Property Taxes In Pennsylvania

When you reach retirement age, your house may be paid off. Your living expenses would be reduced to property maintenance and taxes. In some states, retirees are quick to downsize to lower their tax burden. In other states with high taxes, property taxes on a single-family home can represent a large part of the retirement budget.

Many homeowners hold their property taxes in escrow, which means they pay toward them each month with their mortgage payment. When the mortgage is paid off, and the taxes are collected twice a year, the amount can be shocking. Many communities across the country are struggling with budget shortfalls and are raising taxes to try to close the gap.

In Pennsylvania, if you are over 65, you may be eligible for a rebate on your housing costs, whether you own or rent your home. For seniors who own their home and do not exceed $35,000 in annual household income, the average property tax rebate is $650. With supplemental rebates, that amount can increase. Income calculations to determine eligibility exclude 50 percent of income that comes from social security and Railroad Retirement benefits.

Property taxes for seniors in Pennsylvania are calculated in their favor. Even renters are eligible for a housing rebate if their income is under $15,000. The same exemptions apply in determining the total amount of income.

At a retirement community such as Cornwall Manor, residents do not pay property taxes.

Factors To Consider When Choosing The Best State To Retire In

When choosing where to retire, its wise to first consider issues like safety, access to healthcare, distance to friends and family, or living near other people of retirement age.

Make a list of features that are important to you in a retirement locale, and consider whether any of them could indirectly impact your cost of living such as being close to friends and family.

Then look at the total cost of living in an area: housing, food, transportation, cultural activities, and other expenses. These retirement expenses generally have a bigger impact on ones lifestyle than taxes.

Finally, to determine whether a state is tax-friendly for retirees, look at the following:

States To Avoid When Retiring

Choosing the best state to retire in sometimes means making compromises. If safety and healthcare access are top priorities, for instance, you may not get your ideal weather. But for many retirees, a high cost of living is a deal-breaker.

Here are the 10 states with the highest annual cost of living for retirees:

1. Hawaii: $99,170

| 7.85% |

Read Also: Turbotax Premier 2021 Tax Software

Affordability Total Points: 40

- Note: This metric is based on WalletHubs “States with the Highest & Lowest Tax Rates” ranking.

- Retired Taxpayer-Friendliness: Full Weight Note: This metric measures taxation on retirement income, property and purchases, as well as special tax breaks for seniors.

- Tax-Friendliness on Estate or Inheritance Tax: Full Weight

- Annual Cost of In-Home Services: Full Weight

- Annual Cost of Adult Day Health Care: Full Weight

Why Do People Move Out Of Maryland

People in all age and income ranges moved both to and from Maryland this past year. The most commonly cited reason for moving both in and out of state was work roughly half of the relocations in and out of Maryland were caused by this. Other reasons included family, retirement, and lifestyle changes.

Also Check: How Much Do You Need To Make To File Taxes

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Best States For Senior Health

To measure the health of each states senior population, United Health Foundation ranks states according to the World Health Organizations definition of health: Health is a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity.

The foundations Americas Health Rankings Senior Report analyzes the nations senior population on a state level using 35 measures of senior health across six categories.

These include:

- Behaviors, such as smoking and drinking

- Macro-level community and environment, such as the quality of nursing homes

- Micro-level community and environment, such as poverty-related threat of hunger

- Policy, such as prescription drug coverage

- Clinical care, such as health screenings and vaccines

- Outcomes, such as hip fractures and premature death

In the 2016 Senior Report, Massachusetts came out on top, followed by Vermont, New Hampshire, Minnesota and Hawaii.

Louisiana was at the bottom of the list, hindered by a high prevalence of smoking, obesity, and physical inactivity.

Recommended Reading: 401k Roth Or Pre Tax

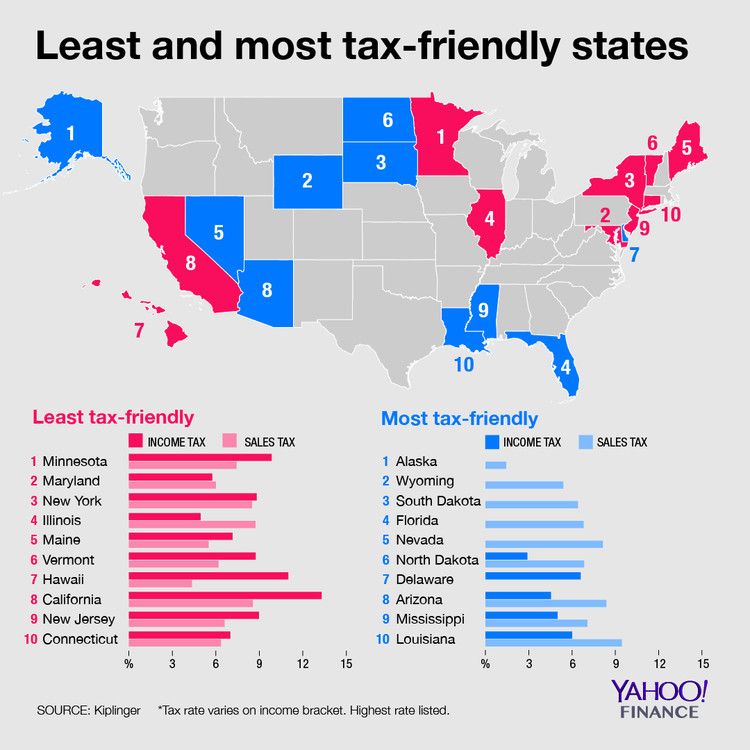

Which States Have The Lowest Tax Burden

Instead of looking at tax rates, which can vary depending on your specific circumstances, the tax burden number measures the proportion of total personal income that youd pay towards state and local taxes.

To determine tax burden, we referenced Wallethubs list that compares the 50 states across three types of state tax in 2022: property taxes, individual income taxes, and sales & excise taxes.

| Rank |

What Does The Best Place For Retirement Really Mean

Choosing where to retire is ultimately a personal or family decision, and while we’ve aspired to build an index that reflects what really matters to people when they retire, everyone has unique circumstances and priorities that can drive that decision.

As a reflection of that, our rankings dramatically change when looking at individual factors. For example, the highest scoring states for weather are among the lowest scoring states overall. However, that may discount retirees that place pleasant summers, mild winters, and sunshine over cost and other factors.

Choosing where to retire isn’t an easy task. But with preparation, research, some luck — and a great IRA — you’ll find a location that fits your priorities.

Recommended Reading: Amend My 2020 Tax Return

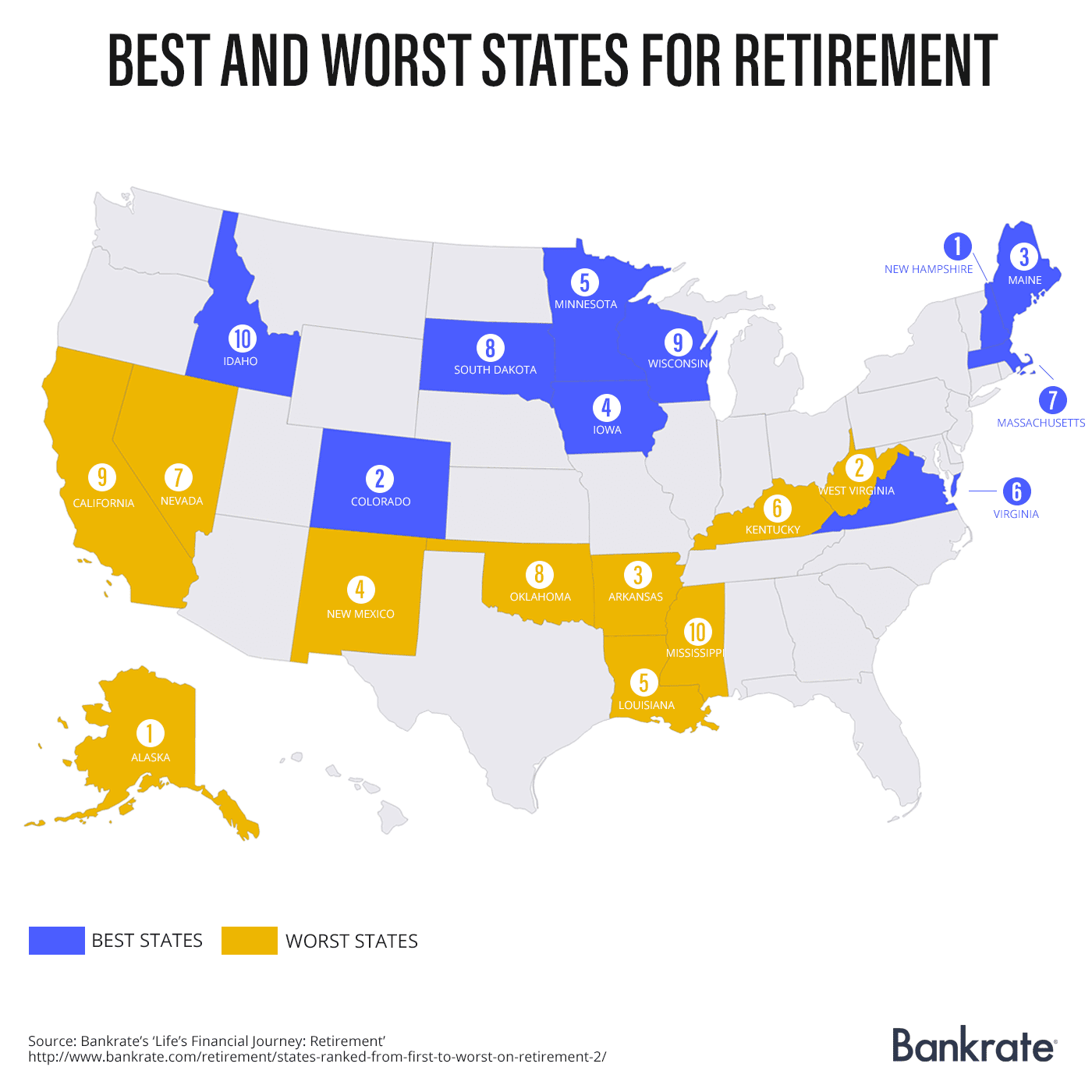

Other Popular Retirement States

There are as many opinions on retirement as there are places to retire, especially in a country as large and diverse as the United States. For example, Bankrate.com put Georgia as the best state to retire in its 2021 study, followed by Florida, Tennessee, Missouri, and Massachusetts. Why Georgia? Bankrate.com said the states low cost of living and lighter-than-normal tax burdens place it 3rd in affordability. Moreover, Georgia has great weather and a beautiful coast for those who want to live along its smaller waterfront.

What Makes Pennsylvania The Best Place To Retire In

Yes, Pennsylvania offers many advantages to retirees. At almost 45 thousand square miles, Pennsylvania is one of the largest states in the country. It is also home to the city of Lancaster, which U.S. News and World Report recently ranked as the second best area to retire in the U.S. Several other cities in Pennsylvania also made the list.

Approximately 15.4 percent of Pennsylvanias population is 65 years old or older and it is home to more than 870,000 veterans. The VA Medical Center in Lebanon County, PA, located near Cornwall Manor Retirement Community, is consistently ranked as one of the best veterans health care facilities in the country. Pennsylvania is also home to 249 retirement communities.

Don’t Miss: What Is Real Estate Tax

Best States For Weather When You Retire

There are 7 significant climate zones in the United States:

- Northwest Coastal

These regions have their own unique weather patterns with varying amounts and types of precipitation , as well as different temperatures. There are some over 65s who cannot tolerate cold, snowy winters, just as there are those who cannot live without it, and the opposite is also true for those who follow the sun all year round.

The National Weather Service keeps you updated on the latest weather in your area, and whether you live in one of the best states for climate change, or in a less temperate one, Nationwide Auto Transportation is your professional auto shipping partner. See what their clients have to say!

Best States For Retirement : Methodology

To take a broad view of retirement conditions in each state, MoneyRates.com grouped ten different data series into four major categories:

Rankings in each of these four categories were averaged to determine the overall rankings.

Don’t Miss: Do Retirees Need To File Taxes

What About Retirement Lifestyle

Money isnt everything in retirement theres no point in having money if you cant spend it on a lifestyle that makes you happy, such as being able to roam in nature or go out to nice dinners, shows, and museums. Many of us wont have unlimited funds when we reach retirement age, so we may need to make sacrifices and relocate.

Its impossible to say with any real conviction which states offer the best lifestyle for retirees since its such a subjective decision. Are you a big city person? Or do you prefer the quiet of a small town? Or maybe youd prefer a secluded country retreat? Which states are the best states to live in is really going to depend on you.

Pros And Cons Of Relocating For Tax Benefits

Lower taxes alone may not be enough to motivate someone to pick up and move house. Other factors should also support the decision.

Pros of Relocating for Tax Benefits

Potentially lower cost of living

Discovering a community of like-minded retirees

Possibly ticking off other boxes on your list

Cons of Relocating for Tax Benefits

Other living costs may cancel out the tax benefits

Moving costs are high, and the stress can be tough

Need to find another home in a sellers market

Read Also: How To Get Copy Of Tax Return

Understand Your Traditional Ira Tax Treatment

Traditional IRA distributions may be fully or partially taxable or not taxable at all, depending on how you treated your contributions before you retired. If you took a tax deduction for contributions you made to the plan in prior tax years, your distributions are likely taxable when you withdraw them, up to the amount you previously deducted.

Traditional IRA contributions are usually made with after-tax dollars, so if you did not take a deduction for some or all of your contributions, the withdrawals you make from these non-deducted contributions are not taxable. That is because you already paid taxes on the money you put in the account, and you didn’t receive a tax benefit for those deposits. Similar to 401 plans, if you deducted traditional IRA contributions from your income in earlier tax years, you may want to limit your retirement withdrawals to reduce your potential tax burden.

South Dakota6th Best State To Retire In

South Dakota boasts a variety of National and State Parks, fishing lakes, wineries and historical sites. These can be enjoyed year-round, as South Dakotas climate is host to all four seasons.

The temperatures range from the 90s in the summer to 10 degrees in the winter . 17% of the population is home to residents 65 years and older.

South Dakota has no state income tax, no inheritance/sales tax, and low sales tax

| Cost of Living Rank- per US News | Healthcare Rank- per Us News | Median Home Value- per Zillow |

| #29 | #32 | $191,400 |

Actually, many publications put South Dakota as the #1 state to retire. Its winter weather ranking is probably in the lower 5 of the 50 states, however.

Average property tax for the state is 1.2%

Recommended Reading: Small Business Income Tax Calculator

Nys Pension Taxation Requirements By State

Will Your NYS Pension be Taxed If You Move to Another State?

If you are considering moving to another state, you should be mindful of the fact that states often enact, amend, and repeal their tax laws please contact their Revenue Agency yourself to verify that the information is accurate. The following taxability information was obtained from each states web site.

We also strongly recommend that you do some further preparation, such as discussing the matter with your tax advisor, before making important decisions that may affect the taxability of your pension and other retirement income.

Information updated 2/24/2022.

Pennsylvania Inheritance And Estate Taxes

The amount of taxes charged on your estate can significantly impact the legacy you leave for your children and other heirs. Estate taxes may make it difficult for you to transfer family wealth or property to succeeding members of the family. The most substantial portion of the inheritance and estate taxes is that imposed by the state.

The state of Pennsylvania does not charge an estate tax for spouses or direct heirs aged 21 or younger. The inheritance tax is based on the relationship to the deceased. A direct heir, a child or grandchild, will see their inheritance taxed at a rate of 4.5 percent. Siblings of the departed will pay 12 percent in inheritance taxes.

All non-relatives or family members of indirect lineage have an inheritance tax of 15 percent. Many of the surroundings states have an estate tax, and some have both an estate and an inheritance tax. Maryland and New Jersey have both. New Jersey has the second highest inheritance tax rate at 16 percent and the lowest exemption threshold for an estate tax.

The tax climate of the state in which you are a resident can impact your children and grandchildren and the legacy you leave them. Pennsylvania is one of the most lenient taxing authorities in the country, making it financially advantageous to move there for retirement.

You May Like: What Happens If I Don’t Pay My Taxes On Time

Does The State Tax Pensions

Many states tax income from pensions and 401 plans, but 12 states do not. These states are Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming.

Most of these states dont have state income tax at all, with the exception of Illinois, Mississippi, and Pennsylvania. Alabama and Hawaii tax 401 plans and IRAs, but not pension plans.

Retirement Account And Pension Income

The way a state handles retirement account and pension income can have a huge impact on the finances of a retiree. Many states do not provide any kind of deduction, exemption or credit on withdrawals from a retirement account such as a 401 or IRA.

How might that affect a typical retiree? Lets say your effective state tax rate in one of these states is 4% and your annual income from your 401 is $30,000. That would add up to taxes of $1,200 on that retirement account income taxes that you wouldnt have to pay in states like Alaska and Mississippi .

Exemptions for pension income are more common. Only a handful of states fully tax income from a government pension, while a few more tax income from a private employer pension. The other states either exempt that income or provide a deduction or credit against it.

Don’t Miss: Tax Credit For Electric Vehicle

What Are The 10 Best States To Retire To

If youre ready to enjoy that sweet retiree life and you want to get a move on, here are the top 10 states retirees are moving to according to U.S. Census Bureau survey data studied by SmartAsset:

Were going to take a deeper look at each of these top 10 states, but first lets answer a few other questions that may be on your mind.

Q: WHAT ARE THE BEST STATES TO RETIRE IN FINANCIALLY?A: Cost of living is used to determine the affordability of a region. It takes into account healthcare, groceries & food, housing, transportation, etc. Now, theres a lot to consider when choosing your retirement home from weather and quality of life to taxes and cost of living* but if were looking at cost of living alone, these 10 states rank the best.

- State Income Tax: No income tax

- Cost of Living: 103

- Population 65+ years: 20.9%

Almost to be expected, Florida leads our list of best states to retire, as it is one of the most affordable places for retirees. Why? Florida is a very tax-friendly state with no state income tax and no tax on retirement income like Social Security hence why its considered a friendly state for people who want to enjoy their retirement fund to its fullest potential. The cost of living is 3% more than the national average, but the state doesnt have estate or inheritance taxes. And as a bonus, the average healthcare costs in the state are also below the national average spending per capita.