Erik M Jensen The Coleman P Burke Professor Emeritus Of Law At Case Western Reserve University

Are there signs that capital gains taxes will be increased to balance the federal debt incurred by issuing stimulus payments?

Before there were stimulus checks, candidate Joe Biden expressed support for eliminating the capital gain preference for higher-income people and the fair-market-basis rule that applies to property transferred at death.

President Biden is expected to include those proposals in a package to be announced next week. He cant make these changes on his own, however, and Im not very good at predicting what Congress will do. With both the House and Senate closely divided, congressional approval might be iffy. Im pretty sure Republicans in Congress would unanimously disapprove of these changes, and Im skeptical that Democrats would all approve.

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I have little doubt that there would be a sell-off in anticipation of a rate increase, particularly if the rate increase is coupled with elimination of the step-up-in-basis rule .

Im not an economist, and I dont have a reasoned opinion about the effects on the economy. However, one interesting point is that, if a sell-off occurs, tax revenues might actually go up in the short run, while the lower rates remain in effect. More sales would mean that what would otherwise have been unrealized appreciation would become realized appreciation.

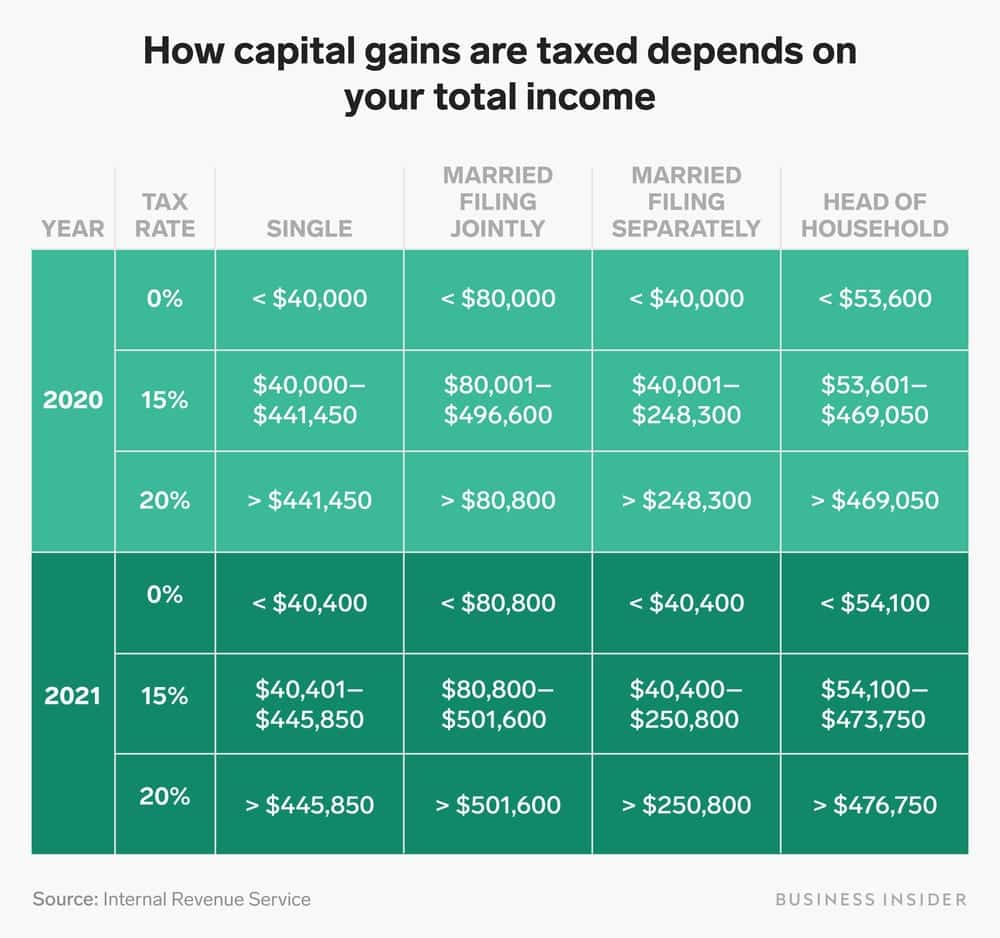

Capital Gains Tax Brackets

There are two main categories for capital gains: short- and long-term. Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%.

Remember, this isn’t for the tax return you file in 2023, but rather, any gains you incur from January 1, 2023 to December 31, 2023.

The actual rates didn’t change for this year, but the income brackets did adjust significantly due to rising inflation.

Federal Capital Gains Tax Rates

The tables below show marginal tax rates. This means that different portions of your taxable income may be taxed at different rates.

For example, a single filer who made $10,000 would pay 10% income tax on their first $9,950 and 12% on the remaining $50. That’s a total of $1,001 in tax and an overall tax rate of 10.01%.

Don’t Miss: Sales Tax In Alameda County

What Is The Capital Gains Tax On Property Sales

Again, if you make a profit on the sale of any asset, its considered a capital gain. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules.

For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly.

If youre just flipping a home for a profit, however, you could be subjected to a steep short-term capital gains tax if you buy and sell a house within a year or less.

California Capital Gains Tax On Real Estate

One distinction in the California tax code is that there is a built-in exclusion for Real Estate owners that hold the property as a primary residence.

The criteria that the owner needs to adhere to is that they may only possess one home dedicated as a primary residence, the owners live on the property for 2-years in a 5-year window, and the sale of the home nets less than $250,000.

Even with this exclusion, any property sold that nets more than $250,000 will be taxed for every dollar above the threshold.

According to the Franchise Tax Board of California, the California capital gains tax rate in 2022 allows for that exclusion if an owner meets the following criteria:

- Reside in the property for 2-years within 5-years of selling

- Properties are defined as any of the following:

Recommended Reading: Free Tax Filing H& r Block

Earned Vs Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. It’s money that you make from other money. Even if you’re actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, “unearned” doesn’t mean you don’t deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

Consider Using A Retirement Account

-

Owning dividend-paying investments inside one could shelter dividends from taxes or defer taxes on them. Think ahead, though. Do you need the income now?

-

Also, the type of retirement account matters when it comes to determining the tax bill. When you eventually withdraw money from a traditional IRA, for example, it may be taxed at your ordinary income tax rate rather than at those lower qualified dividend tax rates. If you qualify for a Roth IRA, you wont receive a tax break on the contribution, but your eventual withdrawals after age 59 ½ may be tax-free.

You May Like: Nys Dtf Pit Tax Paymnt

How To Avoid Capital Gains Tax

There are several strategies to reduce your total capital gains tax:

Capital Gains Taxes Are Confusing

Wealthy Americans likely breathed a collective sigh of relief when President Joe Biden revealed his $2 trillion infrastructure plan.

Despite the president’s campaign pledge to raise the capital gains tax rate, the new plan doesn’t include any changes in that regard.

However, when it comes to capital gains tax, it’s not just the federal tax rate that matters. States can also set their own tax rates, and some may have changes on the horizon. In the state of Washington, the governor has proposed a capital gains tax that could raise almost $1 billion if passed.

To provide the most recent info on capital gains taxes, we’ve collected data on long and short-term capital gains tax rates at both the federal and state level.

Also Check: Does Texas Have State Income Taxes

Capital Gains Tax Rates In Other States

As for the other states, capital gains tax rates are as follows:

Alabama

Taxes capital gains as income and the rate reaches 5%

Arizona

Taxes capital gains as income and the rate reaches 4.5%

Arkansas

Taxes capital gains as income and the rate reaches around 5.50%.

Colorado

Colorado taxes capital gains as income and the rate reaches 4.55%.

Connecticut

Connecticuts capital gains tax is 6.99%.

Delaware

Taxes capital gains as income and the rate reaches 6.60%.

Georgia

Taxes capital gains as income and the rate reaches 5.75%.

Idaho

Idaho axes capital gains as income. The rate reaches 6.93%.

Illinois

Taxes capital gains as income and the rate is a flat rate of 4.95%.

Indiana

Taxes capital gains as income and the rate is a flat rate of 3.23%.

Kansas

Kansas taxes capital gains as income. The rate reaches 5.70% at maximum.

Kentucky

Taxes capital gains as income. The rate is a flat rate of 5%.

Louisiana

Taxes capital gains as income. The rate reaches 4.25%.

Taxes capital gains as income and the rate reaches 5.75%.

Massachusetts

Taxes capital gains as income. Long-term capital gains are usually taxed at a flat rate of about 5% but there are some types of capital gains that the state taxes at 12%.

Michigan

Taxed as income and at a flat rate of 4.25%.

Mississippi

Taxed as income and reaches 5%.

Missouri

Taxed as income and the rate reaches 5.4%.

Montana

Taxed as income and the highest income tax rate is 6.90%, but with a 2% capital gains credit, this rate is technically 4.9%.

Nebraska

How Can Capital Losses Affect Your Taxes

As previously mentioned, different tax rates apply to short-term and long-term gains. However, if your investments end up losing money rather than generating gains, those losses can affect your taxes as well. However, in this case, you can use those losses to reduce your taxes. The IRS allows you to match up your gains and losses for any given year to determine your net capital gain or loss.

- If after fully reducing your gains with your losses and you end up with a net loss, you can use up to $3,000 of it per year to reduce your other taxable income.

- Any additional losses can be carried forward into future years to offset capital gains and up to $3,000 per year of ordinary income.

- Since you don’t generate capital gains or losses in a retirement account, you can’t use losses in IRAs or 401 plans to offset gains or your other income.

Don’t Miss: Pay My Car Tax Online

What Exactly Is A Capital Gains Tax

The Capital Gains Tax is a tax on the profit from the sale of certain assets, including real estate, stock market, and bonds. The tax rate varies depending on the type of asset sold, as well as the holding period of time .The tax is one of the most important sources of tax revenue for the state of California. It is used to fund public schools, roads, and other infrastructure projects. The tax is also used to help balance the state budget.It is a controversial tax. Some people believe that the tax is too high, and that it discourages people from selling their property or investments. Others believe that the tax is necessary to fund important public projects.What is your opinion on the capital gains tax on real estate? Do you think that the tax is too high, or is it necessary to fund important public projects?

Stay Invested And Know When To Sell

As weve emphasized, your income tax rate is a dominant factor when considering capital gains. By waiting to sell profitable investments until you stop working, you could significantly decrease your tax liability, especially if your income is low. In some cases, you might owe no taxes at all.

The same could be true if you retire early, leave your job, or your taxable income drastically changes. In essence, you can evaluate your financial situation each year and decide when the optimal time to sell an investment is.

You May Like: Federal Tax Married Filing Jointly

How Is Capital Gains Taxed In California Stocks Investments & Real Estate

Regardless of how long an asset was kept, California capital gains are recognized as income.

In contrast, the federal tax will treat money invested differently, with a higher income tax level and different rates for different types of capital gains long term capital gains tax rate and short term capital gains tax.

Short-term capital gains are gains on capital assets kept for less than a year, whereas long-term capital gains are gains on investments or investment properties held for more than a year.

RELATED READING:

:

Capital Gains Tax: Short

Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset.

Here are the differences:

- Short-term capital gains tax is a tax applied to profits from selling an asset youve held for less than a year. Short-term capital gains taxes are paid at the same rate as youd pay on your ordinary income, such as wages from a job.

- Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate.

Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own set of rules .

Don’t Miss: Sc State Tax Refund Status

Ca Capital Gains Rate Vs Previous Years

Since California taxes capital gains as regular income, the tax rates themselves don’t change much. Instead, the criteria that dictates how much tax you pay has changed over the years. For example, in both 2018 and 2022, long-term capital gains of $100,000 had a tax rate of 9.3% but the total income maxed out for this rate at $268,749 in 2018 and increased to $312,686 in 2022.

CA vs. Other Large U.S. States

Now let’s compare the California capital gains tax to the capital gains tax rate of other large states:

- Texas: no state capital gains tax

- New York: 12.70%

- Florida: between 0% and 20%.

It’s important to note that the federal capital gains tax rates are the same in all states.

While California capital gains tax might be easier to understand because it is taxed as regular income, it’s worse on your wallet than other states. In fact, it can be quite expensive for some to pay capital gains on their many investments when compared to a state like Texas.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Read Also: File State And Federal Taxes For Free

Capital Gains Tax Rate For Qualified Small Business Stock

If you sell “qualified small business stock” that you held for at least five years, some or all of your gain may be tax-free. However, for any gain that is not exempt from tax, a maximum capital gains tax rate of 28% applies.

As with the 28% rate for collectibles, if your ordinary tax rate is below 28%, then that rate will apply to taxable QSBS gain. The 28% rate doesn’t apply to short-term capital gains from the sale of QSBS, either.

Capital Gains: The Basics

Let’s say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value.

The profit you make when you sell your stock is equal to your capital gain on the sale. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

There are short-term capital gains and long-term capital gains and each is taxed at different rates. Short-term capital gains are gains you make from selling assets that you hold for one year or less. They’re taxed like regular income. That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. They’re taxed at lower rates than short-term capital gains.

Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. That’s why some very rich Americans don’t pay as much in taxes as you might expect.

To recap: The amount you pay in federal capital gains taxes is based on the size of your gains, your federal income tax bracket and how long you have held on to the asset in question.

Also Check: Free Amended Tax Return 2020