Using Cryptocurrency To Buy Goods Or Services

Lets say you bought 5 bitcoin for $150 each prior to 2014 and havent touched them since. To treat yourself, you used one BTC and bought a new Harley-Davidson for $56,000the price of one bitcoin at the time of purchase.

With this transaction, you incurred a taxable event. As a result, you incur a long-term capital gain of $55,850the difference between the value of the bitcoin when you bought it: $150, and the value of the bitcoin when you made the transaction: $56,000.

You need to report your transaction as a long-term capital gain on your taxes.

Can The Irs Track Crypto

Yes – the IRS can track crypto. So if you’re asking yourself do you have to pay taxes on crypto gains? Does the IRS know about my crypto investments? Stop right there.

Here’s how the IRS knows about your crypto:

- All major crypto exchanges must now complete KYC checks.

- Exchanges process banking information where they accept fiat payments in exchange for crypto.

- Many exchanges also have records of crypto addresses you’ve withdrawn funds to – so they can identify custodial wallets too.

- Many exchanges are sending 1099 forms to the IRS and users.

- The IRS has won cases against Coinbase, Kraken and Poloniex, forcing them to share customer data.

You can learn more about 1099 forms, Coinbase and the IRS, John Doe Summons and how the IRS tracks crypto in our blog.

Selling Crypto For Usd

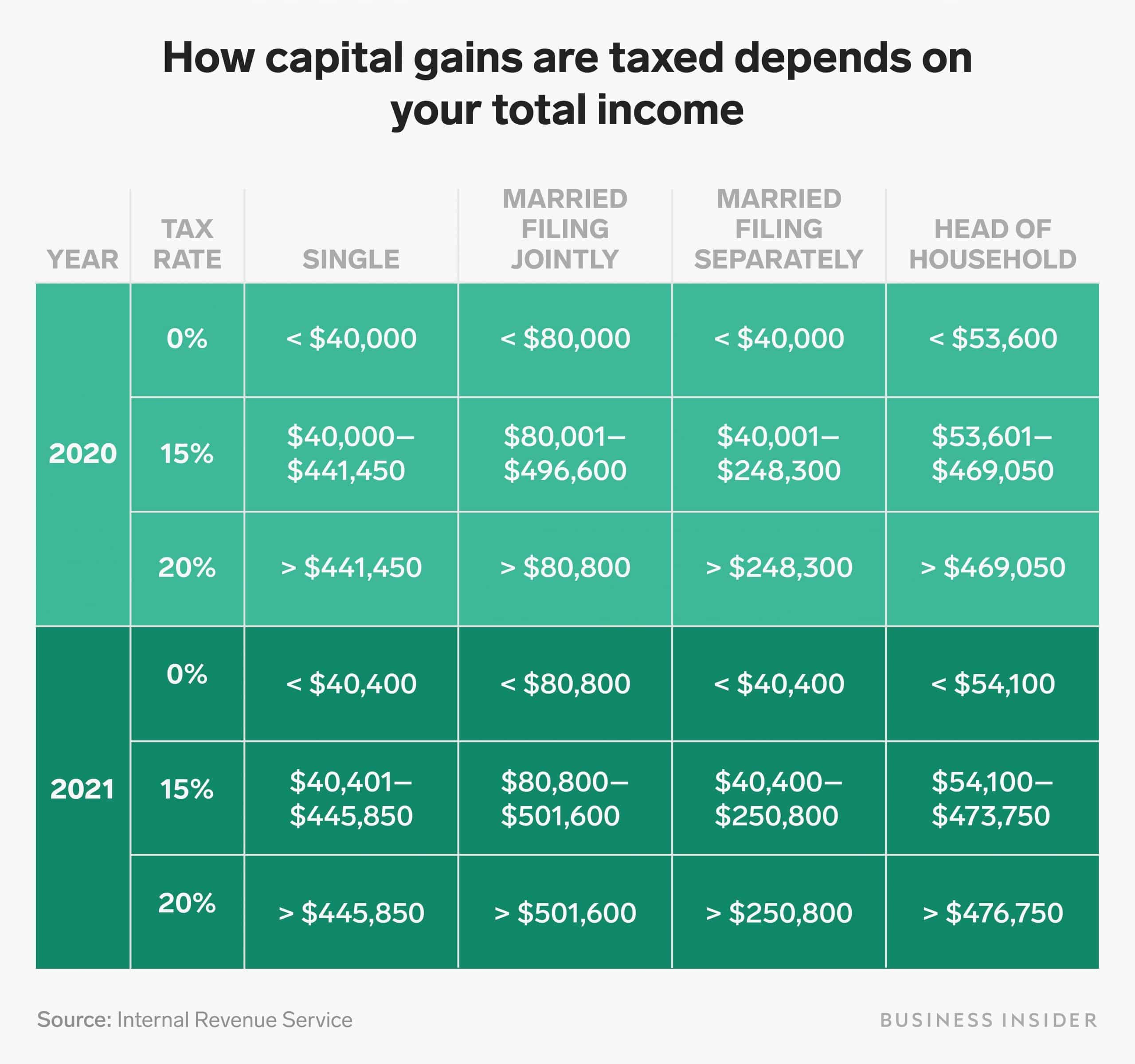

Selling crypto for fiat currency like USD is a taxable event according to the IRS. If you sell your crypto asset for fiat currency after owning it for less than a year, you’ll pay short-term Capital Gains Tax. This will be at the same tax rate as your Income Tax rate. If you sell your crypto asset for fiat currency after owning it for more than a year, you’ll pay long-term Capital Gains Tax. The amount you pay will depend on how much you earn in regular income, but you’ll pay anywhere between 0% to 20%.

Recommended Reading: When Are Taxes Due By

How To Minimize Crypto Taxes

Now that you know a bit more about crypto taxes, which is really just another way of saying capital gains taxes, you will want a set of strategies to minimize how much you pay to the IRS. Here are some useful tips to reduce your tax bill.

1. Hold Until Your Short-Term Gains Turn Into Long-Term Gains

As just noted, different capital gains rates will apply depending on how long you own cryptocurrency. If you want to lower your tax bill, hold your cryptocurrency long enough to turn your short-term gains into long-term gains. It may not be an easy task, but if you have the patience and fortitude to keep your crypto for at least a year before selling, then you’ll likely pay a reduced tax rate on any capital gain.

Heres an example: Mary, a single taxpayer, earns $70,000 in wages for 2022. She also has $5,000 in capital gains from the sale of cryptocurrency. If the gain is short-term gain, she’ll have $75,000 of ordinary income. After claiming the standard deduction, that leaves her with $62,050 of taxable income, which puts her in the 22% tax bracket and results in a tax bill of $9,268. However, if the gain is long-term gain, the $70,000 of ordinary income, minus the standard deduction, is still taxed in the 22% bracket, but the $5,000 of capital gain income is only taxed at 15%. That means an overall tax of $8,918 and a savings of $350.

2. Offset Capital Gains with Capital Losses

3. Sell In a Low-Income Year

4. Reduce Your Taxable Income

Adding And Removing Liquidity

If you’re adding or removing liquidity from various DeFi protocols, on the surface, this doesn’t look like a taxable event. You’re not disposing of your crypto and these transactions are more akin to a transfer.

However, if you receive a token in exchange for your share in the liquidity pool, this could be viewed as a crypto-to-crypto trade and subject to Capital Gains Tax. Each DeFi protocol works slightly differently – your best bet here is to speak to an experienced crypto accountant to ensure you remain tax compliant.

You May Like: H& r Block Tax Identity Shield

How Would An Increase In Capital Gains Tax Affect Crypto Traders

President Bidens proposal to raise the long-term capital gains tax from 20% to 39.6% would only apply to those making over 1 million dollars in income. According to White House advisor Brian Deese, this would affect about 0.3% of households.

So, most crypto traders and investors wouldnt see any change to their long-term tax rates. However, for those who are affected by the nearly doubling tax rate, the incentive to hold on to taxes long-term disappears.

Additionally, historical examples of capital gains tax hikes in the Tax Reform of 1986 and the American Taxpayer Relief Act of 2012 led to an increase in stock selling. This pattern would suggest that we could expect to see large sell-offs by crypto whales who are sitting on significant amounts of unrealized gains, hoping to lock-in the lower tax rate on their cryptocurrency gains.

While there is still much uncertainty around the proposal, we do know there are strategies that can be used to offset capital gains, and therefore reduce taxes on cryptocurrency gains in the event the rates do increase.

Is It Taxable When Gifting Crypto To Others

Yes, sending a gift in crypto is generally taxable as it results in the disposition of the crypto. The capital gains/losses can be calculated by subtracting the cost basis from the FMV of the coins on the date of gifting.

When the crypto is ultimately sold by the recipient of the gift, the proceeds of disposition is the FMV on this date.

Example:

You bought 10 ETH for AUD 10,000 and then sent 5 ETH to friends as a gift. The FMV per ETH is AUD 2,000.

Results:

Cost basis per coin: AUD 10,000/10 = AUD 1,000 per ETH

Proceeds: AUD 2,000 * 5 = AUD 10,000

Total cost basis for 5 ETH: AUD 1,000 * 5 = AUD 5,000

Capital gain/loss: AUD 10,000 – 5,000 = AUD 5,000

Read Also: State Of Ct Income Tax

How Much Tax Do You Pay On Crypto In The Uk

For capital gains from crypto over the £12,300 tax free allowance, you’ll pay 10% or 20% tax. For additional income from crypto over the personal allowance, you’ll pay between 20% to 45% in tax. The exact amount you’ll pay will depend on the transaction you’ve made, the tax that applies and the Income Tax band you fall into.

Using Cryptocurrency To Pay For Goods And Services

A complicating factor for crypto investors arises when they attempt to use their virtual currency to pay for goods and services. The IRS chose to treat cryptocurrency as property in 2014 because most people only saw it as a capital asset at the time. Now, as more companies choose to accept cryptocurrency as a form of payment and people begin to adopt it as a unit of account, many people have begun to see it as a viable alternative currency. However, the current tax treatment of crypto impedes the wholesale replacement of fiat currency.

With traditional fiat currencies, you simply pay for your purchase and have no tax consequences related to cost basis or the value of your currency at the time of payment. However, cryptocurrency users must deal with capital gains and losses in addition to whatever sales taxes they might face at the point of sale.

For example, let’s imagine you bought $10 worth of Bitcoin two years ago and it has since appreciated to $100 in value. If you sold it on an exchange, you’d have $90 of realized long-term capital gains, just like you would with any other capital asset.

If you instead used that same $100 worth of Bitcoin to buy groceries from the supermarket, you’d still have to pay long-term capital gains taxes on the $90 difference between appreciated value and your cost basis.

Recommended Reading: Tax Refund When To Expect

What If I Sold Cryptocurrency For A Loss

If you sell crypto for less than you bought it for, you can use those losses to offset gains you made elsewhere. The resulting number is sometimes called your net gain. For example:

-

You buy $100 of Crypto ABC and $100 of Crypto XYZ.

-

You later sell ABC for $75 and XYZ for $200 .

-

Your taxable amount would be $75 .

If your losses exceed your gains, you can use the additional amount to reduce your taxable income, up to $3,000 in most cases. You can then use, or carry over, any remaining losses to offset gains in future years.

» Learn more:Tax-loss harvesting: Turn investment losses into tax breaks

Offset Your Crypto Gains With Crypto Losses

Youll either profit or lose money when you sell your crypto, depending on how the value fluctuates after its purchased. Gains and losses each come with different tax requirements, though they can offset each other when the values are balanced. Tax-loss harvesting is the term for using offsetting to your advantage.

When using this strategy, note that you must first offset short-term gains against short-term losses and long-term with long-term. After offsetting your short- and long-term losses individually, you can compensate a net short-term gain against a net long-term loss to reduce taxes as much as possible.

For example, if you made $4,000 in short-term gains and lost $2,000, along with $6,000 in long-term gains and $9,000 in losses. Using these figures, you would have a net short-term gain of $2,000 and a long-term loss of $3,000. Once netted together, you have a $1,000 loss.

You can claim a maximum of $3,000 of capital losses each year, and any leftovers can roll over to the future. If numbers arent your forte, we recommend seeking professional help to pull off this strategy.

You May Like: Sales Tax In Nj Calculator

Claim Expenses For Mining

While it might seem like a low-cost activity in theory, mining crypto comes with considerable expenses, including computers, servers, electricity and internet service provider charges. If you are a crypto miner, you can deduct these costs against your mining income, though the amount youll be able to deduct will depend on whether you categorize your operation as a business or as a hobby.

What Are The Tax Implications Of Donating Gifting Or Inheriting Cryptocurrency

The IRS treats crypto donations the same as cash donationsboth are tax-deductible. Based on the market price of the coin at the time, an appraiser will assign a fair market value to it. The donor doesnt owe any taxes on the price gain.

Crypto gifts below $15,000 arent subject to gift taxes. If you receive a crypto gift and you decide to sell that gift, then your cost basis will be the same as that of the gift donor and youll be subject to capital gains tax.

Inherited cryptocurrency assets are subject to the same estate regulations as other assets.

Don’t Miss: Haven T Received Tax Return

Selling Or Trading Coins From An Airdrop

You’ve already paid Income Tax on your airdropped coins and you later decide you want to sell them so you can invest in something else.

Airdropped coins or tokens are viewed exactly the same way as any other cryptocurrency from a tax perspective, so you’ll pay Capital Gains Tax when you later dispose of airdropped crypto by selling it, trading it or spending it.

Your cost base for your airdropped coins will be the fair market value on the day you received them. We’ll use the same example as above to explain.

Do You Pay Taxes On Crypto

Yes, you’ll pay tax on cryptocurrency profits in the US. You’ll pay up to 37% tax on short-term capital gains and crypto income and between 0% to 20% tax on long-term capital gains.

In the US, cryptocurrency isn’t viewed as a currency. Instead, it’s viewed as property – just like a share or a rental property.

Why does this matter? Because it dictates the way your crypto is taxed.

Recommended Reading: Income Tax Return E Filing

How Can I Reduce The Tax I Pay

If youre earning money from trading crypto, unfortunately youre not allowed to deduct your business spending from your profits. But if youre staking or mining, you can. Youre allowed to deduct anything that you use wholly, exclusively and necessarily for your business e.g. mining rigs. Read more about how expenses work.

Something else to make use of if youre staking or mining crypto is the Trading Allowance. You can earn up to £1,000 in untaxed income per year. Youll see it applied to your calculation when you use our calculator.

Swapping Crypto For Crypto

Wondering if crypto to crypto is taxable or whether you pay taxes on crypto trades? The answer is a resounding yes.

If you’re buying your crypto with another cryptocurrency, for example, buying ETH with BTC – this is a taxable event in the USA. The IRS views this as two separate transactions. Let’s use the example above – you want to buy ETH with BTC.

The IRS sees this as you selling your BTC. You’re then buying ETH at market value. Even though you never received any fiat currency, you still need to pay tax on the sale of the BTC – not the purchase of the ETH.

To calculate your capital gain in this example, you’d use the cost base of your BTC and subtract it from the fair market value of BTC on the day you bought ETH. If you eventually sell the ETH, your cost basis will be the market value of ETH on the day you made the trade.

Recommended Reading: What States Do Not Have Sales Taxes

How To Report Crypto On Taxes

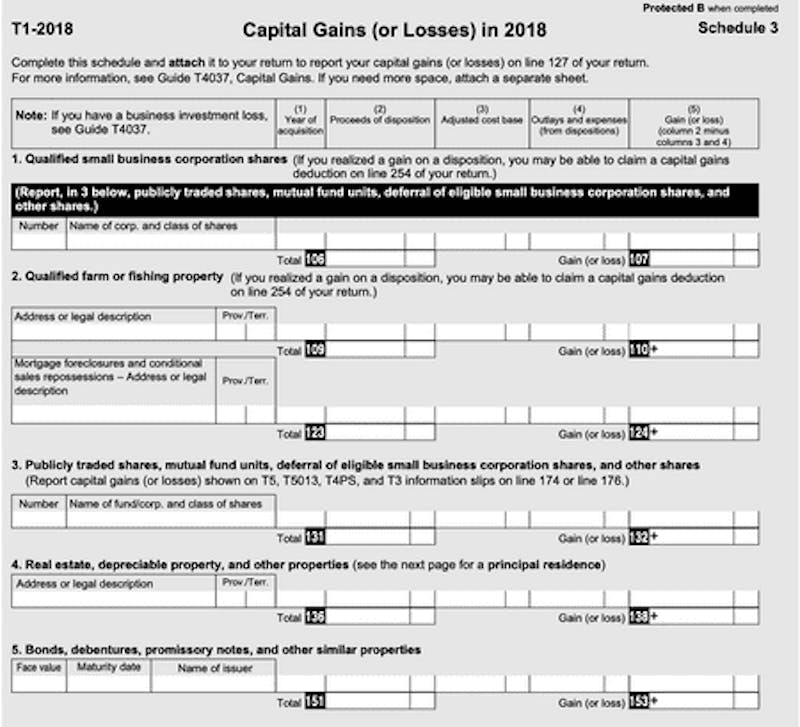

You file your crypto taxes with your annual tax return – but you’ll need a few other forms to do so. You can see our complete guide on filing your crypto taxes with the IRS, but in short:

Report crypto disposals, capital gains and losses on: Form Schedule D and Form 8949.

Report crypto income on: Form Schedule 1 or Form Schedule C .

You can do this with paper forms or through a tax app like TurboTax or TaxAct. We’ll walk you through both.

Do I Pay Tax When Donating Crypto To Charity

Yes, it is generally taxable when you donate crypto to charity and results in capital gains/losses. If the payment is made directly to a not-for-profit organization which has Deductible Gift Recipient Status , it can be tax deductible. However, only a small number of Australian entities are DGRs, you can check here to see if the entity has DGR endorsement. In addition, it is required to keep the receipt issued by the DGR. You can also claim the deduction by using other records such as bank statements. Please refer to this webpage for more information.

The capital gains/losses can be calculated by subtracting the cost basis from the FMV of the coins on the date of donation, less amount or benefit received or receivable from the charity.

Example:

You bought 1 BTC for AUD 10,000 and then donated 1 BTC to a charity. The FMV per BTC is AUD 20,000.

Results:

Capital gain/loss: AUD 20,000 – 10,000 = AUD 10,000

Note: AUD20,000 may be tax deductible and should be reported as a donation.

Don’t Miss: How Do I Get My Tax Transcripts

Crypto Tax Rates: Complete Breakdown By Income Level 2022

Miles Brooks holds his Master’s of Tax, is a Certified Public Accountant, and is the Director of Tax Strategy at CoinLedger.

Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets.

Wondering how much youâll need to pay in cryptocurrency taxes? Letâs break down how much money youâll owe to the IRS in different scenarios.

How Is The Crypto Tax Rate Calculated

Cryptocurrencies can be taxed as short-term capital gains or long-term capital gains.

If you sold or traded crypto in the United States, your capital gains tax rate is calculated using two factors:

-

Your realized gains or losses

-

Your holding periodhow long you held the asset before selling or trading it

Your holding period begins the day after you either purchase crypto or make a crypto transaction and continues until the day you trade or sell the asset.

Also Check: How To Get Old Tax Returns

Capital Gains Tax Events

The following are short-term and long-term capital gain tax events:

-

Trading cryptocurrencies for fiat money or using these currencies to pay for products and/or services

-

Trading or exchanging one kind of cryptocurrency for another

Investors should note that transferring assets from one wallet or exchange to another does not result in capital gains or losses and is, therefore, not a taxable event.

How Do Cryptocurrency Taxes Work

Because cryptocurrencies are viewed as assets by the IRS, they trigger tax events when used as payment or cashed in. When you realize a gainsell, exchange, or use crypto that has increased in valueyou owe taxes on that gain.

For example, if you bought 1 BTC at $6,000 and sold it at $8,000 three months later, you’d owe taxes on the $2,000 gain at the short-term capital gains tax rate. Profits on the sale of assets held for less than one year are taxable at your usual tax rate. For the 2022 tax year, that’s between 0% and 37%, depending on your income.

If the same trade took place a year or more after the crypto purchase, you’d owe long-term capital gains taxes. Depending on your overall taxable income, that would be 0%, 15%, or 20% for the 2022 tax year.

In this way, crypto taxes work similarly to taxes on other assets or property. They create taxable events for the owners when they are used and gains are realized. That makes the events that trigger the taxes the most crucial factor in understanding crypto taxes.

Also Check: Are Real Estate Taxes The Same As Property Taxes