Tax Credits For Seniors

If you are a taxpayer over age 65 or permanently disabled, you are eligible for a tax credit of up to $5,000. The complete rules for qualifying for the credit can be found on the IRS website, including a flowchart for determining your eligibility. Tax credits reduce your tax burden dollar-for-dollar.

Seniors are eligible for a higher standard deduction on their return. If you are not itemizing, you can take an extra standard deduction of $1,750 for single filers or $1,400 for married filing joint filers.

Factors That Impact Income Thresholds For Taxes

Four factors generally determine whether you must file a tax return, and each circumstance may influence your gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

Some of these factors can overlap, which can change the income thresholds for required filing.

Single And 65+ Or Blind

If you are a single dependent who is either 65 or older or blind, you will have to file a tax return if:

- You made more than $2,800 in unearned income

- You made more than $14,250 in earned income

- Your gross income was more than the larger of either $2,800 or your earned income up to $12,200 plus $2,050

Read Also: What Is Car Sales Tax In California

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How Much Do You Have To Make To File Taxes

Every taxpayer is entitled to an annual standard deduction a portion of income not subject to income tax. If your 2021 income is less than the standard deduction for your filing status, you generally won’t owe tax.

The standard deduction is taken before taxable income is calculated and can wipe out your total tax liability if you didn’t earn enough.

However, how much you make isn’t the only factor the IRS uses to decide whether or not you need to file a tax return.

Quick tip: Even if you aren’t required to file a tax return, you’ll need to if you want to get a refund of overpaid taxes or claim refundable credits such as the earned income tax credit or child tax credit .

You May Like: Taxes As An Independent Contractor

How To File An Income Tax Extension

There are two methods to request an income tax extension: Mail Form 4868 or make a tax payment electronically. In either case, the IRS states you must file your request no later than your regular tax filing deadline. Also, filing your taxes late without a tax extension could leave you on the hook for paying tax-filing penalties.

According to the IRS, the fastest and easiest option to file a tax extension is to submit Form 4868 using the IRS Free File service. Form 4868 is a simple one-page form that asks for your name, address, Social Security number and estimated tax liability. You can also mail the completed paper form to the IRS, but make sure it is postmarked by the tax return filing deadline.

Your other option to file a tax extension is to make an electronic tax payment before the filing deadline for some or all of your estimated income tax due using Pay Online. When making your payment, note the payment is for a tax extension and save the confirmation number for your records. By doing so, the IRS will treat your note and payment as an extension request.

If youre filing for a federal tax extension, ensure you also meet your states filing requirements, which may vary. The Federation of Tax Administrators offers a helpful resource to access your states tax agency website to discover the specific rules for your state.

If you have existing tax debt and are not sure of what to do next, an expert can also help.

Dont Miss: When Is It Too Late To File Taxes

Consequences Of Failing To File Your Taxes

If you decide not to file taxes for the previous year because you didnt earn the minimum amount of income required by the federal government last year, you will not face any consequences from the IRS, other than potentially missing out on receiving a stimulus check or refund that is only issued if you file taxes with the IRS. Although not everyone is required to file, it is usually beneficial to do so anyway to see if you qualify to tax benefits or if you can claim a tax refund.

Are you still feeling uncertain about whether or not you need to file your taxes this year? It can get confusing when trying to determine if filing taxes is the right decision for you, especially when you know that there are other scenarios involved aside from checking to see if your income is at the standard amount required. In these times of stress and frustration regarding your tax preparation, speaking with a professional can give you valuable insight into whether you should file or not.

We provide professional guidance to people whose lives have been affected by tax problems. To evaluate your specific tax issue and determine if you qualify for tax relief, please contact us for a free consultation. We are COVID-19 prepared, we will work with you over the phone and via e-mail.

The content of this post does not replace the advice of a licensed tax professional. Consult a qualified tax professional for questions specific to your circumstances.

Based on over 140 Google reviews

Don’t Miss: Is Mortgage Interest Tax Deductible

Is My Social Security Taxable

For purposes of this discussion, we are talking about social security payments that get reported to you and the IRS on a tax form SSA-1099. These are social security retirement income, survivor benefits, and Social Security Disability Insurance payments. The good news is that 15% of your social security payments are never taxable.

But what about the other 85 percent?

Lets start with the federal tax return. If half of your social security income, plus any other taxable income , is below the base amount, none of your social security is taxed. So NO taxes on social security if you are below the base amount listed for your filing status:

- $25,000 if youre single, head of household, or qualifying widow,

- $25,000 if youre married filing separately and lived apart from your spouse for the entire year,

- $32,000 if youre married filing jointly,

- $0 if youre married filing separately and lived with your spouse at any time during the tax year.

If single , etc.) and half your social security payments plus your other income is between $25,000 and $32,000, up to 50% of your social security is taxable. If the total is greater than $32,000, up to 85% of your social security is taxable.

If filing jointly and your total is between $32,000 and $44,000, up to 50% of your social security is taxable. If the total is greater than $44,000, up to 85% of your social security is taxable.

Whats The Earliest Date To File Taxes In 2023 How To Get The Quickest Tax Return

SOPA Images/LightRocket via Getty Images

Key Takeaways

- The earliest the IRS accepts tax filings is the end of January. Expect an official date from the IRS sometime in mid-January.

- Filing your taxes as early as possible allows you to get a faster refund. It can also help protect you against identity theft.

- There are several different tax deductions and credits that can help you get the largest refund. See details below.

Gone are the days of large, pandemic-related tax credits. Your 2022 tax return is likely to look more like your 2019 tax return, but this doesnt mean there arent ways to strategize and ensure maximum tax savings.

To get the biggest refund, youll want to file early, take advantage of eFile and direct deposit options, and review all the tax deductions or credits you might be eligible for.

Don’t Miss: Short-term Rental Tax Loophole

Do I Need To File Taxes

Not everyone is required to file or pay taxes. Depending on your age, filing status, and dependents, for the 2022 tax year, the gross income threshold for filing taxes is between $12,550 and $28,500. If you have self-employment income, youre required to report your income and file taxes if you make $400 or more.

The main factors that determine whether you need to file taxes include:

There are also a few other variables that impact your tax filing requirements, including whether you owe special taxes whether you received distributions from a health savings account , Medicare Advantage MSA, or Archer Savings Account or you, your spouse, or a dependent received advance payment from the health coverage tax credit or the premium tax credit.

So, you dont need to file taxes if:

- You earned less than the gross income requirements for your filing status and age

- You made less than $400 in self-employment income

- You dont owe any special taxes

- You did not receive distributions from an HSA, Medicare Advantage MSA, or Archer Savings Account

- You, your spouse, or a depending did not receive an advance payment for the health coverage tax credit or the premium tax credit

You do need to file taxes if:

Can I Avoid Paying Estimated Taxes

Probably not without incurring those penalties. Some classes of workers — particularly those whose income is exceptionally modest, inconsistent or seasonal — are exempt from having to make quarterly payments to Uncle Sam, however:

- If your net earnings were $400 or less for the quarter, you don’t have to pay estimated taxes — but you still have to file a tax return even if no taxes are due.

- If you were a US citizen or resident alien for all of last year, your total tax was zero and you didn’t have to file an income tax return.

- If your income fluctuates drastically throughout the year , you may be able to lower or eliminate your estimated tax payments with an annualized income installment method. Refer to the IRS’s 2-7 worksheet to see if you qualify.

For more freelance tax advice, read our explainer on tax form 1099-K and check out this business owner’s best tips for preparing to pay taxes for your side hustle.

Get the So Money by CNET newsletter

Recommended Reading: How To Pay Doordash Tax

Dependents May Have To File

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,550, must file a tax return.

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2021, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2021, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2021 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Related:Where to Get Your Taxes Done

What If I Don’t Pay My Estimated Taxes

It’s a good idea to post a calendar reminder as the quarterly deadline approaches to avoid paying a late penalty. You may be charged a penalty if:

- You owe more than $1,000 in taxes after subtracting withholdings and credits.

- You paid less than 90% of the tax for the current year through estimated taxes.

The penalty could be waived in some situations. If you want to delve further into estimated tax penalties and conditions of a waiver, see the instructions in IRS form 2210.

Also Check: State Tax Rate In Hawaii

Tips To Help You File An Income Tax Return In India

If you are a resident of India, you are required to file an income tax return every year. This return is important for two reasons: it helps the government collect taxes from you and allows you to claim various benefits from the government. A few tips will help you file your income tax return in India correctly. First, make sure that you have all the correct information. Include all of your income, deductions, and credits on your tax return. Also, be sure to include all of your bank statements and other documentation that proves your income. Finally, be aware of any special filing requirements that apply to you. Contact an accountant or tax specialist if you have any questions about filing your income tax return in India.

Filing For A Business How Much Small Businesses Have To Make To Pay Taxes

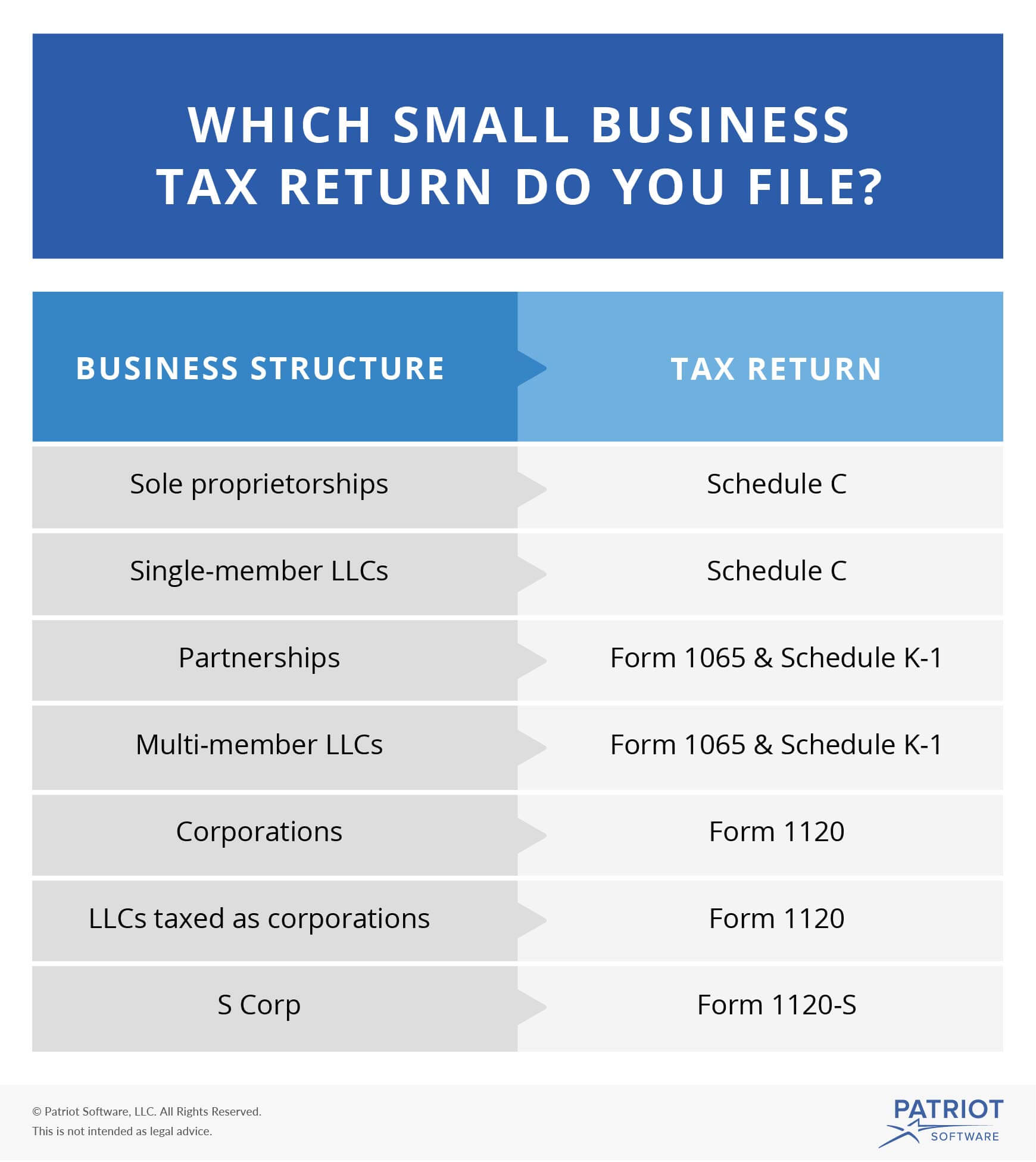

If you own a small business, you must file an annual income tax return.

The only exception is partnerships, which are required to file an information return.

The filing requirements for small businesses vary based upon the businesss legal structure. Pass-through businesses such as sole proprietorships and S-corporations are taxed at the individual level. This simply means that the owner of the business adds the profit or loss to their individual tax return.

Not all businesses are pass-through businesses and will have to file different forms. Businesses that are not classified as pass-through businesses include:

- LLCs that are taxed as corporations

The required tax forms that need to be filed each year vary based on the structure of the business. Additionally, businesses may also have to file additional tax forms throughout the year and pay estimated taxes each quarter.

If you are a freelancer, you may not be required to file taxes. If you make a freelance income of $400 or more from a single employer, you are considered self-employed and must file a federal income tax return with the IRS.

Don’t Miss: Hr Block Free Tax Filing

Filing Requirements Chart For Tax Year 2021

| Filing Status |

|---|

G.S. 105-153.8 requires a married couple to file a joint State income tax return if:

Generally, all other individuals may file separate returns.

On joint returns, both spouses are jointly and severally liable for the tax due. A spouse will be allowed relief from a joint State income tax liability if the spouse qualifies for innocent spouse relief of the joint federal tax liability under Code section 6105.

A married couple who files a joint federal income tax return may file a joint State return even if one spouse is a nonresident and had no North Carolina income. However, the spouse required to file a North Carolina return has the option of filing the State return as married filing separately. Once a married couple files a joint return, they cannot choose to file separate returns for that year after the due date of the return. If an individual chooses to file a separate North Carolina return, the individual must complete either a federal return as married filing separately, reporting only that individual’s income and deductions, or a schedule showing the computation of that individual’s separate income and deductions and attach it to the North Carolina return. In addition, a copy of the complete joint federal return must be included unless the federal return reflects a North Carolina address.

First Day To File Your Taxes

Technically, the first day to file your taxes is January 3, 2023. However, if you do it that early, the IRS wont accept or process them. You also likely wont have all the forms you need to complete your tax return yet, including your W-2 or 1099s for interest payments.

The IRS is usually ready to accept tax returns the last week of January, with the official announcement arriving sometime in the middle of the month.

For example, in 2022 the IRS announced on January 10 that it would start accepting tax filings effective January 24.

You May Like: Irs Tax Return Copy Online

The Minimum Income To File Taxes

| Filing Status | |

|---|---|

| $25,100 | $26,450 |

If your income meets or exceeds the requirements set forth by the IRS based on your age and filing status, you will be required to file a tax return. The chart above outlines these requirements for individuals. This does not apply to dependents well talk more about that in the next section.

If you own a small business, you must file an annual income tax return regardless of your income. Certain businesses arent taxed separately. Instead, you will report the businesss profit or loss on your individual tax return. Businesses that are taxed on the individual level are also known as pass-through businesses. Pass-through businesses that pay taxes on the individual level include:

- Sole Proprietorships

If youre a freelancer, the income limits in the table above dont apply. Instead, you must file a tax return if your net earnings from self-employment were $400 or more. You will also be required to file a tax return if youre a church employee with income of $108.28 or more. In either of these situations, you will be required to file IRS Form 1040 or IRS 1040-SR, along with a Schedule C.