Do You Have To Pay Taxes On Insurance Settlements

Most insurance settlements are considered taxable income by the IRS. This means that you will have to pay taxes on any money that you receive from an insurance settlement. There are a few exceptions to this rule, but they are rare. If you are unsure whether or not your insurance settlement is taxable, you should speak to a tax professional.

The tax implications of personal injury settlements should be carefully examined by an attorney and tax planning expert. The IRS has some extensive guidelines on what you must include in your tax return and whether you must pay taxes. Please contact us right away if you want a free case evaluation about whether or not your settlements with the taxing authorities are taxable. Personal injury settlements and awards are distinguished by a variety of line elements. Certain aspects of your award may be taxable, while others are not. Before signing any releases related to the settlement, you should consult with a tax professional. If youâre having a conversation with the insurance company, itâs a good idea to put the value of any potential taxes into perspective.

What Is Inheritance Tax

Inheritance Tax is a tax on the estate of the decease persons estate after all other debts and funeral expenses have been deducted.

IHT threshold and rates 2022-2023

Everyone in the 2021-22 tax year has a tax-free inheritance tax allowance of £325,000 This is usually referred to as the nil-rate band. The allowance has remained the same since 2010-11.

The standard inheritance tax rate is 40% of anything in your estate over the £325,000 threshold.

For example, Mr. Bob Worth left behind an estate worth £500,000, the tax bill will be £70,000 .

If the value of their estate is below £325,000 threshold theres normally no Inheritance Tax to pay however your personal legal presentative will still need to report it to HMRC.

For married couples or civil partners, they can leave more than this before paying tax.

From April 2017, you can also pay less inheritance tax if you’re leaving property to a family member. This could be your children or grandchildren. For the 2021-22 tax year, this new transferable allowance rose to £175,000, up from £150,000 in 2019-20.

When You Leave A Cash Value Policy

This one may not be a taxable issue, but still affects the beneficiary. The policy owner can borrow against the funds in a cash value policy. If you borrow against your policy and dont pay it back, the insurance company will deduct what you owe before they pay out the death benefit.

A cash value policy where paid premiums are greater than the amount permitted in order to maintain full income tax treatment is called a modified endowment contract . With an MEC, cash value distributions are first deducted from taxable gains, as opposed to distributions which are taken from non-taxable contributions. In other words, when a life insurance policy is determined to be an MEC, tax-free withdrawals are not available from the policys cash value.

Cash value policies can impact beneficiaries in other ways, including the following scenarios:

You May Like: Is Auto Insurance Tax Deductible

Is There A Penalty For Cashing Out Life Insurance

If you surrender a cash value life insurance policy, the only penalty is that you may have to pay a surrender fee. The life insurance company will deduct the surrender fee when it sends you the money. Check your policy to find out the fee, or ask your life insurance agent.

Surrendering a policy ends the life insurance coverage. A portion of the money you receive may be taxable if it includes investment gains.

Is Life Insurance Taxable

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read Also: Roth Vs Pre Tax 401k

The Life Insurance Payout Goes Into A Taxable Estate

Most life insurance payouts are made tax-free directly to life insurance beneficiaries. But if a beneficiary was not named, or is already deceased, where does the life insurance death benefit go? It goes into the estate of the insured person and can be taxable along with the rest of the estate.

This could create a significant tax bill, especially considering both federal and state estate taxes. While federal estates taxes will not tax the first $12.06 million per individual in 2022, state estate taxes can have significantly lower exemption levels.

Another possible unhappy scenario is that an estate is below the exemption level but a large life insurance payout into the estate pushes it above the exemption threshold into taxable territory.

This should all be avoidable by naming both primary and contingent life insurance beneficiaries, and keeping those selections up to date.

Are Life Insurance Proceeds Taxable

You may be wondering, Is life insurance taxable? The IRS states that proceeds from a life insurance policy are not generally considered gross income for the beneficiary. However, there are exceptions. For example, interest received by a beneficiary as a result of the insureds death should be reported as income. A beneficiary may also need to report some of the payout as taxable income if they receive it in exchange for cash or something else of valuable consideration, up to the total amount of what was expended.

There are some exceptions when you may have to pay tax:

You May Like: How To File An Extension Taxes

Are Insurance Proceeds For Property Damage Taxable

There is no universal answer to this question since tax laws vary from country to country. However, in general, insurance proceeds for property damage are not considered taxable income. This is because the insurance company is merely compensating the policyholder for an loss that has already occurred.

There is no taxable income from insurance settlements for property damage and personal injury. If the insurance payment exceeds the repair cost of the damaged property, you will only be liable for a taxable gain. As a result, the amount you receive is considered an adjustment to the propertyâs cost. You do not need to invest in the property to reap the benefits of its restoration. Physical injuries are not taxable as insurance settlements. If you deducted any amount from the settlement for medical expenses that were covered by insurance, you would be considered to be in the black. A question about taxes can be asked on Tax Talk by selecting it from the Ask the Experts option on the page.

Whats The Benefit Of Cash Value

The cash value piece of your whole life insurance will increase each year1 on a schedule guaranteed by the insurance company,2 allowing it to grow throughout your life. Its also likely to grow from annual dividend payments , if you buy the policy from a mutual whole life insurance company.3 As long as you pay the premium your coverage cant be cancelled for any reason. This could be a big plus when youre older. Even if you live a very long life, your beneficiaries will receive a guaranteed sum of money after youre gone.

Apart from the certainty that your loved ones will receive an income-tax-free sum of money , there are other benefits you get from a whole life insurance policy, including tax considerations.4

Recommended Reading: When Is An Estate Tax Return Required

There Are Unrelated People Involved In The Policy

Do you have to pay taxes on life insurance when it comes to unrelated people involved in the policy? Most of the time, individuals are buying a life insurance policy on themselves with the intent of providing for their named beneficiaries. In some circumstances, a policy may be sold or transferred, after the initial purchase, to a non-related third party. In this case, the new owner would most likely name a new beneficiary, themselves, or some other party, not related to the insured. Upon the death of the insured, instead of the death benefit passing to the beneficiary tax-free, the beneficiary would owe income taxes on any benefit amount exceeding the original purchase price + premiums paid by the unrelated party.

NOTE: Corporate key employees, partners, and business associates are considered related for the purpose of life insurance.

You Take Out A Loan Against The Cash Value

Cash value loans are tax-deferred, even if you borrow more than the policy basis. This means you can borrow against your life insurance policy, tax-free, as long as you repay it. However, if you fail to repay the loan, the tax implications can be severe.

Heres an example: Say your policy has $10,000 in cash value and the policy basis is $5,000, meaning youve paid $5,000 in premiums. If you take out a $9,000 loan, you dont have to pay taxes on the additional $4,000 as long as the policy is active. But as the loan accrues interest, the amount you owe can become greater than the cash value. At this point, you must repay the loan or the insurer can cancel the policy.

If the insurer cancels the policy, it typically uses cash value to repay the loan, and you pay tax on the amount that exceeds the policy basis. This is where you can run into trouble. Not only were you struggling to repay the loan, but youre now also hit with a big tax bill.

Note that if you die before paying off the loan, any amount you still owe is taken from the death benefit, which means your beneficiaries receive less money.

You May Like: How Much Is Inheritance Taxes

When You Profit From Surrendering Your Cash Value Policy

After buying a replacement term life policy, getting the payout from your cash value account, and then surrendering your permanent life policy, you may owe taxes. Bummer! If the amount you receive is more than what youve paid in fees and premiums over the life of the policy , youll need to report that amount as extra income. But take heartthis hardly ever happens.

Note: The order here is important. You never want to be even a moment without life insurance coverage. Dont worry if youre double-covered for a few days with both whole and term insurance. Make sure the term is in force before surrendering your whole life and receiving the cash value amount.

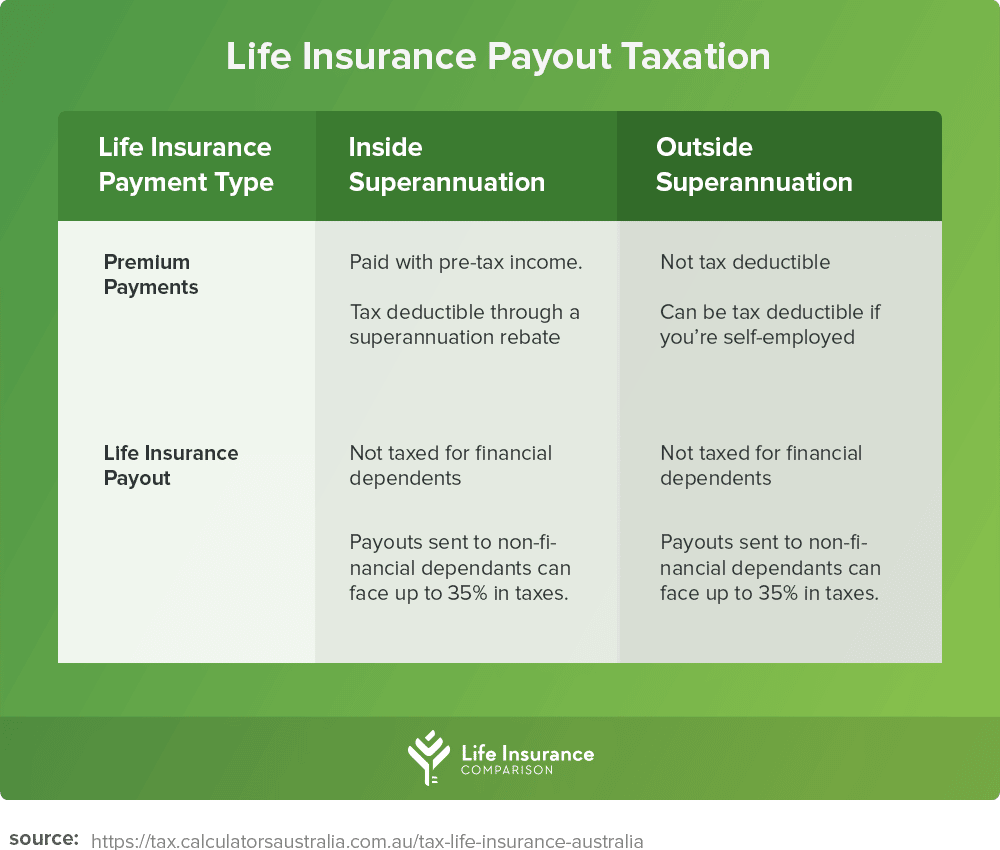

Is Life Insurance Tax Deductible When Obtained Through Of Superannuation

According to the ATO, the answer is no. Life insurance taken out via super funds is not tax deductible. However, there is an exception to be explored for those with a Self Managed Super Fund. If you have a Self Managed Super Fund, you may be able to tax deduct your life insurance premiums, and it is best to discuss your options with your accountant or financial adviser.

You May Like: Free Irs Approved Tax Preparation Courses

Using An Ownership Transfer To Avoid Taxation

Federal taxes won’t be due on many estates due to the Tax Cuts and Jobs Act of 2017, the exemption amount was increased to $11.7 million for 2021 and $12.06 million for 2022. Meanwhile, the maximum estate tax rate is capped at 40%.

Many of the changes enacted by the Tax Cuts and Jobs Act, including the higher federal estate tax exclusion, are currently set to expire at the end of 2025 unless Congress extends them.

For those estates that will owe taxes, whether life insurance proceeds are included as part of the taxable estate depends on the ownership of the policy at the time of the insured’s death. If you want your life insurance proceeds to avoid federal taxation, you’ll need to transfer ownership of your policy to another person or entity.

Here are a few guidelines to remember when considering an ownership transfer:

What To Do If Your Car Is Totaled In An Accident

An auto insurance policyâs total loss value is the cost of the carâs repairs, as well as the value your car loses due to an accident, as well as your rental reimbursement expenses. If you are the beneficiary of a car insurance policy and the car is totaled in an accident If you had a total loss of any other vehicle in the accident, your insurance company will compensate you for that loss, as well as pay for the total amount of damage.

Read Also: California Sales Tax By Zip Code

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Do Hsas Have Tax Implications

A health savings account is another savings account for your pre-tax dollars. As with a traditional IRA, your HSA contributions make your taxable income smaller. As long as you use the money for health-related expenses, you don’t have to pay taxes on it.

You might want to consider creating an HSA if you have an insurance plan with a high deductible and you want to put aside money for healthcare down the road.

There are always important things to think about when it comes to taxes, especially in preparing for your retirement and estate planning. Consider working with a tax professional to find the best strategy for your long-term needs.

Read Also: Small Business Income Tax Calculator

Regulations On Life Insurance Policy Ownership

The IRS has developed rules that help determine who owns a life insurance policy when an insured person dies. The primary regulation overseeing proper ownership is known in the financial world as the three-year rule, which states that any gifts of life insurance policies made within three years of death are still subject to federal estate tax. This applies to both a transfer of ownership to another individual and the establishment of an ILIT.

The IRS will also look for any incidents of ownership by the person who transfers the policy. In transferring the policy, the original owner must forfeit any legal rights to change beneficiaries, borrow against the policy, surrender, cancel the policy, or select beneficiary payment options.

Furthermore, the original owner must not pay the premiums to keep the policy in force. These actions are considered part of the ownership of the assets, and if any of them are carried out, they can negate the tax advantage of transferring them.

However, even if a policy transfer meets all of the requirements, some of the transferred assets may still be subject to taxation. If the policy’s current cash value exceeds the gift tax exclusion of $15,000 in 2021 and $16,000 in 2022, gift taxes will be assessed and due at the time of the original policyholder’s death.

What If You Already Spent The Money And Cant Pay The Taxes

If you spent the full amount of the cash surrender value without realizing youd owe taxes and dont have money to pay the taxes, the IRS will charge interest and failing to pay penalties until you pay the amount owed. If you cant pay in full, you may want to consider an installment agreement or other payment options.

Read Also: Sales Tax And Use Texas

When There Are More Than Two Parties Involved

The main parties involved in determining if your life insurance premium is taxable are the policy owner, the beneficiary, and the insured person. Usually, the policy owner and the insured person are one and the same. If this is the case, the policy is not taxable.

However, if a third person is involved, the beneficiary on the life insurance policy may be taxed. For example, say a mother buys her daughter a life insurance policy but names the father the beneficiary. In this instance, the father would be taxed.

Icipating Whole Life Insurance What You Must Know

The main draw of whole life insurance, besides it being a policy that never needs to be renewed, is how it functions as an investment with dividends. Typically, whole life insurance cash values grow at rates between 5%-8% for the duration of the policy. The investment mix is typically very stable one insurance company has returned a positive dividend for over 165 years straight! Its a great low-risk product that allows the policy owner a great deal of control and consistency.

So, what happens if you like the attributes of whole life insurance but dont want to pay for a policy for your entire life? You have the option of paying a little more on the premium in exchange for paying up the policy earlier.

As you can see, this is a fairly complicated insurance product. In order to maximize your investment, not cross the MTAR limit, and to have access to your cash reserves, it is vital to choose an advisor that understands all of this products many nuances.

Also Check: 1 Year Tax Return Mortgage