Irs Postpones Due Date For Filing And Payment Of Federal Estate Taxes Expands Extension Of Other Filing Deadlines

The Internal Revenue Service has announced that the due date for certain taxpayers filing Form 706, United States Estate Tax Return, and/or making payments of federal estate and generation skipping transfer tax is automatically extended until July 15, 2020. Ordinarily such filings and payments are due nine months after the date of death of a decedent. If the due date for filing the estate tax return and/or paying estate tax falls on or after April 1, 2020 and before July 15, 2020 , Notice 2020-23 automatically extends the due date for filing and/or payment until July 15, 2020. No interest or penalties will be imposed during the postponement period.

If the original due date that is nine months after the decedents date of death falls during the postponement period, a taxpayer may file Form 4768 by July 15, 2020 in order to obtain an extension of time to file Form 706 to the date that is six months after the original nine month due date. However, the payment of federal estate and generation-skipping tax will still be due by July 15, 2020.

Notice 2020-23 also broadly expands the relief provided in prior IRS Notices by extending the due date to July 15, 2020 for most filings, payments, and time-sensitive tax elections and actions that otherwise would be due during the postponement period. This includes relief of the following:

Extension of these additional filings beyond July 15, 2020 does not extend the due date for any resulting payment due beyond July 15, 2020.

Individual Income Tax Return

The first step is to file the decedents final income tax return for the year of his or her death. This return includes income earned by the decedent from January 1 through the date of death. The return is due by April 15 in the year after the decedent died. For example, if your father died on November 30, 2020, his final income tax return would be due on April 15, 2021. The return can be filed by itself, or jointly with a surviving spouse.

Dc Estate Inheritance And Fiduciary Tax Returns

Frequently asked questions about Estate, Fiduciary and Inheritance taxes are listed below. For additional information, call 478-9146.

DC Estate Taxes

What is an estate tax?The estate tax is a tax imposed on the transfer of the “taxable estate” of a deceased person.

When must it be filed?A DC Estate Tax Return must be filed where the gross estate is:

Who must file?The District of Columbia estate tax return must be filed by the Personal Representative responsible for administering the estate.

Where should returns be sent?Mail returns and payments to the Office of Tax and Revenue, Audit Division, Estate Tax Unit, P.O. Box 556 Washington, DC, 20044-0556. Make the check or money order payable to the DC Treasurer.

What documents are required with form D-76?Generally, the following documents are attached to Form D-76:

Also Check: Capital Gains Tax On Cryptocurrency

What Is The Difference Between Form 706 And Form 709

Form 706 is used by the executor of a decedents estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 709 is used to report transfers subject to the Federal gift and certain generation-skipping transfer taxes, and to figure the tax, if any, due on those transfers.

Estate Income Tax Return

You may also have to file a return for the estates income. When a person dies, any income generated by assets that pass through their probate estate exceeding $600 is taxed. The probate estate consists of assets that are held in the decedents sole name without a joint holder or named beneficiary. The estates first income tax year begins immediately after death. The tax year can end on December 31 or the estate can operate on a fiscal year . The estate income tax return must be filed by April 15, 2022 for a December 31, 2021 year end or the 15th day of the fourth month after end of the fiscal year.

If the annual gross income of the estate is below $600, a return does not have to be filed. A tax return is also not required if all the decedents income-producing assets pass directly to the surviving spouse or other designated joint holders or beneficiaries.

Recommended Reading: How To Check If Your Taxes Were Filed

File An Estate Tax Income Tax Return

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.The types of taxes a deceased taxpayer’s estate can owe are:

- Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

May 2023 Tax Deadlines

| Military Personnel on Duty Outside the U.S. File 2022 Tax Return |

| Military Personnel on Duty Outside the U.S. File Form 4868 to Request 4-Month Income Tax Return Filing Extension |

Military personnel and other taxpayers who are serving or living outside the U.S. have until June 15 to file their 2022 tax return. If they want an additional four-month filing extension, they must submit an application by June 15.

Estimated tax payments for the 2nd quarter of 2023 are also due June 15, while the tip reporting deadline for workers who received tips in May is June 12.

You May Like: Can You File Taxes On Ssi Disability

How To File File An Estate Tax Return

Online+

Massachusetts estate tax returns may be filed online through MassTaxConnect.

You will need to create an online account to file the estate tax return. Using MassTaxConnect:

- Choose Register a New Taxpayer then

- Choose Register an Estate

Once you’ve created an account, you can log in with MassTaxConnect and file your estate tax return.

What You Need For File An Estate Tax Return

The estate tax is a transfer tax on the value of the decedent’s estate before distribution to any beneficiary.

For estates of decedents dying in 2006 or after, the applicable exclusion amount is $1,000,000. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Estate tax returns and payments are due 9 months after the date of the decedent’s death.

Estate tax returns must be filed by the:

- Personal representative of the estate or

- Any person in actual possession of the decedent’s property.

Also Check: File Sales Tax In California

Factors That May Influence Tax Payments Due To The Irs

Its important for your business to have its taxable income calculated correctly by a professional. Getting the assistance from the experts will offer you tax savings, save you time, give you peace of mind and help your business grow.

What Is The Fiscal Year For An Estate

Estate Tax Year Typically, the estate calendar year starts on the day of the estate owners death and ends on Dec. 31 of the same year. The executor, however, can file an election to choose a fiscal year, which means the tax year ends on the last day of the month before the one year anniversary of death.

You May Like: Irs How To Pay Taxes

Table Aunified Rate Schedule

| Column A | Tax on amount in column A | Column DRate of tax on excess over amount in column A |

|---|---|---|

| $0 | ||

| 40% |

Line 1

If you elected alternate valuation on Part 3Elections by the Executor, line 1, enter the amount you entered in the Alternate value column of Part 5Recapitulation, item 13. Otherwise, enter the amount from the Value at date of death column.

Line 3b. State Death Tax Deduction

You may take a deduction on line 3b for estate, inheritance, legacy, or succession taxes paid on any property included in the gross estate as the result of the decedent’s death to any state or the District of Columbia.

You may claim an anticipated amount of deduction and figure the federal estate tax on the return before the state death taxes have been paid. However, the deduction cannot be finally allowed unless you pay the state death taxes and claim the deduction within 4 years after the return is filed, or later ) if:

-

A petition is filed with the Tax Court of the United States,

-

You have an extension of time to pay, or

-

You file a claim for refund or credit of an overpayment which extends the deadline for claiming the deduction.

Note.

The deduction is not subject to dollar limits.

If you make a section 6166 election to pay the federal estate tax in installments and make a similar election to pay the state death tax in installments, see section 2058 for exceptions and periods of limitation.

Send the following evidence to the IRS.

Total amount of tax imposed .

Amount of discount allowed.

Line 6

Worksheet Tgtaxable Gifts Reconciliation

| Worksheet TGTaxable Gifts Reconciliation | ||||

|---|---|---|---|---|

| Gifts made after June 6, 1932, and before 1977 | a.Calendar year or calendar quarter | b.Total taxable gifts for period | Note. For the definition of a taxable gift, see section 2503. Follow Form 709. That is, include only the decedents one-half of split gifts, whether the gifts were made by the decedent or the decedents spouse. In addition to gifts reported on Form 709, you must include any taxable gifts in excess of the annual exclusion that were not reported on Form 709. | |

| Taxable amount included in column b for gifts included in the gross estate | d.Taxable amount included in column b for gifts that qualify for special treatment of split gifts described below | e.Gift tax paid by decedent on gifts in column b | f.Gift tax paid by decedent’s spouse on gifts in column c | |

| 1. Total taxable gifts made before 1977 | ||||

| 2. Totals for gifts made after 1976 | ||||

| Line 4 WorksheetAdjusted Taxable Gifts Made After 1976 | ||||

| 1. | Taxable gifts made after 1976. Enter the amount from Worksheet TG, line 2, column b | 1. | ||

| 2. | Taxable gifts made after 1976 reportable on Schedule G. Enter the amount from Worksheet TG, line 2, column c | 2. | ||

| 3. | Taxable gifts made after 1976 that qualify for special treatment. Enter the amount from Worksheet TG, line 2, column d | 3. | ||

| Add lines 2 and 3 | 4. | |||

| 5. | Adjusted taxable gifts. Subtract line 4 from line 1. Enter here and on Part 2Tax Computation, line 4 | 5. |

Don’t Miss: When Do You Get Your Tax Returns

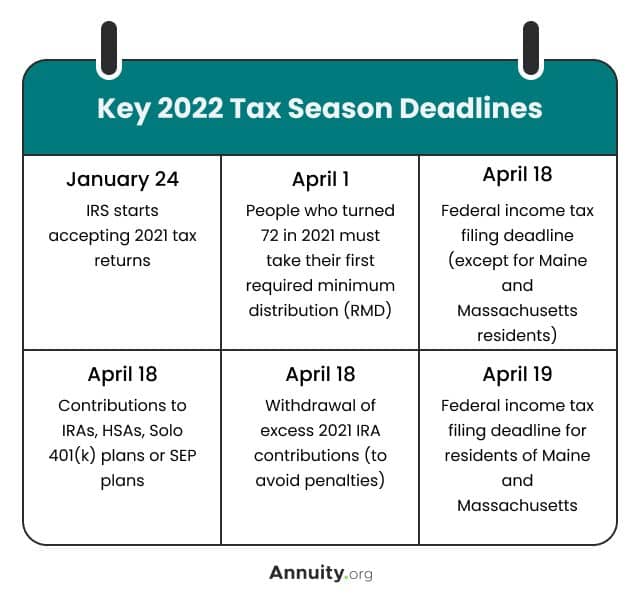

When Are Taxes Due In 2023 Tax Deadlines By Month

Know the tax deadlines that apply to you, so you don’t get hit with IRS penalties or miss out on a valuable tax break.

It’s very important to know when taxes are due in 2023. And, for many people, there are more tax deadlines to worry about than just the due date for your income tax return. If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break. That’s why it’s so important to be familiar with the various tax deadlines throughout the year.

But it’s not easy keeping track of every IRS due date. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2023 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

How Much Do You Have To Make To File A 1041 Form

Not every estate is required to file Form 1041 for the income it earns. No return is necessary if the estate has no income-producing assets or its annual gross income is less than $600. The only exception is if one of the grantors beneficiaries is a nonresident alien. In that case, the estates income total does not matter, and a federal tax return must be filed. The executor or personal representative of the estate must file the estate tax return using Form 706.

Also Check: I Claimed 0 And Still Owe Taxes 2021

Who Pays The Income Tax For Estates

The estate itself is not responsible for paying income taxes if its assets are distributed to the beneficiaries before earning income. In this case, the beneficiaries are responsible for paying any tax due on that amount. Each beneficiary will receive a Schedule K-1 Form 1041, which tells them the amount and type of income to report on their individual tax returns .

Who Is Responsible For Paying Estate Taxes

Federal, state and local taxes, as well as any other outstanding debts all come out of the estate itself before the assets of the estate go to beneficiaries. Assets are split following the guidelines set in the trust or will of the deceased. If there were no arrangements made, then allocations to beneficiaries will be determined by the probate court judge.

The person responsible for making sure all returns are completed and taxes are paid is generally the executor of the estate. If a trust was created, then the trustee is usually the one responsible. The estate taxes are not paid from the trustee or executors personal assets, but from the assets of the estate. If the estate taxes are not paid, then the IRS may place a lien against the estate and seize its assets.

Read Also: Capital Gains Tax On Farmland 2021

Does The Executor Of An Estate Have To File Taxes

The executor must file a federal income tax return for the estate if the estate generated $600 or more in gross income for the tax year or has a beneficiary who is a nonresident alien. The executor files the estates first income tax return at any point up to 12 months after the date of death.

When Is Estate Tax Return Due

Generally, the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The gift tax return is due on April 15th following the year in which the gift is made.

You May Like: Mass Tax Connect Phone Number

Filing Requirements For California Estate Tax Return

A California Estate Tax Return, Form ET-1, is required to be filed with the State Controller’s Office, whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service . However, after January 1, 2005, the IRS no longer allows the state death tax credit therefore, a California Estate Tax Return is not required to be filed for decedents whose date of death is after December 31, 2004.

Pursuant to Revenue and Taxation Code section 13302 the amount of California estate tax is equal to the maximum allowable amount of the credit for state death taxes, allowable under the applicable federal estate tax law. Generally, this amount would be shown on either line 13 or 15 of the Form-706.

The California Estate Tax Return must include a complete copy of the IRS Form 706 and all related schedules. The return should mailed to:

State Controller Sacramento, CA 94250-5880

NOTE: The return should not be mailed to the Franchise Tax Board.

California estate taxes are due and payable by the estate’s executor on or before nine months following the date of death. Checks shall be made payable to the State Treasurer and mailed to the State Controller’s Office at the address listed above.

Pursuant to Revenue and Taxation Code section 13510, the penalty for failure to file a California Estate Tax Return is five percent per month or portion thereof, not to exceed 25%.