Do Not Sell My Personal Information

For California residents, and to the extent NEOGOV sells your personal information as the term sell is defined under the California Consumer Privacy Act, you have the right to opt-out of the sale of your personal information by us to third parties at any time. This setting only applies to registered account holders that have opted-in for an Access Membership. If you wish to opt-out click follow these steps:

If you do not have a registered account this setting does not apply, however, you can review your right on our privacy policy.

If you require further assistance, please email

Welcome To Bexar County Job Opportunities

Bexar County provides equal employment opportunities to all employees and applicants for employment without regard to sex, race, color, ethnicity, national origin, citizenship, gender, gender identity, gender expression, sexual orientation, pregnancy status, age, religion, political affiliation or beliefs, physical or mental disability, genetic information, veteran status, or any nonmerit factor in accordance with applicable federal, state, and local laws governing nondiscrimination in employment.

Please take a moment to look at our current openings. If you are interested, click on the “Apply” link!First time applying with Bexar County? Then you will need to create an account.Username: You may use letters and numbers and the underscore “_” Example: bexar_app101 Must be at least 8 characters long _ _ _ _ _ _ _ _ Must contain at least one special character !@#$%^& * Must contain at least one letter Must contain at least one number. Example password#4BXRNote: If you have applied using Neogov with other entities, you might already have a user account active.When you “Build Job Application”, it is very important that you complete each section completely and that your education and experience you possess is clear. Resumes will not be accepted in lieu of an application.This online application stores all information on a secure site. Only authorized employees and hiring authorities have access to the information submitted.

Resources For Bexar County

If you need more information about property taxes and other tax and residency information for Bexar County, have a look at some of the following resources:

This Bexar County government site connects residents, homeowners, and visitors to important information and resources they may need, including pertinent tax information.

The Bexar Appraisal District website gives residents access to resources they may need for property valuation, disaster appraisals, and other solutions within their specific area. Their office is located at 2949 North Stemmons Freeway , Dallas, TX 75247. Telephone: 631-0910.

The Bexar County Clerks office helps residents find information on costs and fees, government agencies, records and documents, and forms that may be necessary to learn more about property taxes. Their office is located at 100 Dolorosa, Suite 104, San Antonio, TX 78205. Telephone: 210-335-2216.

You May Like: Are Municipal Bonds Tax Free

What Are Property Taxes

For property tax purposes, January 1 of each year is the effective date of the tax roll. A tax lien is automatically attached to all taxable properties on January 1 of each year to secure the tax liability. During the course of the year, there are several phases involved in the taxation process.

During these phases, appraisal districts identify and appraise all real and business personal properties. The governing bodies of the taxing jurisdictions adopt a tax rate to support their fiscal year budget. In the final phase, the Tax Assessor-Collector assesses and collects property taxes for each of the taxing jurisdiction they are responsible for collecting.

Bexar County Collection Information

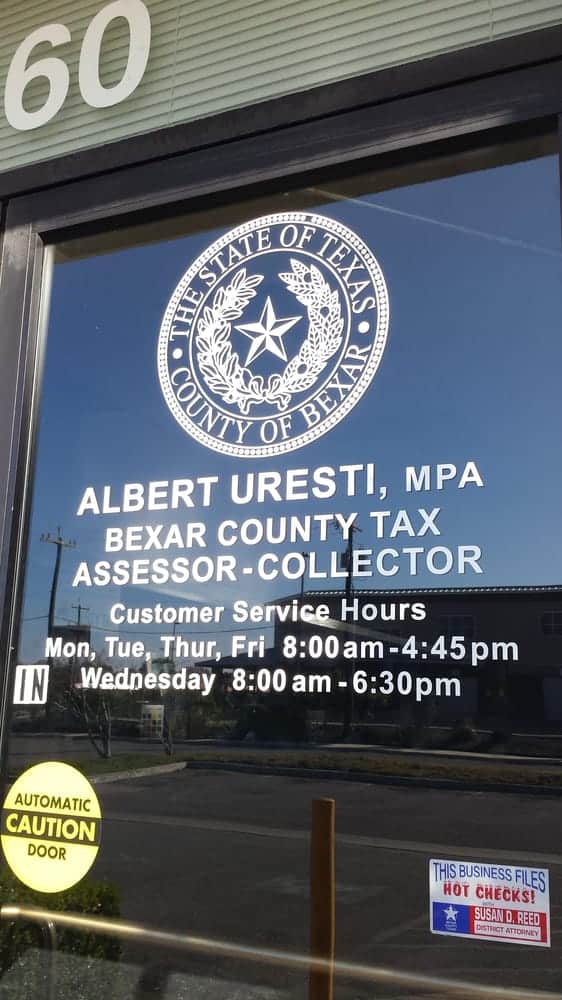

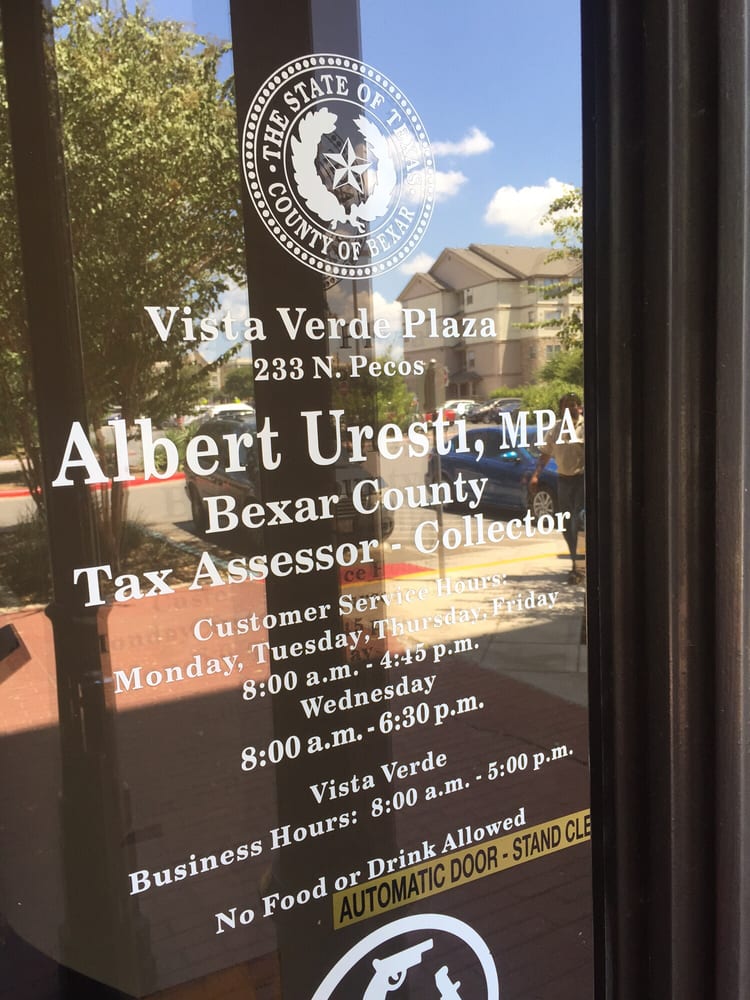

The Bexar County Tax Assessor-Collector website provides you with information about the countys Tax Assessor-Collector. On this website, you can also find tax rates, exemptions, and payment plan options. Their office is located at Vista Verde Plaza Building, 233 N. Pecos La Trinidad, San Antonio, TX 78207. Telephone: 210-335-2251.

You May Like: How Much Is Tax At Walmart

Your California Privacy Rights

If you are a California resident, you have the additional data rights listed below. You can exercise some of these rights by utilizing the prompts within messages we send you within your account settings, or within the privacy settings on our web pages. Otherwise, you are also able to exercise these rights by contacting our support team using the privacy support emails listed at the end of this Policy. Please note, if we cannot verify your identity we may deny certain data right requests. You can designate an authorized agent to submit requests on your behalf, but we require written proof of the agents permission and verify your identity directly.

California Civil Code Section 1798.83 permits our visitors who are California customers to request certain information regarding our disclosure of personal data to third parties for the third parties direct marketing purposes. To make such a request please send a letter to: Governmentjobs.com, Inc., 300 Continental Blvd. Suite 565, El Segundo, CA 90245 Attn: Privacy Department. Requests must include California Privacy Rights Request in the first line of the description and include your name, street address, city, state, and ZIP code. Please note Governmentjobs is not required to respond to requests made by means other than through the provided mail address.

Speech Request & Appearances

Albert Uresti and other representatives of the Bexar County Tax Office are available to speak at your organizations event or meeting. During our presentation, we can address issues on taxpayer rights, property tax laws, motor vehicle issues, and any other issues our office handles.

To request a speaker, please fill out a speech request form. Should you have any additional questions regarding a speaking engagement for Mr. Uresti, please call 335-6585.

Albert Uresti, MPA, PCAC, CTOPBexar County Tax Assessor-Collector

Chief Deputy of Administration and OperationsJeffrey Acevedo, PCCDirector, Motor Vehicle Registration Department

Carlos J. Gutierrez, PCC

Also Check: What Do You Need To Do Your Taxes

Bexar Country Deferral Information

To ensure certain protected classes can stay in their homes, the State of Texas has a law allowing for property tax deferrals. Pursuant to section 33.06 of the Texas Property Tax Code, people over 65, disabled individuals, and certain veterans or spouses of deceased veterans are entitled to deferred collection of property taxes until the homeowner passes away or relocates from the property. If you meet these guidelines, apply for a deferral to the Bexar County Appraisal District using the appropriate form on this page. Dont get a property tax loan.

Personal Data We Collect About You And Why

In this Section we set out general categories of personal data we may collect and the purpose for using your personal data, including the personal data collected and processed over the past year. We collect and process personal data to provide you the Services, fulfill our contractual responsibility to deliver the Services to our Customers, fulfill your requests, and pursue our legitimate interests and our business and commercial purposes. We also automatically collect data during your usage and collect other personal data about you from other sources. Your personal data will only be collected and used for purposes stated herein, where you provide additional consent, or as required by law or regulation – including national security or law enforcement requirements.

Information Provided by You.

We collect personal data from you directly when you visit our Services from either your computer, mobile phone, or other device, attend one our events, or communicate with our personnel. The categories of personal data we collect from you, including over the past year, involve the following:

You may voluntarily submit other personal data to us through our Services that we do not request and are not required for the relevant data processing activity. In such instances, you are solely responsible for such personal data.

Information Collected Automatically.

Information from Other Sources.

Information Collected When Using the PowerLine Application

You May Like: Sales Tax And Use Texas

Property Tax Loans In Bexar County

Are you looking for a way to keep your property as well as your peace of mind? If you own any type of property in Bexar County, you are subject to property taxes. In the state of Texas, these taxes cause property owners a lot of stress as they are subject to penalties and interest fees if they fall delinquent on the taxes.

Bexar County Tax Office

County tax assessor-collector offices provide most vehicle title and registration services, including:

- Registration Renewals

- Vehicle Title Transfers

- Change of Address on Motor Vehicle Records

- Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates

- Disabled Parking Placards

- Copies of Registration Receipts

- Temporary Registration

Many counties allow you to renew your vehicle registration and change your address online. Some counties allow renewals at substations or subcontractors, such as participating grocery stores. Acceptable forms of payment vary by county.

Other locations may be available. Please contact your county tax office, or visit their Web site, to find the office closest to you.

This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Please CHECK COUNTY OFFICE availability prior to planning travel.

You May Like: How Do Tax Write Offs Work

Youre Projecting A Significant But Not Overwhelming Shortfall This Year In Property Tax Collections What Do You Expect For 2021

A lot of people pay property taxes in October. I do think its going to impact the amount of taxes we collect in October because of the economic downturn. Values will go down in 2021 I know that the values are going to go down. But are we going to see a decrease in the amount of taxes collected from October 2020 through Jan. 31 of 2021? Thats when we collect the most taxes, in those four months. I would guess theres going to be an impact.

About The Bexar County Assessor

The Bexar County Assessor, located in San Antonio, Texas, determines the value of all taxable property in Bexar County, TX. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Property assessments performed by the Assessor are used to determine the Bexar County property taxes owed by individual taxpayers.

Property owners may contact the Assessment Office for questions about:

- Bexar County, TX property tax assessments

- Property tax appeals and reassessments

- Paying property tax bills and due dates

- Property tax rates and tax roll

- Bexar County GIS maps, property maps, and plat maps

- Property records and deeds in Bexar County

Read Also: Can I Still File My 2017 Taxes Electronically In 2021

Whats Your Message To The Thousands Of Unemployed Workers Staring At A Property Tax Bill They Cant Pay

We will work with them. If they come in and theyre sincere about wanting to keep their homes, we will work with them. Ignoring the problem is not going to make it go away. They need to come in and sit down with us and not be afraid to come in. For July and August, we have no residential properties on the tax sale so no foreclosure sales for delinquent taxes.

Ive instructed our attorneys not to have any residential properties on sale for July and August, and it may go beyond that. Were trying to make sure families stay in their homes and business owners, were trying to keep them in business.

Important Electronic Payment Information

All credit card and eCheck payments will take 3 to 5 business days to process and post to your account. However, your payment will be posted as of the date of the online transaction. Before you begin the credit card or eCheck payment process, it is important to make the necessary modifications to your spam blocker to allow the confirmation e-mail to be sent to you. Once you receive the e-mail confirmation, you can go back and enable your spam blocker. You may also include the to your authorized list of senders.

If you should have any questions or concerns, please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251.

Read Also: Montgomery County Texas Tax Office

What Kind Of Revenue Shortfall Do You Expect This Year Given That Many People Have Lost Their Jobs And May Be Unable To Pay Property Taxes

Are we anticipating a shortfall? I would say yes, and I think we are going to have a shortfall for two reasons. One is because appraisals are going to be somewhat inflated, and because of that, with all the people who have lost their jobs, its going to be that much more difficult for people to be able to pay their property taxes. I know the county managers are trying to make cuts in anticipation of a budget shortfall.

Overall, on the countys entire budget for the year on property taxes, were looking at approximately an $8 million to $11 million shortfall, out of a total amount of $496 million or about 2.2 percent. In the grand scheme of things, its not a lot of money for this year, because a lot of the money had already been collected by Jan. 31.

This is property taxes only. There will be other revenue shortfalls that the county is having that may have more detrimental effects on things. Right now, property taxes are OK because most of the taxes had been collected pre-pandemic, but I think next year, with the loss of jobs, it may be more difficult to collect property taxes

About The San Antonio Assessor Office

Assessor Offices in San Antonio, TX are responsible for assessing the values of all taxable property within their jurisdictions. Assessors appraise values of all land and commercial property , and business’ fixed asset . The office determines property tax values, tax rates, maintains and updates the local tax assessment rolls.

Property owners may contact the Department of Assessment for questions about:

- San Antonio property tax appeals and challenges

- Property tax assessments and reassessments

- San Antonio GIS maps, plat maps, and property boundaries

- Delinquent property taxes

You May Like: When Is The Last Day To Turn In Taxes

Albert Uresti Bexar County Tax Assessor

- Veronica Fernandez MillerJuly 30, 2012The information clerk is really nice and patient 🙂

- Quantum ZambalesMay 9, 2016They take credit cards now as a percentage of your total. It’s like a 2% fee.

- Karen TarttJanuary 7, 2013Roped off lines and the line wrapped around the building…It’s like waiting to get into a club without the promise of drunken good times!!! Lol

- M WJanuary 4, 2013Been here 5+ times

- Lynda DeyoAugust 9, 2013Been here 5+ times

- Ed GarciaDecember 29, 2011Can’t believe in the 21st Century you can’t pay them online AND they only take checks & cash. Lines out the door.

- Adam Diaz JrJanuary 28, 2021Too many people in line to do whatever did my VRS at home online, took less time…Ill wait the week!

- Teresa O’KelleyJuly 10, 2013There is an ATM machine… I wasn’t charged a fee. 🙂

- GregJuly 8, 2010

- Rick BarreraJanuary 30, 2012Accepting Debit Cards would be helpful.

- Cory BellamyJanuary 24, 2012How is it that they don’t take credit or debit at the counter? Such a hassle for this generation.

- Kiris Calo-oyNovember 10, 2011Been here 10+ times

- Eric MartinezOctober 1, 2012Lines are fun. Hope you think so too

- Monica ChristinaOctober 1, 2010Don’t come on a Friday at 4pm when they close at 4:45pm.

- Doris MauleNovember 3, 2010No credit and no debit. Remember to bring your cash or a check!!

- MissTammy NunezFebruary 29, 2012Omg the lines are suppper long!!!! Ugh

Overview Of Your Data Rights

Your data rights for personal data where we are the data controller.

You can review and enforce your personal data rights through your account, communications you receive from us, third party mechanisms, or with the assistance of our support team using the emails at the end of this Policy. For instance, you can:

Your data rights for personal data you submit to our Customers.

Upon making your personal data available to an employer , your personal data may be controlled by our Customer. In this regard, we are a data processor for personal data Customers maintain have us process, and your data rights are subject to our Customers internal policies. For these reasons, we are not in a position to directly handle data requests for personal data controlled by Customers. You should contact the Customer regarding personal data they may hold about you and to exercise any data rights you may have. We will cooperate with such inquiry in line with applicable law and our contractual obligations with the Customer.

Read Also: California Llc First Year Tax Exemption

Your Nevada Privacy Rights

A sale under Nevada law is the exchange of personal data for monetary consideration. We do not currently sell personal data as defined under Nevada law. If you want to submit a request relating to our compliance with Nevada law, please contact us at the privacy support emails listed at the end of this Policy.

About The Bexar County Assessor’s Office

The Bexar County Assessor’s Office, located in San Antonio, Texas, determines the value of all taxable property in Bexar County, TX. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Property assessments performed by the Assessor are used to determine the Bexar County property taxes owed by individual taxpayers.

Property owners may contact the Assessment Office for questions about:

- Bexar County, TX property tax assessments

- Property tax appeals and reassessments

- Paying property tax bills and due dates

- Property tax rates and tax roll

- Bexar County GIS maps, property maps, and plat maps

- Property records and deeds in Bexar County

You May Like: Free Irs Approved Tax Preparation Courses