List Of Countries By Tax Rates

|

|

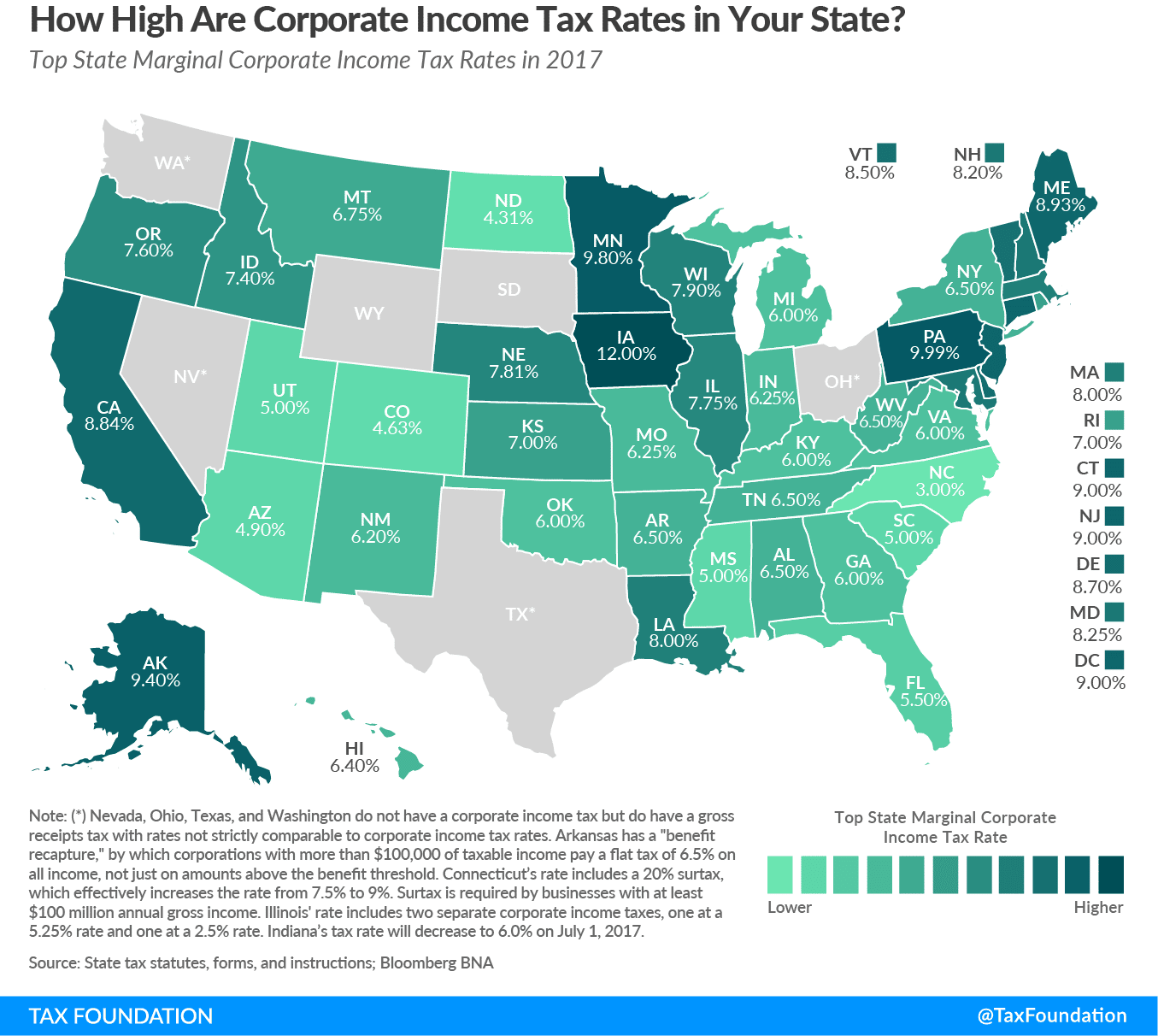

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance tax.

Some other taxes and payroll tax are not shown here. The table is not exhaustive in representing the true tax burden to either the corporation or the individual in the listed country. The tax rates displayed are marginal and do not account for deductions, exemptions or rebates. The effective rate is usually lower than the marginal rate. The tax rates given for federations are averages and vary depending on the state or province. Territories that have different rates to their respective nation are in italics.

Property Taxes By State

The table below shows average property taxes by state, in alphabetical order. It indicates both the annual property tax on a median-value home in the state and, for comparison, what the property tax would be on the U.S. national median home sales price of $440,300, as of the second quarter of 2022.

| State |

|---|

| $2,686 |

Featuredown The Rabbit Hole: Sales Taxation Of Digital Business Inputsjuly 18 2022

In this article, Frieden, Nicely and Nair document for the first time that the sales taxation of business purchases of digital products is not just commonplace, but the overwhelming norm among states that tax software and digital products. The taxation of digital business inputs undermines the optimal goal of states sales and use taxes to impose taxes on end-user consumption of products. The authors recognize the interest of many states in expanding their sales tax bases to address digital products, but caution against base expansion that results in a pyramiding of sales tax on both business inputs and consumer sales.

Recommended Reading: Federal Small Business Tax Rate

Featurelocally Administered Sales And Accommodations Taxes: Do They Comport With Wayfairjuly 28 2022

The Study effectively demonstrates that the burdens of complying with numerous disparate local tax regimes are extremely onerous, particularly in states that lack centralized collection and remittance of local taxes. The Study opens with a Foreword authored by well-known state and local tax experts Jeffrey A. Friedman and Nikki E. Dobay of Eversheds Sutherland LLP that evaluates and analyzes the legal framework and constitutional concerns surrounding state imposition of local taxesparticularly decentralized local taxesafter the Supreme Courts 2018 decision in South Dakota v. Wayfair.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Residents of the Land of Lincoln also get no relief when it comes to property taxes. The statewide median property tax rate in Illinois is the second-highest in the nation.

Sales tax rates are high in Illinois, too. The state has the eighth-highest average combined state and local sales tax rate at 8.81%. Illinois also has an estate tax, which can be bad news for your heirs.

On the bright side, Illinois is sending two tax rebates in 2022 to qualified residents one for income taxes and one for property taxes. The state started sending rebate payments in September, but it’s expected to take a few months before all payments arrive in residents’ hands.

You May Like: New Mexico State Tax Refund

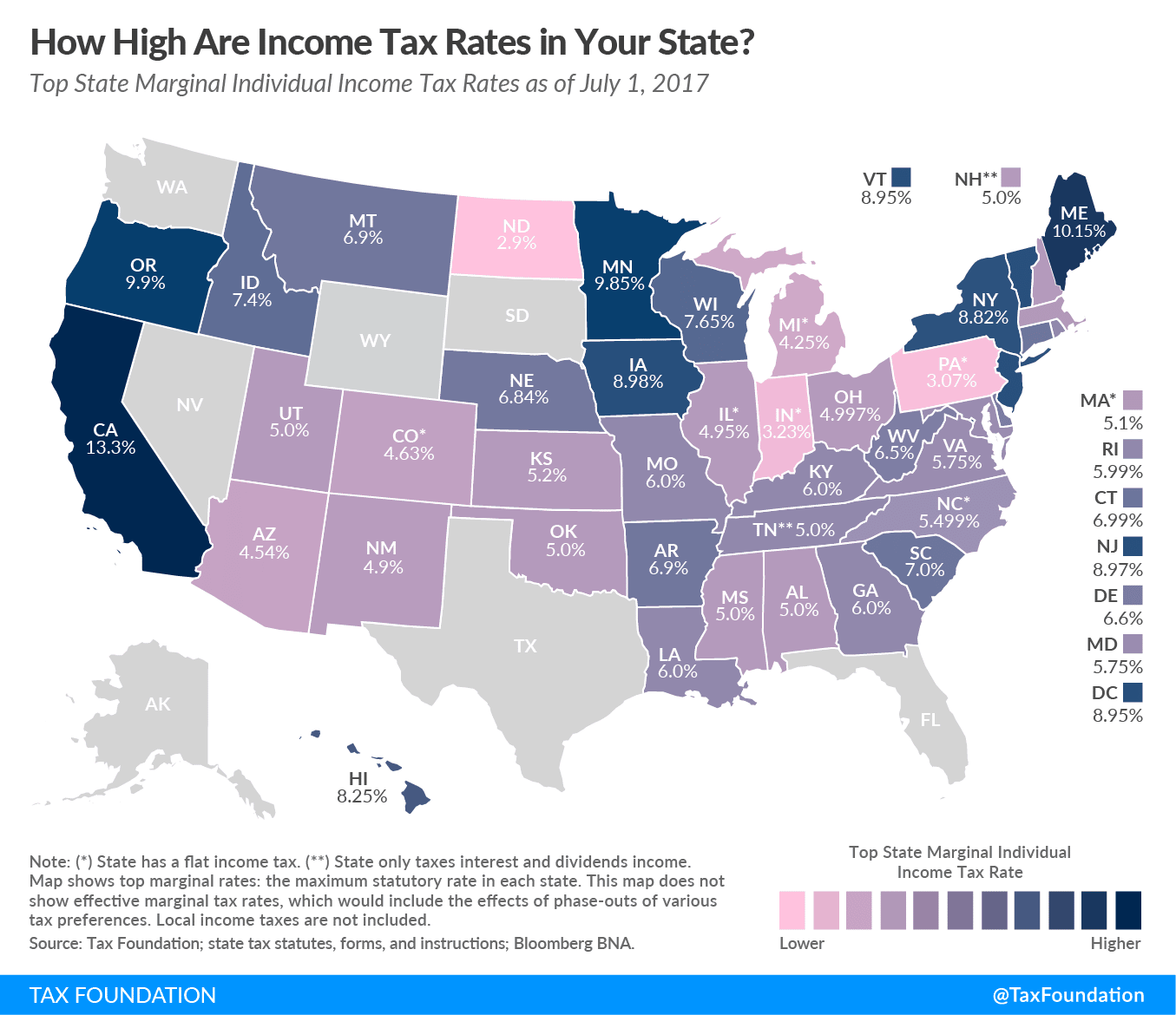

Personal Income Tax Rate Structure

Of the states currently levying a broad-based personal income tax, all but nine apply graduated tax rates . Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah tax income at one flat rate. While most of the Terrible 10 states achieve membership in this club by having no income taxes at all, two of them Pennsylvania and Illinois achieve this dubious honor through their use of a flat-rate tax.

However, using a graduated rate structure is not enough to guarantee an overall progressive income tax some graduated-rate income taxes are about as fair as some flat-rate taxes, and some even less fair. The level of graduation in state income tax rates varies widely. As does the level of progressivity. This is illustrated by a look at the income tax structures in the District of Columbia, Pennsylvania, and Virginia, three jurisdictions with income taxes whose wide-ranging structures result in very different distributional impacts.

The District of Columbias income tax is quite progressive. Its six-tier graduated tax rates range from 4 percent to 8.95 percent. Because the top tax rate of 8.95 percent is a millionaires tax, most District residents pay a lower top rate. And most of those at the bottom of the income scale are held harmless by a generous Earned Income Tax Credit provided at 40 percent of the federal credit for workers with children and 100 percent for workers without children in the home.

FIGURE 7

States Where The Tax Burden Has Changed Dramatically Over Time

Among states with declining tax burdens, Alaska is the extreme example. Before the Trans-Alaska Pipeline system was finished in 1977, taxpayers in Alaska paid 11.7 percent of their share of net national product in state and local taxes. By 1980, with oil tax revenue pouring in, Alaska repealed its personal income tax and started sending out checks to residents instead. The tax burden plummeted, and now Alaskans are the least taxed with a burden of only 4.6 percent of income.

Similarly, North Dakotas burden has fallen from 13.0 percent in 1977 to 8.8 percent of net state product in 2022.

Although the majority of states have seen a decrease in tax burdens over time, 16 have experienced increases since 1977, many of these likely to be temporary upticks due to the pandemic. Connecticut taxpayers have seen the largest increase, of 3.3 percentage points, followed by Hawaii at 2.5 percent.

Read Also: Property Tax Help For Low-income Homeowners

States Without Income Tax

On the flip side, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington state, and Wyoming dont impose an income tax at all. New Hampshire falls into a gray area. It doesn’t levy a tax on earned income, but it does tax interest and dividends at a flat 5%.

Since they don’t collect income tax, some states generate revenue in other ways. Tennessee has one of the highest combined state and local sales tax rates in the country. Your paycheck might be safe, but you’ll be dinged at the cash register. New Hampshire and Texas have high property taxes in relation to home values. And Pennsylvania charged the highest tax on gasoline in 2021.

Which Are The Highest Find Out Here

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

One of the biggest tax bills that most people pay is the federal income tax calculated on the Internal Revenue Service Form 1040 in April of each calendar year. Three other major taxes come from your state or locality: state income taxes, sales taxes, and property taxes. The way that each type of tax is calculated is complicated factors such as your income level, marital status, and county of residence affect your tax rates.

Simple, apples-to-apples comparisons of how much total tax youll pay living in one state versus another are impossible. And since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you cant simply add up the average rates in each state and rank them from lowest to highest.

However, if youre trying to choose where to live or to locate your businessand taxes are a factor in your decisionthen the tables below can give you a big picture to use as the starting point for more research on how taxes in each state would impact your unique financial situation.

Recommended Reading: Capital Gains Tax In California Real Estate

State Individual Income Tax Rates And Brackets

U.S. Census Bureau, 2020 State Government Tax Tables, Fiscal Year 2020,

See Jared Walczak, Inflation Adjusting State Tax Codes: A Primer, Tax Foundation, Oct. 29, 2019, .

S.B. 1828, 55th Leg., First Reg. Sess. , .

Howard Fischer, Court Rules Prop 208 Surcharge Can Stay For Now, Arizona Capitol Times, Aug. 19, 2021, .

Fann v. Arizona, 493 P.3d 246 .

H.B. 2838, 55th Leg., First Reg. Sess. .

State Income Tax Rates In 202: What They Are And How They Work

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

State income tax rates receive relatively little attention compared with federal income taxes, but they can still put a large dent in your wallet. How large depends on the amount you earn, as well as where you live and work. Here’s how it works, and a list of states with no income tax.

Read Also: Can You File State Taxes Without Filing Federal

Which States Have The Lowest And Highest Property Tax Rates

As of 2022, Hawaii , Alabama , and Colorado are the states with the lowest effective real-estate tax rates. The states that have the highest property taxes are New Hampshire , Illinois , and New Jersey . How do the different rates translate into an annual property tax bill? Take a home valued at $217,500: In Hawaii, the homeowner would pay $606 a year in property taxes, while in New Jersey, the homeowner would pay $5,419.

State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $25,295 and spends annually an amount equal to the spending of a household earning the median U.S. income.

Read Also: Sales And Use Tax Exemption Certificate

What Is The Difference Between Tax Burdens And Tax Collections

The distinction between tax burdens and tax collections is crucial to understanding tax shifting across state lines. Because tax collections represent a tally of tax payments made to state and local governments, they measure legal incidence only. In contrast, our tax burdens estimates allocate taxes to states that are economically affected by them. As a result, the estimates in this report attempt to measure the economic incidence of taxes, not the legal incidence.

Tax collections are useful for some purposes and cited frequently. However, dividing total taxes collected by governments in a state by the states total income is not an accurate measure of the tax burden on a states residents as a whole because it does not accurately reflect the taxes that are actually paid out of that states income.

The authoritative source for state and local tax collections data is the Census Bureaus State and Local Government Finance division, which serves as the main input and starting point for our tax burdens model. Here are a few additional examples of the difference between tax collections and our tax burdens estimates:

In addition to allocating the taxes cited above, this study also allocates taxes on corporate income, commercial and residential property, tourism, and nonresident personal income away from the state of collection to the state of the taxpayers residences.

What Are Tax Burdens

In this study, we define a states tax burden as state and local taxes paid by a states residents divided by that states share of net national product. This studys contribution to our understanding of true tax burdens is its focus on the fact that each of us not only pays state and local taxes to our own places of residence, but also to the governments of states and localities in which we do not live.

This tax shifting across state borders arises from several factors, including our movement across state lines during work and leisure time and the interconnectedness of the national economy. The largest driver of this phenomenon, however, is the reality that the ultimate incidence of a tax frequently falls on entities other than those that write the check to the government.

Don’t Miss: When Is An Estate Tax Return Required

Income Tax Rates Run From 0% To More Than 13%

Halfpoint / Getty Images

Location is everything if you want to save a few income tax dollars. Overall, state tax rates range from 0% to more than 13%.

Learn which states have the highest tax rates, no taxes, and flat taxes and see a complete list of tax rates for every state in the union.

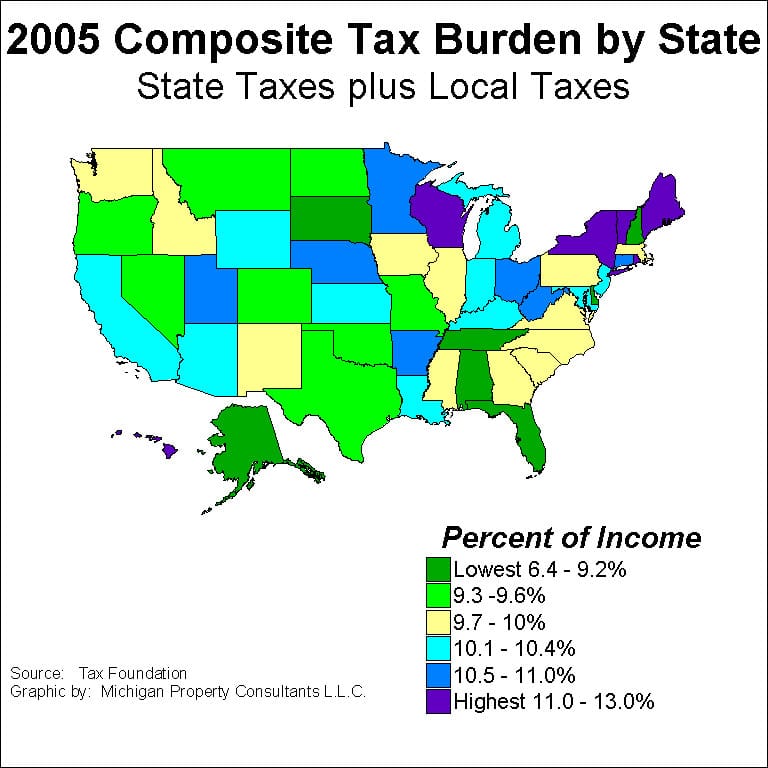

Percentage Of State Residents’ Total Income

One simple way to rank state tax burdens is by the percentage of all state residents’ total income that goes to state and local taxes.

| State and Local Tax Burden as a Percentage of State Income, Fiscal Year 2019 | |

|

State |

|

|

7.0% |

Based on this chart, New Hampshire taxpayers pay 9.7% of their total income to state and local taxes. Massachusetts taxpayers pay 10.5%.

But the above chart provides a rather crude measurement of comparative state and local tax burdens because everybody is lumped together regardless of income. Depending on your income, you might have to pay more than this chart indicates.

Recommended Reading: How Much Do I Have To Make To File Taxes

Undermining Progressivity With Tax Breaks For Wealthy Taxpayers

In contrast to states that improve tax fairness with tax credits for low-income families, more than a dozen states currently allow substantial tax breaks for the wealthy that undermine tax progressivity. Two of the most regressive state income tax loopholes are capital gains tax breaks and deductions for federal income taxes paid .

In combination with a flat rate structure, these tax breaks can create an odd and unfair situation where the highest income taxpayers devote a lower percentage of their income to income taxes than their middle-income neighbors.

For example, Alabama allows a deduction for federal income taxes. Although Alabamas income tax is essentially flat, the federal income tax is still progressive. So Alabamas deduction for federal income taxes disproportionately benefits the states wealthiest taxpayers. As a result, effective marginal income tax rates in Alabama actually decline at the states highest income levels. Despite the 5 percent top tax rate, the effective income tax rate on the very wealthiest taxpayers is actually less than 3 percent. Among the six states that allow a deduction for federal taxes, three allow a full deduction for federal taxes, including Alabama, while the other three have a partial deduction.

These States Have The Highest And Lowest Tax Burdens

- You may have a wildly different tax bill depending on where you live.

- That’s because your tax burden individual income, property, sales and excise taxes as a share of total personal income varies by state.

- You can expect to spend the most in New York, Hawaii, Maine, Vermont and Minnesota, according to a WalletHub report.

As this year’s tax deadline approaches, you may have a wildly different bill depending on where you live, according to a WalletHub report ranking how much residents pay by state.

The report compares total tax burdens individual income, property, sales and excise taxes as a share of total personal income.

“Tax burden is a simpler ratio and helps cut through a lot of the confusion, especially when you’re looking to relocate,” WalletHub analyst Jill Gonzalez said.

Also Check: How Old Do You Have To Be To File Taxes

Are There Any States That Don’t Charge Sales Taxes

Only five states don’t have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Besides state-level sales taxes, 38 states have local sales taxes. Indeed, Alaska lets localities charge local sales taxes. The states with the lowest average combined state and local sales tax rates are Alaska , Hawaii , and Wyoming , while those with the highest average combined state and local sales tax rates are Arkansas , Tennessee , and Louisiana .

Sales And Excise Taxes

Sales and excise taxes are the most regressive element in most state and local tax systems. Sales taxes inevitably take a larger share of income from low- and middle-income families than from rich families because sales taxes are levied at a flat rate and spending as a share of income falls as income rises. Thus, while a flat rate general sales tax may appear on its face to be neither progressive nor regressive, that is not its practical impact. Unlike an income tax, which generally applies to most income, the sales tax applies only to spent income and exempts saved income. Since high earners are able to save a much larger share of their incomes than middle-income families and since the poor can rarely save at all the tax is inherently regressive.

The average states consumption tax structure is equivalent to an income tax with a 7.1 percent rate for the poor, a 4.8 percent rate for the middle class, and a 0.9 percent rate for the wealthiest taxpayers. Few policymakers would intentionally design an income tax that looks like this, but many have done so by relying heavily on consumption taxes as a revenue source.

On average, states rely more heavily on sales and excise taxes than any other tax source. Sales and excise taxes accounted for 35 percent of the state and local taxes collected in fiscal year 2015. However, states that rely much more heavily on consumption taxes increase the regressivity of their state and local tax systems:

FIGURE 9

Also Check: Federal Tax Extension Deadline 2022