Federal Income Tax Returns Were Due April 18 For Most Of Us But Some People Have Some Extra Time To File Are You One Of Them

Getty Images

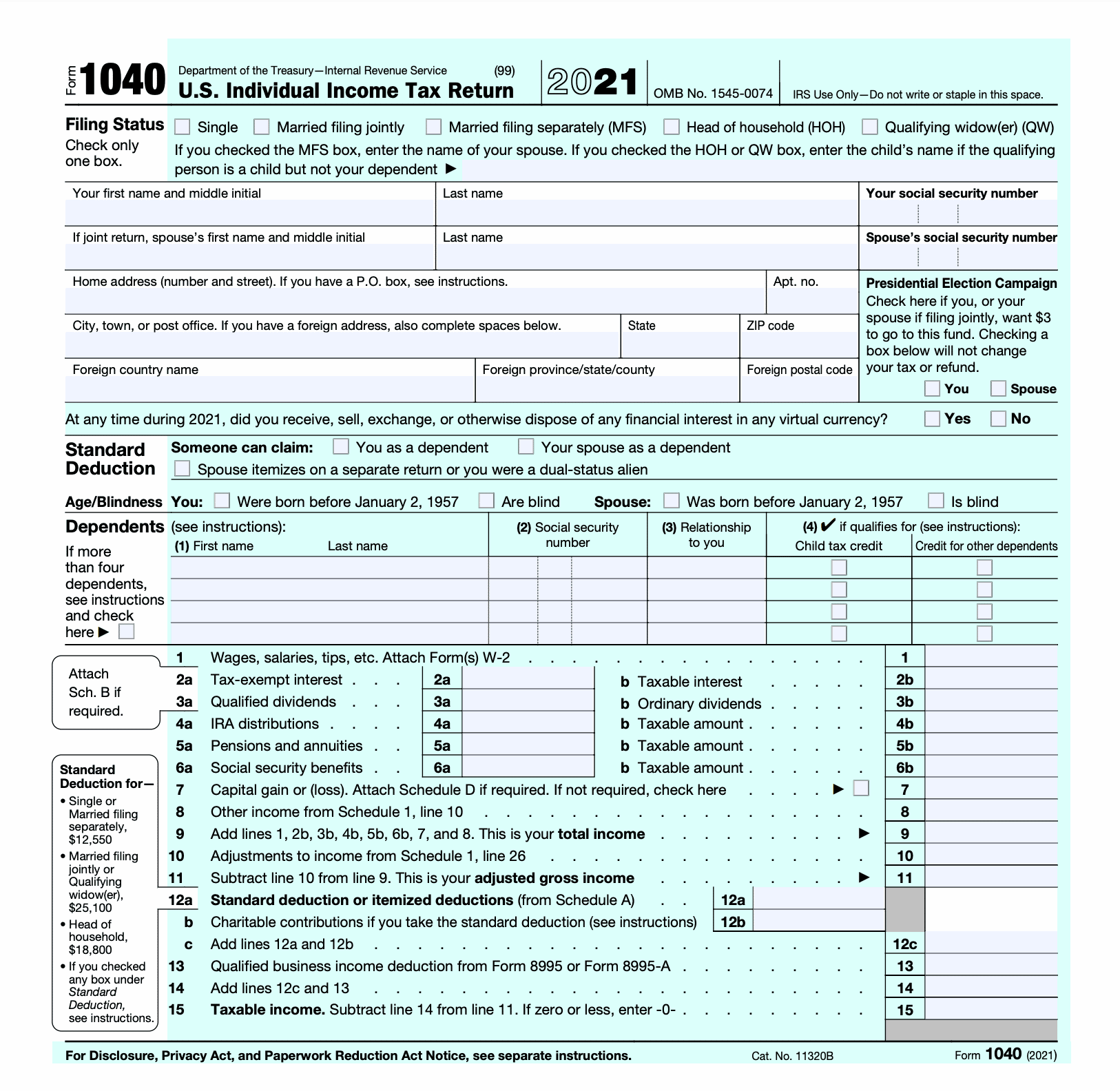

Most Americans had to file their federal tax return for the 2021 tax year by April 18, 2022. Note that we said most Americans. Taxpayers in two states had until April 19 to submit their 1040s to the IRS. Victims of certain natural disaster also get more time to file, with varying dates depending on when the disaster hit.

If for some reason you werent able to file your federal tax return on time, hopefully you requested an automatic six-month tax extension to October 17, 2022, by filing Form 4868 or making an electronic tax payment. To get the extension, you had to act by the original due date for your return, whether that was April 18, April 19, or some other date. Keep in mind, however, that an extension to file doesnt extend the time to pay your tax. If you didnt pay up by your original due date, youll owe interest on the unpaid tax and could be hit with additional penalties for filing and paying late.

Also note that special tax extension rules apply for Americans living abroad and people serving in a combat zone or contingency operation. As a result, they might have more time beyond April 18 to file their 2021 tax return and pay whatever tax they are expected to owe, and they could receive an extension past October 17.

What Are The 2022 Tax Brackets

The IRS released a new bracket to account for inflation, credits and deductions tax payers may be subject to while filing this year.

For individual filers:

-

37% for incomes greater than $539,900

-

35% for incomes over $215,950

-

32% for incomes over $170,050

-

24% for incomes over $89,075

-

22% for incomes over $41,775

-

12% for incomes over $10,275

-

10% for incomes $10,275 or less

For married couples filing jointly:

-

37% for incomes greater than $647,850

-

35% for incomes over $431,900

-

32% for incomes over $340,100

-

24% for incomes over $178,150

-

22% for incomes over $83,550

-

12% for incomes over $20,550

-

10% for incomes $20,550 or less

Amended Income Tax Returns

You can file an amended 2018, 2019, 2020 or 2021 income tax return as of February 21, 2022.

Important

For an income tax return for a year prior to 2018, the request for an adjustment must be made using form TP-1.R-V,Request for an Adjustment to an Income Tax Return, which you must send by mail.

End of note

Read Also: H& r Block Tax Refund Calculator

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

I Have Adhd Am I Eligible

The Canada Revenue Agency recognizes several types of disabilities. In order to be determined eligible, it will depend on the way in which the disability affects your daily life. Two main criteria need to be met. First, the disability must be prolonged for a period of at least 12 consecutive months and second, the disability must restrict at least one or more of the aspects of your day-to-day life.

Recommended Reading: Is Gym Membership Tax Deductible

You May Like: How To Pay Irs Online For 2021 Taxes

Will Tax Refunds Be Bigger In 2023

In November 2022, the IRS warned that tax refunds issued in 2023 may be smaller. This is because taxpayers won’t be receiving any Economic Impact Payments as they did in the past.

Taxpayers will also have to submit Form 1099-K for third-party transactions that exceed $600. In the past, 1099-Ks were only issued for transactions if the number of transactions exceeded 200 for the year and the aggregate amount of these transactions exceeded $20,000.

The IRS also stated that if a taxpayer doesnt itemize and take the standard deduction, they wont be allowed to deduct charitable contributions. This year, the IRS raised the standard deduction for all categories of taxpayers. They are as follows:

- Single or married filing separately, $12,950

- Head of household, $19,400

Irs Free File Is Now Closed

Check back January 2023 to prepare and file your federal taxes for free.

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Read Also: What State Has The Highest Property Tax

When Can I Expect My Refund

Once the IRS begins accepting returns, the agency says taxpayers who file electronically and are due a refund can expect it within 21 days — if they choose direct deposit and there are no issues with their return. By law, the agency cannot issue refunds involving the Earned Income Tax Credit or Additional Child Tax Credit before mid-February, in order to help prevent fraudulent refunds from being issued.

When Do I Get My Tax Refund

When will you get your tax refund fluctuates from year to year.

Generally, the IRS has said that about 90% of refunds are issued within 21 days of when the return was received.

You can check on the status of your refund on the IRS website or at our Wheres My Refund page. Live updates will appear the same day e-file opens. Using this tool, you can easily track the progress of your return as it is processed.

Read Also: How Much Can You Inherit Without Paying Taxes

The Due Date For Filing 2021 Tax Returns:

Getting the tax returns on time and within the deadline, is mandatory to prevent unwanted penalties from the IRS. For people who are entitled to get tax refunds, filing early can put a lot of money in their pockets faster. Though you are ready to file the tax returns right at the start of the year, you still have to wait for the right documents to be sent by the vendors and the employers, before starting the tax filing process. But the Internal Revenue Service will not start accepting the returns until late January.

The due date for filing 2021 tax returns is April 18th, 2022. The tax day is typically the 15th of April of each year. But this year, the taxpayers get additional three days, as April 15th is a Good Friday, followed by a weekend. You can also choose to electronically file your tax returns earlier. The IRS will begin accepting the electronic returns of the tax Forms between January 15th and February 1st, 2022.

How long does it take for the tax returns?

It can take less than 30 minutes to prepare the tax returns for the tax year 2021. The IRS will process most of the tax returns in less than 21 calendar days. Citizens who have filed an Earned Income Tax Credit or Additional Child Tax Credit will take longer to process the tax refunds. Choosing the method of tax filing will also depend on quickly the return process is accomplished by the IRS. Processing a tax return will delay, under the following circumstances

Information required to file IRS taxes:

Important Changes To The Auto

If you agree with the auto-assessment, after viewing your assessment, you do not need to do anything further, the return will be regarded as submitted and final.

If you are not in agreement with the assessment, you can access your tax return via eFiling or SARS MobiApp, complete the return, and file it. This must be done within 40 business days from the date that your assessment was issued to you.

You can view the auto-assessment by:

Also Check: What Does It Mean To Write Off Taxes

Tax Season Opens Soon

The IRS has announced that tax season will open Monday, January 24, 2022.

Some folks have suggested that a January start date is earlybut Im guessing they have a short memory. Its true that tax season opened a little later in 2021on February 12, 2021but thats an outlier due to the pandemic. The January 24, 2022, tax season open is on par with the open dates for the past few yearsJan. 27 in 2020, Jan. 28 in 2019, and Jan. 29 in 2018. In fact, other than last year, the agency has opened tax season in late January for more than a decade.

Read Also: Do You Pay Taxes On Inherited Money

California Postponed The 2020 Tax Year Filing And Payment Deadline For Individual Taxpayers To May 17 2021 Did California Also Postpone The Time For An Individual Taxpayer To File A Claim For Refund To May 17 2021 If That Period Expires On April 15 2021

Yes, if the statute of limitations to file a timely claim for refund normally expires on April 15, 2021, the FTB considered the claim timely if the individual taxpayer filed the claim on or before May 17, 2021. For purposes of claiming a refund within one year of an overpayment, the look-back period did consider payments made within one year of the actual expiration of the statute of limitations, but if that date expired on April 15, 2021, the FTB considered the claim for refund timely if the individual taxpayer filed the claim on or before May 17, 2021.

You May Like: How To Find Houses With Unpaid Taxes

Also Check: I Only Got Half Of My Tax Refund 2021

Getting The Child Tax Credit If You Havent Filed Tax Returns

Even if you do not normally file tax returns, you are still eligible to claim any Child Tax Credit benefits you are eligible for.If you did not file a tax return for 2019 or 2020, you likely did not receive monthly Child Tax Credit payments in 2021. This was because the government did not know how many qualifying children you have and how much money to send you per child.But you are still able to receive the full amount of the 2021 Child Tax Credit. To get assistance filing for the Child Tax Credit, .

Recommended Reading: How Do I Calculate Property Tax

How Can I Try E

@dano256 – given the backlogs, if you paper filed in April, chances are they have it but have not gotten to it yet.

There is NO WAY the rep could have looked for it as these returns are literally sitting in boxes waiting to be processed

The IRS states on their webstite that they have only completed processing returns that have no errors in them through March…..

Filed a Tax Return

We are opening mail within normal time frames, and weve processed all paper and electronic individual returns in the order received if they were received prior to April 2022 and the return had no errors or did not require further review.

“opening the mail” only means they are looking for the checks inside the envelopes! They are not processing the return upon receipt.

I’ll bet your return from April is nearing the top of the pile currently,

Also Check: Calculate Capital Gains Tax On Property Sale

Having Your Return Filed By An Accredited Person

You can have a person accredited by Revenu Québec file your return. Note that accredited persons who file more than 10 income tax returns are required to file them online.

Before having an accredited person file your return online, you must complete and sign two copies of the authorization form .You and the accredited person must each keep a copy of the form for a period of six years from the date on which the tax return was filed. Do not send us a copy unless we ask for it.

Its Never Too Late To Get Help

With nearly 60 years of experience preparing and filing all sorts of Canadian taxes, H& R Block has tax solutions that will fit your needs and gives you access to the largest network of reliable Tax Experts.

Although our offices are busier in April than in January, H& R Block Tax Experts are here for you all year round whether its your first time filing, if you need to catch up on returns from previous years, or anything else tax season sends your way. We can even review up to three of your past returns looking for money that others may have missed through our Free Second Look service. By filing with H& R Block, you can be sure youll get the most out of your return, with our Maximum Refund GuaranteeTM.

Read Also: How Much Tax Is Taken From My Check

Tax Day For Maine And Massachusetts Residents

Residents of Maine and Massachusetts got an extra day this year until April 19 to file their federal income tax return. Why? Because Patriots Day, an official holiday in Maine and Massachusetts that commemorates Revolutionary War battles, fell on April 18 this year. So, for the same reason Tax Day was moved from April 15 to April 18 for most people , the IRS couldnt set the tax filing and payment due date on April 18 for taxpayers in those two states. As a result, the deadline was moved to the next business day for Maine and Massachusetts residents, which was April 19.

Should I File My Taxes Early

If you have all your paperwork in order and you’re getting a refund, then it makes sense to file as soon as possible, said Joe Burhmann, senior financial planning consultant at eMoney Advisor. “From a planning perspective, the IRS likes that.” If you owe money, though, you might want to wait a bit.

“It gives you a bit more time to hold onto your money,” Burhmann said. “And it gives you time to figure out how to pay whether that means getting a loan, putting it on credit cards or something else.”

Even if you’re not filing immediately, you should prepare your taxes as soon as possible.

“Knowledge is always a good thing to have,” Burhmann said. “Make sure you’ve gotten your 1099 and know what you’re going to be dealing with.”

Don’t Miss: Short Term Capital Gains Taxes 2021

Filing Of Tax Return On Time

Individuals Tax Returns for 2021/22 have been issued on 1 June 2022. Taxpayers are required to complete and send the tax return back to the Inland Revenue Department within 1 month from the date of issue of the return . For sole-proprietors of unincorporated businesses, the deadline for submission is extended to 1 September 2022. An extension of 1 month will be given automatically if the return is filed electronically.

Filing your tax return on time, be a compliant taxpayer

If you file your Tax Return Individuals on time, the information provided in your tax return will assist the Assessor to prepare your assessment correctly and your claims for deductions for tax allowances, approved charitable donations and home loan interest etc. will be duly taken into account.

Taxpayers who have earned no income or of an amount below their allowance entitlements do not have to pay tax. Nonetheless, should they receive a tax return from the IRD, they are still required to complete and send it back to the IRD in time.

Consequences of NOT filing your tax return on time

Non-receipt of tax return

If you change your postal address, you are required to notify the IRD within 1 month.

How to complete the tax return If you have any enquiry concerning the completion of the Tax Return Individuals , you may call 187 8022 or see how to complete BIR60.

Read Also: How To File Ny State Taxes

When Can I File My Return

An important point to note is that while you can file your taxes anytime after the beginning of the year, the IRS will not process any returns until IRS e-File goes live. This includes returns filed via the main tax software providers or directly via the IRS website for lower income filers.

The IRS also reiterated that filing your taxes electronically is the most accurate way to file a tax return and the fastest way to get a refund. It is expected that more than over 80% of tax returns will be e-filed in the latest tax year.

Once your return is accepted the IRS processes your refund based on the IRS E-file Refund Cycle Chart. Exact refund dates are based on IRS processing times and can be found in IRS Publication 2043 and IRS Topic 152 for both e-filed and mailed returns.

After filing and assuming your tax return is on order you should receive your federal refund between 8 and 21 days. If you did not select the electronic deposit option, getting a paper check mailed to you adds about a week. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

Don’t Miss: Tax Deductible For Self Employed