Social Security In The Us

Social Security, which is administered by the Social Security Administration, is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance program.

Along with medicare, contributions to these are automatically withheld and deducted from your paychecks by your employer just like with both federal and state income taxes.

For employees, the contribution rate for social security is 6.2% while the contribution rate for medicare is 1.45%. Employers also contribute in equal amounts.

Social security contributions have a maximum cap on the applicable income which is called the wage base limit. For 2022, the wage base limit for social security contributions is $147,000.

Medicare contributions do not have any maximum cap on applicable income. Additionally, high income earners above a certain threshold, which varies depending on filing status, must contribute an extra 0.9% to medicare.

California Income Tax Brackets And Other Information

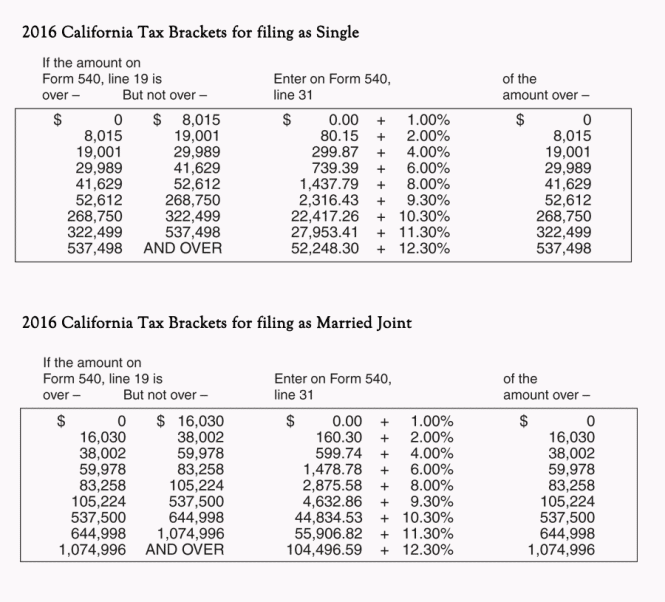

The state income tax system in California is a progressive tax system. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. The tax brackets are different depending on your filing status. Those that are filing as single or married filing separately see tax rates that range from 1% to 12.3%.

For 2021 tax year

| Taxable Income |

|---|

| From 850,503 onwards | 12.3% |

A state standard deduction exists and varies depending on your filing status. There is also a standard personal exemption available too which is structured as a tax credit. This, along with all other state tax credits, phase out and are reduced for high income earners until a certain limit at which one is then no longer eligible for them.

Additionally, California has additional social security related taxes.

The first is a disability insurance tax which applies to everyone at all income levels while having a maximum cap on the applicable income.

For sales tax, please visit our California Sales Tax Rates and Calculator page.

Resident Status And Income Tax In The Us

The United States is unique in that it levies tax on its citizens and residents on their worldwide income regardless of where they live or stay in the world. Note that many tax treaties do exist between the United States and other countries which help to reduce the tax burden by eliminating double taxation .

Non-resident foreign nationals are generally taxed only on their US-sourced income and income that is related with a US trade or US business.

Foreign nationals can be considered residents under a wide variety of scenarios along with an equally wide variety of exceptions. One basic scenario is being a permanent resident in the way of possessing a green card. Another relatively basic scenario is via the “substantial presence test” which, for the most part, states that individuals that stay for at least 31 days in the current year plus a combined total of 183 equivalent days during the current year and prior two years may also be considered residents. Determining residence can get extremely complex really quickly, so for more details, please consult with a tax professional.

Also Check: How To Pay Doordash Tax

California Provides Path To Deduct State Income Tax For Calculating Federal Tax

In IRS Notice 2020-75, the IRS invited the states to circumvent the $10,000 limit on the deduction of state taxes by individuals, trusts, and estates for purposes of calculating federal income tax by permitting the states to implement an elective tax on certain pass-through entities and permitting a credit for those taxes to the owners of the entities. Thus, instead of the owners paying non-deductible state income tax, the entities can pay the elective tax as a deductible expense that passes through to the owners as a federal deduction and state tax credit. Voila! A non-deductible state income tax becomes deductible!

It is remarkable that the IRS issued such a notice, but it is not remarkable that the states are taking up the offer, including most recently California in Assembly Bill 150 signed into law on July 16. To make the new law understandable, this article omits some of the arcane details and instead uses lay persons language. It is thus critical to consult with a tax advisor based on your particular facts before relying on this summary.

Taxable Income In California

The flip side is that you’ll have to pay taxes in California on some types of income that aren’ttaxed at the federal level, such as foreign earned income that you can exclude on your federal tax return. In addition, interest earned on municipal, state, and local bonds from outside California is also taxable.

Alimony you receive is taxable income in California, although it’s no longer taxable at the federal level for divorces entered into after 2018. The spouse paying alimony or spousal support is entitled to a tax deduction for that amount.

You May Like: How Do Tax Write Offs Work

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

You May Like: Do I Need To Report Cryptocurrency On My Taxes

How Bench Can Help

Wondering what deductions you can claim? Could you save on taxes by switching to an S corporation status? Bench provides small businesses with year round tax advice from a team of experts inside our easy-to-use platform.

With Bench, you receive a dedicated bookkeeper to do your monthly bookkeeping and ensure your financials are organized and up-to date for tax filing. Youâll have an on-going, accurate view of the health of your business and the most stress-free tax season yet.

California State Income Tax

Self-employed workers, independent contractors and unincorporated businesses in California might not have to pay state corporate or franchise taxes, but most still have to pay state income taxes. Same goes for people who earn income from pass-through entities like S Corporations and LLCs.

The California state income tax rate ranges from 1 to 12.3 percent. Your income tax rate is based on which of the nine California tax brackets you fall into, and also your filing status.

If your filing status is âSingleâ or âMarried Filing Separately,â youâll calculate your 2020 California income tax based on the following schedule:

| Over | Enter on Form 540, line 31 | |

|---|---|---|

| $0 | $0.00 + 1.00% of the amount over $0 | |

| $8,932 | $89.32 + 2.00% of the amount over $8,932 | |

| $21,175 | $334.18 + 4.00% of the amount over $21,175 | |

| $33,421 | $824.02 + 6.00% of the amount over $33,421 | |

| $46,394 | $1,602.40 + 8.00% of the amount over $46,394 | |

| $58,634 | $2,581.60 + 9.30% of the amount over $58,634 | |

| $299,508 | $24,982.88 + 10.30% of the amount over $299,508 | |

| $359,407 | $31,152.48 + 11.30% of the amount over $359,407 | |

| $599,012 | And over | $58,227.85 + 12.30% of the amount over $599,012 |

Consult the FTBâs schedules here if youâre filing your taxes jointly with a spouse, are a qualifying widow, or are using the âHead of Householdâ filing status.

You May Like: Do I Have To Pay Taxes On Inherited Money

Software Electronically Transmitted To Customers

According to Regulation 1502, the sale of noncustom software to customers who download the software from a server is generally not subject to sales tax because the transaction does not involve tangible personal property. However, if the customer is provided a copy of the software on a physical storage medium such as a CD-ROM or a DVD, the entire transaction is generally subject to sales tax. Thus, a customer can generally avoid sales tax liability by purchasing a downloadable version of software instead of a physical version.

/24 California State Tax Refund Calculator

Calculate your total tax due using the CA tax calculator . Deduct the amount of tax paid from the tax calculation to provide an example of your 2023/24 tax refund.

The California State Tax calculator is updated to include:

Don’t Miss: When Is Tax Returns Due

Do I Have To Pay Income Tax In California

You are required to file a California tax return if you receive income from California, have income above a certain income threshold, and you fall into one of the following categories:

You are considered a resident if you are one of the following:

- You reside in California for other than a temporary time period

- You reside in California but are away for a temporary time period

Timing Of Payment Of The Elective Tax

For 2021, the Elective Tax is due on or before March 15, 2022. For taxable years 2022 through 2025, the Elective Tax is due in two installments:

- The first installment is due by June 15th of the current year, and is the greater of $1,000 or 50% of the Elective Tax paid in the prior year and

- The second installment for the remaining amount is due on or before March 15 of the subsequent year.

If payments are not made as required above, the Election is invalid, so it is critical that the Elective Tax is timely paid. However, even though part of the Elective Tax can be paid after year end, if the Qualified Entity is on the cash method of accounting, it will have to pay the tax by year end in order to pass through the deduction in the current year to the Qualified Owners. Qualified Entities must use Pass-Through Entity Elective Tax Payment Voucher to remit the tax to the FTB.

Read Also: Unexpected Tax Refund Check 2021

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

The State Of California

In 1542, the Spanish expedition led by Juan Rodriguez Cabrillo used the name California to name the region. This name most likely comes from a fictional island paradise also named California which was described in a Spanish novel that was published in 1510.

After Alaska and Texas, California is the third largest state. California’s admission into the Union in 1850 as the 31st state was aided by the discovery of gold and the immigration of thousands of “forty-niners” in 1849.

California has the highest population of any state in the nation and is also a very important agricultural state in America. Additionally, it is also the home of Hollywood which is the center of America’s movie and television industry.

The state’s outdoor way of life is attractive to a lot of visitors and residents alike. The warm, dry climate makes it possible for outdoor recreation most of the year.

Geographically, the High Sierra Nevada can be seen near the eastern border while the shore of the Pacific Ocean in the west has rocky cliffs and sandy beaches. The Coast Ranges in the northwest have thick redwood forests and there are dramatic deserts across the southeast.

Also Check: How To File Tax Return For Free

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

Recommended Reading: How To File Taxes For 2020

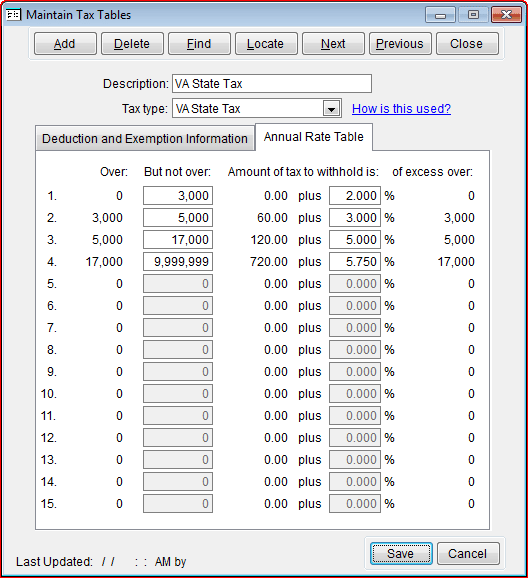

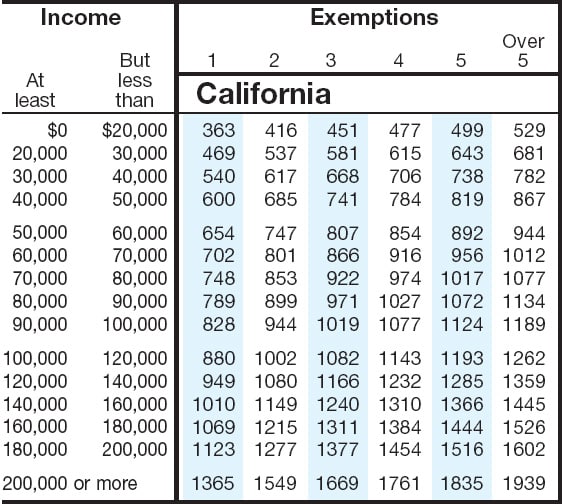

How To Calculate 2022 California State Income Tax By Using State Income Tax Table

| 1. Find your income exemptions2. Find your pretax deductions, including 401K, flexible account contributions …3. Find your gross income 4. Check the 2022 California state tax rate and the rules to calculate state income tax5. Calculate your state income tax step by step6. If you want to simplify payroll tax calculations, you can download ezPaycheck payroll software, which can calculate federal tax, state tax, Medicare tax, Social Security Tax and other taxes for you automatically. You can try it free for 30 days, with no obligation and no credt card needed.Learn more about the |

Liability For The Elective Tax

The Qualified Entity pays the Elective Tax on the sum of the allocable share of income of all Qualified Owners that have consented to the Election. Given that the Qualified Entity is liable for the Elective Tax, the non-consenting owners of the Qualified Entity will want to make sure that the Elective Tax is borne solely by the consenting Qualified Owners, either through one or both an offset of distributions to them or an indemnity from them in case the Elective Tax exceeds such distributions, as often occurs with so-called phantom income.

You May Like: Does Texas Have State Income Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Recommended Reading: How Much In Taxes Do I Owe