How Is Social Security Financed

A1: There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government. The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way.

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

Social Security Benefit Taxation By State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. Of this number, nine statesAlaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyomingdo not collect state income tax, including on Social Security income.

Out of the nine states that do not levy an income tax, New Hampshire still taxes dividend and interest income.

Below is a list of the 12 states that do levy a tax on Social Security benefits on top of the federal tax, with details on each states tax policy.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance

The Amish: A Sect Of American Citizens Opting Out Of Social Security And Medicare

The Amish, a religious sect, do not want to accept social security, medicare, or other government benefits. Most of them are not eligible to vote in the United States presidential election because they are Americans. To prove their identity, Amish people will need a baptism certificate, a letter from a family member, or an employer, and a directory where they can find their name and familys name. Woodworking and construction businesses, for example, have helped them raise funds. Some Amish people have a lot of money.

How Long Does It Take To Receive Social Security Disability Benefits

Its also important to note that the SSA is a large organization, housing many different departments which are usually not in sync. So, it makes total sense that you could receive a favorable decision and not receive payment for 30 to 120 days. It is also possible, but uncommon, to could get payment before you actually receive the decision.

Read Also: How To Amend Tax Return Turbotax

Do Social Security Recipients Need To File Taxes

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. If Social Security is your sole source of income, then you don’t need to file a tax return.

How Social Security Benefits Are Taxed

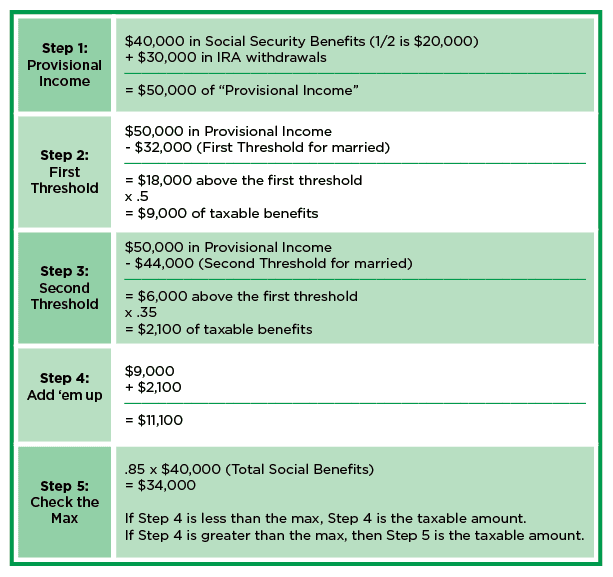

Social Security beneficiaries must pay federal income tax on a portion of their benefits if their income exceeds certain thresholds the portion of benefits that is taxable rises with income. Income for this purpose equals a taxpayers adjusted gross income plus tax-exempt interest, certain other tax-exempt income, and half of Social Security benefits this is referred to as modified AGI. A three-part formula applies:

- For individuals with modified AGI below $25,000 and couples with modified AGI below $32,000, no Social Security benefits are taxable.

- For individuals with modified AGI between $25,000 and $34,000 and couples with modified AGI between $32,000 and $44,000, up to 50 percent of benefits are taxable.

- For individuals with modified AGI over $34,000 and couples with modified AGI over $44,000, up to 85 percent of benefits are taxable.

For a detailed explanation of the tax calculation, see Appendix Table 1.

Also Check: How Is Property Tax Paid

When Does A Retiree’s Income Trigger Taxes

Retirees who are still working likely have at least two streams of income: Social Security benefits and a paycheck from a job. The Social Security benefits you receive can be taxable if 50% of your benefits, plus all of your other income, is greater than the specific limits for your filing status. These amounts are as follows:

-

Single filers, qualifying widowers and heads of households bringing in more than $25,000, based on the math above, may have to pay taxes on their Social Security benefits.

-

A married couple filing jointly bringing in more than $32,000, based on the math above, may have to pay taxes on their Social Security benefits.

With that, the benefits you receive may or may not be taxable based on your other income. For example, let’s say that you are a single filer that received $20,000 in Social Security benefits. Additionally, you earned $20,000 at a part-time job. When you run the numbers, 50% of your benefits plus your other income would be $30,000. With that, Uncle Sam would require you to pay federal taxes on a portion of your Social Security benefits.

As another example, let’s say a receives Social Security benefits of $20,000. You also bring in $20,000 through other sources. With that, 50% of your benefits plus your other income would be $30,000. That’s less than the base amount for married couples filing jointly. So, you wouldn’t have to pay federal income tax on any of your Social Security benefits.

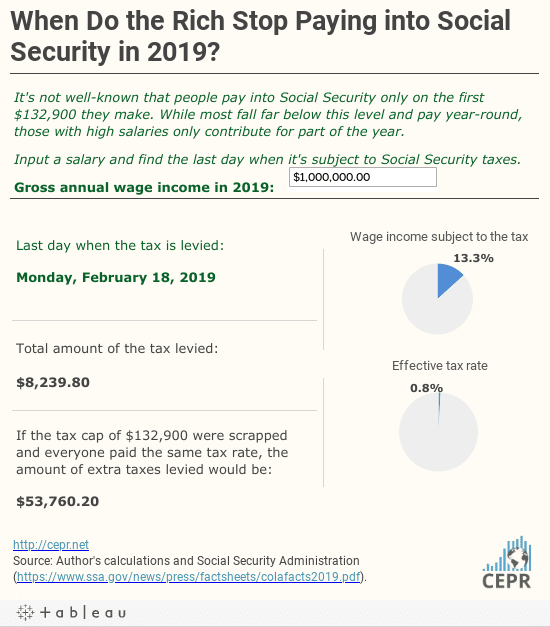

Social Security Tax Rates

Social Security functions much like a flat tax. Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800.

Half this tax is paid by the employee through payroll withholding. The other half is paid by the employer. So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employee’s wage earnings up to the maximum wage base, for a total of 12.4%.

This 12.4% figure does not include the Medicare tax, which is an additional 2.9% divided between employee and employer.

Recommended Reading: Corporate Tax Rate In India

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Uncle Sam Can Tax Up To 85% Of Your Social Security Benefits If You Have Other Sources Of Income Such As Earnings From Work Or Withdrawals From Tax

Getty Images

Many people are surprised to learn that Social Security benefits can be taxed. After all, why is the government sending you a payment one day and asking for some of it back the next? But if you take a closer look at how the federal tax on Social Security is calculated, you’ll see that many people actually don’t pay any tax on their Social Security benefits.

There’s no federal income tax on Social Security benefits for most people who only have income from Social Security. Thanks to the highest cost-of-living adjustment in 40 years, the average monthly Social Security check for a retired worker in 2022 is $1,658, which comes to $19,896 per year. That’s well below the minimum amount for taxability at the federal level.

On the other hand, if you do have other taxable income such as from a job, a pension or a traditional IRA then there’s a much better chance that Uncle Sam will take a 50% or 85% bite out of your Social Security check. Plus, depending on where you live, your state might tax a portion of your Social Security benefits, too.

payments sent by the Social Security Administration are not taxable.)

You May Like: Bexar County Tax Assessor Collector San Antonio Tx

Are States That Tax Social Security Benefits Worse For Retirees

Including Social Security benefits in taxable income doesnt make a state a more expensive place to retire. According to the Missouri Economic Research and Information Center, as of the third quarter of 2021, while four of the states that tax Social Security benefits have notably high cost-of-living index scores, the remaining eight fell within the two lowest-scoring groups. Kansas, in particular, had the second-lowest score in the U.S., after Mississippi.

The inverse is also true, as states that dont levy a Social Security tax arent inherently tax-friendlier places to live. When a state government doesnt garner income from one potentially taxable source, it typically makes up for it with other forms of taxation.

For instance, while Texas doesnt levy a state income tax at all , it relies heavily on taxes from a variety of other sources, including insurance taxes sin taxes on mixed beverages, tobacco products, and coin-operated machines and motor fuel taxes.

Other states that dont earn revenue from Social Security incomesuch as Arkansas, California, Louisiana, and New Yorkhave some of the highest income and/or sales tax rates in the U.S.

Living in a state that levies fewer taxes may be good for your budget, but it can limit the local governments ability to invest in social services that you or your loved ones may rely on, such as healthcare, infrastructure, and public transportation.

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Don’t Miss: Penalty For Missing Tax Deadline

Maximum Earnings Subject To Social Security Taxes Increased By $4200

Each year, the federal government sets a limit on the amount of earnings subject to Social Security tax. In 2022, the Social Security tax limit is $147,000 . The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2022 will be $9,114 .

Social Security recipients will also receive a slightly higher benefit payment in 2022. The cost-of-living adjustment was increased in October 2021 by 5.9% for 2022, compared with a 1.3% increase for 2021.

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Don’t Miss: When Are Tax Payments Due 2022

Taxing Social Security Benefits Is Sound Policy

Social Security beneficiaries with higher incomes pay income tax on part of their benefits. Those with incomes below $25,000 pay no tax on benefits, while those with the highest incomes pay tax on as much as 85 percent of their benefits. This arrangement is sound for several reasons:

- The substantial proceeds from taxing Social Security benefits are credited to the Social Security and Medicare trust funds, strengthening the programs financing.

- The taxation of benefits is broadly progressive, since people with low incomes pay nothing and the tax rate on benefits increases with income.

- As an earned benefit, Social Security should be subject to tax, like other earned benefits, such as employer pensions.

- Social Securitys tax treatment is more favorable than that of private defined-benefit pensions, primarily because of the protections for low-income beneficiaries.

Which States May Tax Student Loan Forgiveness

The following states could tax debt forgiveness under current laws, according to the nonprofit Tax Foundation.

Arkansas: The state tax code is silent on the treatment of student loan debt forgiveness, so the ordinary rule that a discharge of indebtedness constitutes taxable income should prevail absent state action, according to the Tax Foundation.

California: The Tax Foundation said California has confirmed that it will tax student loan debt discharge under current law. An existing law exempting student loans canceled pursuant to income-based repayment programs will not apply.

Indiana: The Indiana Department of Revenue confirmed in an email to the Associated Press this week that residents are required to list their forgiven loans as taxable income per Indiana law.

Minnesota: State law currently lacks any provision to exclude student loan debt cancellation from income, per the Tax Foundation.

Mississippi: State law considered discharged debt taxable income and is in line to tax student loan debt forgiveness, according to the Tax Foundation.

North Carolina: A state statute taxes student loan debt forgiveness, according to the Tax Foundation.

Wisconsin: State tax law would include debt forgiveness as taxable income. Wisconsinites who have their student loans forgiven by the federal government shouldn’t be penalized by having to pay more income taxes, a spokesperson for Democratic Gov. Tony Evers said in an emailed response to USA TODAY.

Read Also: How Old Do You Have To Be To File Taxes

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

Other Things To Watch Out For

While everyone likes to minimize their taxes, especially ones that you can avoid without too much legwork, its important that you keep things in perspective.

Tax strategy should be part of your overall financial planning, says Crane. Dont let tax strategy be the tail that wags the dog.

In other words, make the financial moves that maximize your after-tax income, but dont make minimizing taxes your only goal. After all, those who earn no income also pay no taxes but earning no income is not a sensible financial path. For example, it can be better to find ways to maximize your Social Security benefits rather than minimizing your taxes.

And it could be financially smart to first avoid some of the biggest Social Security blunders.

Dont forget that these rules apply to minimizing your tax at the federal level, but your state may tax your Social Security benefit. The laws differ by state, so its important to investigate how your state treats Social Security.

There really arent any tricks, you just have to be careful with your interest and dividends, says Paul Miller, CPA, of Miller & Company in the New York City area.

Don’t Miss: Are Funeral Expenses Tax Deductable

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.