If You Need To Change Your Return

You can make a change to your tax return 72 hours after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2023 for the 2020 to 2021 tax year

- 31 January 2024 for the 2021 to 2022 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

How Long Do You Have To Amend A Tax Return

There is a limited amount of time during which taxpayers can file for an amended return and have it accepted by the IRS. So, if you want to receive a tax refund, the amended tax return deadline is:

- No later than three years from the due date for the original tax return.

- Three years from the date on which you filed the return in question.

- Within two years after youve paid your taxes for the year in question.

How Do I File An Amended Return

Form 1040-X can be filed by mail or electronically, in certain cases. To prepare your amended return, you will need:

- A copy of your original tax return that you want to fix

- Explanation for why you are amending your tax return

Make sure that your W-2s, forms, and schedules are for the same tax year as your tax return.

If your amended return indicates that you owe more taxes, you should pay your taxes as soon as possible to limit interest and penalty charges. You can pay your taxes online directly from your bank account for free using IRS Direct Pay.

Filing by mail:

Helpful tips if you are filing by mail:

- You do not need to submit your original tax return with your amended return. This is for your reference only.

- If you are amending more than one tax return, you will need to file a separate Form 1040-X for each tax return you are amending. You will need to mail each form in a separate envelope.

- Unlike filing electronically, you DO NOT need to submit new forms and schedules for your entire tax return. Only submit new forms and schedules that you have made changes to.

Filing electronically:

You May Like: Property Taxes In Austin Texas

How Do I Amend My 2021 Return

There are a few things you need to know before you can start the amendment process:

- To amend your 2021 return, you need to use the same TurboTax account that you used to file your original 2021 return.

- If you dont see your 2021 return under Your tax returns & documents on the Tax Home screen, you might be in the wrong account. Use our account recovery tool to find all of your accounts.

When you’re ready to amend, select your product below and follow the instructions.

Related Information:

Who Is Liable For Incorrect Tax Return

The IRS doesn’t care if your accountant made a mistake. It’s your tax return, so it’s your responsibility. Even though you hired an accountant, you are liable to the IRS for any mistake. So, if the IRS adjusts your tax liability and say you owe more money, it’ll be you who has to pay, not your accountant.

Also Check: Free Amended Tax Return 2020

Submit Your Amended Forms

Beginning with the 2019 tax year, the IRS allows you to e-file amended tax returns if you filed the original return electronically and provided that your tax software supplier supports electronically filing amended returns. To amend a return for 2018 or earlier, you’ll need to print the completed Form 1040-X and any other forms you’re amending. Attach any necessary supporting documentation, such as:

- Any new or amended W-2s or 1099 forms

- Other forms or schedules that changed, such as Schedule A if you updated your itemized deductions

- Any notices that you received from the IRS regarding your amended return

Mail all the forms and documents to the address provided in the instructions or electronically file the return if you are able to.

If amending your tax return results in a higher tax bill, you will need to make an additional tax payment. You can mail a check with the amendment or go online and make a payment at the IRS website after logging into their system. By making a payment now instead of waiting for the IRS to send an invoice, you can minimize the interest and penalties you’ll owe.

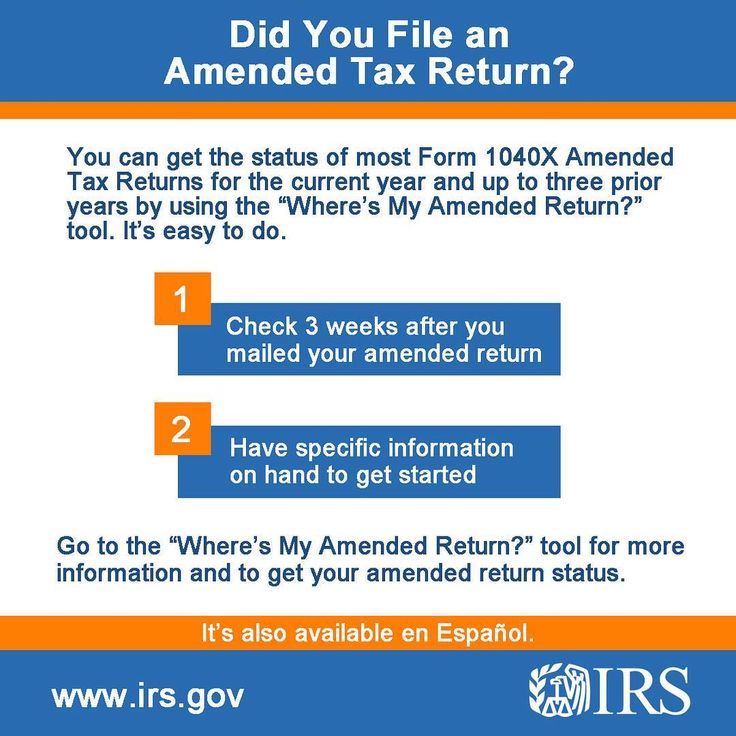

Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight weeks or longer to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system.

Reasons You Need To File An Amended Virginia Income Tax Return

Changes to Your Federal Return

If you or the IRS changes your federal return, youre required to fix or correct your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change.

IRS CP2000 Notices & Federal Tax Adjustments

The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – dont wait for us to notify you.

You have one year from the resolution of your federal audit to file an amended Virginia return. If you dont file an amended return, or notify us in writing of IRS audit results, we can adjust your return based on the IRS audit findings at any time in the future, which may result in additional tax and interest.

If youre not sure if you need to file an amended Virginia tax return, give us a call.

Changes to Another States Return Affecting Your Virginia Return

If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Correcting an Error

Also Check: What States Do Not Have Sales Taxes

How To Amend A Tax Return: Step

Amended tax returns are filed to rectify mistakes on previously filed taxes. Amending a tax return is not a complicated process, but you need to be careful not to miss anything when filing for an amendment. But if you go through all the required steps the first time you file for an amendment, youll have no additional responsibilities regarding the amendment process, and you wont have to refile tax returns.

How Do I Generate The Amended Return

For the current year program, log into the account and click the “Continue”, then select “2021 Amended Return” from the left side of the screen on the navigation bar. For Prior year Amended returns, select the Prior Years tab and select the tax year you wish to amend. Continue until you are in the correct return and click on the Amended Return on the left side navigation bar.

You May Like: Federal Taxes On Capital Gains

What Is An Amended Tax Return

An amended tax return is necessary when youve made a mistake on your original return. For example, if you need to change the amount of income you initially reported, the number of dependents, or change your tax filing status, you should amend your return. Additionally, you can also file an amendment if you forgot to claim a certain tax deduction or tax credit. If you file for an amended return, you can maximize your tax returns.

Not all mistakes, however, require you to amend your return. For example, if there is a small mistake in your returnsuch as a typo in your Social Security number or addressthe IRS will reject the tax return, and youll only need to refile taxes with the correct information.

Amended returns are usually filed when the filer needs to receive an overlooked tax refund. But a simple mathematical error on the original tax return is not a reason for filing for an amendment. If there are such errors, the IRS will automatically correct them, and you wont need to do any corrections yourself. But if there is a more significant error in your calculations, or youre missing a specific form, youll be notified by letter.

Auditing is sometimes a big concern if youre filing an amended return. Still, the amending tax return audit risk is equal to the risk youre undertaking when you file the initial return.

How Far Back Can You Amend A Tax Return

The IRS gives taxpayers three years from the date the original return was filed to file an amended return if they are seeking a tax refund or credit, but only two years if taxes were paid. If taxes are owed on the amended return, the taxpayer may face penalties and interest.

How long does it take for an amended tax return to come back?

- You cant e-file your taxreturn. Receiving your amendedtaxreturnsbacktakes a long time. Usually, it takes about 3 weeks from the date you mailed the amendedreturn for it to show up in the IRS system. Thereafter, you can get your amendedtax refund after 16 weeks.

Read Also: Tax Credits For Electric Vehicles

What Do I Need To Know

If you realize there was a mistake on your return, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return.

For example, a change to your filing status, income, deductions, credits, or tax liability means you need to amend your return. Or, IRS may have made an adjustment to your return, and sent you a notice that you disagree with. If so, you would file an amended return to change the amounts adjusted by IRS. If youre unsure if you should file an amended return, you can use this tax tool to help you decide.

You can also amend your return to claim a carryback due to a loss or unused credit. In this case, you may be able to use Form 1045, Application for Tentative Refund instead of Form 1040-X, which will generally, result in a quicker refund.

Generally, in order for IRS to be able to issue a refund, you must amend your return within three years after the date you filed your original return or within two years after the date you paid the tax, whichever is later. However, there are exceptions to the rule in some situations, such as:

- Financial disability,

- Foreign tax credit or deduction,

- Loss or credit carryback, and

- Disaster-related grants

When you file Form 1040-X for a tax year, it becomes your new tax return for that year. It changes your original return to include new information.

If all you need to do is change your address, IRS.govs Address Changes page lists all available options.

When Should I Amend My Michigan Return

Amend your Michigan return only after your original return or claim has been filed and processed. If you are claiming a refund on your amended return, you must file it within four years of the due date of the original return . For example, to amend a 2017 return that was not extended, the amended return must be received by April 17, 2022.

Recommended Reading: How To Report Tax Fraud To The Irs

To Complete The Amendment Process For Your State Return:

How To File An Amended Return

Until recently, you could only file an amended return on paper, and it could take a long time to get an extra refund. Now, you can file an amended return electronically for 2019 and 2020 returns that were originally e-filed . But even for the years when the IRS is accepting electronic returns, it’s still sending paper checks you can’t have your amended return deposited electronically. That slows things down by a few days or a week, says Rigney. To file an amended return electronically, ask your tax software provider about its procedure for filing an amended return.

If you’re filing a paper amended return, fill out Form 1040-X and mark the calendar year that you’re amending at the top of the form. The form includes separate columns to report the original amount and changes you are making, and also submit any additional forms that are affected by the changes .

You can use the IRS’s Where’s My Amended Return? tool to check on the status of your amended return. You’ll need to provide your Social Security number, date of birth and ZIP code. The tool will let you know if the amended return has been received and is processing, or if the adjustment has been made , or has been completed. The tool generally updates daily.

It can take up to three weeks after mailing a paper amended return for it to show up in the IRS’s system, and can take up to 16 weeks to process. See IRS Topic No. 308 Amended Returns for more information.

You May Like: States That Are Tax Free

What Do I Attach To 1040x

When you file a 1040X tax form, you might wonder what to include in your amended return. What to include in your amended return

If You Must Amend Your Return

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

However, you dont have to amend a return because of math errors you made the IRS will correct those. You also usually wont have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed the IRS will normally request those forms from you.

Don’t Miss: Montgomery County Texas Tax Office

What If I Didn’t File My Return With Taxact

Anyone can file an amendment with TaxAct, even if they used a different provider or mailed in their original return. If you didnt file your original return with TaxAct, TaxAct wont have your original figures. You must re-create your original return as it was submitted to the IRS or state. Once your return looks like the original, you can begin the amendment process.

When To File An Amended Tax Return

There are times when you should amend your return and times when you shouldn’t. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.

You usually don’t need to file an amended return if you discover math or clerical errors on a recently filed tax return. The IRS will often correct those types of mistakes on its own and, if necessary, send you a bill for the additional tax due or a refund if the error was in your favor.

Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, it will be less likely that the IRS will get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return.

Just keep in mind that the IRS limits the amount of time you have to file an amended return to claim a refund to:

- Within three years from the original filing deadline, or

- Within two years of paying the tax due for that year, if that date is later.

If you’re outside of that window, you typically can’t claim a refund by amending your return.

You May Like: Do You Get State Or Federal Taxes Back First