What Are Capital Gains Taxes On Real Estate Investments

Capital gains from real estate investments are taxed when the asset is sold. Regardless of how much the property realizes or grows over time, investors wont have to worry about capital gains until they sell.

These taxes can be imposed on both a state and federal level. Keep in mind that taxes on capital gains only apply to investment propertiesnot primary residencesas long as the homeowner lives in the home for two years or more.

So Whats My Capital Gains Tax Rate

For capital gains over that $250,000-per-person exemption, just how much tax will Uncle Sam take out of your long-term real estate sale? Long-term capital gains tax rates are based on your income , explains Park.

Lets break it down.

For single folks, you can benefit from the 0% capital gains rate if you have an income below $40,400 in 2021. Most single people will fall into the 15% capital gains rate, which applies to incomes between $40,401 and $445,850. Single filers with incomes more than $445,851, will get hit with a 20% long-term capital gains rate.

The brackets are a little bigger for married couples filing jointly, but most will get hit with the marriage tax penalty here. Married couples with incomes of $80,800 or less remain in the 0% bracket, which is great news. However, married couples who earn between $80,801 and $501,600 will have a capital gains rate of 15%. Those with incomes above $501,601 will find themselves getting hit with a 20% long-term capital gains rate.

Dont forget, your state may have its own tax on income from capital gains. And very high-income taxpayers may pay a higher effective tax rate because of an additional 3.8% net investment income tax.

If you held the property for one year or less, its a short-term gain. You pay ordinary income tax rates on your short-term capital gains. Thats the same income tax rates you would pay on other ordinary income such as wages.

How To Avoid Capital Gains Tax

There are several strategies to reduce your total capital gains tax:

Also Check: Montgomery County Texas Tax Office

What Is A Flow

You are a member of, or investor in, a flow-through entity if you own shares or units of, or an interest in, one of the following:

Example Of Capital Gains Tax On A Home Sale

Consider the following example: Susan and Robert, a married couple, purchased a home for $500,000 in 2015. Their neighborhood experienced tremendous growth, and home values increased significantly. Seeing an opportunity to reap the rewards of this surge in home prices, they sold their home in 2020 for $1.2 million. The capital gains from the sale were $700,000.

As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. Their combined income places them in the 20% tax bracket. Therefore, their capital gains tax was $40,000.

You May Like: Small Business Income Tax Calculator

Ladder Real Estate Syndications

When you invest in real estate syndications, you tend to show paper losses for the first few years. You can use those paper losses to offset other passive income and gains.

Why do syndications typically report losses on paper for the first few years, even as they pay you hefty distributions and cash flow? Because syndicators often perform a cost segregation study when they buy the property, to recategorize as much of the building as possible to other tax categories with shorter depreciation periods.

Of course, once the property sells and you get your big payday, youll owe both capital gains taxes and depreciation recapture. Which is precisely why it helps to keep investing in new real estate syndications every year, so you continue offsetting gains with paper losses from depreciation.

Hence the term ladder the new syndication you buy this year helps offset taxable gains from the syndication you bought four years ago.

Offset Gains With Losses

One of the simplest ways to reduce your exposure to the capital gains tax is to offset the profits made from selling a home with losses that have been realized from another investment. While the Internal Revenue Service taxes profits made from investments, investors can deduct losses from their taxable income. Otherwise known as tax-loss harvesting, this particular strategy reduces exposure to taxes levied on gains. By accounting for both gains and losses, investors can reduce the capital gains they are taxed on.

Also Check: Capital Gains Tax Calculator New York

What Is Capital Gains Taxand Who Pays It

In a nutshell, capital gains tax is a tax levied on possessions and propertyincluding your homethat you sell for a profit.

If you sell it in one year or less, you have a short-term capital gain.

If you sell the home after you hold it for longer than one year, you have a long-term capital gain. Unlike short-term gains, long-term gains are subject to preferential capital gains tax rates.

Watch: How Much a Home Inspection Costsand Why You Need One

Best Places To Buy Investment Properties This 2022

Before you can compare properties and calculate your possible rental income or capital gains taxes, the first thing you need to do is buy a property. To avoid high capital gains taxes, you may want to consider buying a property with the intention of holding it. You could ensure that you do not lose any money from maintaining the property during this time by buying a property with a high rental income to cover the maintenance costs. Using Mashvisorsâ database based on traditional and Airbnb potential rental income, these are the best places to buy investment properties this 2022:

1. Cave Creek, Arizona

- Airbnb Occupancy Rate: 59%

Also Check: What Do You Need To Do Your Taxes

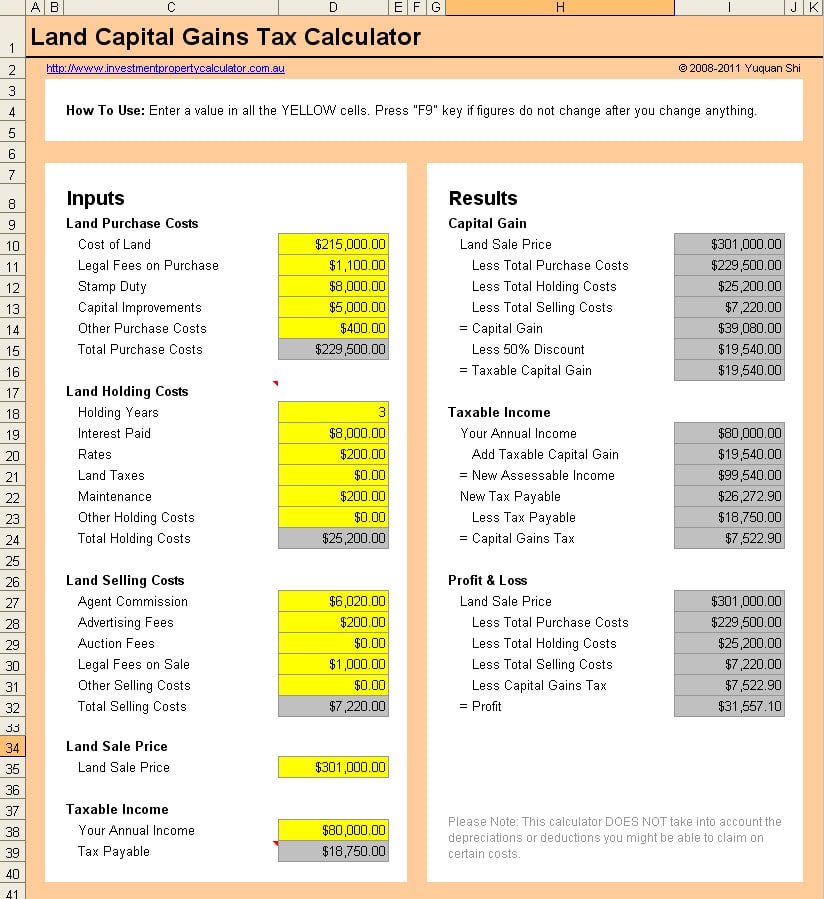

Calculate Your Capital Gains Taxes

This section provides you some of the essential tools we use on a regular basis to assist with our clients’ transactions. Access capital gains tax calculators, 1031 identification/closing Deadline calculators, commercial real estate analysis spreadsheets, and more.

This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset . It was updated in 2013 to reflect changes in Medicare taxes and several state tax rates . You should consult your CPA or tax attorney if you have any questions.

Taxes are what we at JRW refer to as “guaranteed losses” and we attempt to defer or eliminate them wherever it is possible. Read about the primary ways in which an investor can legally avoid capital gain taxes. These include the 1031, 721, & 1033 tax-deferred real estate exchanges, Deferred Sales Trust , and various tax write-offs and credits. Capital gains taxes and depreciation recapture taxes can be deferred indefinitely through the use of such exchanges. This tax burden can then be avoided permanently through a “step up in basis,” whereby heirs inherit property and realize a basis adjustment to the current market value as of the date at death or alternate valuation date. The heirs then receive a new depreciation schedule, which can be utilized to shelter the property’s income from taxes.

1055 E. Colorado Blvd, Suite 310 Pasadena, CA 91106

Important Disclosures

How To Calculate Capital Gains Taxes On Real Estate

In order to accurately calculate capital gains taxes on real estate, first subtract the cost basis or original purchase price of the house from the net proceeds or net profits of the sale.

Cost basis includes expenses at the time of purchase and any major improvements made to the property, Routine maintenance and superficial repairs/updates dont count towards your cost basis deduction.

Net Proceeds is the money you, the investor, walks away with after all the closing costs are said and done. Any costs accrued during the sale of a property can be deducted from the gross profits.

For example: Elaine bought an investment property in 2000 for $250,000. In 2020, the property sold for $550,000. Her total capital gain is $300,000, before subtracting expenses and improvement costs. Now lets assume the following associated expenses:

- $10,000 in closing costs upon purchase of the rental property,

- $10,000 for a roof replacement,

- $25,000 for new plumbing, and

- $50,000 in commissions and fees upon sale of the rental property.

In this scenario, Elaines cost basis would be $295,000 . Her net proceeds would be $500,000 .

Now, deduct Elaines cost basis from her net proceeds to determine the total capital gains on the investment property.

$500,000 $295,000 = $205,000

Recommended Reading: When Are Llc Taxes Due

Selling A Building In 2021

If you sold a building of a prescribed class in 2021, special rules may make the selling price an amount other than the actual selling price. This happens when you meet both of the following conditions:

- You, or a person with whom you do not deal at arm’s length, own the land on which the building is located, or the land adjoining the building if you need the land to use the building

- You sold the building for less than its cost amount and its capital cost

Calculate the cost amount as follows:

- If the building was the only property in the class, the cost amount is the undepreciated capital cost of the class before the sale

- If more than one property is in the same class, you have to calculate the cost amount of each building as follows:

×

Note

You may have to recalculate the capital cost of a property to determine its cost amount in any of the following situations:

- You acquired a property directly or indirectly from a person or partnership with whom you did not deal at arm’s length

- You acquired the property for some other purpose and later began to use it, or increased its use, to earn rental or business income

For more information, call 1-800-959-8281.

If you sold a building under these conditions, this may restrict the terminal loss on the building and reduce the capital gain on the land. For more information, see Guide T4036, Rental Income, or Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance.

Selling part of a property

Example

Total ACB

Qualified Farm Or Fishing Property

Generally, when you dispose of qualified farm or fishing property , you report any capital gain or loss in this section of Schedule 3. Report dispositions of QFFP on lines 10999and 11000 of Schedule 3. See the definition of qualified farm or fishing property.

If the capital gain or loss is from a mortgage foreclosure or conditional sales repossession, report it on lines 12399 and 12400 of Schedule 3. For more information, see Other mortgage foreclosures and conditional sales repossessions.

If you dispose of farm or fishing property, other than QFFP, report it on lines 13599 and 13800 of Schedule 3. For more information, see Real estate, depreciable property, and other properties.

Special reporting instructions apply to the disposition of property included in capital cost allowance Class 14.1 that is QFFP. For more information, see the chapter called “Eligible Capital Expenditures” in guides T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income, RC4060, Farming Income and the AgriStability and AgriInvest Programs Guide, or RC4408, Farming Income and the AgriStability and AgriInvest Programs Harmonized Guide.

Capital gains deduction

If you have a capital gain when you sell QFFP, you may be eligible for the lifetime capital gains deduction. For more information, see Claiming a capital gains deduction.

Read Also: How Much Foreign Income Is Tax Free In Usa

No Matter How You File Block Has Your Back

How Much Is The Capital Gains Tax On A Rental Property

If you own a rental property, the rent you collect is considered regular income, and youll pay taxes on it like a normal paycheck. But if you decide to sell the property, youll owe capital gains taxes on your profit. And since a rental is not your primary residence, you wont be able to exclude a portion of your profit.

So if you owned the property for less than a year, youll pay short-term capital gains taxes at your normal income tax rate. If you owned the property over a year, youll pay long-term capital gains taxes at a rate of 0%, 15% or 20% depending on your income.

Recommended Reading: Is Spousal Support Tax Deductible

Exchange Capital Gain Examples

In general, you can follow the three following simple steps to calculate the cost basis of a new property involved in your 1031 exchange:

These three steps will help you calculate the basis for any asset acquired as part of a 1031 exchange. However, looking at a couple of specific 1031 exchange capital gain examples can help you understand the concept better.

Live In The Property For 2 Years

When you sell a property that youve lived in for at least two of the last five years, you qualify for the homeowner exemption for real estate capital gains taxes.

Single homeowners pay no capital gains taxes on the first $250,000 in profits from the sale of their home. Married homeowners filing jointly pay no taxes on their first $500,000 in profits.

You dont have to live in the property for the last two years, either. Any two of the last five years qualifies you for the homeowner exclusion.

Consider doing a live-in flip, where you live in the property for two years as you renovate it, then sell it for a profit. It makes for a fun way to house hack, if youre handy and enjoy fixing up old homes.

Alternatively, you could house hack a multifamily property, then either sell it after two years or keep it as a rental. Either way, you get to live for free and pay no real estate capital gains taxes! Toy around with our house hacking calculator to plug in any propertys cash flow numbers.

You can use the homeowner exemption repeatedly, moving as frequently as every two years and avoiding capital gains taxes. But you cant use it twice within a two-year period.

Recommended Reading: How Much Is Bonus Tax