Can State Income Tax Rates Change

Yes, state legislatures can vote on income tax laws and they can be altered from tax year to tax year. For example, North Carolinas flat income tax was reduced from 5.49% in 2018 to 5.25% for 2019. Heres another example: Tennessee is phasing out its Hall Tax and will repeal its income tax completely beginning in 2022. Its important to keep up to date on state tax laws where you work and live so you know how they affect you.

North Carolina Income Tax

As a business owner, youll need to pay state income tax on any money you pay to yourself. These earnings flow through to your personal tax return. Youll be taxed at the state’s standard rate, and youll be able to apply regular allowances and deductions.Your employees will also need to pay North Carolina income tax.The North Carolina income tax rate is 5.25 percent, though this may change from year to year, so check with your accountant or tax preparer to ensure you pay the correct amount.

When And How Do I File My North Carolina Income Tax Return

If you file your return on a calendar year basis, the 2021 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or legal holiday, the return is due on or before the next business day. For example, in 2022, Emancipation Day, a legal holiday in the District of Columbia, will be observed on April 15, 2022. If your 2021 calendar year return is postmarked on or before April 18, 2022, your return is considered timely filed. (For more information on timely mailing North Carolina tax returns, see Directive TA-18-1.

You May Like: Sc State Tax Refund Status

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent.Speak to your accountant for more information.

Does Nc Have State Income Tax

North Carolina has a flat 4.99 percent individual income tax rate. North Carolina also has a 2.50 percent corporate income tax rate. North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.98 percent.

You May Like: How Much Is Bonus Tax

Nc Innocent Spouse Relief

In North Carolina, spouses are jointly and severally liable for the taxes that are due . However, a spouse will be allowed relief from a joint state income tax liability that is attributable to a substantial understatement by the other spouse if the spouse qualifies for innocent spouse relief of tax liability for federal tax due to the same substantial understatement by the other spouse under Internal Revenue Code Section 6015.

It is the only type of innocent spouse relief offered by North Carolina G.S. § 105-153.8.

There is no time limit specified by the North Carolina statute to file. In comparison, to qualify for innocent spouse relief under Internal Revenue Code Section 6015, taxpayers must file Form 8857 no later than two years after the first IRS attempt to collect the tax from the taxpayer that occurs after July 22, 1998.

Failure To Pay And File Tax Penalties

If a taxpayer doesnt pay or file their state income taxes in North Carolina, they may be subject to the following penalties:

- Failure to file penalties Returns filed after the due date are subject to a failure to file penalty of 5% of the net tax due for each month or part of a month that the return is late .

- Failure to pay penalties If a taxpayer fails to pay their tax on time, NC state will assess a late payment penalty of 10% of the tax not paid by the original due date. If the taxpayer files a timely extension, the penalty will only apply to the remaining balance due if the tax paid by the original due date is less than 90% of the total amount due. If the taxpayer paid at least 90% of the total tax due, DOR expects the taxpayer to pay the remaining balance before the expiration of the extension period to avoid late payment penalties. DOR will not assess the late payment penalty if the taxpayer pays the amount due with the amended return. The additional tax due is subject to the 10% late penalty if DOR does not receive the tax payment within 45 days of the assessment or a Request for Departmental Review is filed promptly.

Recommended Reading: What Do You Need To Do Your Taxes

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Do I Have To Pay Income Tax In North Carolina

You are required to file a North Carolina tax return if you receive income from North Carolina and you fall into one of the following categories:

- Resident: You have lived in North Carolina for more than 183 days during the taxable year.

- Part-Year Resident: You became a resident of North Carolina during the tax year or moved and became a resident of another state during the tax year.

- Nonresident: You did not live in North Carolina at any time during the tax year but received income from North Carolina sources.

Related: North Carolina Income Tax Calculator

Read Also: Roth Vs Pre Tax 401k

What Are The Filing Requirements For Part Year And Nonresidents

You must file a North Carolina income tax return if you received income while being a resident of NC or received income from NC sources.

If you had North Carolina income tax withheld but do not meet the filing requirements, you must file a North Carolina return in order to receive a refund for any withholdings.

Nc Installment Payment Agreement

North Carolina offers an Installment Payment Agreement. Many may also refer to it as a tax payment plan or installment agreement. With this option, if the taxpayer cannot pay the balance in full, they can pay it over time. The type of tax and the amount owed usually determine the duration of the Installment Payment Agreement. Taxpayers can find out more about NCs installment payment agreement here.

You May Like: How To File Taxes For 2020

Choosing Income Tax Withholding Preferences

To change your withholding, complete the following steps:

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

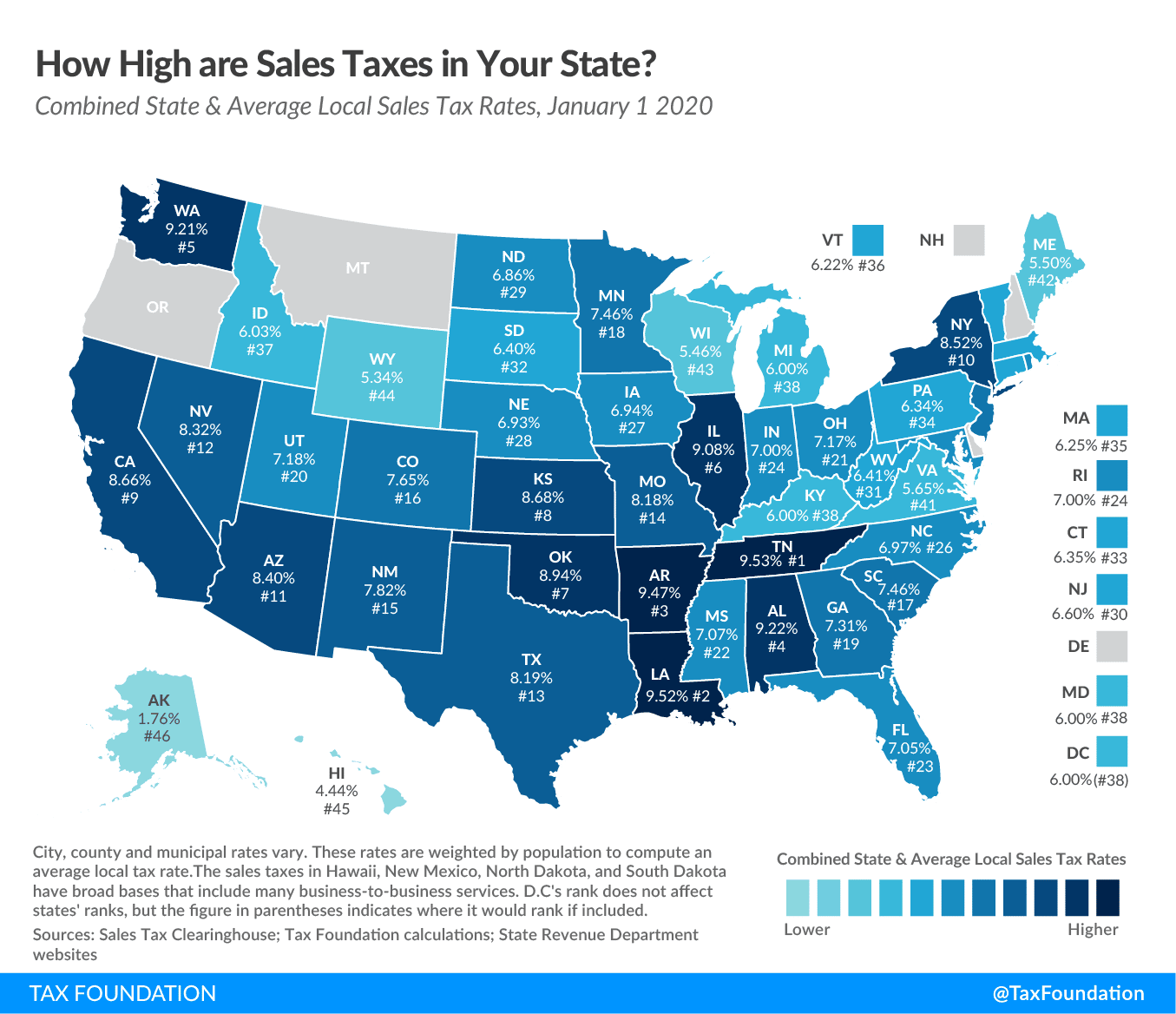

Sales taxes in the state are close to the national average. But, while the state doesn’t tax groceries, localities do.

Property taxes are on the low end, too. Plus, there are no estate or inheritance taxes in North Carolina, either. When you add it all up, North Carolina’s overall tax burden is generally in the middle when compared to other states.

Don’t Miss: Pay Federal Estimated Tax Online

Fraud Negligence Frivolous Tax Return Penalties

- Negligence penalties and Large tax deficiency If a taxpayer understates their taxable income, in an amount equal to 25% or more of gross income, the 25% large individual income tax deficiency or other large tax deficiency penalty will be assessed. If the taxpayer understates their income by less than 25%, a 10% negligence penalty may be applied. If the taxpayer had an accuracy penalty assessed for federal income tax purposes, DOR will assess the 10% negligence penalty for State income tax purposes, unless a larger deficiency penalty applies.

- Fraud If a taxpayer received a fraud penalty from the federal government and their state return was based on that fraudulent return, they will also be assessed a 50% fraud penalty for state purposes. If taxation authorities assess a fraud penalty, the state cannot also assess a taxpayer for negligence, large tax deficiency, or failure to file for that same deficiency.

- Frivolous return If a taxpayer files a frivolous return, the state may assess up to a $500 penalty. A frivolous tax return is one that both fails to provide sufficient information to permit a determination that the tax return is correct and positively indicates the tax return is incorrect and evidences the intent to delay, impede or negate the State or purports to adopt a position that lacks seriousness.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Recommended Reading: How Much Is Inheritance Taxes

Frequently Asked Questions About Income Tax And 1099 Forms

Yes. You can download your 1099R by logging into your ORBIT account.

If you have not set up your ORBIT account, you can do so by going to the ORBIT website and following the instructions on how to register. If you encounter problems while trying to register in ORBIT, click on the Help & Resources link at the top of the page. We have added How To videos and step-by-step guides to help members with ORBIT registration.

Although you will not be subject to federal income taxes again on any contributions for which you have already paid tax, you may exclude only a small portion of your previously taxed contributions each month throughout a time period specified by the federal government. The total amount of your contributions for which you have already paid federal tax is referred to as your federal tax base. The Retirement Systems Division computes the non-taxable portion of your monthly benefit by using the Internal Revenue Services Simplified General Rule. Under this method, your federal tax base is divided by a specified number, based on your option and your age at retirement, to determine the non-taxable amount of your monthly benefit.

| Table 1 – For Maximum Allowance and Option 4 |

|---|

| Your Age |

Who Must Pay North Carolina Income Tax

You must file a North Carolina income tax return if you received income while being a resident of NC or received income from NC sources. If you had North Carolina income tax withheld but do not meet the filing requirements, you must file a North Carolina return in order to receive a refund for any withholdings.

You May Like: States With Highest Sales Tax

North Carolina Set To Become The Newest 0% Corporate Income Tax Rate State

On November 18, 2021, Governor Roy Cooper signed the first state budget in several years into law. This $25.9 billion budget included numerous provisions, including pay raises for teachers and state employees, funding for broadband expansion, increases to individual income tax deductions and increases to a rainy day fund, among other important changes. Poole College of Management assistant professor of accounting, Nathan Goldman, explains the impact for North Carolina corporations.

One key provision in the budget was the gradual decline in state corporate income tax rates. Prior to the passage of the budget, North Carolinas corporate income tax rate was 2.5%, which was already the lowest in the country among states that collect corporate income taxes. However, this tax rate will decline gradually using the following schedule:

| Year | |

| 2030 and beyond | 0.00% |

North Carolina Retirement Taxes

From the Outer Banks to the Smoky Mountains, there are many wonderful places in North Carolina to settle down for your retirement. Whether you prefer sitting on the beach, hitting the links or exploring nature, there will be plenty of opportunities to do what you love in the Tar Heel State.

While North Carolinas retirement taxes arent quite as low as several other southeastern states, many retirees will find them acceptable. North Carolina exempts all Social Security retirement benefits from income taxes. Other forms of retirement income are taxed at the North Carolina flat income tax rate of 5.25%. Other taxes seniors and retirees in North Carolina may have to pay include the states sales and property taxes, both of which are moderate.

A financial advisor in North Carolina can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial planning – including taxes, homeownership, insurance and estate planning – to make sure you are preparing for the future.

Don’t Miss: What If I Already Paid Taxes On Unemployment

North Carolina Taxes For Retirees

What is it like to retire in the great state of North Carolina? For one, the weather is mild, making it an excellent destination for active retirees. The state also teems with natural beauty. But one of the most important factors regarding whether NC is a great retirement destination is its tax-friendliness and cost of living.

So, what exactly are North Carolinas taxes for retirees like? Read on to learn more about what to expect.

Paying Taxes Is A Part Of Life For Most Americans And While Everyone Is Subject To The Same Irs Tax Laws When They File Their Federal Tax Return Annually They Dont Necessarily Pay The Same State Income Taxes

Why? Where you live and work affects the state tax laws that apply to you. Some states dont have any income tax at all and you may be tempted to relocate to one thinking the move will reduce your overall tax obligation.

While the thought of living in a state where income taxes arent taken from your paycheck may be appealing to those who live in states where their income is taxed, theres usually a give and take. States may need to make up for a lack of income tax revenue in other ways. For example, some states have higher sales tax rates or rely on money from tourism to help fund budgets. Others have local taxes levied by municipalities or counties.

Before you consider a move to a state with no personal income tax, its important to know all the details and how they could impact you.

Keep in mind, just because you live in a state that doesnt have an income tax doesnt necessarily mean you wont file a state income tax return. If you live in one state and work in another, you may have to file an income tax return in the state where you earn your paycheck. Likewise, if you moved during the tax year and previously worked in a different state, youll likely need to file with that state. Its important to check each states tax laws to find out the details.

You May Like: Are Property Taxes Paid In Arrears

Where To Send Your North Carolina Tax Return

| Express Delivery |

You can save time and money by electronically filing your North Carolina income tax directly with the . Benefits of e-Filing your North Carolina tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

To e-file your North Carolina and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.