How Do I Claim The Credit

For those who are married filing jointly, have 3 or more children, and made under $56,844 you probably qualify for this tax credit.

You can claim the Earned Income Tax Credit if your income meets the table requirements.

The credit decreases all federal income tax you currently owe, dollar-for-dollar. If the credit totally wipes out your tax bill and some credit remains, you will get a cash tax refund for the outstanding amount.

What Is The Earned Income Tax Credit

The federal Earned Income Tax Credit helps low- to moderate-income workers and families get a tax break.

If you qualify for the EITC, you can use the tax credit to reduce the taxes you owe and maybe increase your refund.

The tax break is based on wages, salaries, tips, and other pay, as well as earnings from self-employment.

Therefore, to be eligible, you have to be earning some form of income either from a job or from self-employment.

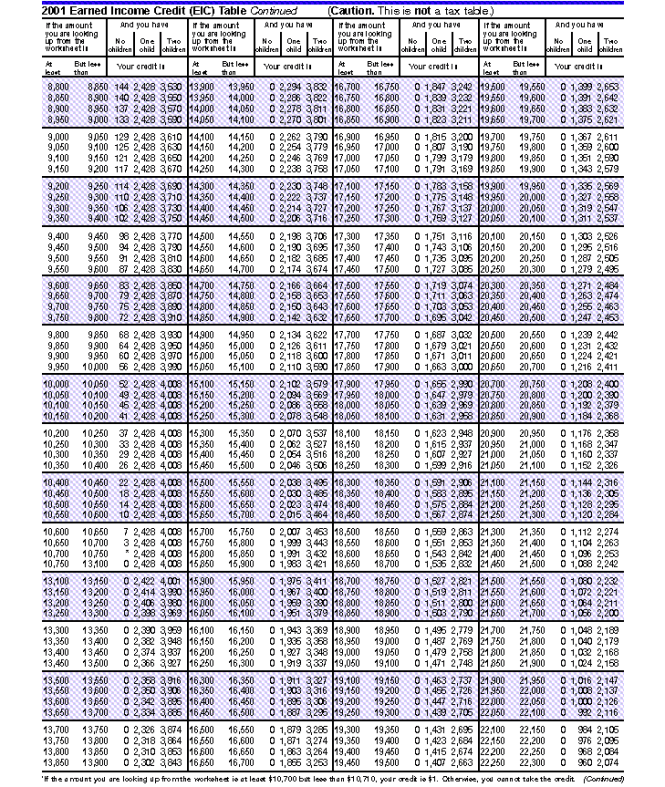

What Is The Earned Income Credit Table For 2022

The Earned Income Credit Table for 2022 is a table that shows the amount of money that a person can receive from the government based on their earned income. The table is updated every year to reflect changes in the cost of living. The Earned Income Credit Table for 2022 is available online and can be found in the IRS Publication 596.

The earned income credit table for 2022 is a great way to get an idea of how much you could potentially receive back in taxes. The EITC is a refundable tax credit for low- and moderate-income working taxpayers. For the tax year 2020, the credit was worth up to $6, 660 for taxpayers with three or more qualifying children.

Recommended Reading: How To Avoid Capital Gains Tax On Stock

Who Qualifies For The Earned Income Credit

To begin with, you must meet the requirements. After that, your earnings must be within indicated limits. Lastly, for those who have at least one child, they must qualify too in order to get a bigger credit. Once you pass all of these checks, you can get a credit of up to $6,660 based on your earnings as well as the number of children you have.

- You have dependents.

- You do not have an eligible child, however you and your husband or wife are between 25 and 65, not the dependents of other people, and you have resided in the USA for over 6 months.

Do I Have To Have A Child To Qualify For The Eic

No, you can qualify for the EIC without a qualifying child if your earned income is less than $21,430 and either:

-

You are at least age 19,

-

You are a specified student and are at least age 24, or

-

You are a qualified former foster youth or a qualified homeless youth and are at least age 18.

See chapter 3.

Don’t Miss: Illinois State Sales Tax Rate 2021

Understanding The Earned Income Tax Credit

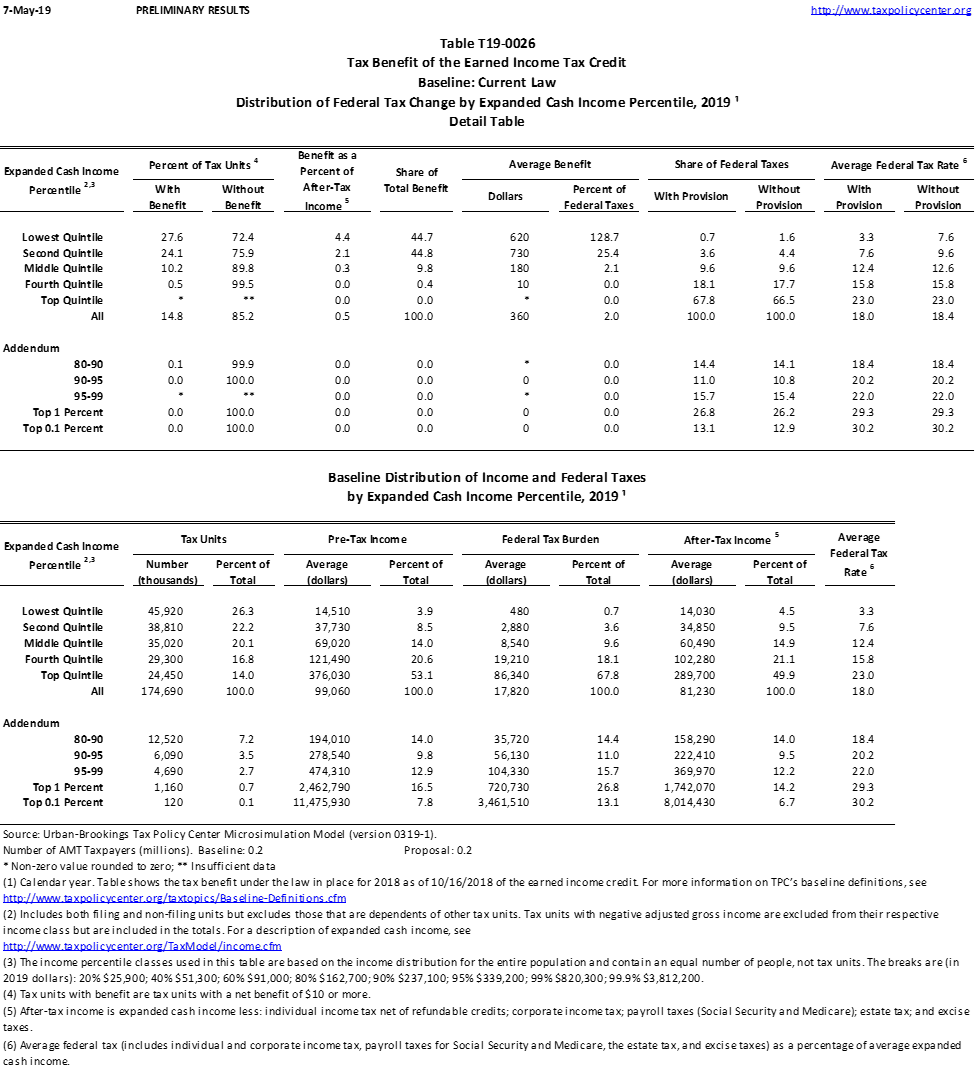

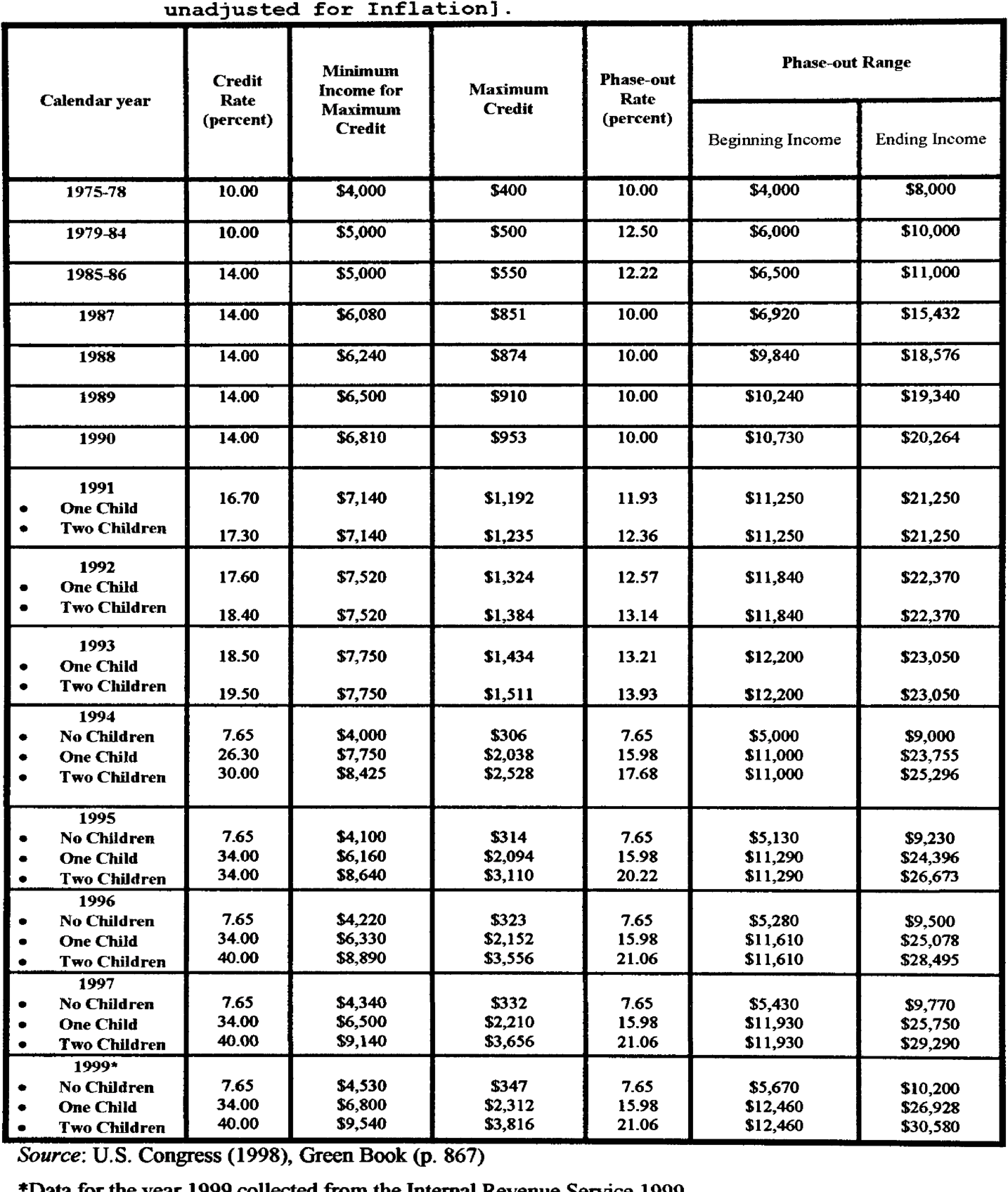

The earned income tax credit , also called the earned income credit , was conceived as a work bonus plan to supplement the wages of low-income workers and help offset the effect of Social Security taxes.It continues to be viewed as an anti-poverty tax benefit.

The EITC is available only to taxpayers with low or moderate earnings, whether or not they have qualifying dependents. To claim the credit for 2021, an individual taxpayer with no qualifying dependents must be at least 19 years old and must live in the United States for more than half of the tax year.

Generally, for 2021, qualifying dependents include dependent children who are under age 19, students under age 24, or dependents with a disability. The credit percentage, earnings cap, and credit amount vary according to a taxpayers filing status and number of dependents. These factors also determine the income phaseout range over which the credit diminishes to zero. No credit is allowed above the ceiling for the phaseout range.

Because many taxpayers 2021 incomes were lower than their 2019 incomes due to the economic crisis, the EITC claimed on 2021 tax returns can be based on 2019 earnings if those earnings are higher.

Eitc Tax Credit Table Age Investment & Other Limits For 2022 & 2023

| Particulars | |

| But BBBA relaxed this criteria > 19 years for most workers> 24 years for part-time students> 18 years for former foster youth and homeless youth | 25 years |

| No Restriction* | 64 Years |

| $10,600 | $11,000 |

The genral rule on age of the low income earner is that the minimum age should be 25 and maximum age of the claimant is 64 years. The ARPA or American Rescue Plan Act relaxed the age for tax year 2021 . This was extended to year 2022 through BBBA .

You May Like: Rv Sales Tax By State

Earned Income Credit Opportunities And Regulations

Depending upon your status, as a taxpayer, you are entitled to additional income tax benefits offered statewide as well. Check with your states Department of Revenue to see how your low-income status could help you qualify for additional programs. In addition, some programs can increase your income quickly during tax time when youll need it the most.

An Earned Income Tax Credit regulation to be aware of is falsifying information provided when filing for the earned income tax credit. Earned Income Tax Credit fraud has raised suspicion lately. Unfortunately, the existing schemes make it hard for those truly in need of the credit. If a tax filer is caught falsifying information, a fine and other penalties would be imposed.

There are, of course, many times where errors occur completing the Earned Income Tax Credit portion of the federal tax return. The rules are so complex its understandable why.

If the credit claimed is found to be unjustified or claimed in error, the IRS has the power to lower any penalties. Contrary to popular belief, the IRS is human-operated and realizes human errors happen. However, the filing instructions are quite complex and lengthy, making it difficult to comprehend, even for professional tax preparers, especially first-time tax filers.

How Much Can I Earn And Still Qualify

This credit is targeted at households with modest incomes, so if you earn “too much” you may not qualify. Just how much can you earn and still qualify? It depends on how many qualifying children you have . Those with the lowest income qualify for the biggest credits. Those with incomes above the phase-out threshold qualify for lower credits until they reach the point where the credit is eliminated completely. The rules have been liberalized to result in higher credits for many households, especially those with three or more qualifying children. The following table shows the 2022 income limits for receiving credits and the maximum 2022 credit amounts.

| If you have: | Your earned income must be less than: | Your maximum credit will be: |

|---|---|---|

| No qualifying children | $16,480 | $560 |

| $43,492 | $3,733 | |

| 2 or more qualifying children | $49,399 | $6,164 |

| 3 or more qualifying children | $53,057 | $6,935 |

Don’t Miss: Are 2022 Tax Forms Available

Does My Child Qualify

To be eligible, the child has to be:

- Your son, daughter, stepchild, adopted child, or a descendant.

- Your foster child was transferred to you by an official agency or court ruling.

- Your brother, sister, stepbrother, stepsister, or a descendant of one of them.

- Age 18 or under as of the years end . Exclusion: An individual that is irreversibly and completely handicapped at any time throughout the year is eligible, irrespective of their age.

- A resident living with you in the USA for over 6 months.

Using 2019 Income Levels For 2020 And 2021 Eitc Eligibility

Note that for 2020 tax filings in 2021, Congress passed legislation in multiple COVID relief bills that allows you to use 2019 income levels to apply for the EITC in your 2020 return and 2021 return.

This is to address the pandemic driven economic slowdown and job or income losses for taxpayers who may not have qualified for the EITC if their 2020 or 2021 income was used to figure their EITC. Tax software providers like TurboTax have updated their software to account for this change.

Earned Income Tax Credit Relief : If your earned income was higher in 2019 than in 2020 or 2021, you can use the 2019 amount to figure your EITC for 2020 and 2021. This temporary relief would allow tax payers to qualify or get a potentially larger refund in their 2020 and 2021 tax filings.

Also Check: Penalty For Missing Tax Deadline

Types Of Earned Income

- Wages, salary or tips where federal income taxes are withheld on Form W-2, box 1

- Income from a job where your employer didnt withhold tax including:

- Driving a car for booked rides or deliveries

- Running errands or doing tasks

- Selling goods online

- Providing creative or professional services

- Providing other temporary, on-demand or freelance work

Earned income does not include:

- Pay you got for work when you were an inmate in a penal institution

- Interest and dividends

- Investment income you can make

Do I Qualify For The Earned Income Tax Credit

A tax credit is one of the quickest ways to reduce tax liability its a direct reduction of the amount of tax owed. To qualify for the IRS earned income credit, you must have earned income during the year. Heres what else you need to do in order to qualify:

- Your investment income for the year cannot exceed $3,650.

- You cannot file Form 2555, Foreign Earned Income.

- Your filing status must not be married filing separately.

- You must be a U.S. citizen or resident alien all year.

- Neither your earned income nor your AGI can be higher than the limit for your filing status.

In addition, you, your spouse if married and any qualifying child you claim must have a valid Social Security number that was issued before the due date for filing your tax return, including any tax extensions for which you qualify.

Dont Forget: All the New Numbers You Need To Know for Planning Ahead on Taxes

Read Also: How To Report Coinbase On Taxes

Figuring And Claiming The Eic

You must meet one more rule to claim the EIC.

You need to know the amount of your earned income to see if you meet the rule in this chapter. You also need to know that amount to figure your EIC.

Rule 15Earned Income Limits

Your earned income must be less than:

-

$51,464 if you have three or more qualifying children who have valid SSNs,

-

$47,915 if you have two qualifying children who have valid SSNs,

-

$42,158 if you have one qualifying child who has a valid SSN, or

-

$21,430 if you don’t have a qualifying child who has a valid SSN.

Earned Income

Earned income generally means wages, salaries, tips, other taxable employee pay, and net earnings from self-employment. Employee pay is earned income only if it is taxable. Nontaxable employee pay, such as certain dependent care benefits and adoption benefits, isn’t earned income. But there is an exception for nontaxable combat pay, which you can choose to include in earned income. Earned income is explained in detail in Rule 7 in chapter 1.

Election to use prior-year earned income.

You can elect to use your 2019 earned income to figure your 2021 earned income credit if your 2019 earned income is more than your 2021 earned income. To make this election, enter the amount of your 2019 earned income on Form 1040 or 1040-SR, line 27c.

.You can’t use your 2020 earned income instead of your 2021 earned income. You can only use your 2019 earned income if it is more than your 2021 earned income..

Figuring earned income.

Clergy.

Church employees.

Is A Rollover From One Account To Another Considered A Distribution

Yes. When funds are removed from an account to complete a rollover, that removal of funds is considered a distribution. The repayment penalty will apply if funds are removed from a VHEIP account and rolled over to an out-of-state account. Vermont does not have a penalty exception for rollovers to out-of-state accounts. On the other hand, if funds are rolled over to a VHEIP account from an out-of-state account, the contribution to the VHEIP account will qualify for Vermonts VHEIP tax credit.

Recommended Reading: How Much Is Capital Gains Tax On Crypto

When You Will Get Your Refund

The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Where’s My Refund? or the IRS2Go mobile app to check your refund status.

What Is An Approved Postsecondary Education Institution

Any postsecondary education institution that is one of the following:

- Accredited by an accrediting agency approved by the U.S. Secretary of Education pursuant to the Higher Education Act

- A non-U.S. institution approved by the United States Secretary of Education as eligible for use of education loans made under Title IV of the Higher Education Act

- Is a college, university, vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the Department of Education.

Also Check: State Withholding Tax Table 2021

Question 5 All Taxpayers: Do Any Of The Following Situations Apply To You

- Yes – If you answer “Yes” to any of following questions, then you do not qualify for the Expanded COEITC.

- Is your filing status married filing separately?

- Are you treated as a nonresident alien for any part of this tax year?

- Are you the qualifying child of another person who is required to file a return or who files a return to claim a tax benefit?

- Are you filing Federal Form 2555 or Federal Form 2555-EZ?

Does My Child Qualify For The Eitc

Here are the requirements you must meet in order for a child to qualify to be claimed for EITC.

Relationship

If you claim one or more children as part of your earned income credit, your child must be your:

- Son, daughter, stepchild, adopted child, or foster child

- Brother, sister, half-brother, half-sister, stepsister, or stepbrother

- Grandchild, niece, or nephew

There are also special rules for Adopted and Foster Children.

Age

The child must be under 19, under 24 if a full-time student or any age if totally and permanently disabled.

Residency

The taxpayer and qualifying child must live in the same home for more than half of the year. That means more than six months or 183+ days.

Additionally, the residence must be in the 50 U.S. states and the District of Columbia.

Also, the taxpayer claiming the EITC must be a citizen or resident of the U.S. and cannot be a non-resident alien.

Read Also: How Much Medicare Tax Is Withheld

Quick Facts About Eitc

Here are some quick facts about EITC from the National Conference of State Legislatures .

- The federal government, 34 states, the District of Columbia, Guam, Puerto Rico, and some municipalities have EITCs.

- The federal EITC has been in place since 1975, and Rhode Island enacted the first state EITC in 1986.

- More than 25 million eligible tax filers received almost $60 billion in federal EITC during the 2020 tax year.

- The average EITC amount received per tax filer was $2,411 during the 2020 tax year.

- Workers must file tax returns to receive the credit.An estimated 20% of eligible workers do not claim EITC.

What Are The Rules For Claiming A Child For Eitc

If you claim one or more children as part of your earned income credit, your child must be your:

- Son, daughter, stepchild, adopted child, or foster child

- Brother, sister, half-brother, half-sister, stepsister, or stepbrother

- Grandchild, niece, or nephew

An adopted child is a child who is lawfully placed with you for legal adoption.

Read Also: Long-term Hotel Stay Tax Exempt

What Income Is Excluded From Eitc

Certain forms of income are not considered earned income for the purpose of the EITC.

These include pension and annuity income, the income of nonresident aliens not from a U.S. business, income earned while incarcerated for work in a prison, and TANF benefits paid in exchange for participation in work experience or community service activities.

Also, taxpayers who claim the foreign earned income exclusion those that file Form 2555 or Form 2555EZ with their federal income tax return are ineligible to claim the EITC.

Earned Income Tax Credit Table

To qualify for the EITC for the 2021 tax year must meet the income limit requirements, in addition to the other eligibility rules.

Below are the EITC Income Limits for the 2021 Tax Year, otherwise known as the Earned Income Tax Table.

This applies to taxes due in April 2022.

| Federal EITC 2021 Income Limits |

| Number of Children |

Here are the most frequently asked questions about the Earned Income Tax Credit Table.

Don’t Miss: How To File Taxes For 2020

About The Expanded Coeitc

The Expanded Colorado Earned Income Tax Credit for ITIN Filers is a new credit and is available for the 2020 tax year. If you could not claim the Federal Earned Income Tax Credit , then you may qualify for the Expanded COEITC. This credit would apply to you if you, your spouse, and/or your child or children have an Individual Taxpayer Identification Number or a Social Security Number that is not valid for employment.

If you and everyone in your household have a work-eligible Social Security Number , meaning you can use your SSN to obtain employment, then visit the EITC for SSN Filers web page to see if you are eligible for the Federal Earned Income Tax Credit.

To claim the Expanded COEITC you must be a Colorado resident. This means that you were domiciled in Colorado or had a permanent home in Colorado where you spent more than six months of the tax year. Other requirements and limits apply to the Expanded COEITC. Before you claim this credit, be sure to complete the eligibility checklist at below.

If the checklist below says you are eligible, then complete the DR 0104TN form to calculate your earned income and the federal EITC that you would have qualified for if you had a work-eligible SSN. For more information, visit the DR0104TN Information web page.