpayers should take half of the Social Security money they collected during the year and add it to their other income. Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Don’t Miss: Free Tax Filing H& r Block

At What Point Does One Stop Paying Social Security Tax

You are not required to pay any Social Security tax past the wage base limit, which for 2021 is $142,800. So if you earn $142,000 or more, the most you will pay in Social Security tax is $8,853.60. If you make less than $142,000, the most you will pay in Social Security tax will be less than that. The wage base limit for 2022 is $147,000.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

Recommended Reading: How Long Do Taxes Take To Process