Making Your Estimated Tax Payments

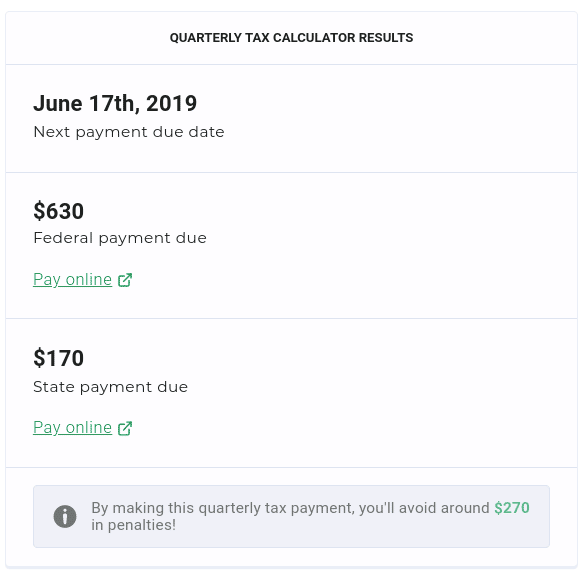

For both federal and California state taxes, you will need to make 4 quarterly payments. The due dates for both are the same, but the percentages due for each payment are different for the IRS and the FTB.

- For the period of Jan. 1 to March 31:

- For the period of April 1 to May 31:

- For the period of June 1 to Aug 31:

- For the period of Sept 1 to Dec 31:

How To Calculate Quarterly Tax Payments Step

The IRS has free resources to help you calculate your quarterly estimated tax payments. And if you use an accounting tool like QuickBooks Self-Employed, your tax payments are estimated automatically. But if you plan to take a DIY approach, or just want to understand how these payments are calculated, these are the steps you should take:

1. Start with your total expected income for the year. Apply any tax deductions to get your adjusted gross income.

2. Use Tax Rate Schedules provided by the IRS to determine your tax amount. Multiply your adjusted gross income by the applicable tax rate to find your estimated income tax owed.

3. Factor in any self-employment taxes to get your total estimated tax for the year.

4. Divide your total estimated tax by four to get your quarterly estimated tax payments.

Penalties Related To Estimated Taxes

If a taxpayer underpaid their taxes they may have to pay a penalty. This applies whether they paid through withholding or through estimated tax payments. A penalty may also apply for late estimated tax payments even if someone is due a refund when they file their tax return.

In general, taxpayers dont have to pay a penalty if they meet any of these conditions:

- They owe less than $1,000 in tax with their tax return.

- Throughout the year, they paid the smaller of these two amounts:

- at least 90 percent of the tax for the current year

- 100 percent of the tax shown on their tax return for the prior year this can increase to 110 percent based on adjusted gross income

To see if they owe a penalty, taxpayers should use Form 2210.

The IRS may waive the penalty if someone underpaid because of unusual circumstances and not willful neglect. Examples include:

- casualty, disaster or another unusual situation.

- an individual retired after reaching age 62 during a tax year when estimated tax payments applied.

- an individual became disabled during a tax year when estimated tax payments applied.

There are special rules for underpayment for farmers and fishermen. Publication 505 has more information.

Don’t Miss: How To Find Tax Rate

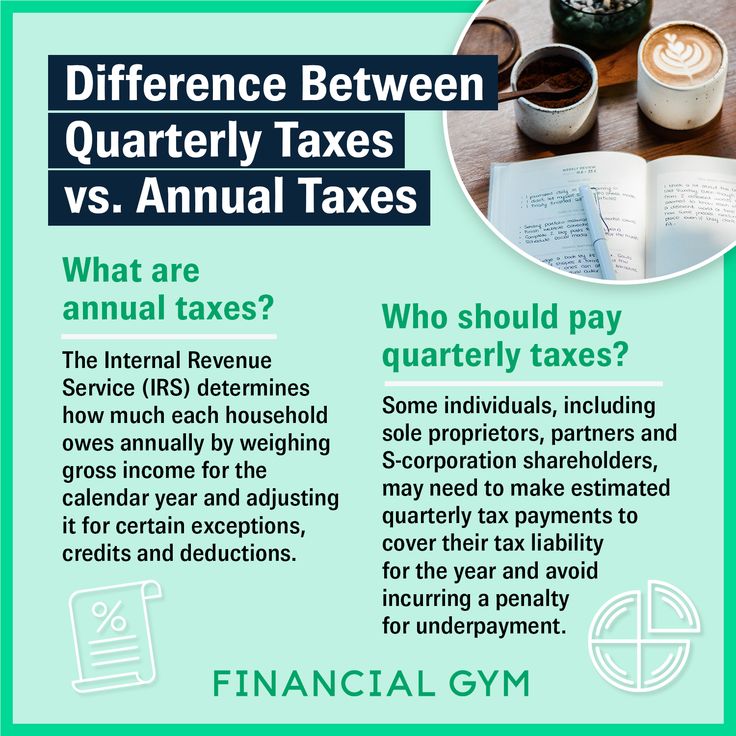

Basics Of Estimated Taxes For Individuals

FS-2019-6, April 2019

The U.S. tax system operates on a pay-as-you-go basis. This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated or additional tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty when they file.

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The number of people who paid this penalty jumped from 7.2 million in 2010 to 10 million in 2017, an increase of nearly 40 percent. The penalty amount varies but can be several hundred dollars.

The Tax Cuts and Jobs Act, enacted in December 2017, changed the way tax is calculated for most taxpayers, including those with substantial income not subject to withholding. As a result, many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system.

Requirement To Make Estimated Income Tax Payments

Taxpayers are generally required to pay at least 80% of their annual income tax liability before the year’s return is filed. This requirement is met through withholding and by making estimated tax payments on any income that is not subject to withholding.

Taxpayers who expect to owe more than $400 in Massachusetts tax on income not subject to withholding must pay estimated taxes. This requirement applies to individual residents and nonresidents, fiduciaries, clubs, or any other entity subject to taxation under G.L. c. 62.

Income from which taxpayers may not have had taxes withheld includes but is not limited to the following:

Salaries and wages from employment not subject to Massachusetts withholding Unemployment compensation Dividends and interest income Gains from the sale or exchange of capital assets Income from a trade, business, profession, partnership, or S corporation Income from an estate or trust Certain Lottery or gambling winnings Income from certain pensions or retirement savings plans Rental income andIllegal income.

Also Check: Do Retirees Need To File Taxes

How To Pay Estimated Taxes

Taxpayers can pay online, by phone or by mail. The Electronic Federal Tax Payment System and IRS Direct Pay are two easy ways to pay. Alternatively, taxpayers can schedule electronic funds withdrawal for up to four estimated tax payments at the time that they electronically file their Form 1040.

Taxpayers can make payments more often than quarterly. They just need to pay each periods total by the end of the quarter. Visit IRS.gov/payments for payment information.

What Are Estimated Taxes

Income unaffected by federal tax withholding throughout the year is still subject to other tax payments. These payments are kept track of and paid through estimated taxes, which must be paid as income is earned during the year.

However, taxpayers are sometimes able to get around making payments by having more taxes withheld from their paychecks. Penalties and interest generally apply for underpayments and late payments.

Examples of income not normally subject to tax withholding include:

- Unemployment compensation.

- Social Security benefits in some cases.

The IRS wants Americans to pay taxes as they earn money. Normally, penalties and interest apply for underpayments and late payments.

Because of the pandemic in 2020, some tax filing deadlines were relaxed and extended. Similarly, interest and penalties were waived and didnt begin accruing until mid-July.

Keep in mind that due to COVID-19 the 1040 returns for 2019 were moved from being due on April 15 to July 15, says Judy OConnor of accounting firm OConnor & Rodriguez, PA, in Miami Shores, Florida. And then due to COVID the first two quarterly payments for estimated taxes were moved from April 15 and June 15 to July 15.

But as of now, no changes are planned for the 2021 tax year due to the pandemic, she adds. But that could change. There is so much up in the air still with COVID-19, and there could be changes once again.

Read Also: Can I Use Bank Statements As Receipts For Taxes

If You Owe Taxes You Have Options

Its best for all taxpayers to file and pay their federal taxes on time. If you cant pay the full amount due at the time of filing, consider one of the payments agreements the IRS offers. These include:

- An agreement to pay within the next ten days.

- A short-term payment plan to pay within 11-120 days.

- An installment agreement, to pay the balance due in monthly payments.

Businesses owing $25,000 or less from the current and prior calendar year, who can pay what they owe within 24 monthly payments, can use the online application.

Read Also: What Does Tax Topic 152 Mean

How To File Quarterly Taxes: A Small Business Guide To Quarterly Estimated Tax Payments

Myranda Mondry,

When you think about tax time, you probably think about the whirlwind of tax forms that occurs between January 1 and April 15. But, in actuality, tax time comes four times a year.

The United States tax system is pay as you go, meaning you pay income taxes as you recieve income rather than all at once at the end of the year. These tax payments are broken up into four installments that occur once every three months called quarterly estimated tax payments. And if you expect to owe more than $1,000 in taxes at the end of the year, you need to make these payments.

But dont worry. More than likely, youve been making these quarterly payments all along and just didnt realize it. If you work for an employer and submit a W-4 form, your employer calculates your quarterly tax payments for you and automatically withholds them from your paycheck. However, for small business owners, the responsibility of calculating and paying quarterly estimated payments falls on you. And it all starts with determining how much youll owe in taxes by the end of the year.

Don’t Miss: What Is Fica Ee Tax

Do I Have To Pay Capital Gains Tax Immediately

Asked by: Mariano Harvey

You should generally pay the capital gains tax you expect to owe before the due date for payments that apply to the quarter of the sale. … Even if you are not required to make estimated tax payments, you may want to pay the capital gains tax shortly after the sale while you still have the profit in hand.

Dont Miss The Tax Day Deadline Stiff Penalties Await Those Who Dont File Their Return By Midnight Tonight

Happy Tax Day 2021! We normally celebrate Tax Day on April 15, but the IRS pushed the due date back to May 17 this year because of the COVID-19 pandemic. So, if you havent already filed your 2020 federal income tax return and paid any tax due, you have until midnight tonight to get it done.

But, of course, some people will miss the Tax Day deadline. And, as you might guess, the IRS doesnt take that lightly and will make you pay a price. If youre curious about what punishment the IRS is going to bring down on you, heres a glimpse of the interest and penalties you may face if you dont act before the tax deadline.

Read Also: How To File 2 Different State Taxes

You May Like: Walmart Tax Refund Advance 2022

Taxes : If You Got An Extension In May Your Taxes Are Due Today

The extension deadline for 2020 income taxes is Oct. 15. Heres everything you need to know.

In 2021, the IRS once again postponed the income tax due date. Last year, the deadline was extended to July 15 due to the pandemic this year, they were due back in May. If you requested and received an extension, however, your deadline is here: Friday, Oct. 15.

And this year, your return may be more complicated than usual, wrapped up in potentially thorny issues including unemployment insurance claims, stimulus check income and pandemic-driven changes in residence. Heres everything you need to know about filing your 2020 taxes.

Read Also: How To Calculate Paycheck After Taxes

Getting Underpayment Penalties Waived

People with fluctuating income aren’t the only taxpayers who can get out of quarterly tax penalties. As we mentioned earlier, you can also apply to waive the underpayment penalty you owe.

Many people are surprised to learn this, but the IRS is actually fairly lenient with penalties, especially if you can demonstrate youâre on top of estimated payments in the current year. In most cases, as long as you can prove that your underpayment was the result of a âreasonable causeâ â such as a family death or medical emergency â youâll probably get a pass.

What wonât be good enough is âwillful neglectâ â basically, intentionally ignoring the payment.

Who qualifies for a penalty waiver

The IRS is willing to waive underpayment penalties if you:

- Became disabled

- Can claim the First Time Penalty Abatement Waiver

A couple of these are worth unpacking some more.

First, note that there are special rules for people who were affected by a federally recognized disaster. If that applies to you, the IRS will give you a waiver automatically â no need to file any forms.

Second, the First Time Penalty Abatement policy is for people who are either filing taxes for the first time, or dealing with their first penalty after three years without any. Basically, itâs a policy of leniency for people who arenât very experienced with penalties.

Requesting a penalty waiver

To request your waiver, fill out Form 2210 and check the right box in Part II.

Justin W. Jones, EA, JD

Recommended Reading: Can I File Taxes Now

Extension Of Time To Pay

The IRS offers an extension of up to 120 days to pay your taxes.

Terms:

- Good for any amount due.

- You must agree to pay the full bill within 120 days.

Time to complete:

- If you request an extension using the IRS online payment agreement tool, it takes about 15 minutes.

- Requesting an extension by phone usually takes about an hour .

When it may take more time:If you have back tax returns, the IRS will need to process them before granting you an extension.

How To Get Out Of Tax Underpayment Penalties

âNo one likes dealing with underpayment penalties. But in some cases, they’re downright unfair.

Even the IRS recognizes this. That’s why they’ve come up with a couple of ways to get out of penalties.

The first is for self-employed people with highly variable income. The second is for taxpayers dealing with special circumstances that prevented them from paying on time.

Read Also: File My State Taxes For Free

How Do You Pay Quarterly Taxes

You have a few options for paying your quarterly taxes. They are as follows:

What Happens If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2021 tax year, theres typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2021 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Read Also: How Much Is Sales Tax In Ohio

You May Like: What Is Form 5498 For Taxes

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If youre one of them, you may not have the funds available to pay your tax bill by the deadline. But dont put off filing just because you cant afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Read Also: Minimum Income To File Taxes

How Is A Franchise Owner Taxed

Franchise taxes may be based on income or a flat amount, depending on the state and type of business. All businesses pay income taxes. but only corporations pay income taxes directly. These income taxes are based on the profit of the corporation.

When should I fill out form 100-es?

Use Form 100-ES, Corporation Estimated Tax, for the calendar year ending December 31, 2021, or fiscal years ending in 2022. Complete Form 100-ES using black or blue ink.

Do I Pay Capital Gains If I Reinvest The Proceeds From Sale

Taking sales proceeds and buying new stock typically doesn’t save you from taxes. … With some investments, you can reinvest proceeds to avoid capital gains, but for stock owned in regular taxable accounts, no such provision applies, and you’ll pay capital gains taxes according to how long you held your investment.

Also Check: Sales Tax Vs Use Tax

Myth : You Dont Owe Taxes On Side Hustles

This is an estimated quarterly taxes myth because the IRS requires you to pay taxes on all sources of income unless theyre specifically excluded. Earning money outside of a formal job where you receive a W-2 typically isnt one of those excluded income sources.

If you earn money from a side hustle or working as an independent contractor, you might need to pay quarterly estimated taxes on this income. This income should be reported to you on a Form 1099-NEC after the tax year. You will use this information to prepare your Form 1040 tax return. You need to prepare a Form W-9 to report your personal information to any company you performed services for or that you sold products for on their behalf.