Whats Californias Family Leave Insurance

A very small but growing number of states mandate paid leave for an employeeâs own health condition: California, Connecticut, Hawaii, Massachusetts, New Jersey, New York, Puerto Rico, Rhode Island, Washington, and Washington, DC. Oregon and Colorado will begin similar programs in 2023.

- Employee pays in CT, NY

- Employer pays in DC.

- Both pay in MA, WA

Find Californiaâs current and historical family leave insurance rates in our Californiaâs FLI section in Payroll Resources.

How Can Child Support Be Modified

There are three general ways to characterize California child support: 1) guideline child support 2) below-guideline child support and 3) above-guideline child support. Modifying child support starts with knowing what kind of child support order exists.

In order to modify guideline child support, a change of circumstances must be established by the person seeking to change the support order. In other words, that parent must show that there has been a change in at least one persons situation that would warrant a change in the order. Examples of changes include but are not limited to the following:

- A parents income has increased

- One parents income has decreased

- A parents net income has changed

- A change in the visitation schedule that alters the amount of time each parent spends with the child, i.e. timeshare

- A change in the visitation schedule that alters the cost of transportation. For example, one parent moves out of state

- A parent applies for or stops receiving State Aid

- The childs expenses have changed

- A change in the available health insurance to cover the child

- One parents failure to comply with a seek work order or to obtain full-time employment commensurate with his or her earning capacity and

- A parent has been incarcerated.

Many people are disappointed to learn that child support has severe limits on retroactivity. Parents often wait, to their detriment, to try to modify child support. Common reasons include:

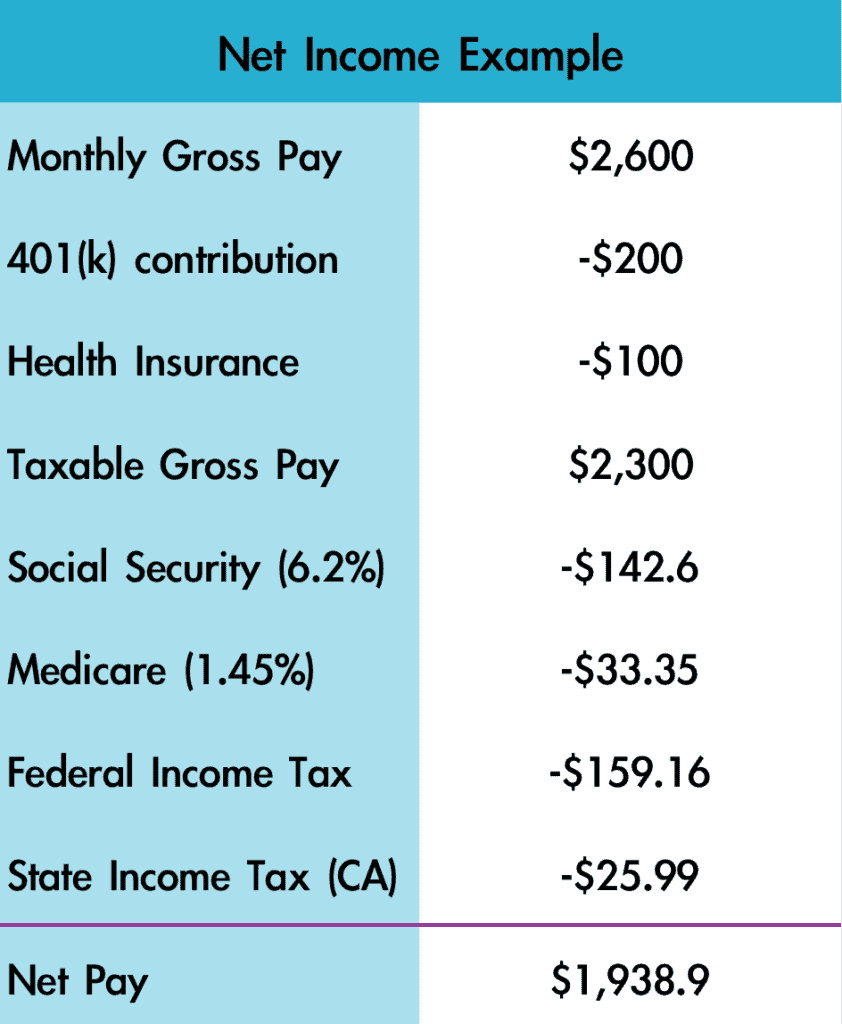

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Also Check: What Are Allowances For Taxes

How To Pay Your 1099 Taxes

If you think you might owe more than $1,000 in federal income taxes, you should be making payments throughout the year â not just when you file your return. These additional payments are referred to as âquarterlyâ or âestimatedâ tax payments. You pay your quarterly taxes on the 15th day following the end of the quarter. For example, letâs say you expect to owe $2,000 in taxes. You would divide that amount by four and make your quarterly tax payments on the following schedule:

| Quarter |

|---|

| $500 |

We havenât gotten into all the nitty-gritty here â like the forms that are involved in the filing process. If youâre interested in more details, check out our blog post on how to pay self-employment taxes step by step.

Earned Income Tax Credit: The Caleitc Or Yctc Tax Credits

You can claim the California Earned Income Tax Credit if you work and have low income , both credits are a refundable credit. The amount of the credit ranges from $243 to $3,027. You can also qualify for the Young Child Tax Credit if you have a qualifying child under the age of 6. If you qualify for the young child tax credit, you may receive up to $1,000.

Also Check: Minimum Income To File Taxes

Which Are The California Taxes

The taxes a Californian citizen has to pay include the state income tax, the local income tax, and the general ones: the FICA tax and the federal income tax.

|

Tax type / Filing status |

|

|---|---|

|

7.65%: Social security + medicare taxes |

|

|

Federal income tax |

Progressive tax brackets from 10% to 37% |

|

Deductions in USD |

|

|

Progressive tax brackets from 1% to 12.3% |

|

|

Local tax |

Only San Francisco has a local tax: 0.38% paid by the employer . |

|

Sales tax |

7.25% – 10.75%: Tax paid for the sale of certain goods and services. |

The California tax calculator already includes all the specifics indicated above however, since we want to make everything crystal clear, we will include the next table: tax brackets for the California state income tax. You should check the tax bracket calculator in case you need more information about the federal income tax.

Single filers California tax brackets 2022. It also applies to married/registered domestic partners who fill separately.

|

Tax rate |

|

|---|---|

|

$4803 Standard deduction or personal exemption is structured as a tax credit. |

$129 credit |

|

$93.25 + 2% of the amount over $9,325 |

|

|

$348.87 + 4% of the amount over $22,108 |

|

|

$860.23 + 6% of the amount over $34,893 |

|

|

$1672.75 + 8% of the amount over $48,436 |

|

|

9.3% |

$2694.99 + 9.3% of the amount over $61,214 |

|

10.3% |

$26,081.79 + 10.3% of the amount over $312,687 |

|

11.3% |

$32,522.79 + 11.3% of the amount over $375,222 |

|

12.3% |

|

|

$1,000,001 or more |

$106,868.89 + 13.3% over $1,000,001 |

Does California Have State Income Tax

Yes, California includes ten different brackets of 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, 12,3%, and 13.3% to a set of two types of filers: single filing and married filing jointly.

They also include a standard deduction of $4,083 for singles, $9,606 for a couple, and exemptions as tax credits of $129 and $258, respectively. You can find more details in the Omni Calculator’s California paycheck calculator.

Don’t Miss: Us Individual Income Tax Return

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Recommended Reading: What Happens If You Don T Do Your Taxes

How Much Tax Do I Owe If I Earn $34000 In California

The estimated total annual tax is $5,833. You can calculate it as follows:

Subtract the pre-tax deduction: $12,950. Based on your adjusted gross income, $21,050, calculate your federal tax rate: 12%. Remember, it is a progressive tax. The tax to pay is $2,321.

Subtract the state tax deduction: $4,803. Similarly to the above, the tax to pay is $503 .

Determine local taxes. It includes ETT and SDI . The result is $408.

Calculate FICA tax . It is $2,601.

Sum all taxes above: The total annual tax is $5,833.

How Is A Child Support Order Enforced

In general, a wage assignment can be an effective tool for enforcing child support, as the payor never has control or access to the money. The employer takes the support directly from the payors check and is not allowed to change this arrangement without a modified order. As previously discussed however, there are times when a wage assignment is impractical, and a parent must turn to other methods for enforcement.

The LCSA can assist with enforcement. This agency has a number of enforcement techniques that are not available to private attorneys or individuals. With the LCSAs assistance, common enforcement methods include but are not limited the following:

- Levying a bank account

- Garnishing a personal injury settlement or workers compensation award

- Recording a real property lien

- Issuing a writ of execution to seize personal assets

- Negatively impacting credit

Another effective enforcement tool is through interest. Interest automatically accrues at the legal rate of 10% per year for all unpaid amounts of child support. The LCSA can assist with tracking and calculating interest. If unpaid for an extended period of time, the accumulated amount of interest can result in significantly increasing the child support arrears and create a situation where a parent is unable to pay off the arrears.

At the first hearing, the accused is given the same rights afforded to a criminal defendant as follows:

Don’t Miss: Illinois State Sales Tax Rate 2021

How Are Bonuses Taxed In California

Theres always something very exciting when you hear youll be receiving a bonus from your employer. However, that excitement can often lead to disappointment when you realize you not only have to pay taxes on the bonus, but oftentimes, its more tax than expected. Additionally, the tax rates can vary by state. Lets look at how bonuses are taxed in California.

Like regular pay, bonuses are subject to both federal and state tax. Many believe that bonus pay is just like a regular paycheck and is added to your regular income and taxed at that rate. But thats generally not the case. Bonuses are typically considered supplemental income and that is taxed at a different rate. The federal bonus flat tax rate is 22%. In California, bonuses are taxed at a rate of 10.23%. For example, if you earned a bonus in the amount of $5,000, you would owe $511.50 in taxes on that bonus to the state of California. In some cases, bonus income is subject to additional taxes, including social security and Medicare taxes.

When it comes to the employer paying taxes on the bonus, there are two ways a business owner may choose to do so. The first option is called the percentage method and its the simplest way to pay bonuses. This method is used when the employer pays the bonus and withholds the California bonus tax rate of 10.23% and 22% federal flat rate.

What Part Of My Income Gets Taxed By California

When it comes to California state tax, there are three residency statuses: resident, part-year resident and nonresident. They determine what portion of your income the state will tax.

|

If your California residency type is … |

California taxes this part of your income |

|---|---|

|

Resident. |

» Find a local tax preparer in California for free: See who’s available to help with your taxes in your area

You May Like: Your Tax Return Is Still Being Processed 2021

California Income Tax Withholding

California’s law requires employers to withhold state personal income tax from employee wages and remit the amounts withheld to the Employment Development Department.

Persons in business for themselves are not employees and are generally not subject to withholding.

California has no specific reciprocal taxation agreements with other states. Still, residents of Arizona, Guam, Indiana, Oregon, and Virginia are allowed credit toward their California income tax liability for taxes paid to their home states.

Additional Deductions On California Paychecks

In addition to federal and state tax deductions, other deductions may come out of an employees paycheckalso referred to as pre-tax deductions.

Pre-tax deductions include any money taken from employees gross pay before withholding taxes, like health benefits and retirement contributions. Because these deductions are accounted for before tax withholdings, it decreases employees taxable income, which may put them in a lower tax bracket.

Pre-tax deductions may include:

Read Also: When Do I Have To File Taxes 2021

California State Payroll Taxes

Now that were done with federal income taxes, lets tackle California state taxes. The State of California wins for the highest top marginal income tax in the country. Its a progressive income tax, meaning the more money your employees make, the higher the income tax. The following graph gives insight into the varied tax rates in place for single filers.

More information can be found on the California Franchise Tax Board website.

The Golden State has four state payroll taxes administered by the Employment Development Department : 1) Unemployment Insurance, 2) Employment Training Tax, 3) State Disability Tax, and 4) Personal Income Tax. Youre responsible for paying half of those taxes, while the other half should be withheld from each employees paycheck. Details and rates can be found on the EDD website.

- What You Pay For:

- Unemployment Insurance is issued by the U.S. Department of Labor. UI provides temporary payments to those who are unemployed against their own capabilities. Employers pay up to 6.2% on the first $7,000 in wages paid to each employee in a calendar year. New employers pay 3.4% for the first two to three years. Each December, you will be notified of your new rate.

- Employment Training Tax, also known as funding for training. You are responsible for paying 0.1% of the first $7,000 of wages per employee a year. This ones relatively cheap, maxing out at $7 per employee a year.

How Is Child Support Paid

For all child support orders, a wage assignment must be issued. A wage assignment, also known as a wage garnishment order, directs an employer to withhold child support from the child support payors wages. Once a wage assignment order is filed, it can either be sent to the employer, or stayed. Staying a wage assignment means to put it on hold.

Staying a wage assignment can be done by agreement between the parents and typically only occurs when the LCSA is not actively involved in enforcing the child support orders. If the wage assignment is stayed, the parents will need to work out an agreement on the method and frequency of child support payments.

Sometimes a wage assignment is impractical or unfeasible. For example, a self-employed payor of child support cannot have his or her wages garnished by a third party employer. Individuals who do not receive a steady source of income may not always earn enough money to be garnished. In those situations, it is important for parents to work together to establish a mutually agreeable alternative to a wage assignment. Not paying child support carries serious consequences, and as a result, it is both parents best interests to ensure that child support is paid regularly, timely, and in a way that can be documented by both parties.

Recommended Reading: Live In One State Work In Another Taxes

How The $140043 A Year After Tax In The United States Is Calculated

First, we need to know our tax-free amount to calculate $140,043 a year after tax in the United States. And based on the information selected in the calculator above, these are the tax-free allowances applicable to your salary:

- $12,950 basic, this only applies for a ‘Filling Status’ of a single person. You can change the calculator setting if the ‘Single Person’ status does not apply to you.

- $0 for itemized deductions if needed, you can update this number in the calculator above.

- $0 for 401 contributions if needed, you can update this number in the calculator above.

- $0 for IRA contributions if needed, you can update this number in the calculator above.

- $0 for children under 17 .

The total tax-free allowance sum you are entitled to a year equals $12,950.

Next, we need to calculate Federal Taxes based on your tax-free allowance and current year Federal Tax brackets, the Federal Tax you need to pay is $24,337 a year.

Then, we need to calculate State Income Tax in this case, it is $0 because the ‘State’ option in the calculator above is not selected.

Next, we need to calculate your Medicare Tax in your case, the sum to pay is $2,031 a year .

After calculating Medicare tax, we need to calculate your Social Security charge in your case, the sum to pay is $8,683 a year .

Lastly, we need to subtract the Federal tax , State tax , Medicare tax , and Social Security tax from the gross $140,043 a year salary, which would be $104,992 a year .

Help With California Income Tax Rates & More

Understanding California income tax rates can be tricky. Luckily, were here to save the day with H& R Block Virtual! With this service, well match you with a tax pro with California tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CA taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find California state tax expertise with all of our ways to file taxes.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

You May Like: State Tax Rate In Hawaii