Does An Llc Need A Business License In California Related Costs

An LLC needs a business license to operate in many California counties and cities.

The state of California doesnt require or provide a statewide business license. The only statewide requirement is to file your articles of organization to become an LLC.

You may need to get a business license from the city where your business is headquartered. And check your countys requirements you may have to get a license from the county as well.

You can see which permits your type of business requires through the governors CalGold site.

The cost varies widely. For a small business, its usually between $50 and $100. In most cases, you have to renew your business license annually for a similar fee.

Alt text: Business license when starting an LLC in California

Get Help Figuring Out How To Start An Llc In California

While starting a business can be exciting, the process is often time-consuming. Avoid the trouble of going it alone by using an online filing service like Incfile. They can act as your registered agent and help with all the steps it takes to form an LLC in California.

Legal Disclaimer: This article contains general legal information, but does not constitute professional legal advice for your particular situation and should not be interpreted as creating an attorney-client relationship. If you have legal questions, you should seek the advice of an attorney licensed in your jurisdiction.

Draft An Operating Agreement

Every LLC in California is required to have an operating agreement. This document outlines your businesss ownership structure and operational rules. It should detail important company information, such as powers and duties of members and managers, how profits and losses will be distributed, and buyout rules. You dont have to file this document with the state, but once an operating agreement is signed by the members of an LLC, it acts as a binding contract.

Read Also: California Sales Tax By Zip Code

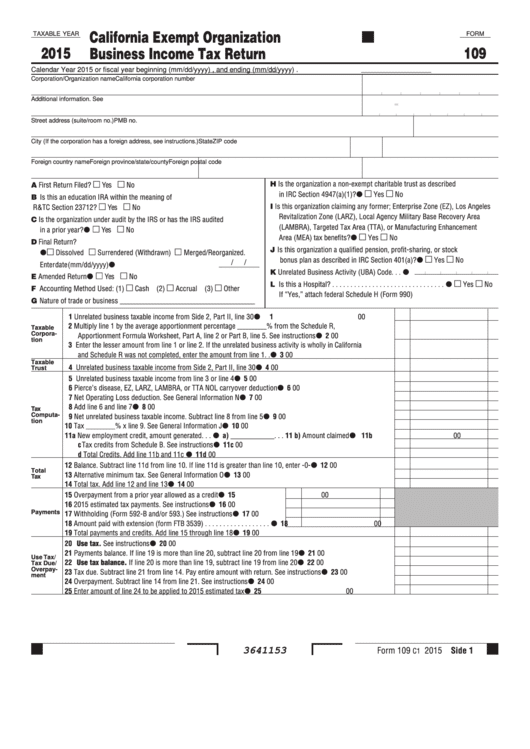

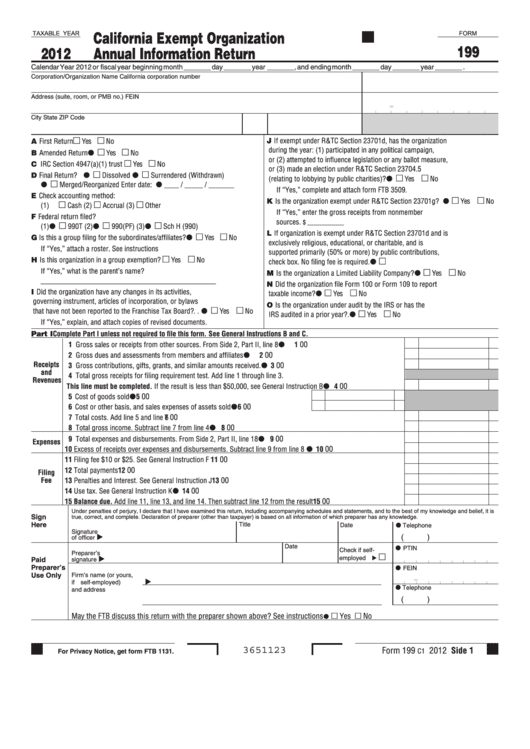

California Annual Franchise Tax Exemptions

Newly incorporated corporations are not required to pay the minimum franchise tax in their first year of operation. Further, businesses are not subject to the minimum tax if their tax year was 15 days or fewer and they did not conduct business during those days the 15-day franchise tax exemption applies to LLCs as well as corporations.

Generally, however, the entity must pay a franchise tax whether the company is fully active, inactive, operating at a loss, or files a return for a period shorter than 12 months. This rule holds for all types of business entities subject to the franchise tax, making this business expense extremely difficult to escape.

While the above information provides a general overview of the California franchise tax, your best resource for complete information is the California Franchise Tax Board, the entity that levies and collects the tax. It has the most up-to-date information regarding the amount your business owes, amount of the minimum franchise tax, applicable deadlines, filing procedures, and any exemptions for which your business may qualify.

About the Author

Michelle Kaminsky, J.D.

Freelance writer and editor Michelle Kaminsky, Esq. has been working with LegalZoom since 2004. She earned a Juris DoctoRead more

California Franchise Tax Llc Exemption

In 2020, Californias state legislature passed a bill exempting some businesses from paying the California Franchise Tax during their first taxable year. California LLCs, LPs, and LLPs formed between January 1, 2021 and December 31, 2021 do not have to pay the California Franchise Tax for their first taxable year. Those businesses will begin paying the California Franchise Tax during their second taxable year in business. See California Assembly Bill 85 for more information.

You May Like: What Do You Need To Do Your Taxes

Do You Need An Ein To Start An Llc

You do not need to have an Employer Identification Number prior to register an LLC, but you do need one after youve formed your LLC in order to do things like open a business bank account. You also need an employer identification number to get a business credit card. You can register your LLC with the Interval Revenue Service and get a federal employer identification number for free

Starting an LLC in California can feel intimidating and expensive, but the perks far outweigh the costs. If you see yourself taking your side hustle or business efforts to the next level in California, having your ducks in a row early on will help you bring your entrepreneurial goals to fruition.

The legal commentary from experts in this article is for educational purposes and is not intended to be legal advice.

Forming An Llc Nonprofit By Irs Rules

The IRS alone will decide whether your company will be tax-exempt when forming an LLC nonprofit. For an LLC nonprofit to be tax-exempt, all company members must be nonprofit organizations who are tax-exempt. There are also complex rules you must follow when applying for this status.

In your LLC’s organizational documents, a statement should be included that limits the activities of your LLC to tax-exempt purposes. The language you use when organizing your LLC must make it clear that the only reason the company exists is the member’s charitable purposes. Your LLC’s organizational language must also mandate that only 501 organizations or government units can be members.

The organizing documents of your LLC must state that company assets and interests can only be transferred to a nonmember for fair market value. This excludes LLC ownership interests. Your organizational language is also required to state that the LLC’s assets that are used for charitable purposes will continue to be used for these purposes after the LLC has been dissolved. When making amendments to the Articles of Organization for your LLC nonprofit, these amendments must comply with 501 rules.

Recommended Reading: How Do Tax Write Offs Work

California Llc Vs S Corp: A Complete Guide

The big question when forming a new business entity in California is what type of entity should be formed. The decision often is between a California LLC vs. S Corp. This is because Limited Liability Companies and Subchapter S Corporations have consistently ranked as the top two options to be considered.

While LLCs and S Corps are both pass-through entities and provide liability protection, they also have several important differences. Owners need to consider profit-sharing, administrative requirements, LLC fees, state franchise taxes, employment tax implications, eligibility of owners, and operational ease when making their choice.

Business owners should consult with an experienced tax professional to weigh the differences between a California LLC vs. S Corp. The type of entity selected should meet the business owners needs, along with being able to handle any potential operational issues that their organization may encounter.

What is in this article?

Basics Of Minimum Franchise Tax

California is one of many states that has a franchise tax levied against corporations and various other business types that wish to do business within California. All corporations, active or inactive, are subject to the minimum franchise tax, even if they have been operating at a loss for under 12 months or are filing a short-term return.

During its first year of business, a corporation is required to pay a certain portion of its net income. This is standard for all corporations, whether they are organized or incorporated in California, a foreign corporation qualified to conduct business, or they do business in California without being incorporated or qualified under the state’s laws.

There are several scenarios where the first year’s franchise tax can be waived:

Also Check: Penalty For Not Paying Taxes Quarterly

Assembly Bill 85 Law Changes For Llcs Llps And Lps And The 15

During the 2020-21 legislative session, Assembly Bill 85 was enacted to make numerous changes to the California Revenue and Taxation Code. One of those changes was to eliminate the annual tax for Limited Liability Companies , Limited Liability Partnerships , and Limited Partnerships , that organize, register, or file with the Secretary of State on or after January 1, 2021, and before January 1, 2024, for their first taxable year, subject to an appropriation by the legislature to FTB for the costs of administration.

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Business entities such as LLCs, LLPs, and LPs are subject to an $800 annual tax. However, before the passage of AB 85, these entities were not able to receive the same benefit of that tax exemption for an entitys first taxable year. With AB 85 now being chaptered, the California Revenue and Taxation Code has been amended to extend the first year exemption to LLCs, LLPs, and LPs that organize, register, or file with the Secretary of State on or after January 1, 2021, and before January 1, 2024.

A business entity is not subject to the $800 annual/minimum tax if the entity both:

Draft And File Your Articles Of Organization And Statement Of Information

Youll file your Articles of Organization when you register your California LLC. Additionally, in California you need to file what is known as a Statement of Information within 90 days of registering your limited liability company and every two years thereafter. This is Californias version of annual reports, and LLC owners need to file them to update the state of California on business activity.

- Yes

LegalZoom helps you set up an LLC in your state quickly, easily, and entirely online. An LLC is needed for important business functions, such as opening a business bank account. Different states have different business formation requirements LegalZoom customizes the process for you based on what state you live in, and the company helped consumers form 447,000 businesses in 2021, according to a press release.

Mistakes can be made when trying to form an LLC by yourself, and business formation professionals can be expensive. If you want a cost-effective and convenient way to create your LLC , LegalZoom is a great option.

Recommended Reading: How Long Does Your Tax Return Take

Forming A California Llc New Tax Exemption Starts In 2021

A vaccine is not the only good news expected in early 2021. California just encouraged a surge in LLC formation by exempting newly-formed LLCs from the $800 franchise tax so long as they form after the first of the year.

California law generally imposes an annual minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. As weve noted before, a corporation that incorporates or qualifies to do business in California does not have to pay the minimum franchise tax in its first taxable year. As we discussed in our prior article, a taxable year includes any period of more than 15 days, so entrepreneurs forming a new corporation in California at the end of a year need to be careful to incorporate only inside of the last 15 days of the year to take full advantage of the exemption from having to pay the minimum annual franchise tax in the corporations first taxable year.

A.B. 85 requires that the Franchise Tax Board submit annual reports to the Legislature indicating the number of first-year corporations, LLCs, LLPs, and LPs that are affected by the exemption. Id. § 24, see alsoCal. Rev. & Tax. Code § 41 the specific goals, purposes, and objectives that the tax exemption will achieve, and detailed performance indicators for the Legislature to use when measuring whether the exemption meets those goals, purposes, and objectives).

See Cal. Rev. & Tax. Code §§§ 17935 , 17941 , 17948 .

Ready to talk?

What Is The California Annual Llc Fee

Liking the sound of a flat franchise tax rate for California LLCs? Dont get too excited. High-earning LLCs dont actually have much of a tax advantage over corporations because of something called the Annual LLC Fee.

The California Annual LLC Fee is imposed on any California LLC that brings in more than $250K annually. It starts at $900 and goes up from there:

| Net Income |

|---|

| $11,790 |

Read Also: Can I Still File My 2017 Taxes Electronically In 2021

Alert California Expands First

Limited liability companies , limited partnerships and limited liability partnerships that are registered to do business in California are currently required to pay an annual franchise tax of Eight Hundred Dollars to the states Franchise Tax Board . California corporations have long been exempt from the minimum franchise tax for their first year of existence. However, this exemption did not extend to LLCs, LPs or LLPs.

California has now extended the first-year exemption to LLCs, LPs and LLPs. In order to relieve pandemic-related financial pressures for newly formed businesses, and to encourage the registration of new businesses, Governor Gavin Newsom extended the first-year exemption to LLCs, LPs and LLPs, as part of the 2020 Budget Act. Any LLC, LP or LLP that registers or files with the California Secretary of State on or after January 1, 2021 and before January 1, 2024, is exempt from paying the Eight Hundred Dollar minimum tax in its first taxable year. The purpose of this change is to remove a barrier to small business creation, particularly for new businesses that are still operating at a loss or have limited income in their first year.

The FTB plans to review annual reports from the Franchise Tax Board for the next several years and evaluate whether the new law does indeed increase the number of LLCs, LPs and LLPs that form in California.

Three Tax Reasons A California Corporation And Not An Llc Should Be Used To Operate A Business

Prepared By: , Los Angeles Business And LLC Attorney

There are many tax reasons to support the choice of a California corporation over a California limited liability company , when the entity selected will be operating a business.

Gross Receipts Tax

The first primary reason why a California LLC is used in real estate, but not to operate a business is that in addition to the annual $800 minimum franchise tax fee imposed on every California corporation and every California limited liability company, the State of California imposes a second “Gross Receipts Tax” on every California LLC, but not on any California corporation. That’s right, in California a corproation’s franchise tax is based on its Net Revenues, but a California LLC’s franchise tax is based on its gross revenues. The gross receipts tax on a California limited liability company is as follows:

| LLC Fee | |

|---|---|

| $250,000 or more, but less than $500,000 | |

| $2,500. | $500,000 or more, but less than $1,000,000 |

| $6,000 | $1,000,000 or more, but less than $5,000,000 |

| $11,790 | $5,000,000 or more |

Since most businesses need to generate at least $250,000 in gross receipts just to break even, the California LLC will have to pay a higher franchise tax than a California corporation, even if the LLC is operating at a real loss. By contrast, no California corporation is subject to a gross receipts tax. Like most other forms of businesses , a California corporation only pays tax on its net taxable income .

Increased Self-Employment Tax

Recommended Reading: Where Is My California Tax Refund

Annual $800 Minimum Franchise Tax After The First Tax Year

When an LLC that has formed or is doing business in California is in its second tax year, it must begin to pay the $800 annual minimum franchise tax each year until it formally dissolves.

Note that LLCs that have elected to be treated as corporations for tax purposes do not pay the $800 franchise tax. They instead pay a 6.65 percent alternative minimum tax .

The Advantages Of Llcs

A key feature distinguishing LLCs from S Corps is that businesses need fewer forms to register, which can reduce start-up costs. In addition, it is not necessary to hold formal shareholder meetings and maintain annual minutes for LLCs.

LLCs provide more flexibility than S Corps. For S Corps, there are pro-rata requirements for items of income, loss, or distributions. Conversely, owners of LLCs may specially allocate income, loss, and distributions within the parameters of the tax law. The method of such allocations should be specifically described in the operating agreement, which is typically prepared by a qualified attorney.

One additional advantage of LLCs over S Corps relates to a concept called tax basis. Tax basis is what allows taxpayers to deduct business losses and to take non-taxable profit distributions. LLC member-owners receive an increase in their tax basis for their share of qualifying debt in addition to equity.

Also Check: What Is Self Employment Tax

Our Filing Experts To Help You Start An Llc In California

With the annual minimum franchise tax exemption, these next few years are an ideal time to start a business in Californiaand CorpNet is here to assist you! Our business filing experts have in-depth knowledge of and experience with Californias registration and tax filing requirements.

We save business owners precious time and give them peace of mind by preparing and submitting Articles of Organization, annual and franchise tax forms, licenses and permits, EIN application, and more. Contact us for a free consultation!

California Does Something Right For Small Business

- Engage in any transaction for the purpose of financial gain within California.

- Are organized or commercially domiciled in California

- Your California sales, property or payroll exceeds certain amounts.

Such broad explanations and definitions can make it extremely difficult for business owners to discern whether or not they must pay this tax. As well, there are ongoing battles in court in order to try to stifle the Franchise Tax Boards broad interpretations. So even before the Coronavirus, these taxes have had the effect of discouraging business in the state.

You May Like: How Old Do You Have To Be To File Taxes