Is It Worth Paying Your Tax Using A Credit Card

Paying income tax with a Credit Card is considered an effective method to discourage cash transactions, which is one of the main reasons why people avoid paying taxes. It also helps avoid instances of counterfeit currency. Read on further to know whether it is worth paying tax using a Credit Card.

The Government of India allows payment of income tax through . It is an attempt to discourage the flow of black money and encourage non-cash transactions in the country. It is much simpler to pay income tax using a Credit Card, as it is quick and convenient. in fact, you can avail a host of tax benefits using this payment method. Paying income tax with a Credit Card boosts the speed of the transaction. As our country still has to deal with instances of counterfeit currency, tax payment through a Credit Card is the Governments attempt to reduce such illegal situations.

Charge Taxes To Help Earn A Big Introductory Offer

Many rewards credit cards offer sign-up or welcome bonuses, where you can collect a giant stash of rewards for spending a certain amount within a relatively short period of time. The biggest bonuses are often tied to bigger spending requirements.

You might find a card offering 100,000 points, but itll also require you to spend $10,000 within a few months. That might not be realistic for your normal spending, but could be attainable in the month youre paying taxes.

Here are this months best credit card sign-up bonuses. And if its travel rewards youre specifically seeking, here are the best travel credit card welcome bonus offers right now.

When Should You Pay Taxes With A Credit Card For Points

If you cant pay your credit card balance in full and on time, paying taxes with a credit card usually does not make sense. Youll pay interest that will negate any rewards you earn, on top of the payment processing fee.

However, its a good strategy to use a credit card in some situations. For example, if you:

- Want a fast and convenient way to meet minimum spending requirements for a new card welcome bonus

- Need to meet a spending threshold to earn elite status, elite qualifying miles or other big spender perks like free hotel night certificates

- Can earn more miles and points than the fees youll pay with certain rewards credit cards cards

But if you have certain cards or card combinations, you can actually earn travel rewards from your tax payments that can be worth double what you pay in fees.

Read Also: States With No Estate Tax

The Best Credit Cards For Paying Your Taxes

- Ink Business Unlimited Credit Card: Best for businesses with an Ultimate Rewards-earning card.

- Discover it® Miles: Best for cash back during the first year.

- Capital One Spark Miles for Business: Best business card for straightforward rewards.

The information on the Discover it Miles has been collected independently by The Points Guy. The card details on this page have not been reviewed or approved by the issuer.

Heres what you need to know about paying your taxes in 2022 with a credit card.

When Not To Pay Taxes With A Credit Card

If you can’t pay off your balance in full every month, you should avoid paying your taxes with your credit card. With average credit card interest rates around 15%, it is better to set up a payment plan with the IRS than pay huge interest charges from your credit card . Interest rates associated with an IRS payment plan will be around 5% or so.

The first question CPA and author Michele Cagan would ask someone who wants to pay taxes with a credit card is why they want to do that. “Look into a payment plan instead because you’ll probably pay less in interest and fees,” she says. Cagan also notes that even with IRS penalties for not paying your taxes on time in full, “it still comes out to less than letting the balance to ride on a credit card.”

If one of your credit cards is offering an introductory 0% APR, it might be tempting to use one of these offers to spread out tax payments without incurring big interest charges.”If you know you could pay it within three months but you can’t pay it now,” Cagan says, paying with a zero interest credit card might give you a net savings. “The credit card fee is based on the amount of your tax bill, so you have to weigh the amount of the fee against everything else,” she adds.

Recommended Reading: Irs Mail Address Tax Return

Can You Pay Taxes With A Credit Card

Yes, you can pay taxes with a credit card, but the real question is, should you?

Unlike paying your taxes with a bank account transfer, credit card payments aren’t free. You’ll wind up incurring a fee that’s a percentage of your tax payment. The fee you’re charged varies by the payment processor you choose.

Chase Sapphire Preferred Card

While youll only earn 1 point per dollar spent when paying your taxes with the Chase Sapphire Preferred, this popular card makes the cut because of its long-term value and .

Youll earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The sign-up bonus alone is worth a $1,200 return in travel rewards, per TPGs most recent point valuations.

Related: Chase Sapphire Preferred card review

Read Also: Capital Gains Tax On Primary Residence

Can I Pay My Income Taxes Due With A Credit Card

If you file and have a balance due, the amount owed can be charged to your American Express, Visa, Discover/Novus, or MasterCard by using ACI Payments, Inc. or Value Payment Systems.

Value Payment Systems does not accept American Express but has a program called BillMeLater. You can pay by calling 1-800-2PAY-TAX , Alabama´s Jurisdiction Code is 1100).

You can also pay over the Internet by visiting ACI Payments, Inc. or Value Payment Systems. There is a convenience fee for this service. The fee is based on the amount of your tax payment and is paid directly to ACI Payments, Inc. or Value Payment Systems.

You may also make a credit card payment by calling the Alabama Department of Revenue at 353-8096.

Do not include Form 40V with your return when you pay your taxes by credit card.

If you file and have a balance due, the amount owed can be charged to your American Express, Visa, Discover/Novus, or MasterCard by using ACI Payments, Inc. or Value Payment Systems.

Value Payment Systems does not accept American Express but has a program called BillMeLater. You can pay by calling 1-800-2PAY-TAX , Alabama´s Jurisdiction Code is 1100).

You can also pay over the Internet by visiting ACI Payments, Inc. or Value Payment Systems. There is a convenience fee for this service. The fee is based on the amount of your tax payment and is paid directly to ACI Payments, Inc. or Value Payment Systems.

You may also make a credit card payment by calling the Alabama Department of Revenue at 353-8096.

Paying Taxes With A Credit Card Means Paying Fees

The many ways to pay your taxes to the Internal Revenue Service include check, an ACH debit, wire transfer, cash payments, installment payments and yes, even credit cards.

To make an IRS payment with a credit card, youll have to use one of the IRSs three independent payment processors. Those processors charge your card, then send the money to the IRS. But these payment processors charge fees, which start at either $2.20 or 1.87% of your overall bill, whichever is higher. Here are the processors and their fees for 2022:

|

ACI Payments, Inc. |

|||

|---|---|---|---|

|

Fee as a % of total bill |

1.98%. |

||

|

Processing fees on a $500 tax bill |

$9.90. |

||

|

Processing fees on a $5,000 tax bill |

$99. |

||

|

Processing fees on a $20,000 tax bill |

$396. |

$374. |

$392. |

If you file and pay using tax software such as TurboTax, your fees might be even higher. TurboTax, for example, charges a 2.49% credit card convenience fee if you pay income tax via credit card through its website. You can file through TurboTax and pay taxes separately through one of the above payment processors .

Given the fees, in many cases it’s simply not worth it to pay taxes with a credit card. If your card earns less than 1.87% back on the transaction, you’ll lose ground even after collecting your rewards.

Look beyond those basic spending rewards, though, and you may find an opportunity to rack up some major miles, points or cash.

Recommended Reading: Taxes On Self Employment Calculator

Pros And Cons Of Using A Credit Card For Paying Taxes

You can pay your taxes for free by check or by making an ACH transfer is free, so you have less expensive options available. The other potential downfall to using a credit card for paying taxes is the interest you may owe interest if you dont pay your card in full.

That said, there are a few times when using a credit card might be a good idea:

- When your return more than the transaction costs

- If it can help you avoid paying IRS late fees and penalties

- You need the cash flow for your personal or business finances

- You can pay the credit card in full, or in a reasonable amount of time

- When your interest rate is minimal or zero

- When you can transfer the balance to a balance transfer credit card for a 0% interest rate.

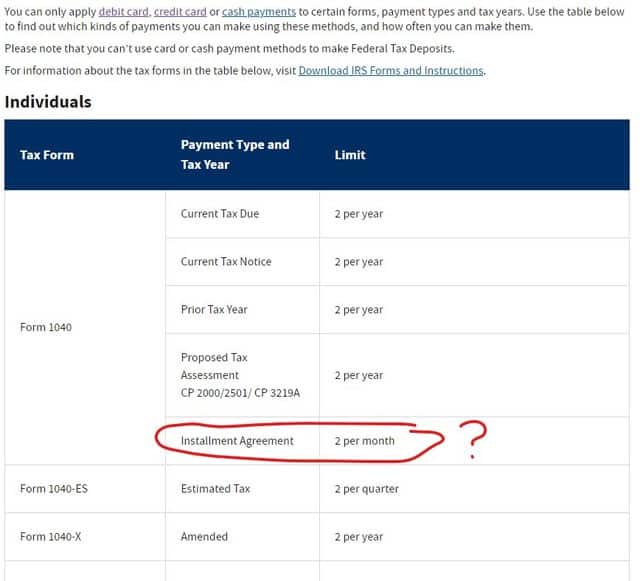

Can I Pay My Taxes In Installments

Yes, it is possible to request an installment agreement through the IRS if you believe you will be unable to pay your taxes in full by the required deadline. This is a payment plan approved by the IRS that allows for either short term or long term installments to be paid. It is important to remember that the longer a payment plan, the more you may incur in interest and late payment penalty fees.

You can also pay your taxes throughout the year ahead of time by making estimated tax paymentswhich are required for the self-employed. If you have trouble setting away money throughout the year to pay at tax time, consider making regular payments each quarter instead.

Read Also: Tax Penalty For Selling House Before 2 Years

Use Multiple Cards To Maximize Earnings

If you have a large tax bill, you dont have to spend the entire amount all on one credit card, either.

The IRS page explaining credit card payments says you can only use debit or credit cards to make up to two payments per tax period , but that means you could use two different cards to make two different payments.

For example, say that you have a $30,000 tax payment due. You could apply for both The Business Platinum Card from American Express and the Ink Business Preferred Credit Card. By putting $15,000 on the Amex Business Platinum Card, youd have spent enough to earn the 120,000-point introductory offer. Plus, since the purchase is more than $5,000, you could earn 1.5 points per dollar , which means youd earn 22,500 points on the purchase itself. Then, you could charge the additional $15,000 balance due on the Ink Business Preferred to earn its 100,000-point sign-up bonus and earn an additional 15,000 points for the spending itself .

All told, youd end up with more than $4,400 in travel rewards, according to TPG’s valuations.

Avoid Interest For A Year Or Longer

For those looking to secure a short-term loan without paying interest, paying taxes with a credit card can make sense. Just remember that a fee applies any time someone pays taxes with a credit cardand that introductory 0% APR offers dont last forever.

Imagine receiving a $7,000 federal tax bill, but not having enough cash in the bank to cover it. In this case, it may be advantageous to apply for a card like the Chase Freedom Unlimited® which grants cardholders a 0% introductory APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.74% – 27.49% applies. An intro transfer fee of either $5 or 3% of the amount of each transfer, whichever is greater, applies in the first 60 days of account opening. After that, a fee of either $5 or 5% of the amount of each transfer applies.

At the moment, this card is offering the ability to earn a welcome bonus 1.5% cash back bonus on everything bought in the first year as a cardholder on up to $20,000 in spending – that’s worth up to $300 cash back in the first year. Cardholders will also earn rewards: 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on eligible dining and drugstores and 1.5% on all other purchases.

As with any 0% APR strategy, stay mindful and avoid being seduced by a false sense of security. When the 0% APR period ends, the interest charges will start racking up quickly.

Don’t Miss: Tax Credit For Electric Vehicle

You Can Pay Taxes With Your Credit Card But Should You

Weve gone through the how but before paying taxes on a credit card, its important to focus on the why. Here are some points to help you consider whether paying taxes on a credit card makes any sense for you:

- Do you need more time to pay your taxes? If you do, the answer may be yes no matter what other considerations come into play. This is especially true if you have a 0% APR offer that you can utilize to buy some extra time. The fee you pay for using plastic payment may seem tiny compared to a tax penalty or a high interest rate.

- What rewards will you receive? If you have a card paying a 2% or more in rewards, you will at least break even with most of the services that handle credit card payments. Even if the amount of rewards earned over the fee isnt notable, you may enjoy the additional convenience.

- Do you have a large minimum spend requirement to meet to earn a welcome bonus? If you have a card that has a large spending requirement, it might be worth knocking out a large amount of that spending in one go, even if there are fees involved. Missing out on the welcome bonus will cost you much more than the fees charged.

- Are there any other spending-based cardholder perks that you are close to earning? If yes, this is an easy way to tip yourself over the edge.

Interest Charges On Unpaid Balances

If you use a credit card to pay taxes, it’s key to pay your balance in full by the due date to avoid interest charges. Otherwise, you can risk debt and high interest charges if you only make the minimum payment and carry a balance month-to-month.

For example, if you charge $1,000 in taxes to a credit card with the average 16.88% APR and only make minimum $35 payments, it’d take you roughly 37 months to pay it off and cost you $287 in interest charges. And if you pay with a credit card, you won’t be able to take advantage of any payment plans offered by the IRS.

Recommended Reading: Do I Pay Taxes On Social Security

Hit Spending Thresholds On Existing Cards For More Rewards

Earning 2% cash back when youre paying a 1.87% credit card processing fee isnt exactly going to make you rich. But heres a potentially lucrative option: Use this chunk of spending as a way to claim other benefits.

For example, many hotel cards offer free night certificates if you spend a hefty sum on them. Some Hilton cards offer free night certificates that can be redeemed for hotel night stays worth over $1,000, but they require you to charge thousands of dollars in a calendar year to the card.

Say you owe $15,000 in taxes and would owe $280.50 in Pay1040 fees. But if you charge it to the right Hilton credit card, you could walk away with a free night certificate and redeem it for a room at Hawaiis opulent Grand Wailea Resort, which otherwise typically costs between $1,200 and $2,000 per night.

Meanwhile, many airline credit cards allow you to spend your way to elite status. For example, JetBlues credit card offers automatic JetBlue Mosaic status if you spend $50,000 in a calendar year. Thats an unrealistic amount for most household budgets, but might be feasible if you have a large tax bill this year.

Say you charge $20,000 in taxes to the card and spend around $2,500 monthly on the card for a year. Your tax bill would incur close to $400 in processing fees, but the payoff to earn elite status benefits could be worth five times that.

Reasons To Pay Your Taxes With A Credit Card

Before deciding whether or not to pay taxes with a credit card, think about specific reasons it makes sense for you to do so or not. Having a reason or incentive to pay taxes with a credit card is a mustwithout one, the processing fee unnecessarily adds to your annual tax costs. If this is the case, write a check instead.

If you are weighing your options and believe you may be eligible to benefit from this method, here are some of the most common incentives for paying taxes with a credit card:

Recommended Reading: C Corp Tax Rates 2021

The Best Credit Cards For Paying Your Taxes In 2022

The best credit card to use when you pay your taxes depends a lot on what you hope to accomplish. Do you want to eke out a very small percentage in rewards, or do you hope to use your tax bill to earn a big bonus? Maybe you want to access an introductory 0% APR so you can pay off the balance over time. For each of these scenarios, here are our top picks for paying your taxes with a credit card: