Reminder Have You Renewed Your Access To Our Electronic Services

Thank you for using the Canada Revenue Agencys electronic services!

To maintain your access for the coming year, including receiving emails from the CRA, you must renew your participation online. This will allow you to use the following electronic services:

- Transmission web services for authorizing or cancelling a representative

- Auto-fill my return service

- Foreign reporting transmission web services, such as Forms T1134 and T1135

- Express Notice of assessment service

- AgriStability/AgriInvest Corporation forms transmission web service

- ReFILE service

- Email notifications from the CRA

The CRA conducts suitability screening each year before electronic filing applicants are permitted to electronically file income tax returns on behalf of their clients. This process may take up to 30 business days. If you failed to submit your renewal by or you do not pass the suitability screening process due to outstanding issues by, you may encounter an interruption in electronic services. Please submit your renewal as early as possible to avoid unnecessary delays.

As of January 28, 2022, at 11:59 p.m. Eastern Time, we will stop accepting T1 transmissions temporarily to convert our systems for the next filing season.

How to renew

Once you have successfully renewed your account, you must update your tax preparation software with your newly assigned password to ensure any future transmissions are successful.

IMPORTANT NOTES:

Have you lost your EFILE number or password?

Discounter information

The Canada Revenue Agency

We permit only approved participants to electronically file income tax returns.

Personal and financial information must be transmitted to us in an encrypted format. Encryption is a way of encoding information before it is transmitted over the Internet. This ensures that no unauthorized party can alter or view the data.

We also ensure that all personal and financial information is stored securely in our computers. We use state-of-the-art encryption technology and sophisticated security techniques to protect this site at all times.

We have made every possible effort to ensure the safety and integrity of transactions on our Web site. However, the Internet is a public network and, as a result, is outside our control.

Avoid Last Minute Delays At Tax Time By Using The Confirm My Representative Service

To save time this tax season, familiarize yourself with the new, two-step verification process for authorizing a representative using Represent a Client. Introduced in the Fall by the Canada Revenue Agency, this process makes it easier for clients to confirm who has access to their personal and tax information, helping them play an active role in protecting their information.

Whether your client is an individual or a business, they can now verify who has access to their personal and tax information by signing in to My Account or My Business Account, without waiting for a confirmation call from the CRA.

The process applies to all new authorization requests submitted through Represent a Client, including when you have a new client or when you are requesting a higher level of access to an existing clients information.

If you already have a clients authorization and do not need to change your level of access, you will not be affected.

How it works:

1. The first step is making sure your client has My Account or My Business Account. If they havent used the CRAs digital services before, they need to register for an account. We have created two step-by-step videos that walk through the process of registering. We encourage you to share these videos with your client.

Other options:

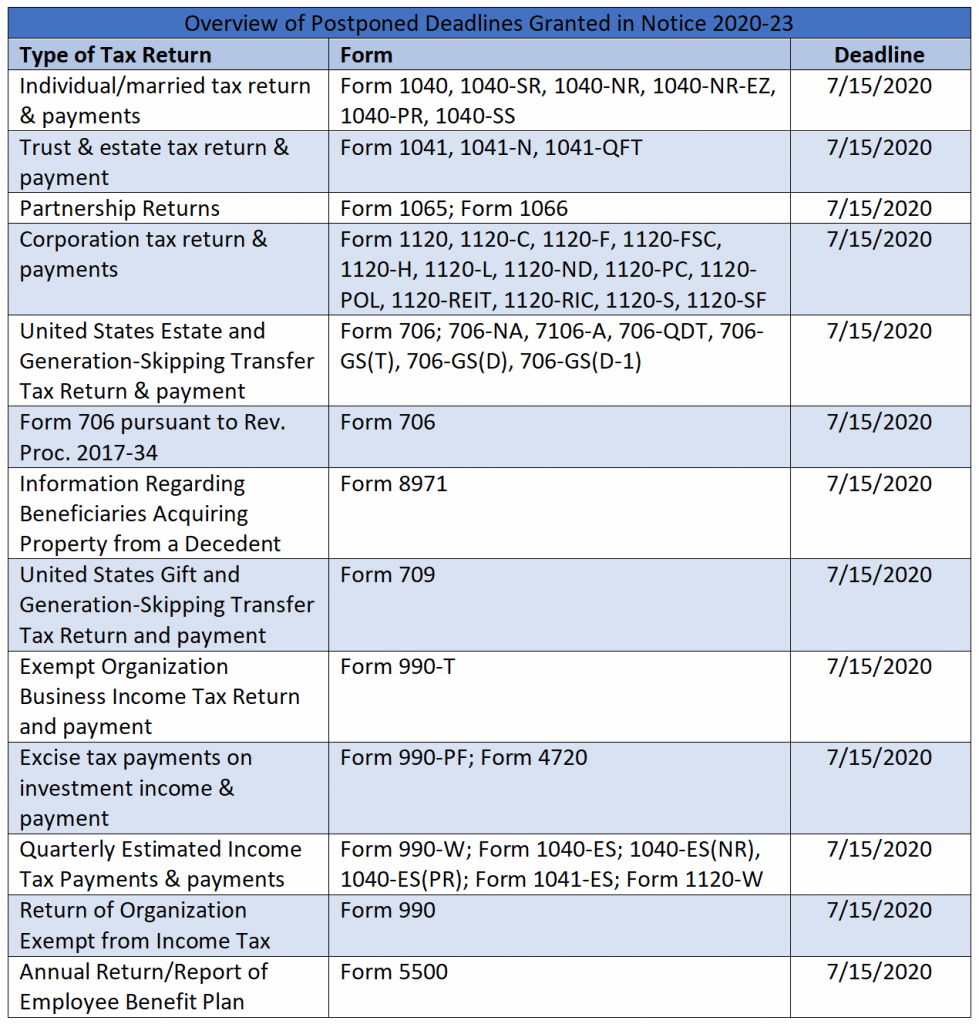

You May Like: Amended Tax Return Deadline 2020

Time Matters With Tax Refunds

May 17, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021.

If you miss the deadline, any excess in the amount of tax you paid every paycheck or sent as quarterly estimated payments in 2017 goes to the U.S. Treasury instead of to you. You also lose the opportunity to apply any refund dollars to another tax year in which you owe income tax.

Under certain conditions the IRS will withhold your refund check. It can be used to pay:

- past-due student loans,

- child support and

- federal tax debt you owe.

The IRS can also hold refund checks when the two subsequent annual returns are missing. That means you should file returns for 2018 and 2019 as soon as possible. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up missing out on a tax refund because you can no longer claim the lucrative tax credits or any excess withholding from your paycheck.

You May Like: Property Taxes In Austin Texas

Or You Can Use Independent Computer Software Products

You can file both your Maryland and federal tax returns online using approved software on your personal computer. To use this method, you’ll need to know the correct county abbreviation for the Maryland county in which you live. You may need to enter the correct subdivision code for the city in Maryland in which you live.

Annual Processing Review Program

We will be starting our annual post-assessment review of individual income tax and benefit returns shortly. If your client’s tax return has been selected for review, we will send our letters to your office if:

- you have been designated as your client’s representative and

- you have indicated that our Processing Review Program letters should be sent to you.

Electronic filers, who are representatives authorized by taxpayers to receive Canada Revenue Agency letters, can sign up for online mail to receive Processing Review letters for these taxpayers in Represent a Client. The electronic delivery of letters in Represent a Client gives authorized representatives quick and convenient online access to our letters.

You may receive letters from National Verification and Collections Centres other than those you have dealt with in the past. Please make sure to send the requested information to the centre indicated in our letter.

All centres will start sending letters on May 26th, 2022.

Read Also: Sale Of Second Home Tax Treatment

Filing Tax Returns For Your Canadian Clients Check The Boxes

Elections Canada encourages tax preparers to ask their clients who are Canadian citizens for their consent to check the boxes in the Elections Canada section of their return. By consenting, these clients will make sure that they are registered to vote at their current address. Sharing their name, address and date of birth with Elections Canada is the easiest way for Canadian citizens to make sure that their voter information stays up to date.

Young Canadian tax filers aged 14 to 17 may also consent to sharing their information with Elections Canada to be added to the Register of Future Electors. Once eligible future electors turn 18, their information will be added to the National Register of Electors.

Accurate lists of electors allow for better services to electors and contribute to electoral integrity. Elections Canada thanks you for your continued support during this tax season.

To learn more about the Elections Canada consent questions in the Canada Revenue Agencys T1 income tax guide, please visit elections.ca or call 1-800-463-6868 or 1-800-361-8935 .

Sent on behalf of Elections Canada

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

Recommended Reading: California Sales Tax By Zip Code

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Help Us Improve Our Process Of Recording Dates Of Death Correctly

Dates of death on tax returns

The Canada Revenue Agency noticed that tax preparers occasionally include a deceased persons date of death on the living spouses tax return. This may result in the CRA mistakenly recording the living spouse as deceased.

This error can cause major financial and emotional consequences since it can stop all benefit payments to the living person. The benefits that would significantly affect them are the Canada child benefit, goods and services tax credit / harmonized sales tax credit, the Canada Pension Plan and old age security. Other benefits may also be affected.

Therefore, please make sure you include the date of death information only on the deceased persons tax return.

Social insurance numbers on legal documents

If you are a representative settling a deceased persons estate, the deceaseds social insurance number must be provided with any request or document you are sending to the CRA. This will help ensure there are no delays in updating the appropriate records with the date of death information.

Thank you for your cooperation.

Don’t Miss: Do You Have To Pay Taxes On Inheritance

Is Your Efile Account Information Up

Keeping your EFILE account up-to-date is very important and updates should be made whenever changes occur. For example, has your mailing or email address, phone or fax number or contact information changed? Or have there been changes to the applicants registered on your EFILE account? If so, it would be a great time to update your account information now that the filing season is winding down.

Ensuring that updates are made each time a change occurs to your EFILE account may also expedite the suitability screening process when you renew your account in October for the next filing season!

Updating your account is easy. Follow the steps below:

- go to the Canada.ca/EFILE page and select EFILE Login

- enter your EFILE number and password

- select the Maintain account option

- review and update the information on all pages and

Although you can update most fields yourself, some will need to be changed by an EFILE Helpdesk officer. Refer to the Account maintenance web page for a complete list of what you can do by yourself and what you may need help with. For any fields you are unable to update, please call your designated EFILE Helpdesk.

Were here to help!

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

You May Like: Corporate Tax Rate In India

Mailing Address For Back Taxes

| Your residence |

|---|

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Alaska, California, Hawaii, Washington | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 7704

San Francisco, CA 94120-7704 || Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, Nevada, New Mexico, Oregon, North Dakota, South Dakota, Utah, Wyoming | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Connecticut, District of Columbia, Maryland, Rhode Island, West Virginia | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000 || Delaware, Maine, Massachusetts, New Hampshire, New York, Vermont | Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 37008

Hartford, CT 06176-7008 || Florida, Louisiana, Mississippi, Texas | Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Illinois, Michigan, Minnesota, Ohio, Wisconsin | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Pennsylvania | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

Interruption Of Services System Maintenance

Some Canada Revenue Agency systems will be undergoing annual maintenance. As a result, the following service interruptions will occur during the time frames noted below:

- The EFILE, ReFILE and T1135 web services will be unavailable from 11:59 p.m. on Friday, January 28, 2022, until 8:30 a.m. on Monday, February 21, 2022, .

- The Pre-authorized debit web service will be unavailable from 11:59 p.m. on Friday, January 28, 2022, until 6:00 a.m. on Monday, February 21, 2022, .

- The Auto-fill my return and Express NOA services will be unavailable from 11:00 p.m. on Friday, February 4, 2022, until 6:00 a.m. on Monday, February 7, 2022, .

- The EFILE online service “Transmission History” will be unavailable from 11:00 p.m. on Friday, February 4, 2022, until 8:30 a.m. on Monday, February 7, 2022, .

- The transmission web service for authorizing or cancelling a representative will be unavailable from 8:00 p.m. on Friday, February 4, 2022, until 6:00 a.m. on Monday, February 7, 2022, .

Note: There will be no interruption of service to the following EFILE online services: “Register for EFILE”, “Yearly renewal” and “Account maintenance”.

Also Check: Rv Sales Tax By State

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you dont enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- Thats no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesnt stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Dont think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Dont Miss: How To Buy Tax Forfeited Land

Individual Tax Forms And Instructions

Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year.

- Restart Safari, then try opening the .PDF in the Safari browser.

Tax Forms Containing 2-D Barcodes

Adobe Reader for Mobile

For information about Adobe Reader on mobile platforms, visit

General Instructions for downloading .PDF Files

The following instructions explain how to download a file from our Web site and view it using ADOBE Acrobat Reader.

Recommended Reading: How To File An Extension Taxes