Capital Gains Taxes On Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller’s basis.

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. When you sell your primary residence, $250,000 of capital gains are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you inherit a home, you don’t get the $250,000 exemption unless you’ve owned the house for at least two years as your primary residence. But you can still get a break if you don’t meet that criteria. When you inherit a home you get a “step up in basis.”

Nice, right? Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family’s estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that’s your goal.

What Is The Capital Gains Tax And How Big A Bite Does It Take

- Copy Link URLCopied!

Dear Liz: We own stocks with enormous capital gains as in, six figures or more. The tax would be a lot. Any advice on how to limit the tax bite? Our income consists of Social Security and a teachers pension.

Answer: Capital gains taxes may be less of a problem than you fear. If your taxable income as a married couple is less than $83,350 in 2022, your federal tax rate on long-term capital gains is zero. If your taxable income is between $83,350 and $517,200, your federal capital gains tax rate is 15%.

In addition, you may owe state taxes. California, for example, doesnt have a capital gains tax rate and instead taxes capital gains at the same rate as ordinary income.

Capital gains arent included when determining your taxable income, by the way, but they are included in your adjusted gross income, which can affect other aspects of your finances. A big capital gain could determine whether you can qualify for certain tax breaks, for example, and could inflate your Medicare premiums. Thats why its important to get good tax advice before selling stocks with big gains.

Californias Overall Tax Picture

California is generally considered to be a high-tax state, and the numbers bear that out. There is a progressive income tax with rates ranging from 1% to 13.3%, which are the same tax rates that apply to capital gains. The Golden State also has a sales tax of 7.25%, the highest in the country. With local sales taxes added on, the sales tax rate in some municipalities can climb as high as 10.25%.

Property taxes in California cant exceed 1% by law. There is no estate tax or inheritance tax.

Read Also: When Does Tax Season End 2022

Adding Up All The Costs Of Selling Your Rental Property

Taxes are not the only expenses you will have to deal with when you sell your rental property. Depending on the state of the property, it could take a significant sum, as well as time and effort, to get it ready for the market. Then the real estate agent will want a cut of the sale price, and there are always incidentals that you dont foresee. So lets keep calculating.

You have to make the sale before you see any of that capital gain. There are several other major expenses before you get there though.

Renovation costs

A property has to be in good repair to receive the best price on the real estate market. Selling a home in need of major repairs is very difficult and rental properties can get pretty beat up. Many property improvements wont necessarily give you an increase in return on your investment. But they may be important for making the sale happen.

But be ready for some big price tags. New central air conditioning will cost around $5,000, and a new heating system will set you back about $4,000and those are low-end estimates. The cost of replacing a roof on average is close to $7,000. Kitchen remodels start at around $5,000 and rises steeply in price from there. But dont skimp on these repairs if you want to get the property sold.

Real estate agent commissions

Staging the property

Holding costs

What Are The Exceptions To The Capital Gains Tax Rate For Long

One major exception to a reduced long-term capital gains rate applies to collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine. Typically, any profits from the sale of these collectibles will be taxed at 28% regardless of how long you have held the item.

Another major exception comes from the Net Investment Income Tax , which adds a 3.8% surtax to certain investment sales by individuals, estates, and trusts above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income.

Also Check: Free Amended Tax Return 2020

How Much Is Capital Gain Tax Rate In California

California does not distinguish between short-term and long-term capital gains, unlike the federal gains tax. The same rates and bands as the standard state income tax are used to tax all capital gains as income.Therefor, the capital gains tax rate California equals your regular income tax rateDepending on the source of the capital gains and a persons regular tax bracket, tax rates can range from 1 percent to 13 percent in California.

Capital Gains Taxes Are Confusing

Wealthy Americans likely breathed a collective sigh of relief when President Joe Biden revealed his $2 trillion infrastructure plan.

Despite the president’s campaign pledge to raise the capital gains tax rate, the new plan doesn’t include any changes in that regard.

However, when it comes to capital gains tax, it’s not just the federal tax rate that matters. States can also set their own tax rates, and some may have changes on the horizon. In the state of Washington, the governor has proposed a capital gains tax that could raise almost $1 billion if passed.

To provide the most recent info on capital gains taxes, we’ve collected data on long and short-term capital gains tax rates at both the federal and state level.

Recommended Reading: Will Property Taxes Go Up In 2022

Jeffrey H Kahn Harry M Walborsky Professor & Associate Dean For Business Law Programs Florida State University College Of Law

If Washington puts state capital gains taxes in place, might that pave the way for other states to do the same?

I do not think that the addition of a capital gains tax in the state of Washington would have much of a bearing on whether other states decide to impose one. The other considerations on whether to impose a state-level capital gains tax are likely more important.

For example, a capital gains tax on top of a higher federal tax might lead some to flee the state or at least make it less desirable to move there. We have seen a general trend of people moving from high tax states to low tax states and state governments are certainly aware of this.

I believe the pandemic has sped up the remote worker movement which allows people to be even more mobile and so tax rates may play an even larger role in residency decisions.

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I believe a sell-off is certainty, especially if the increase is paired with the repeal of section 1014 which provides for a step-up basis at death.

The loss of value in the market will impact pension and retirement funds and make investments less attractive. It is unclear whether an increase will actually raise significantly more revenue so the trade-off does not appear to be worth it.

The Capital Gains Tax In California

Capital gains tax charges you on the difference between the amount you paid for the asset and the amount for which you sold the asset. This tax may apply to a number of different types of investment, such as stocks and bonds, or to assets such as boats, cars and real estate. The amount you earned between the time you bought the property and the time you sold it is your capital gain.

The IRS charges you a tax on your capital gains, as does the state of California through the Franchise Tax Board, also known as the FTB. The exemption is $250,000 for single taxpayers. Married taxpayers have a double exemption for a $500,000 exemption. This means that if you bought a home for $300,000 and sold it for $900,000, you ‘d have a capital gain of $600,000. But if you’re married, your exemption is $500,000 of that amount, so you’d have a capital gain of $100,000 that you’d need to pay taxes on.

There are a few things that could disqualify you from the capital gains exemption. For example, if the house was not your primary residence. If this is an investment property or a second home, you will not qualify for a tax exemption on capital gains.

Other things that might disqualify you from the exemption:

Read Also: Aarp Foundation Tax-aide Site Locator

What About Selling A Home You Inherited

If youve inherited your home, things change a little bit for both state and federal capital gains taxes. Basically, if you inherit a home and occupied it during two of the last 5 years, your tax gains will be based on its fair market value at the time you were given the house vs. your own sale price. Youll have to pay capital gains on anything over $250,000 or $500,000 .

If you receive a home and sell within less than the time allowed for exemptions of any kind, your capital gains will be the difference between your sale price and the FMV of the house when it was given to you and youll be liable for paying them completely.

So for example, if you received a home from a relative who originally bought it for $100,000 2 decades ago, but its assessed value when the home was bequeathed to you is $400,000, and you sell the house a year after that for $600,000, your taxable capital gains will be $200,000.

How Can I Save Capital Gains Tax On The Sale Of My House

Exemptions from your Gains that Save Tax Section 54F

Recommended Reading: Montgomery County Texas Tax Office

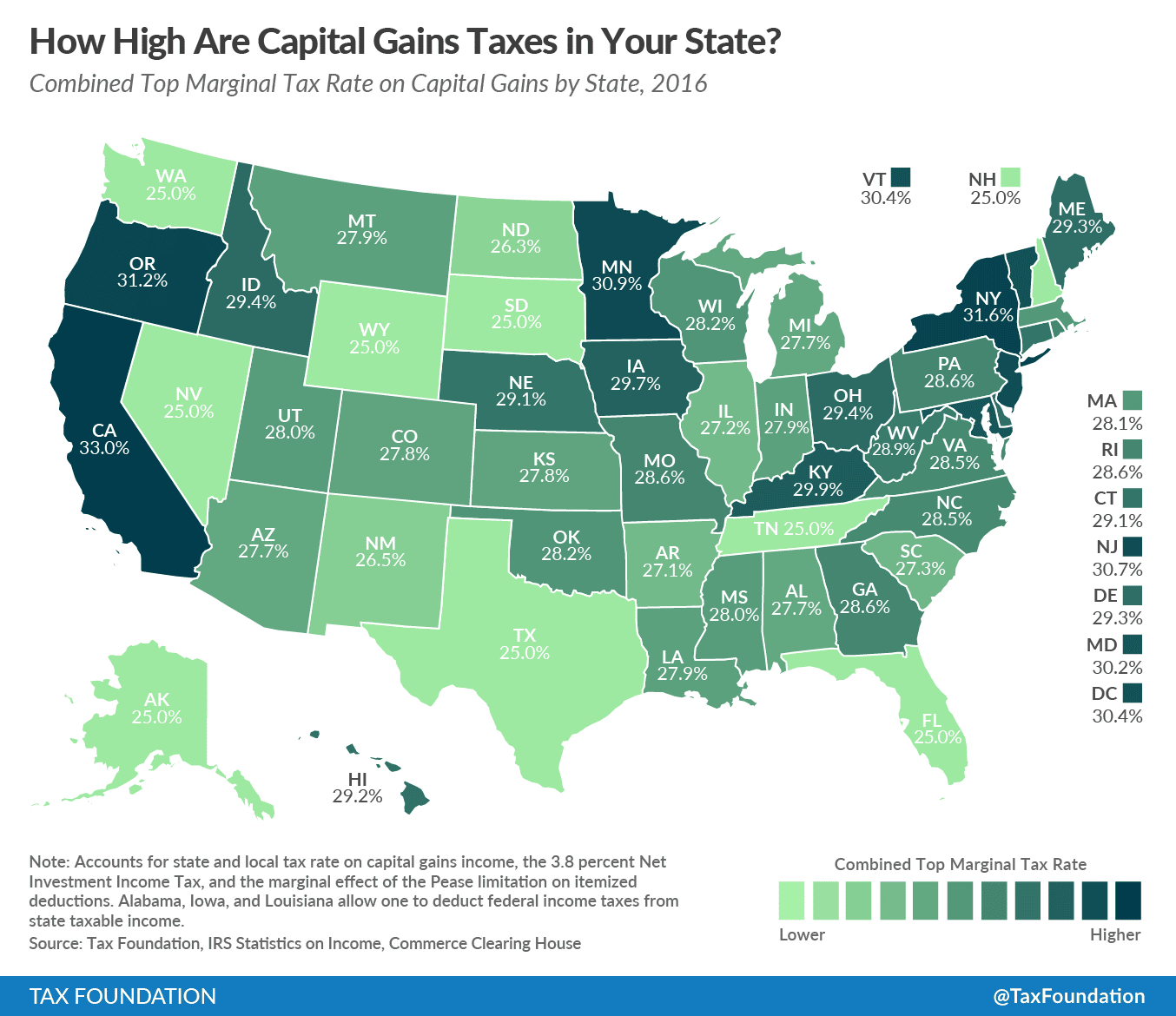

State Capital Gains Tax Rates

Each state has its own method of taxing capital gains. Most states tax capital gains as income. In states that do this, the state income tax applies to both long- and short-term capital gains.

Keep in mind that if your state taxes capital gains as income, you’ll add your capital gains to your other ordinary income, which may put you in a higher tax bracket.

There are also plenty of states that handle capital gains differently. Some allow taxpayers to deduct a certain amount of capital gains. Others don’t tax income or capital gains at all.

The sections below cover every state’s tax laws for capital gains. Keep in mind that many states have special rules that apply to the sale of certain assets, such as exclusions for collectibles purchased before a certain year.

Not every rule for every situation is included. Taxpayers should always review the capital gains rules in their state so they know about any relevant exceptions.

Also, it’s important to note that this is the most recent data for each state at the time of this writing — to get exact figures, taxpayers should consult their state’s online documentation. If you have questions about capital gains on your tax return, it’s a good idea to consult that documentation or a tax professional.

California Capital Gains Tax On Real Estate

The California capital gains tax on real estate is different than the normal capital gains tax because of the potential exemption. The tax is calculated by taking the purchase price of the property, subtracting any improvements that have been made to it, and then subtracting the selling price. Those selling homes they lived in might be excluded from paying the tax altogether.

Any single homeowners can deductup to $250,000 of gains from the sale of their property as long as they meet the requirements, such as living in the home for at least 2 of the last 5 years. Any couples can exclude a gain of up to $500,000. This benefits individuals who spent time and money living in and improving their property.

Don’t Miss: How Long To Get Tax Return

Californias Capital Gains Tax Rates For Short

Contrary to the federal rate, California does not have a different tax based on how long you have owned the asset. Everyone is subject to taxation at the standard income rates in California since capital gains are treated as ordinary income. These tax brackets range from 1 percent to 13.3 percent, as was already mentioned.

How To Calculate Capital Gains Tax

At a Glance:

The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

When you sell capital assets like mutual funds or stocks theres a tax implication. But knowing what tax rate applies depends on several factors. In this post, well outline capital gains taxes and how to calculate them.

Recommended Reading: How Can I Get My Tax Transcript Online Immediately

Transfer Taxes Exist Too

In case you thought your only tax debts for your house sale are to the state and to the Federal Government, we have a surprise for you there are also transfer taxes that you might need to pay at the county or city level for a home sale.

For example, the California cities of Los Angeles, San Francisco and Riverside all collect their own transfer taxes on home sales. You should check with your city or county tax offices to see what these transfer tax amounts are and how they apply.

Typically, transfer tax payments can be negotiated between you they buyer and your seller. In some parts of California, its more traditional for the buyer to pay them while in other parts of the state, the seller should cover this tax. If youre using a real estate or listing agent for your home sale, you can ask them what the general rule in your area is.

California Income Tax Rates For 2022

1 week agoAdditionally, taxpayers earning over $1M are subject to an additional surtax of 1%, making the effective maximum tax rate 13.3% on income over $1 million. If you have questions, you can contact the Franchise Tax Board’s tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505.

Also Check: How Do I Report Crypto On Taxes

Change Of Residency From California

If you are a former California resident, your installment proceeds from the sale of property located outside California that you sold while you were a California resident are not taxable by California.

Example 6

In June 2007, while a California resident, you sold a parcel of real property located in Washington in an installment sale. On March 1, 2010, you became an Ohio resident, and on June 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

The capital gain income is not taxable by California because the property was not located in California. The interest income is not taxable by California because you were a nonresident of California when you received the proceeds.

Example 7

In March 2008, while a California resident, you sold a parcel of real property located in California in an installment sale. On June 1, 2010, you became a Washington resident, and on August 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

The capital gain income is taxable by California because the property you sold was located in California. The interest income is not taxable by California because you were a nonresident of California when you received the proceeds.

Example 8

Determination

How California Taxes Capital Gains On Principal Residence

The California capital gains tax on real estate is a tax imposed on the sale of property located in the state of California. The tax is based on the profit realized from the sale, and is calculated as a percentage of the sale price. The tax rate depends on the type of property sold, and the length of time the property was held by the seller.

How To Avoid California Capital Gains Tax

One distinctive aspect of the California tax system is the built-in deduction for property owners who use their home as their primary residence. The owner must adhere to the rules that state they may only own one home that is recognized as their principal residence, live on the property for a two year period within a five-year period, and get less than $250,000 upon selling the home.

Any property sold for more than $250,000 will still be liable to tax on every dollar over that sum, despite this clause.

Even if you dont qualify for this exemption, you may still be eligible for a partial exemption. Property owners can also increase the cost basis by, for example, taking into account costs associated with the purchase of the property, such as fees, expansions, and home modifications. The increase in cost basis offsets therefore cancels out, reduces and gives breaks for capital gains.

Read Also: Boat Loan Calculator With Tax