How To Get Through To The Irs

Whatâs a taxpayer to do if you have questions and the information in your online account doesnât solve the mystery? What if the IRS sends you a billing notice for something you already paid?

Your first step should be to check your online account at IRS.gov. This free account is free to set up, and allows you to view information about your balances, prior tax records, payments and economic impact payments .

If your online account doesnât have the information you need, Bell offers a few tips for maintaining your cool as you navigate IRS systems during this incredibly trying time.

Find A Local Taxpayer Clinic

Low Income Taxpayer Clinics help individuals to resolve tax disputes with the IRS, including tax audits, appeals, and collection matters. The LITC Program receives some funding from the IRS, but its considered an independent organization. You may qualify for free or low-cost assistance if you meet certain LITC income requirements and other criteria. Use the LITC map to find your local clinic or see IRS Publication 4134 . For general questions, you can contact the LITC Program Office by phone or by email .

How To Contact The Agency For Tax Help

FG Trade / Getty Images

It might seem inconceivable these days that an entity doesn’t stand by with a convenient email address available for contact, but, no, you cant email the IRS. At least, you can’t do so regarding most problems and issues. The agency does maintain a single email address for such a purpose.

But this shouldnt prevent you from reaching out to the IRS for help when you need it. You have quite a few other options, depending on your problem and why you need assistance.

Don’t Miss: California Used Car Sales Tax

Be Ready With Everything The Irs Will Ask About

First, youll have to prove your identity with your name and Social Security Number or Individual Taxpayer Identification Number .

Be prepared to provide your tax return information, including:

- Name, dates of birth, and SSNs on the return

- Your filing status

- Possibly information from one of your information statements

- Any letters/notices the IRS sent you

Its best if you have your last filed return in front of you when you call.

If youre calling for someone else, youll need the person there with you to speak with the IRS. Or, he or she can authorize you to make the call with Form 8821.

You can make the call more effective by:

- Writing down your questions ahead of time

- Recording the IRS representatives name and badge number in case you need to reference the call later

- Remaining courteous to the IRS representative

- Writing down all the answers you get in as much detail as possible

- Setting a deadline with the IRS if you need the IRS to take action

What You Need When You Call The Irs

After you finally get through the long hold and reach a real person at the IRS, the last thing you want is to have to hang up and call back. That’s why it’s essential to be prepared before you call the IRS. Here’s what you need when you call the IRS:

- A copy of your last year’s tax return. The IRS uses info from the return to verify your identity.

- Social Security numbers and birthdates of everyone on the tax return you’re calling about. This information will be on the tax return, but some tax prep software blacks out these numbers on the printed copy of the return.

- Individual Taxpayer Identification Numbers for anyone on the return who doesn’t have a Social Security Number.

- Filing status from your last tax return.

- Any notices or letters you’ve received from the IRS.

To make the call easier, you may want to write down the questions you want to ask. Then, you won’t forget anything once you get a live IRS agent on the phone.

Also Check: Taxes Minimum Income To File

Heres How To Check Your Child Tax Credit Payment Status

The easiest way to see whats happening with your previous checks is to log in to the IRS Update Portal to view your payment history. To use it to manage all of your advance payments, youll need to first create an ID.me account.

If the portal says your payment is coming by mail, give it several business days to arrive. If you have direct deposit set up, make sure all the information is accurate. If you havent set up banking details in the portal, or if the bank account on file with the IRS has closed or is no longer valid, you should expect all further payments to come as paper checks.

If your payment history in the portal says that the money was sent by direct deposit, check your bank account again in the next few days to make sure its cleared. According to the White House website, transactions will show the company name IRS TREAS 310 with a description of CHILDCTC and an amount for up to $300 per kid . Dont get this deposit confused with those for stimulus checks, which show up as TAXEIP3 when deposited. Also, if youre waiting on a tax refund, itll show up as TAX REF.

Irs Phone Numbers For Specific Tax Issues

In many cases, you shouldn’t call the main number. You’ll get faster and better service if you call one of the IRS’s specific phone numbers. Here is a list of the IRS’s phone numbers and links to resources with more information about each of these topics.

| Tax Assistance for deaf or hard of hearing | 800-829-4059 |

|---|

Also Check: Lovetothe Rescue.org/tax-receipt

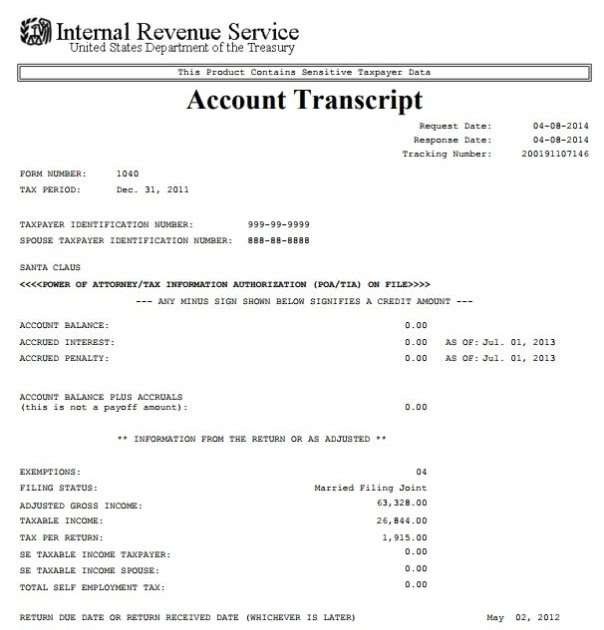

Tax Transcript Email Scam

Scammers claiming to be from IRS Online are sending fraudulent email messages about tax transcripts. A transcript is a summary of your tax return. You may need a tax transcript to apply for a loan or for government assistance.

To avoid tax transcript scams, learn the real way to get a tax transcript from the IRS.

Need Help Try Contacting Your Local Irs Office

If you cant reach a real person over the phone, you can contact your local IRS office. The Taxpayer Assistance Center operates by appointment only, where you can get help directly from an agent.

The IRS also provides a great service called the Taxpayer Advocate. to find a Taxpayer Advocate in your area.

Don’t Miss: How Much Taxes Deducted From Paycheck Pa

Irs Phone Numbers: How To Speak To A Human At The Irs

Weve all been thereyou need to speak with someone at the IRS about a tax issue, and youre having a hard time getting an actual human being on the phone. Its frustrating. We want to help you avoid this annoyance and get your tax solutions quickly. Whether youre calling the stimulus check phone number or the general IRS phone number, you need a live person.

This guide helps you navigate the different communication channels within the IRS. Soon, you will be speaking to the correct IRS representative for your situation.

Visit Your Local Irs Office

If your question or problem isnt something youre able to solve over the phone, visiting a local IRS office is an option. Sometimes sitting down face to face with a real person is the best approach, even if it isnt the fastest.

The IRS maintains several hundred local offices, sometimes called Taxpayer Assistance Centers, located in small and midsized cities as well as large metropolitan areas. You can locate an office near you with the IRS Taxpayer Assistance Center Office Locator.

If youre dealing with an issue that assistors arent able to solve over the phone or you just cant seem to get a clear answer, then an in-person visit may be the best option for you. Make sure to schedule an appointment, though, as walk-ins generally arent accepted. You can do so through the locator link above or by calling 545-5640.

You May Like: Wisconsin Sales And Use Tax

What Should I Attach To A Letter To The Irs

Where relevant, such as if you want to file an amended or corrected return, attach the relevant form, completely filled and signed, along with relevant attachments that have changed since your original filing. If your contact information has changed, include your new contact information and phone number.

Recommended Reading: How To Appeal Property Taxes Cook County

Will Tax Refunds Be Bigger In 2023

In November 2022, the IRS warned that tax refunds issued in 2023 may be smaller. This is because taxpayers won’t be receiving any Economic Impact Payments as they did in the past.

Taxpayers will also have to submit Form 1099-K for third-party transactions that exceed $600. In the past, 1099-Ks were only issued for transactions if the number of transactions exceeded 200 for the year and the aggregate amount of these transactions exceeded $20,000.

The IRS also stated that if a taxpayer doesnt itemize and take the standard deduction, they wont be allowed to deduct charitable contributions. This year, the IRS raised the standard deduction for all categories of taxpayers. They are as follows:

- Single or married filing separately, $12,950

- Head of household, $19,400

Also Check: Federal Tax Return By Mail

House Committee Releases Trump’s Tax Returns

Former President Donald Trump’s tax returns have been released Friday after a years-long legal battle.

The Democrat-led House Ways and Means Committee released the final piece of six years’ worth of Trump’s tax returns.

Today, the Committee released the final piece of supporting evidence in our investigation into the IRS’s mandatory audit program under the prior administration.Find Attachment E here â¬ï¸

This comes after a vote last week to make the returns public after the Committee reviewed the documents, handed over from the Treasury Department. The Supreme Court ruled last month that the returns could be turned over to Congress.

The returns from 2015 to 2020 span nearly 6,000 pages, including more than 2,700 pages of individual returns from Trump and his wife, Melania, and more than 3,000 pages in returns for Trump’s businesses. They will also include redactions of personal sensitive information such as Social Security and bank account numbers.

Trump refused to publicly release his tax returns when he was a presidential candidate in 2016 and kept them secret through a lengthy legal battle when he was in the White House. The release of this information comes as Trump announced his 2024 presidential bid.

While Democrats have championed the release of Trump’s tax returns as a pillar of transparency, Republicans argue that this move will set a dangerous precedent of government overreach and loss of privacy. The former president himself has

Help With Finding Items In File Listings

File listings on IRS.gov can contain thousands of items. To help you find what you need our listings application allows you to search, filter and sort your results.

All searches are done from the single Find box that appears on each listing page.

Clicking on any column heading sorts the table by the content of that column. Clicking the same heading again reverses the sort order.

Use the Show per page box to change the number of items displayed on each page.

Read Also: What Is The Maximum Tax Refund You Can Get

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Understand Typical Refund Time Frames

- E-filers: You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

- Paper filers: You can expect your refund about 10 to 11 weeks after we receive your return. We must manually enter information from paper returns into our database.

Exceptions

- First-time filers: It takes about three weeks to enter new filers into our system. Until that time, well report your return as not entered in system. Add those three weeks to the estimates above to determine your refund timeline.

- If you received a letter from us asking for more information: Your refund will be delayed until we get the requested information. It will then take about six more weeks to finish the process.

Also Check: How To Pay Nanny Taxes

Other Irs Phone Numbers

The IRS maintains a range of other phone numbers for departments and services that deal with specific issues. Try one of these numbers if any of them makes sense for your situation.

- Businesses: 829-4933

- Innocent spouse tax relief: 681-4271

- International taxpayer advocate: 522-8601 522-8600

Between all these alternate numbers, youll find answers to an extremely wide range of tax filing questions.

How Do You Speak To A Live Person At The Irs

Did this post save you a ton of time and heartache? Consider buying me a cup of coffee. Thanks so much!

Also Check: Irs How To File Taxes

Prevent Tax Id Theft With An Identification Protection Id

Identification Protection PINs are six-digit numbers issued to taxpayers by the IRS to prevent tax ID theft. If youve experienced tax ID theft in the past, the IRS will automatically issue you an IP PIN. You can also voluntarily request one. After the IRS issues your IP PIN, you will use it to file your return. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. Learn more about the IP PIN and how you can apply.

How To Contact Irs

IRS Mailing Address For those who don’t file their federal tax returns electronically, the “Where to File” pages provide mailing addresses for filing all paper tax returns. You may also use your appropriate “Where to File” address for other written correspondence with the IRS.

Contact the Taxpayer Advocate Service If you have an ongoing issue with the IRS that has not been resolved through normal processes, or you have suffered, or are about to suffer a significant hardship/economic burden as a result of the administration of the tax laws, contact the Taxpayer Advocate Service.

This is NOT the place for tax law questions or questions regarding your specific tax return, but you can give us some constructive feedback regarding the web site if you like. Give us your email address if you want a response, but don’t include any social security numbers or other personal tax account information.

Don’t Miss: How To File Taxes With Last Pay Stub On Turbotax

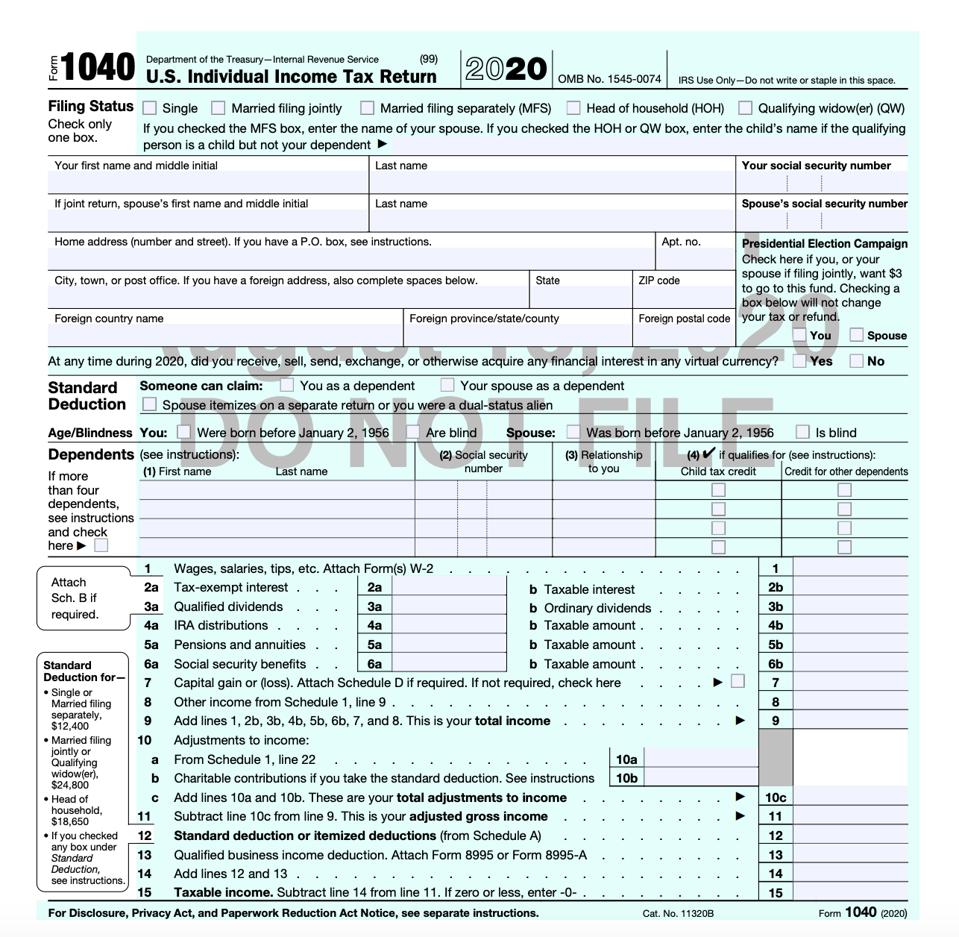

Amending A Tax Return

If you file your individual tax return and then realize you made a mistake, you can change your tax return. Usually this involves filing Form 1040-X, Amended U.S. Individual Income Tax Return, to report changes to your income, deductions or credits. You may also be able to make certain changes to your filing status.

Trump Tax Returns Updates: House Committee Makes Records Public

- A batch of former President Donald Trump‘s tax returns were released this morning by the House Ways and Means Committee.

- The tax returns cover Trump’s personal and business finances between 2015 and 2020. This covers the period when he first ran for president and his subsequent tenure in office.

- Trump broke from tradition by refusing to release his tax returns while running for president, claiming an IRS audit prevented him from doing so. The committee has accused the IRS of failing to adequately audit Trump during his time in office.

- Today’s revelations are likely to shed light on Trump’s much-discussed financial situation, at a time when he is actively campaigning for a return to the White House in 2024.

Live updates have ended.

Read Also: How Much Is The Tax In Texas

Irs Phone Numbers And Website

At www.irs.gov you can find:

- Forms, worksheets, and publications needed to complete your return

- Advice and FAQs

- Information on new and changing tax laws

- Links and information for your state taxes

- Online tools and calculators

To contact the IRS, call:

- Customer service 800-829-1040

- Questions about refunds and offsets to IRS liabilities 800-829-1954

- Taxpayer advocate service 877-777-4778

To pay tax by credit card Call any of these numbers:

To learn more, see these tax tips:

- Amended Return Form 1040X

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.