Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Out-of-state property transactions can be extra challenging at the best of times. Not only are you not there in person to handle the negotiations, but you may have to deal with different laws that apply to specific regions. Even after your buyer closes on the sale of the property, you could have additional challenges at the start of tax season.

Should you consider the impact of capital gains tax on property sold out of state? Who has to pay this tax and why? Learn more about capital gains and whether this tax will apply to your home sale.

Dont Fret Too Soon About This As There Are Exemptions

For single taxpayers, the exemption is $250,000. Married taxpayers have double the exemption amount for a $500,000 exemption.

This means that if you bought a home for $300,000 and sold it for$900,000, you would have a capital gain of $600,000. But if youre married,your exemption is for $500,000 of that amount, so you would have a capital gainof $100,000 that you would need to pay taxes on.

There are a few things that can disqualify you from the capital gains exemption. For example, if the house wasnt your primary residence. If this is an investment property or a second home, you wont qualify for the exemption from the capital gains tax.

Other things that might disqualify you from the exemption:

- In the five years before you sold the property,you didnt live in it for at least two of those years. If you are in themilitary, disabled, or in the intelligence community, then this rule doesntaffect you. You still qualify for the exemption.

- You owned the house for less than two years.

- You are paying expatriate tax.

- You bought the house through a 1031 exchange inthe past five years.

Do You Really Need A Real Estate Agency To Help Sell Your Home

Already overwhelmed by the paperwork?

It can be tempting to enlist the help of real estate agents and expensive lawyers to take care of all the complex tax business for you, so you just have to sign on the dotted line and pay closing costs as instructed.

But if youre looking to sell as quickly as possible and without any of the headaches of listing your property, finding the right agent, and negotiating who will pay for what, theres no better option than getting in touch with a buyer who understands your troubles!

We buy houses in any condition in Southern California, fast and for cash, requiring only one quick viewing before making you an obligation-free offer.

We will also take care of all closing costs, so you dont have to pay taxes for the transfer of the property and walk away with cash in hand in a matter of weeks.

Get in touch today to sell your California home the easy way!

Read Also: Income Tax By State Ranked

Capital Gains Tax Basics

Many people know the basics of the capital gains tax. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15% or 20%, plus a 3.8% investment tax for people with higher incomes. Compare this with gains on the sale of personal or investment property held for one year or less, which are taxed at ordinary income rates up to 37%. But there are lots of exceptions to these general rules, with some major carveouts applying to residential real estate.

How To Avoid Capital Gains Tax On Real Estate

Appreciation of real estate is a great thing, depending on how you look at it. However, as a seller, that could translate to thousands, or even hundreds of thousands, of dollars in taxes after a home sale.

Fortunately, there are a few things homeowners and investors can do to offset their capital gains tax on real estate:

Offset Gains With Losses

Convert Rental Property To Primary Residence

You May Like: Your Tax Return Is Still Being Processed 2022

How To Report Your Home Sale In California For Capital Gains Taxes

When reporting the capital gain on the sale of your residential house, you need to fulfill the federal tax reporting requirements. And in California, you also need to file a California Capital Gain or Loss Schedule D 540 form package if your home sale created a gain for you above the $250,000 or $500,000 exclusion limits.

Transfer Taxes Exist Too

In case you thought your only tax debts for your house sale are to the state and to the Federal Government, we have a surprise for you there are also transfer taxes that you might need to pay at the county or city level for a home sale.

For example, the California cities of Los Angeles, San Francisco and Riverside all collect their own transfer taxes on home sales. You should check with your city or county tax offices to see what these transfer tax amounts are and how they apply.

Typically, transfer tax payments can be negotiated between you they buyer and your seller. In some parts of California, its more traditional for the buyer to pay them while in other parts of the state, the seller should cover this tax. If youre using a real estate or listing agent for your home sale, you can ask them what the general rule in your area is.

You May Like: Filing Taxes With No Income

How Much Is A Capital Gains Tax On Real Estate

Now that we understand what capital gains tax is, lets explore how much capital gains taxes typically are so that taxpayers can properly anticipate any payments that will need to be made. The tax rate for these capital gains isnt an umbrella percentage but is based on numerous factors that affect the percentage of taxable gain. Within the context of real estate, if you were to sell a property, the capital gains tax you would owe depends on three main factors:

-

Duration of time in which the property was owned

-

The cost of owning the property, including any fees paid

-

Income tax bracket

-

Tax filing status

According to Nate Tsang, the Founder and CEO of Wall Street Zen, tax on a long-term capital gain in 2021 is 0%, 15%, or 20% based on the investors taxable income and filing status, excluding any state or local taxes on capital gains. On the other hand, short-term gains are taxed on ordinary income rates and can go as high as 34%, depending on the income level. This is why it is advisable to hold an investment longer than a year so that you can take advantage of lower long-term capital gains tax rates. Well explore short-term and long-term capital gains tax rates a bit further later on in the article.

Ca Capital Gains Rate Vs Previous Years

Since California taxes capital gains as regular income, the tax rates themselves don’t change much. Instead, the criteria that dictates how much tax you pay has changed over the years. For example, in both 2018 and 2022, long-term capital gains of $100,000 had a tax rate of 9.3% but the total income maxed out for this rate at $268,749 in 2018 and increased to $312,686 in 2022.

CA vs. Other Large U.S. States

Now let’s compare the California capital gains tax to the capital gains tax rate of other large states:

- Texas: no state capital gains tax

- New York: 12.70%

- Florida: between 0% and 20%.

It’s important to note that the federal capital gains tax rates are the same in all states.

While California capital gains tax might be easier to understand because it is taxed as regular income, it’s worse on your wallet than other states. In fact, it can be quite expensive for some to pay capital gains on their many investments when compared to a state like Texas.

Also Check: Does Texas Have State Income Taxes

What To Know About Federal And Other Tax Obligations On A Home Sale

As we mentioned above, federal tax exemptions and taxes on home sales apply in California too. These are the same as the state tax exemptions but the IRS offers its own special forms for declaring a house sale capital gains tax. These are called Capital Gains and Losses Schedule D and include IRS forms 1040 and 1040-D.

Remember that you dont have to report the sale of your house or your capital gains on it if any of these conditions is the case:

- The gain you made from your home sale was less than $250,000 for you individually or less than $500,000 for you with a formal partner who filed jointly with you on your last tax return.

- Youve occupied your house for 2 of the last 5 years and neither you nor your partner has used an exclusion in the last two years.

- The IRS hasnt issued you with Form 1099-S for reporting proceeds from real estate transactions.

Also remember that capital gains tax exemptions DONT apply to investment properties that you cant prove to have not occupied or which arent your primary home. Houses in California that you bought only as investment properties wont be covered by IRS or DTB exemption amounts.

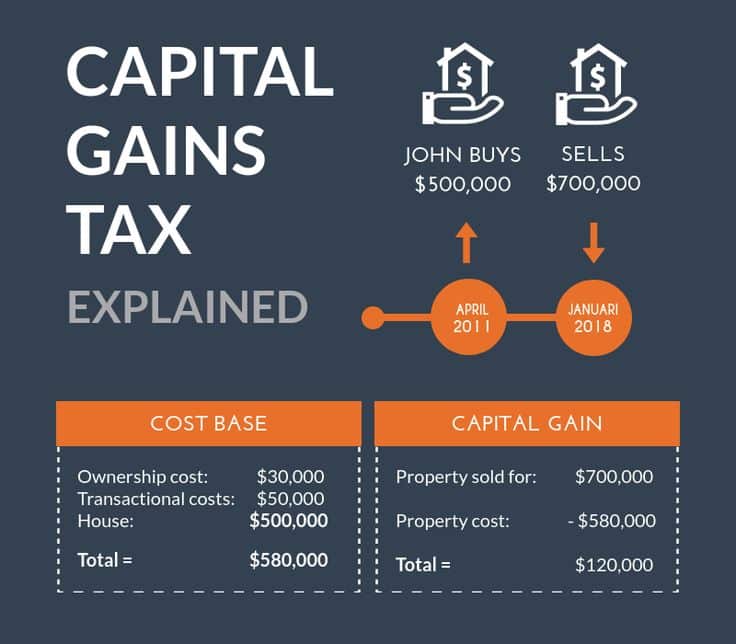

How To Calculate Capital Gains Tax

At a Glance:

The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

When you sell capital assets like mutual funds or stocks theres a tax implication. But knowing what tax rate applies depends on several factors. In this post, well outline capital gains taxes and how to calculate them.

Recommended Reading: How Can I Get My Tax Transcript Online Immediately

Read Also: Morgan Stanley Tax Documents 2021

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. So if you have sold or are selling a house, what does this mean for you?

If you sell your home for more than what you paid for it, thats good news. The downside, however, is that you probably have a capital gain. And you may have to pay taxes on your capital gain in the form of capital gains tax.

Just as you pay income tax and sales tax, gains from your home sale are subject to taxation.

Complicating matters is the Tax Cuts and Jobs Act, which took effect in 2018 and changed the rules somewhat. Heres what you need to know about all things capital gains.

Can You Have A Capital Loss

Our definition of capital gains begs the question: Can you have a capital loss? Yes, you can. A capital loss occurs when you sell a property for less money than you originally purchased it for. In some cases, you might be able to use a capital loss to reduce your income for your tax return, if you are reporting capital gains in the same year.

Speaking of tax, a capital gains tax is the money owed in taxes from the income earned. Its not a specific tax, per se. But more on that below.

For more on the ins and outs of how capital gains works, read: Capital gains explained.

You May Like: Average Percentage Of Taxes Taken Out Of Paycheck

A Guide To The Capital Gains Tax Rate: Short

OVERVIEW

This guide can help you better understand the different rules that apply to various types of capital gains, which are typically profits made from taxpayers sale of assets and investments.

|

Key Takeaways Profits you make from selling most assets are known as capital gains, and they are generally taxed at different rates depending on how long you have held the asset. Gains you make from selling assets youve held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your ordinary income, anywhere from 10% to 37%. Gains from the sale of assets youve held for longer than a year are known as long-term capital gains, and they are typically taxed at lower rates than short-term gains and ordinary income, from 0% to 20%, depending on your taxable income. If your investments end up losing money rather than generating gains, you can typically use those losses to reduce your taxes. |

Must I Pay Capital Gain On Property In Another State

I am a resident of California and sold property in Washington State. Am I supposed to pay capital gain on the sale of that property to the State of California?

As a California resident, you are taxable on any income, no matter where you earn it. Therefore, no matter what state you have property in, you would have to report the gain to California. You are fortunate that the State of Washington has no state income tax. If you had sold property in most states, you would have had to file a state return and pay a tax. Then you would also have had to report it to California. California, however, would give you a credit for the tax that you paid to the other state, subject to some limitations. Consider yourself lucky that you had property in Washington and not another state that has individual income taxes.

Rob Seltzer is principal of Robert Seltzer, CPA, PFS, in Beverly Hills. You can reach him at 278-9944 278-9944.

Also Check: Where To Find Tax Id Number

How Are Taxes Calculated On Sale Of Property

The indexation factor can be calculated by dividing the Sale Years Cost Inflation Index by the Purchase Year Cost Inflation Index. Once this has been determined, the indexed acquisition cost of the house can be calculated by multiplying the initial purchase price of the house and the indexation factor.

Talk To A Cpa Regarding State And Federal Capital Gains Tax

It’s a good idea to get some professional help while considering the tax implications of investing. Wise guidance from a tax preparer will help you make the best plan for handling your taxes and investments. Capital gains are taxed at different rates by the federal government and the State of California. Advice on the tax code will help you feel you’re taking the best actions to protect your investments.

Real estate, stocks and bonds, and even crowdfunding investments can generate capital gains. For California, capital gains are taxed the same as ordinary income. Your tax bracket guides the federal government’s tax rate for capital gains. Taxpayers must report any gains or losses from the sale or exchange of capital assets.

You May Like: What Do I Need For My Taxes

California Capital Gain Taxes

The state of California taxes capital gains very differently from the federal government. The most important difference is that in California, capital gains are not classified as short-term capital gains and long-term capital gains. This means that no matter how long you hold an investment, your capital gain will be treated the same way.

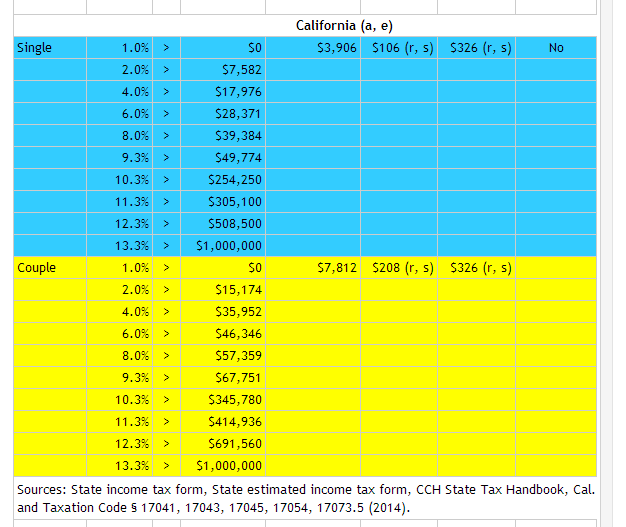

Since there is no distinction between long-term and short-term capital gains, all capital gains are treated as income when considered at the state level. The tax rate charged on the capital gains depends on the individuals income and tax filing status. The rates can be found below:

Capital Gain Tax Rates California

| Tax Rate | |

|---|---|

| $850,503 or more | $625,369 or more |

California also charges a 1% Mental Health Services surtax on income above $1,000,000, which is not reflected in the table above. This means that individuals who make more than $1,000,000 effectively pay a 13.3% tax rate on their capital gains.

Example Of Capital Gains Tax On A Home Sale

Consider the following example: Susan and Robert, a married couple, purchased a home for $500,000 in 2015. Their neighborhood experienced tremendous growth, and home values increased significantly. Seeing an opportunity to reap the rewards of this surge in home prices, they sold their home in 2022 for $1.2 million. The capital gains from the sale were $700,000.

As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. Their combined income places them in the 20% tax bracket. Therefore, their capital gains tax was $40,000.

You May Like: When Will I Get My Tax Return

Are Capital Gains Taxed In California

The short answer to whether capital gains are taxed in California is yes.

This is because the tax rate including income and capital gains are higher than most other states and is one of the ways that California generates a bunch of its annual revenue.

California treats capital gains as an income regardless of how long the asset was held. In contrast, federal capital gains tax will consider capital made from short-term and long-term investments differently.

This means that the average investor holding an investment may be a more financially sound strategy than buy-and-sell investments such as stocks or flipping homes.

A more prudent approach then is to buy and hold, whether its an investment vehicle such as a stock or Real Estate, rather than looking for a quick source of income in order to benefit from various exclusions available.

Capital Gains Tax On The Short Sale Of Your Main Home

Some financially distressed homeowners might be considering a short sale of their home. A short sale occurs when your mortgage lender agrees to accept less than the outstanding balance on your loan to help facilitate a quick sale of the property. The tax rules applicable to short sales differ depending on whether the debt is recourse or nonrecourse.

Recourse debt is when the debtor remains personally liable for any shortfall. If the lender ends up forgiving the remaining debt, a special tax rule provides that up to $750,000 in forgiven debt on a primary home is tax-free. The debtor will be taxed on any remaining forgiven debt at ordinary income tax rates up to 37%.

The tax results are different for nonrecourse debt, meaning the debtor isn’t personally liable for the deficiency. In this case, the waived debt is included in the amount realized for calculating capital gain or loss on the short sale. For primary homes, no loss is allowed and up to $250,000 of gain can be excluded from income for homeowners that meet the two-out-of-five-year use and ownership tests.

Read Also: Are Gofundme Donations Tax Deductable