Earned Income Tax Credit: The Caleitc Or Yctc Tax Credits

You can claim the California Earned Income Tax Credit if you work and have low income , both credits are a refundable credit. The amount of the credit ranges from $243 to $3,027. You can also qualify for the Young Child Tax Credit if you have a qualifying child under the age of 6. If you qualify for the young child tax credit, you may receive up to $1,000.

California Median Household Income

| 2011 | $57,287 |

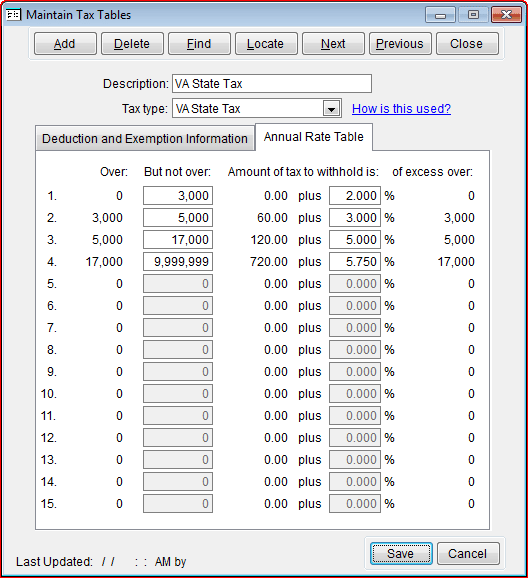

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

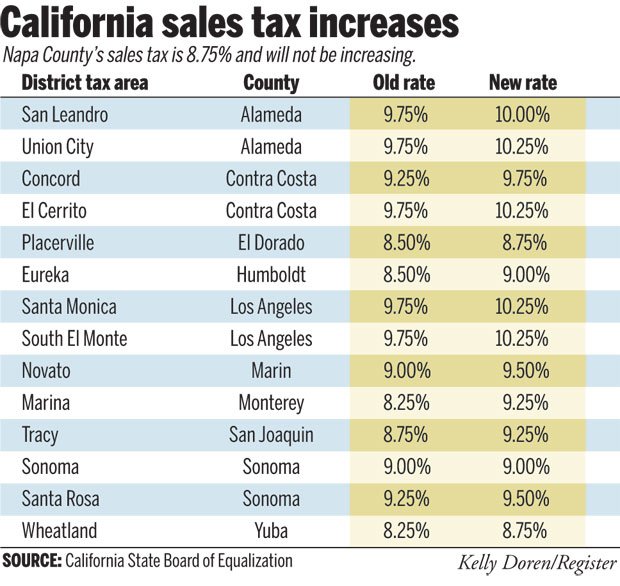

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Also Check: Is Spousal Support Tax Deductible

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Pay Capital Gains Tax

Tax Credits And Deductions

A tax credit in Canada directly reduces the income tax you must pay. For example, a $1,000 tax credit can directly be applied to lower the tax you need to pay by the same amount. If you have a tax bill worth $13,000, you can use the $1,000 to reduce your payment to $12,000. It is important to understand what can be deducted from your tax base to make sure that yournet worthdoes not get hurt due to overpaying for taxes. Itâs essential to understand the difference between refundable and non-refundable tax credits. A refundable credit will deposit the excess amount into your bank account if your credits exceed your tax bill. However, a non-refundable credit will not provide you with the unused portion. Some of the most popular tax credits in Canada include:

- Home Renovation Tax Credit:Many provinces in Canada allow senior homeowners to receive a tax credit by renovating their home to increase accessibility. Additionally, some provinces, such as Manitoba, offer a tax credit for purchasing green energy equipment.

- Home Buyersâ Amount:This is a non-refundable $5,000 tax credit for first-time homebuyers.

Also Check: States That Are Tax Free

Calculating Income Tax Rate

The United States has a progressive income tax. This means there are higher tax rates for higher income levels. These are called marginal tax rates they do not apply to total income, but only to the income within a specific range.

These ranges are called brackets. Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax. This table reflects the rates for the 2018 tax year, which are the taxes you pay in early 2019. This table also includes all of the changes from the new plan that President Trump and congressional Republicans passed in 2018.

State And Local Income Taxes

Many states as well as some cities and counties have their own income tax, which is collected in addition to the federal income tax. States that do have a state income tax require that you file a separate state tax return and have their own rules. If you are curious about a particular states tax system and rules, visit one of our state tax pages.

Recommended Reading: Do I Have To Pay Taxes On Inherited Money

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year , your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Federal Income Tax: W

W-2 employees are workers that get W-2 tax forms from their employers. These forms report the annual salary paid during a specific tax year and the payroll taxes that were withheld.

This means that employers withhold money from employee earnings to pay for taxes. These taxes include Social Security tax, income tax, Medicare tax and other state income taxes that benefit W-2 employees.

Both employers and employees split the Federal Insurance Contribution Act taxes that pay for Social Security and Medicare programs. The FICA rate due every pay period is 15.3% of an employees wages. However, this tax payment is divided in half between the employer and the employee.

Read Also: Sales Tax Exempt Form Ny

California State Rate For 2022

6.5% is the smallest possible tax rate 7.25%, 7.375%, 7.5%, 7.75%, 7.875%, 7.975%, 8%, 8.125%, 8.25%, 8.35%, 8.375%, 8.475%, 8.5%, 8.625%, 8.725%, 8.75%, 8.875%, 8.975%, 9%, 9.125%, 9.225%, 9.25%, 9.375%, 9.5%, 9.625%, 9.75%, 9.875%, 10%, 10.25%, 10.5% are all the other possible sales tax rates of California cities.10.75% is the highest possible tax rate

The average combined rate of every zip code in California is 8.351%

Also Check: Long Term Capital Gain Tax Calculation

Do I Have To Pay Income Tax In California

You are required to file a California tax return if you receive income from California, have income above a certain income threshold, and you fall into one of the following categories:

You are considered a resident if you are one of the following:

- You reside in California for other than a temporary time period

- You reside in California but are away for a temporary time period

Read Also: Can You File Taxes On Ssi Disability

Now Write Those Paychecks

Feel that wave of relief? Youve checked payroll taxes off your to-do list so you can move onto the important things. Once each employees net pay is calculated , youre in the clear. All you have to worry about is getting your employees paid on time as well as setting aside whatever you owe in FICA and UI taxes. Those numbers can add up quickly!

You can pay federal taxes online to the IRS here. Plus, heres everything you need to know about federal tax filings.

Capital Gains Tax Canada

There is no special capital gains tax in Canada. Instead, capital gains are taxed at your personal income tax rate. Only 50% of your capital gains are taxable. This means that only half of your capital gains amount will be added to your taxable income.

If you have incurred both capital gains and losses, you can use your capital losses to offset the amount of your capital gains. For example, if you have capital gains of $10,000 and losses of $4,000, your net capital gain would be only $6,000.

You can rollover your capital losses to offset capital gains in the future, or you can retroactively apply them to capital gains that you have realized in the past three years. For example, if you have capital gains of $10,000 and losses of $14,000, your capital gains for that year would be $0. You can then roll over the leftover capital loss of $4,000 to apply to future years, or the previous three years.

Read Also: 1 Year Tax Return Mortgage

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Common Errors And How To Prevent Them

Help us process your tax return quickly and accurately. When we find an error, it requires us to stop to verify the information on the tax return, which slows processing. The most common errors consist of:

- Claiming the wrong amount of estimated tax payments.

- Claiming the wrong amount of standard deduction or itemized deductions.

- Claiming a dependent already claimed on another return.

- The amount of refund or payments made on an original return does not match our records when amending your tax return.

- Claiming the wrong amount of withholding by incorrectly totaling or transferring the amounts from your W-2.

- Claiming the wrong amount of real estate withholding.

- Claiming the wrong amount of SDI.

- Claiming the wrong amount of exemption credits.

To avoid errors and help process your tax return faster, use these helpful hints when preparing your tax return.

Don’t Miss: Car Registration Fee Tax Deductible

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Recommended Reading: What Are The Taxes In Florida

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability .

For example, if you calculate that you have tax liability of $1,000 and you are eligible for a tax credit of $200 that would reduce your liability to $800. You would only owe $800.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. The list below describes the most common federal income tax credits.

-

The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,431 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

-

The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

-

The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

-

The American Opportunity Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition and course materials for the first four years of post-secondary education.

There are numerous other credits, including credits for the installation of energy-efficient equipment, a credit for foreign taxes paid and a credit for health insurance payments in some situations.

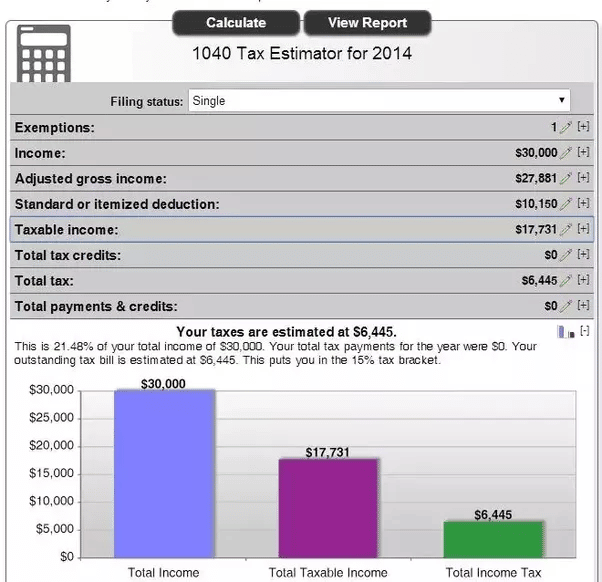

Tax Withholding Estimator: Calculating Taxable Income Using Exemptions And Deductions

Federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Read Also: Massachusetts State Income Tax 2021

Tip #: Prepay Your Work Expenses

If you know youâre in for a painful tax bill, this strategy could help.

Hereâs how it works: rather than waiting till January to pay your regularly scheduled bills, pay them in December instead.

For example, if your business rent is due January 5th, pay it December 30th. This will allow you to claim more deductions in the current tax year â essentially borrowing from next yearâs write-offs.

If youâre going to use this strategy, itâs important to look ahead first. Here are some scenarios where prepaying could be a beneficial move and help you save money overall:

- You owe a sizable tax bill and havenât made any estimated payments.In this situation, reducing your tax liability by prepaying expenses is a good idea. The lower your tax liability, the less youâll pay in underpayment penalties and interest.

- You donât expect to have much â or any â self-employment income next year. People change jobs and hop careers all the time. If you expect a major change to the type of income youâre earning, itâs probably worthwhile to maximize your write-offs now.

- You expect to have more tax-saving opportunities next year.If you recall, only two things can lower self-employment tax: business write-offs and tax credits. So for example, if you plan to enroll in college, youâll have a sizable tax credit to play with. In that case, borrowing from next yearâs write-offs probably wonât hurt you.

Sarah York, EA

What States Have Local Taxes

There are 15 states with municipalities, counties, school districts, or special districts that impose local income taxes: Alabama, Maryland, Ohio, Colorado, Michigan, Oregon, Delaware, Missouri, Pennsylvania, Indiana, New Jersey, Washington, Kentucky, New York, and West Virginia.

To find your local taxes, head to our California local taxes resources. To learn more about how local taxes work, read this guide to local taxes.

Recommended Reading: Average Percentage Of Taxes Taken Out Of Paycheck

California Alcohol Cigarette And Gas Taxes

Products that face separate tax rates include alcoholic beverages, tobacco products and gasoline. For alcohol and cigarettes, rates are assessed based on the quantity of the product purchased. Wine, for example, faces a rate of 20 cents per gallon. For regular gasoline, there is a 51.10 cent per gallon excise tax.

What Was Updated In The Federal W4 In 2020

In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. The redesigned Form W4 makes it easier for your withholding to match your tax liability. Hereâs how to answer the new questions:

- Step 2: check the box if you have more than one job or you and your spouse both have jobs. This will increase withholding.

- Step 3: enter an amount for dependents.The old W4 used to ask for the number of dependents. The new W4 asks for a dollar amount. Hereâs how to calculate it: If your total income will be $200k or less multiply the number of children under 17 by $2,000 and other dependents by $500. Add up the total.

- Step 4a: extra income from outside of your job, such as dividends or interest, that usually don’t have withholding taken out of them. By entering it here you will withhold for this extra income so you don’t owe tax later when filing your tax return.

- Step 4b: any additional withholding you want taken out. Any other estimated tax to withhold can be entered here. The more is withheld, the bigger your refund may be and youâll avoid owing penalties.

If your W4 on file is in the old format , toggle “Use new Form W-4” to change the questions back to the previous form. Employees are currently not required to update it. However if you do need to update it for any reason, you must now use the new Form W-4.

You May Like: Property Tax Vs Tax Assessment