What Is A Capital Gain

Capital gains are profits you make from selling an asset. Typical assets include businesses, land, cars, boats, and investment securities such as stocks and bonds. Selling one of these assets can trigger a taxable event. This often requires that the capital gain or loss on that asset be reported to the IRS on your income taxes.

What Is Ordinary Income Tax

Ordinary income refers to any type of income taxed at the standard marginal tax rates.

These, simply put, are just your normal income tax rates using the tax brackets . We discussed the 2022 rates along with a downloadable guide in last weeks article, 2022 Tax Rates and Resources.

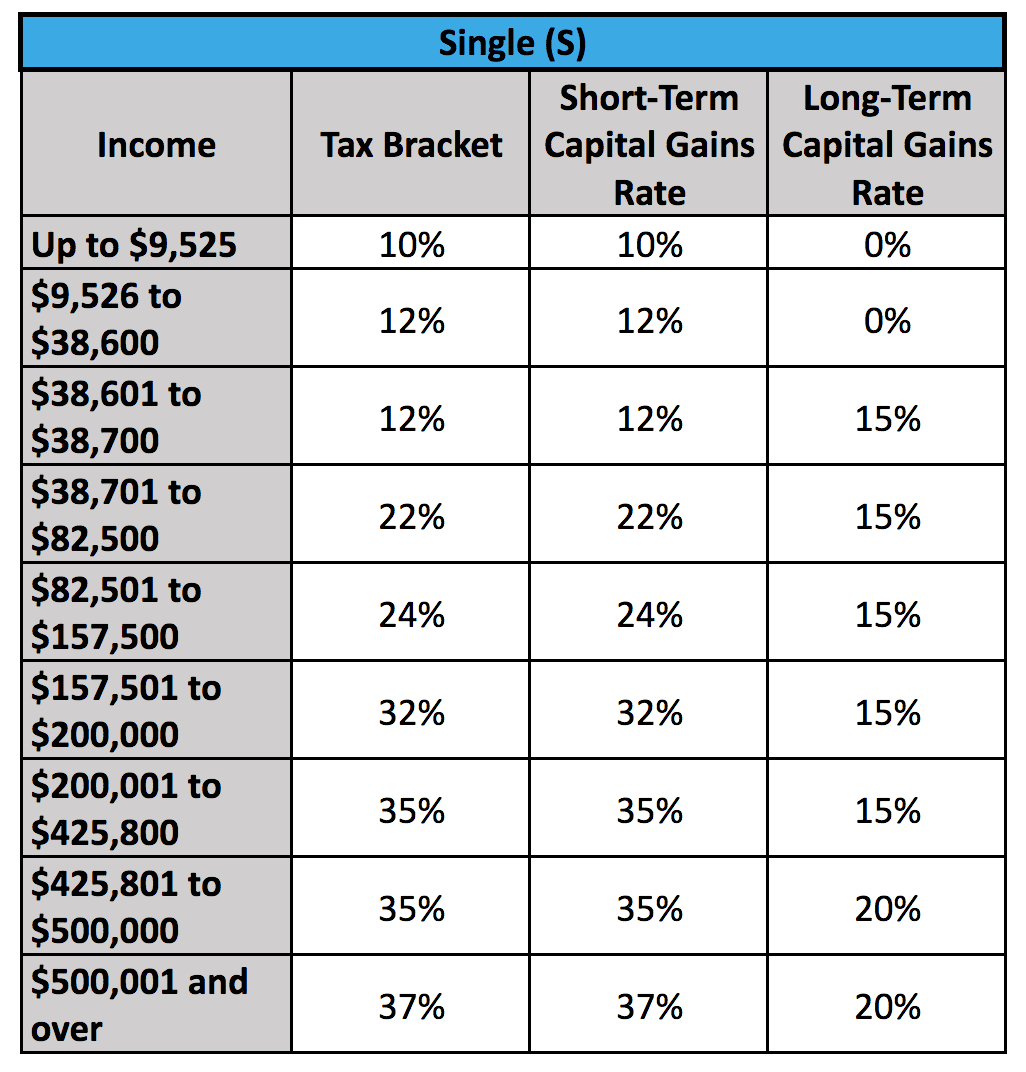

Check out that article to find the brackets and rates for your specific scenario but just as a refresher here is what they are in 2022 for those that are filing as .

- 10%: $20,550 and Under

- 35%: $431,900 – $647,850

- 37%: Over $647,850

Remember you pay taxes on the income in each respective bracket. As an example using the table from above, if you make $100,000 you will NOT pay 22% on all of that. You’ll pay 10% on the first $20,550 and then $12% on $20,550 to $83,500 and then 22% on $83,500 to $100,000.

This is often a misunderstood piece. Simply put, by jumping into another tax bracket you are not hit with a higher tax on all of your income, just the portion of income that went into that next tax bracket.

Capital Gains Tax Strategies

The capital gains tax effectively reduces the overall return generated by the investment. But there is a legitimate way for some investors to reduce or even eliminate their net capital gains taxes for the year.

The simplest of strategies is to simply hold assets for more than a year before selling them. That’s wise because the tax you will pay on long-term capital gains is generally lower than it would be for short-term gains.

Don’t Miss: Tax Deductions For Home Office

What Are Capital Gain Tax Rates

Capital gains have a much more favorable tax treatment than ordinary income. There are two buckets of capital gain taxes:

- Short-Term Capital Gain: Held for 1 year or less

- Long-Term Capital Gain: Held for more than 1 Year

Each bucket is taxed differently:

- Short-Term Capital Gain

- Taxed at Ordinary Income Tax Rates

As you can tell from above, the IRS rewards you for holding on to assets. As an example if you purchase a stock and hold it for 6 months and then sell it, you’ll be taxed at ordinary income tax rates. If you would have instead held on to it for 18 months you would have paid long term capital gain tax rates.

One thing to note is that there are a couple exceptions to the capital gain tax rates:

- Collectibles Held > 1 Year: Taxed at 28%

- Section 1202 Qualified Small Business Stock Held > 5 Years: Taxed at 28%

- Unrecaptured Section 1250 Gain Held > 1 Year: Taxed at 25%

If you’re facing a potential large capital gain, you may want to look into advanced planning before making the sale, this would be a good time to reach out to us or join our Tax Minimization Program.

Tax Treatment Of Business Income Vs Capital Income

Business income and capital income receive different tax treatment under the Income Tax Act. Business income is fully taxable. Business losses are deductible against non-capital income. Those losses earned after 2005 can be carried forward 20 years and back three years . Taxpayers may additionally be able to claim certain business expenses to decrease their business income. Conversely, only 50 percent of capital gains and losses are taxable or deductible, respectively. Capital losses can only be deducted from capital gains. These losses can be carried forward indefinitely and back three years. In certain circumstances the lifetime capital gains exemption can be applied to reduce capital income.

Don’t Miss: Annual Income After Taxes Calculator

Irs Publications & Guidelines

The Internal Revenue Service provides detailed information on the capital gains tax rate in its publications and guidelines. These documents provide an overview of how the capital gains tax works and specific instructions on filing taxes with this type of income included.

Its important to note that these documents are not meant to replace professional advice from a qualified accountant or financial advisor they should only be used as a starting point for further research.

State Taxes On Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level.

New Hampshire, for example, doesn’t tax income, but does tax dividends and interest. By comparison, states with high income tax California, New York, Oregon, Minnesota, New Jersey and Vermont) also have high taxes on capital gains too. A good capital gains calculator, like ours, takes both federal and state taxation into account.

You May Like: Tax Credits For Electric Cars

How Do The Tax Brackets Work

Lets say you have $100,000 in taxable income in 2022 and are unmarried. Will your 2022 tax bill just be 24% of $100,000, or $24,000, since $100,000 is in the 24% rate for singles? No! Your tax is less than that sum. This is because, thanks to marginal tax rates, only a part of your income is subject to a 24% tax. The remaining portion is taxed at rates of 10%, 12%, and 22%.

Again, if you are single and have $100,000 in taxable income in 2022, the first $10,275 of your income is subject to a 10% tax, which results in a $1,028 tax bill. The following $31,500 of income is subject to 12% tax, which results in an extra $3,780 of tax. Your subsequent $47,300 in income is subject to a 22% tax rate, which results in a tax bill of $10,406.

Only $10,925 of your remaining taxable income is subject to the 24% rate of tax, which results in an extra $2,622 in taxes. Your total tax for 2022 comes to merely $17,836 when all is said and done.

What Is The 2022 Short

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period begins ticking from the day after you acquire the asset, up to and including the day you sell it.

- For 2022, ordinary tax rates range from 10% to 37%, depending on your income and filing status.

You May Like: How To Get My Tax Return From Last Year

Investing For Longer Periods Of Time

One way to minimize your capital gains tax liability is by investing for longer periods of time. This strategy works because the amount of taxes you owe on any investment is based on how long you held it before selling it.

The longer you hold an asset, the lower your tax rate will be when you sell it. For example, if you hold a stock or mutual fund for more than one year before selling it, then any sales profits are taxed at a much lower rate than if you had sold within one year.

What Are Capital Gains

Capital gains taxes are applied to any profits that you make on the sale of an asset. Theyre designed to encourage risk-taking and non-speculative investments. As a helpful rule of thumb, it helps to remember that capital gains apply to profits from the sale of an investment such as real estate, stocks, etc.

You May Like: How To Read Tax Return

Capital Gains Tax Rate For Qualified Small Business Stock

If you sell “qualified small business stock” that you held for at least five years, some or all of your gain may be tax-free. However, for any gain that is not exempt from tax, a maximum capital gains tax rate of 28% applies.

As with the 28% rate for collectibles, if your ordinary tax rate is below 28%, then that rate will apply to taxable QSBS gain. The 28% rate doesn’t apply to short-term capital gains from the sale of QSBS, either.

Is Capital Gains Added To Your Total Income And Puts You In Higher Tax Bracket

A capital gain or loss affects your tax if it is recognized. The size of your capital gains and losses affects how much income tax you have to pay. Ordinary income includes all kinds of income other than capital gain. So, if you do not have capital gains and losses, your taxable income is simply your ordinary income reduced by your ordinary deductions.

Recommended Reading: How Much In Inheritance Tax

Capital Gains: Definition Rules Taxes And Asset Types

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Investopedia / Mira Norian

Will Realized Capital Gains Push Me Into A Higher Income Tax Bracket

That depends on whether the capital gains are long- or short-term. The profit made on assets sold after a year may push you into a higher capital gains tax bracket but will not affect your ordinary income tax bracket, as such gains are not treated as ordinary income.

Assets sold within a year receive less favorable treatment. Short-term gains count as ordinary income and, therefore, could push you into the next marginal ordinary income tax bracket.

Read Also: Who Qualifies For The Employee Retention Tax Credit

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow.

A capital gain rate of 15% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single more than $80,800 but less than or equal to $501,600 for married filing jointly or qualifying widow more than $54,100 but less than or equal to $473,750 for head of household or more than $40,400 but less than or equal to $250,800 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Test To Determine Income Classification

The test to determine whether particular income is classified as business or capital income was developed in the leading case Happy Valley Farms Ltd. v. Her Majesty the Queen. The test contains six elements. None of these elements are determinative on their own and must be considered together with the overall conduct and circumstances of the taxpayer. The six factors are as follows:

All of these factors are geared towards deriving the intention of the taxpayer with respect to the sale of the property from the taxpayers conduct and surrounding circumstances. A taxpayer who intends to earn business income and acts accordingly should be found under this test to earn business income.

The Court in Happy Valley Farms did acknowledge the possibility of secondary intention. A secondary intention is found where, at the time the property was purchased, part of the taxpayers motivation for the purchase was the possibility of resale for profit even though the taxpayers main intention was investment. Where a secondary intention is found, the sale can be taxed as business income.

You May Like: Calculate Capital Gains Tax On Real Estate

Retirement Plan Contribution Limits

Roth IRA contribution limits remain at $6,500, with an additional $1,000 catch-up contribution limit for workers age 50 and older. The income phaseout on contributions is $138,000 to $153,000 , $218,000 to $228,000 and $0 to $10,000 .

The contribution limits for 401, 403 and 457 plans increased to $22,500, with an additional $7,500 catch-up contribution limit for workers age 50 and older.

The contribution limit for SIMPLE retirement plans increased to $15,500, with a catch-up contribution limit of $3,500.

The income limit for the Saver’s Credit is $36,500 , $73,000 and $54,750 .

How Are Capital Losses Treated

We talked about what happens if you sell an asset for a gain but what happens if you sell it for a loss? Capital losses can offset capital gains.

Losses must first be used to offset gains of the same type but if losses of one type are more than the gains of that type then you can apply the rest to the other type.

Traditionally we would try to avoid using a short term capital loss to offset a long term gain.

If you have more capital losses in a year than capital gains, the maximum capital loss you can take over and above capital gains in a year is $3,000. The remaining would be carried forward.

As an example, lets say you have a capital gain of $10,000 but have a capital loss of $40,000. You would be able to offset the $10,000 capital gain entirely but then would only be able to take an additional capital loss of $3,000 with the remaining $27,000 capital loss being carried forward.

Recommended Reading: Sales And Use Tax Exemption Certificate

Capital Gains And Dividends Accrue Overwhelmingly To The Wealthy And Are Taxed At Preferential Rates

A capital gain is the profit from selling an asset such as a stock or other financial instrument, an interest in a business, or real estate. The gains from the sale of such assets held more than one year are considered long-term gains and taxed at special low rates. While ordinary income such as wages and salaries is taxed at rates ranging from 0 percent for low levels of income to 37 percent for the highest levels of income, long-term capital gains are taxed at 0 percent, 15 percent, and 20 percent. Most corporate dividends that are paid to shareholders are also taxed at these favorable rates. There is also a 3.8 percent Medicare tax on high-income taxpayers net investment income, including capital gains and dividends. The 3.8 percent net investment income tax was enacted in companion legislation to the Affordable Care Act in 2010 and essentially parallels the Medicare tax on wages.1

Figure 1

The vast majority of capital gains and dividends reported on tax returns are received by individuals at the very top of the income spectrum. According to the Tax Policy Center , the richest 1 percent of Americans reported an estimated 75 percent of all long-term capital gains in 2019, with the richest 0.1 percentpeople with annual incomes exceeding $3.8 millionbringing in more than half of all gains.2

Figure 2

Capital Gains Tax Rates By State

In 2015, the Tax Foundation released a report detailing the uppermost capital gains tax liabilities by state. As the Tax Foundation notes, most states do not levy a separate capital gains tax. Rather, the states tax capital gains according to the same rates as personal income. The table below summarizes uppermost capital gains tax liabilities by state in 2015. California’s uppermost rate ranked highest in the country at 13.3 percent. The combined rate totaled 33 percent. By contrast, nine states that do not levy a personal income or capital gains tax tied for the lowest combined uppermost rate in the nation at 25 percent.

| Uppermost capital gains tax rates by state, 2015 |

|---|

| State |

You May Like: File Income Tax Return India

How Can Capital Losses Affect Your Taxes

As previously mentioned, different tax rates apply to short-term and long-term gains. However, if your investments end up losing money rather than generating gains, those losses can affect your taxes as well. However, in this case, you can use those losses to reduce your taxes. The IRS allows you to match up your gains and losses for any given year to determine your net capital gain or loss.

- If after fully reducing your gains with your losses and you end up with a net loss, you can use up to $3,000 of it per year to reduce your other taxable income.

- Any additional losses can be carried forward into future years to offset capital gains and up to $3,000 per year of ordinary income.

- Since you don’t generate capital gains or losses in a retirement account, you can’t use losses in IRAs or 401 plans to offset gains or your other income.

Get Your Investment Taxes Done Right

For stocks, crypto, ESPPs, rental property income and more, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: New Jersey Tax Refund Status