Tax Extension Filing Faqs

If you need more time to file your individual federal income tax return, you can request an automatic extension from the IRS using Form 4868. The filing deadline to request a tax extension is the same as filing your return, April 18, 2022.

A tax extension will give you an additional six months to file your taxes this years tax extension due date is Oct. 17, 2022.

No, a tax extension only gives you more time to file your return it doesnt give you extra time to pay any taxes you owe. You must pay your tax bill by the Tax Day deadline to avoid late payment penalties.

When you request a tax extension with Form 4868, you can estimate and pay your total tax liability for the tax year. To help estimate your potential tax liability, try to complete your return as much as possible, estimating wherever necessary.

Filing for an extension is an excellent option for many taxpayers who feel stressed about tax season or have other commitments on their plate and just need more time.

Requesting an extension from the IRS is also an easy process, and you dont need to give a compelling reason why you need more time to file. So long as you submit your extension request form on time and correctly, approval is typically automatic, and youre granted an extension.

The downside of filing a tax extension is that it only gives you more time to file, not more time to pay. As discussed in the last section, youll still need to estimate and pay any taxes you might owe by the tax filing deadline .

Today Is Last Day To File Income Tax Return For Ay 2023 Both Belated And Revised

In case if you have still not filed your income tax return or need to file a revised return for financial year 2022 , then December 31, 2022 is the last date for filing that return

If you have missed filing your income tax return for the financial year 2021-22 , till now, or need to file a revised return for the year, then you need to do it right away.

Some Important Things To Know About Belated Return

Compare Online Tax Filing Services

1 6 of 6

Can I mail my tax extension?

If you prefer to go the snail mail route, print and fill out your tax extension form, and drop it in the mail. Make sure you have proof that you mailed it. This way the IRS cant come back and claim they never received it.

Page four of Form 4868 lists several addresses to mail out your extension. The exact address depends on the state you live in and whether youre including a payment with your form.

Also Check: Capital Gains Tax On Cryptocurrency

When To File And Pay

You must file your return and pay any tax due:

Note: The due date may change if the IRS changes the due date of the federal return.

You must pay all Utah income taxes for the tax year by the due date. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. See

Utah does not require quarterly estimated tax payments. You can prepay at any time at tap.utah.gov, or by mailing your payment with form TC-546, Individual Income Tax Prepayment Coupon.

You May Like: How To File Free Taxes

Extension Of Time To File

An extension of time to file a return may be requested on or before the due date of the return. The extension is limited to six months. You may receive another 6-month extension if you are living or traveling outside the U.S. You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.

Extensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Complete the Military Combat Zone on your Extension of Time to File, FR-127.

Note: Copies of a federal request for extension of time to file are not acceptable.The extension of time to file is not an extension of time to pay. Full payment of any tax liability, less credits, is due with the extension request. If the tax liability is not paid in full with the extension, the request for an extension will not be accepted, and the taxpayer will be subject to a failure-to-pay penalty and interest on any tax due.

Recommended Reading: Where Do I Mail My State Tax Return

Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

How To Get An Automatic 6 Month Tax Extension

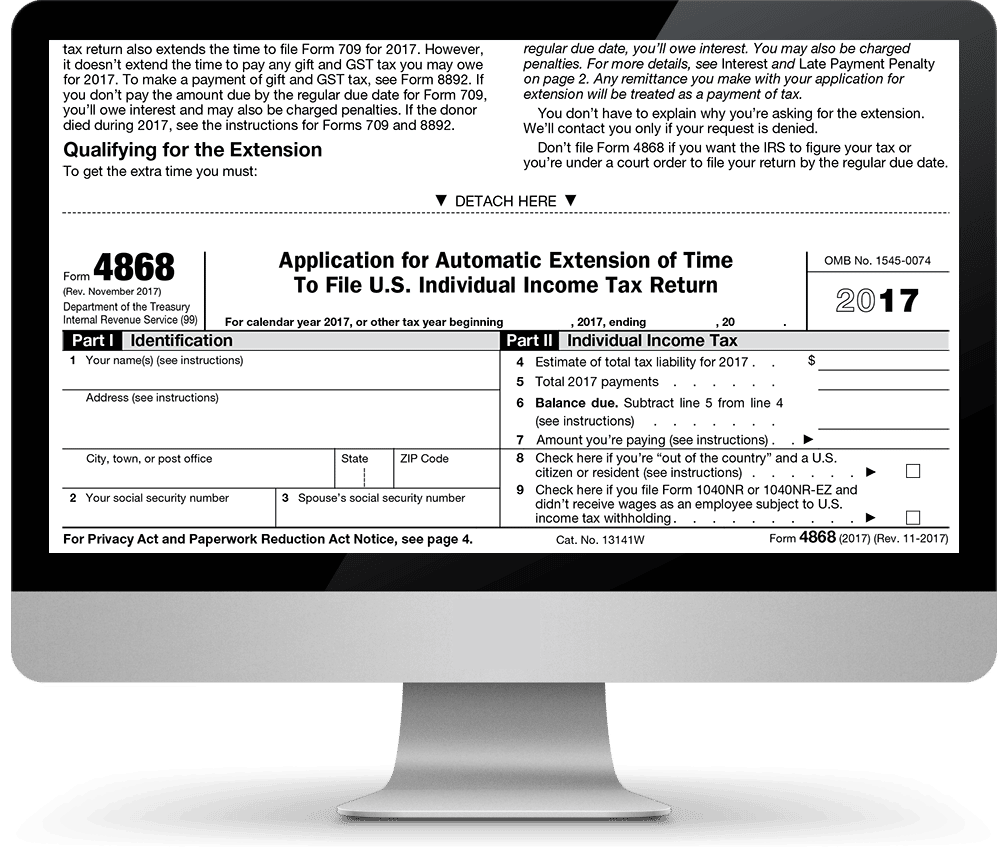

If you are a U.S. Citizen who owes taxes you can file the IRS Form 4868 to ask for a six-month tax extension. This is an automatic approval process. You will need to download the IRS Form 4868 from the government, but you dont need to use any paid services. Well show you how to file a tax extension from your computer, iPhone, iPad or Android device.

If you want to skip the manual process of downloading and filling out the IRS Form 4868 you can use an app to e-File your tax extension. Youll need to pay for this option when it is available. At this stage, the app isnt updated for 2017.

You may want to e-file IRS Form 4868 if you miss the deadline to mail your taxes to the IRS. The app allows users to e-File a tax extension up until midnight on April 18, 2016.

If you are comfortable filling out the form and mailing it to the IRS, you can save yourself a dollar and get started with the directions below. Make sure you fill out the IRS Form 4868 for 2016 taxes and include the estimated amount to pay if you own taxes. Jump down below to figure out how much you need to pay.

1. Download the IRS Form 4868 for 2016 taxes

2. Fill it out on a computer and print it out.

Fill out the short and easy IRS Form 4868 to get an automatic tax extension

3. To file an IRS Tax Form 4868 on iPad, iPhone or Android you need the Adobe Reader App.

4. Print the IRS Form 4868 and mail it to the IRS. Make sure it is postmarked by April 18, 2017.

Also Check: What Is Tax Filing Deadline

How Do I File A Tax Extension

You can get a tax extension electronically or via mail. You should request an extension on or before the to avoid a late-filing penalty from the IRS.

If you dont plan to use tax software or havent decided which software to use, consider IRS Free File. The IRS partners with a nonprofit organization called the Free File Alliance to provide people who make less than $73,000 of adjusted gross income access to free, name-brand tax-prep software. Anybody even people above the income threshold can go there to file an extension online.

If youre planning to use tax software, make sure your provider supports Form 4868 for tax extensions. Most do. You can simply follow the programs instructions and see how to file a tax extension electronically that way. The IRS will send you an electronic acknowledgment when you submit the form.

|

Donât Miss: Do I Need To File Income Tax Return

Get An Extension When You Make A Payment

You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System , or a . This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

Read Also: How To Become Tax Preparer

Easy Options For Filing An Extension

Option 1: E-file your federal tax extension in minutes withTurboTax Easy Extension

Using TurboTax Easy Extension, you can:

- E-file your federal extension

- Make a payment of any tax due directly from your checking or savings account

- Print a PDF copy of your e-filed extension

- Receive notifications when your extension has been accepted by the IRS

- Get easy instructions on how to file a state extension by mail

Note: Once your extension is approved, youll have until October 16, 2023 to file your return. If youre expecting a refund, it will not be processed until once you have completed your tax filing. If you think you owe, the estimated amount of taxes due will need to be paid to the IRS by the April tax return filing due date.

Option 2: Print and mail your completed IRS extension form

If youd rather mail your extension directly to the IRS, simply refer to IRS Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, complete and print the form, and send it to the IRS address for your state.

If you owe federal taxes, include your estimated payment with your Form 4868 and mail itpostmarked by April 18, 2023 to avoid any penalties or interest. Then complete and file your return on or before October 16, 2023.

You May Like: Can I Get My Tax Refund On Cash App

How To File A Claim For Refund

California Department of Tax and Fee Administration publication 117, Filing a Claim for Refund, details the general requirements for filing a claim for refund and includes form CDTFA-101, Claim for Refund or Credit, and instructions. Mail claims to:

The Fuel Tax programs also have some special requirements not included in publication 117. Be sure to review the Program Specific Guidelines and Procedures for the individual Fuel Tax programs to ensure you include all required information with your claim for refund.

You May Like: Are Real Estate Taxes The Same As Property Taxes

How To File A Tax Extension By Mail

The process for filing a tax extension by mail is the same as filing online, except youll need to submit a hard copy of the required form. Heres how:

Obtain and fill out IRS extension Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Mail your completed tax extension form for 2020 to the IRS using the correct address for your location you can find it on page 4 of Form 4868.

Once youve filed your completed tax extension form, youll automatically get the five-month extension to file your 2020 tax return, provided you meet the qualifying criteria.

Its possible to get the automatic extension for an individual tax return without filing the IRS 4868 tax form. To do this, pay all or part of your estimated income taxes that are due. You must provide relevant tax information and indicate that the payment is for a tax-filing extension using one of the IRS-approved methods of payment. Youll then receive a confirmation number for your records.

Dont Miss: Www Michigan Gov Collectionseservice

Cant Pay Still File For A Tax Extension

Even if you cant pay the tax, file for an extension. The combined penalty for failure to file taxes and failure to pay taxes is 5 percent of the amount you owe. The penalty for late payment is just 0.5 percent of the amount you owe per month, plus interest on the amount you owe.

If youre unable to pay taxes because of financial hardship, you can ask the IRS for an installment payment plan. In most cases, you can arrange one online with the Online Payment Application tool.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplingers Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. WaggonersUSA Todayinvesting column ran in dozens of newspapers for 25 years.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Read Also: What Will My Tax Return Be

Submit Georgia Form It

You must mail Form IT-303 before the statutory return due date and attach a copy to the return when filed. We will notify you only if your extension request is denied.

An extension to file cannot exceed 6 months and does not extend the date for paying the tax.

Tax must be mailed, along with Form IT-560, by the statutory due date for filing the return to avoid late payment penalty and interest. The amount paid should be entered on Form 500, Page 2, Line 20.

Dependent Care And Child Tax Credits

If you have children, you may qualify for the child tax credit, which is $2,000 per qualifying child. And if your child tax credit amount exceeds your tax obligation for the year, you may be able to claim the Additional Child Tax Credit of $1,400 per qualifying child.

If you had to pay someone to watch your child or other dependent while you looked for work, you may also be able to claim the nonrefundable child and dependent care tax credit. For 2019 taxes, the amount of credit is between 20% and 35% of allowable expenses, which maxes out at $3,000 for one qualifying person or dependent, or $6,000 for two or more qualifying persons or dependents.

The percentage is based on your adjusted gross income, and you must have earned income in order to claim the credit. This means that if your only source of income in a year was unearned from unemployment benefits, for example you would not be eligible to claim this credit.

You May Like: How Long Receive Tax Refund

Read Also: Is Mortgage Interest Tax Deductible In 2021

Heres How Taxpayers Can File An Extension For More Time To File Their Federal Taxes

IRS Tax Tip 2019-41, April 15, 2019

Taxpayers needing more time to file their taxes can get an automatic six-month extension from the IRS. For most taxpayers, this years tax-filing deadline is today, April 15. Taxpayers who live in Maine or Massachusetts have until April 17, 2019 to file their returns. This is because of the Patriots Day holiday on April 15 in those two states, and also because the Emancipation Day holiday on April 16 in the District of Columbia.

There are a few different ways taxpayers can file for an extension.

Here are a couple things for people filing an extension to remember:

- More time to file is not more time to pay. An extension to file gives taxpayers more time to file their return, but not more time to pay their taxes. Taxpayers should estimate and pay any owed taxes by the April deadline to help avoid possible penalties.

- The IRS can help. The IRS offers payment options for taxpayers who cant pay all the tax they owe. In most cases, they can apply for an installment agreement with the Online Payment Agreement application on IRS.gov. They may also file Form 9465, Installment Agreement Request. The IRS will work with taxpayers who cant make payments because of financial hardship.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To File Quarterly Taxes

Pros And Cons Of Filing An Extension

You might not have a choice under some circumstances. Having extra time to finish your return is often necessary if youre still waiting for tax documents to arrive in the mail or if you need additional time to organize your deductions. However, there are both pros and cons involved with filing for an extension.

-

Fund a Self-Employed Retirement Plan

-

Take Extra Time To Make Elections

-

Improve the Accuracy of Your Return

-

Reduce Your Tax Preparation Fees

-

You Wont Gain Extra Time To Fund an IRA

-

You Cant Switch From Married Filing Jointly to Separately After April 15

-

The Mark-to-Market Election for Professional Traders Doesnt Advance

-

You Might Confuse the IRS

-

You Cant Recharacterize an IRA Contribution

Is It Easy To File A Tax Extension

Yes, securing an extension is a fairly straightforward process. All you need to do is get Form 4868, fill it out, and then send it off to the IRS, either electronically or by post, before the deadline. The form itself isnât very long, although coming up with an estimate of your total tax liability in the tax year can sometimes be tricky.

Read Also: How To File Taxes For 2 States

You May Like: How To Get My Tax Return From Last Year