What Should You Do If You Are Overwhelmed

As your company grows larger, the issues you face become increasingly complicated.

When you reach this stage, you must hand over control to the specialists so they can assist you in growing your online business while keeping your focus in your business growth only.

We here at Free cash flow, helping online businesses to boost their revenue and doing what other firms miss.

I know youre anxious about not receiving as much as you had hoped, but believe me when I tell you that we exceed your expectations.

Move your online business to the next step NOW and book a free consultaion call with Alan Chen, CEO of Free cash flow

$15 Billion In Unclaimed 2018 Refunds

The IRS estimates 1.5 million taxpayers did not file a 2018 tax return to claim tax refunds worth more than $1.5 billion. The three-year window of opportunity to claim a 2018 tax refund closes April 18, 2022, for most taxpayers. If they do not file a 2018 tax return by April 18, 2022, the money becomes the property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the 2018 tax return is postmarked by that date.

Can I File An Extension

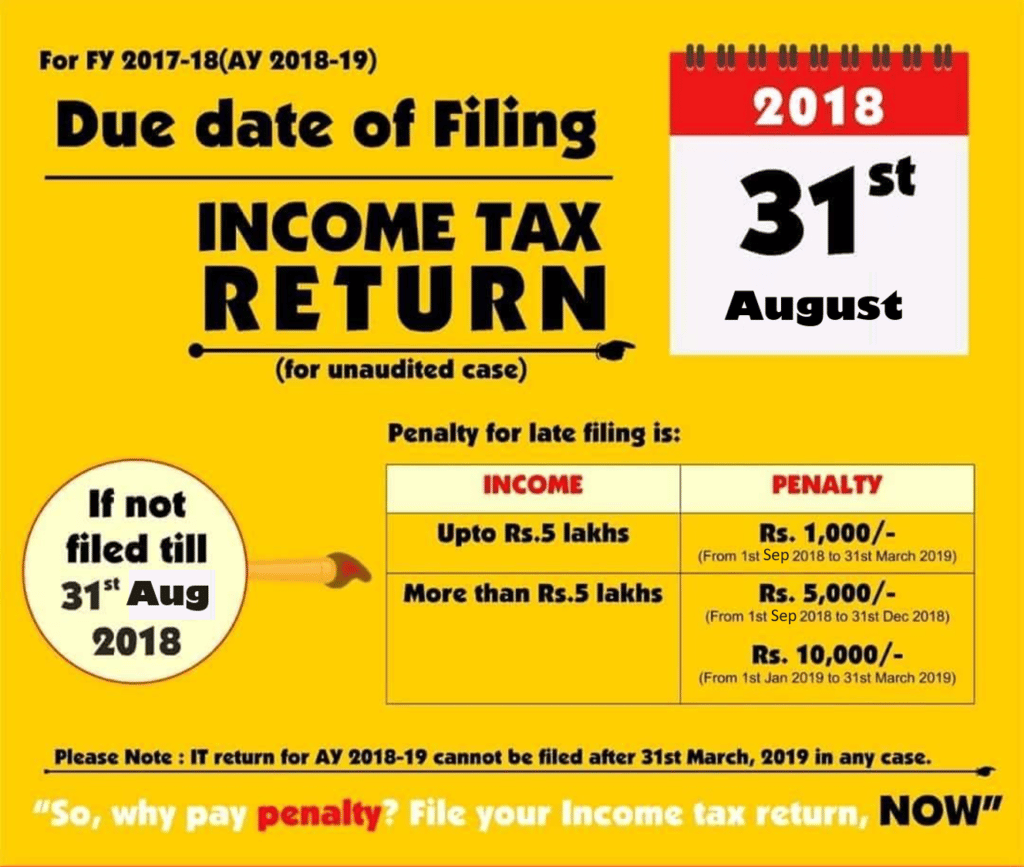

As in past years, you can request an extension if you need more time to prepare and file your 2021 return. Before the April 18, 2022, deadline, you must fill out and submit Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. At the time you file Form 4868, you must also pay the estimated income tax you owe to avoid penalties and interest, the IRS says.

Generally, taxpayers are granted an automatic six-month extension to file, or two months if theyre out of the country, in which case the extension also applies to payment of taxes owed.

To qualify for an extension, you must file Form 4868 before April 18, 2022. You will not be notified unless your request is denied.

Recommended Reading: G Wagon Tax Write Off

Not Ready For The April 18 Tax Deadline Here’s How To File An Extension

Being able to count the days left to file your taxes, on one hand, is far from comforting.

Crunch time only adds to your stress levels and the odds of making a mistake or missing out on a good tax break. Tax rules change constantly and most people couldn’t possibly keep up.

“It’s sort of like trying to fix your car once a year,” said Henry Grzes, lead manager for Tax Practice & Ethics with the American Institute of CPAs.

“It used to be back in the day you could change a spark plug, you could change an air filter. Not many people do that anymore because it’s just way too complicated.”

More people, no doubt, will be doing their own taxes in the days ahead than changing their spark plugs, thanks to tax software.

The Internal Revenue Service received nearly 42 million e-filed returns that were self-prepared through April 1 and 45.9 million returns filed by tax professionals.

The total returns that the IRS received hit nearly 91.3 million through April 1 down 2.1% from a year ago.

The average refund was $3,226 up 11.5% from the same time a year ago.

WHAT TO DO WITH YOUR TAX REFUND: Should you invest it?

Waiting until the last minute can create trouble whether you’re a do-it-yourself filer or one who pays a tax professional.

Either way, you need to take time to gather all the necessary paperwork, consider what has changed in your life that needs to be taken into account at tax time, and consider if, maybe, you need to file an extension.

Is There A Deduction For 529 Plan Payments For 2021

For tax year 2021, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per beneficiary If you are married filing separate returns, either you or your spouse may take the subtraction, or you may divide it between you, but the total subtraction taken by both of you cannot be more than $4,000 per beneficiary.

Don’t Miss: Where’s My Tax Refund Pa

Payroll Taxes For Household Employees

If you employ a nanny, babysitter, maid, gardener or other household worker, but you aren’t filing a federal income tax return , you must file Schedule H and pay 2021 employment taxes for your household workers by the end of the day today . If you do file a tax return, include Schedule H with the return and report the tax owed on Schedule 2 , Line 9.

Both you and the employee may owe social security and Medicare taxes. You’re responsible for payment of the employee’s share of the taxes as well as your own. You can either withhold your worker’s share from his or her wages or pay it out of your own pocket.

Your share is 7.65% of the employee’s wages . Your employee owes the same amount. The limit on wages subject to social security tax was $142,800 for 2021 , but there’s no limit on wages subject to the Medicare tax. Household employees also owe a 0.9% additional Medicare tax on wages exceeding $200,000 for the year. The additional tax is only imposed on the employee, but you have to withhold it from his or her wages and pay it to the IRS.

Claim For 2018 Tax Refund

According to the IRS, there’s almost $1.5 billion in unclaimed refunds from the 2018 tax year. That money belongs to about 1.5 million Americans who didn’t file a 2018 tax return, but who had taxes withheld or otherwise paid them during 2018. If some of that unclaimed cash is yours, you must act today to get what you’re owed.

To get the refund, you have to file a 2018 tax return with the IRS. If you don’t have/can’t get W-2, 1099, or other forms needed to complete the 2018 return, you can get a wage and income “transcript” from the IRS that includes the necessary data from information returns received by the IRS . This information can be used to file your 2018 tax return.

There’s a chance that you might not get all the refund money you’re expecting, though. For example, the IRS could take your 2018 refund to pay taxes you owe for other years or to pay off certain other debts. For more information on claiming a 2018 refund, see Claim Your 2018 Tax Refund Now Or Lose It Forever.

Also Check: Tax On Ira Withdrawal After 59 1/2

What If The Irs Owes Me A Refund

If it turns out the IRS owes you money, you’ll have to wait until after the IRS processes your tax return for the refund. So if you hold off until October 17 to file, you won’t get the refund until about three weeks after that date based on the IRS’ assessment that most taxpayers receive their refund within 21 days of filing.

This year’s average refund is more than $3,200, according to the latest IRS data.

If you believe the IRS owes you money, you don’t have to send in a check by April 18 to the IRS, of course. However, you should be confident that you are correct in your assessment, otherwise you’ll face penalties for failing to pay your debt to the IRS.

Estimated Tax Payment Deadlines For Us Citizens Overseas

If youre living outside the U.S. and usually owe U.S. taxes, you may need to make quarterly estimated tax payments to the IRS. An expat tax expert can help you figure those quarterly payments so you can avoid end-of-year penalties.

Quarterly Income and Expat Self Employment Tax Deadlines

| 1st installment quarterly income and self-employment taxes |

| 2nd installment quarterly income and self-employment taxes |

| 3rd installment quarterly income and self-employment taxes |

| 4th installment quarterly income and self-employment taxes |

Read Also: How Does The Electric Car Tax Credit Work

Tax Day Is April 18 Here Are A Few Do’s And Don’ts For Last

The clock is ticking as we approach the April 18 deadline to file tax returns.

The deadline to file taxes, which is usually April 15, was due to the Emancipation Holiday in the District of Columbia. By law, District of Columbia holidays impact tax deadlines for everyone the same way federal holidays do.

With the deadline nearing, weve compiled a list of dos and donts to help last-minute tax filers.

Do I Have To Enter My Driver’s License Or State

In an ongoing effort to protect taxpayers from identity theft, the IRS, state tax agencies and the tax industry are asking for drivers license numbers or state-issued identification numbers. Providing this information helps verify identity and can prevent unnecessary delays in tax return processing.

Recommended Reading: What State Has The Lowest Sales Tax

Dont Forget To Include An Important Document

Taxpayers who have worked multiple jobs throughout the past year may forget to report income from one of their jobs. To ensure this doesnt happen, taxpayers should double check that they have all documents relating to their taxable income on hand before filing their taxes.

W2s And 1099s Due By January 31

For business owners, another important deadline to remember is that forms W2 and 1099 must be filed by January 31, 2023.

-=====-

See an estimated chart of when taxpayers may anticipate their 2023 income tax refunds:

See more federal tax deadline dates at

Don’t Miss: How Do I File Back Taxes

Why Is The 2023 Tax Deadline April 18 Instead Of April 15

Because April 15, the standard deadline, falls on a Saturday in 2023. When the deadline falls on a weekend, the IRS moves the deadline to the next business day. However, that Monday, April 17, 2023, is Emancipation Day, a holiday recognized in Washington, D.C., where the IRS is headquartered. April 17 is also Patriots Day, a state holiday in Maine and Massachusetts.

As a result of all of this, the deadline for filing federal income tax returns , will be Tuesday, April 18, 2023, and most states usually follow the same calendar for state income tax returns.

In other words be ready to have your taxes filed by April 18. Depending on when a taxpayer files, they can often receive their tax refund payments within only 2-3 weeks.

Will the 2023 tax filing season be normal? It will likely be closer to normal than it has been since 2019, the last tax filing season before COVID caused widespread office closures, even at the IRS, which delayed the 2020 tax filing deadline by several months, and even the 2021 filing season. The pandemic also ushered in many tax credits and deductions for businesses, as well as stimulus payments for most Americans. These were also sometimes given as a credit on a taxpayers taxes, if they did not receive payment directly. Most individual and married tax filers will not have pandemic or stimulus-related issues on this years tax filings.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Read Also: H& r Block Tax Identity Shield

What Is This Year’s Filing Deadline

Typically, the tax filing deadline is April 15, but this year taxpayers have until April 18 to file because the 15th falls on Emancipation Day, which is observed as a holiday in Washington, D.C. As a result, IRS offices were closed on April 15.

Residents of Maine and Massachusetts get one extra day to file until April 19 because of those states’ recognition of Patriots Day on April 18.

Taxpayers who get an extension to file their taxes will have until October 17 to file their taxes. Typically, the extension gives people until October 15 to file their forms, but because that date falls on a Saturday, taxpayers have until the next business day, October 17, to file.

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2022.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people must also meet quarterly estimated tax filing deadlines. Small businesses must file their tax return either by March 15 or the 15th day of the third month following the close of their tax year, unless the date falls on a weekend or holiday or you file Form 7004 seeking an extension until September 15 . |

Read Also: Free Irs Approved Tax Preparation Courses

Us Tax Filing Deadlines And Important Dates In 2022

Are you a citizen of the United States or a Green Card Holder residing in Canada? Do you have an interest in the U.S. or foreign business entity? Are you a Canadian individual or a business owner with U.S. interests? Or maybe you are in charge of your business tax compliance? You should be aware of the important dates and deadlines of your income tax filing requirements.We designed this page to assist you or your qualified cross-border and U.S. tax advisor in determining U.S. tax filing deadlines that may apply to your case. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service is April 15 . However, an automatic extension to June 15 is granted to those U.S. citizens or residents whose tax home and abode, in real and substantial sense, is outside the United States and Puerto Rico. Further extensions may be requested by taking affirmative action and filing Form 4868 ), sending a letter with a relevant explanation to the IRS , and filing Form 2350 requirements extends the filing deadline to meet the FEIC requirements).

The extension of time to file ones tax return DOES NOT extend the time for making the tax payment. To avoid potential penalties and/or interest for late tax payment, please ensure that you either pay tax with a timely filed tax return or along with filing an extension to file the respective tax return.

Is There A Deduction For 529a Able Accounts For 2021

In addition to the allowable subtraction for contributions to a 529 College Savings Plan, certain individual taxpayers may also take a subtraction for contributions made during the taxable year to a 529A, Achieving a Better Life Experience Account , during the taxable year on behalf of the designated beneficiary to the extent that contributions were not deducted in computing federal adjusted gross income.

For tax year 2021, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per beneficiary If you are married filing separate returns, either you or your spouse may take the subtraction, or you may divide it between you, but the total subtraction taken by both of you cannot be more than $4,000 per beneficiary.

Recommended Reading: What Is The Federal Tax On Gasoline

When Can I Expect My Refund

If you file electronically and choose direct deposit, the IRS says you can expect your refund within 21 days, assuming there are no problems with your return.

The IRS has already processed more than 70 million returns for fiscal 2021 and issued nearly 52 million refunds. But the agency has also warned about delays in processing returns, especially as the 2022 tax season involved complications like stimulus payments and an expanded child tax credit.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement.

Experts agree direct deposit is the fastest way to get your refund from the IRS.

What If I Made A Mistake And Need To Re

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after youve already filed your original Form 1040. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Read Also: Can You File State Taxes Without Filing Federal