Get Your Investment Taxes Done Right

For stocks, crypto, ESPPs, rental property income and more, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

In Most Cases Your Home Has An Exemption

The single biggest asset many people have is their home, and depending on the real estate market, a homeowner might realize a huge capital gain on a sale. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax, as long as you meet all three conditions:

If you meet these conditions, you can exclude up to $250,000 of your gain if you’re filing as single, head of household, or married filing separately and $500,000 if you’re married filing jointly.

When Is A Home Sale Fully Taxable

Not everyone can take advantage of the capital gains exclusions. Gains from a home sale are fully taxable when:

- The home is not the sellers principal residence.

- The property was acquired through a 1031 exchange within five years.

- The seller is subject to expatriate taxes.

- The property was not owned and used as the sellers principal residence for at least two of the last five years prior to the sale .

- The seller sold another home within two years from the date of the sale and used the capital gains exclusion for that sale.

Don’t Miss: How To Calculate The Sales Tax

Who Pays Capital Gains Tax On Real Estate

The majority of homeowners will not have to pay capital gains tax on their properties or they will receive a steep discount on what is actually taxed. A lot of this has to do with the Taxpayer Relief Act of 1997. This was one of the largest tax-reduction bills passed in the United States and covered costs related to education savings, child tax credits, and IRAs.

In regard to capital gains, the Taxpayer Relief Act of 1997 lowered the overall tax rate that sellers had to pay from 28% to 20% in the higher bracket and 15% to 10% in the lower bracket. This law also introduced exemptions for sellers. If you are selling your house in 2023, here are a few ways you will be exempt from paying federal capital gains tax on real estate:

- Your profits on the home sale are less than $250,000 for single taxpayers and $500,000 for couples who file their taxes together.

- You lived in the house as your primary residence for two years.

- You earn less than $44,625 as a single taxpayer or $89,250 for married couples who file jointly.

These taxable income thresholds change every year, so make sure you check the income limits and tax filing status when you decide to sell your home.

Saving Tax On Sale Of Agricultural Land

In some cases, capital gains made from the sale of agricultural land may be entirely exempt from income tax or it may not be taxed under the head capital gains. See below:

a. Agricultural land in a rural area in India is not considered a capital asset and therefore any gains from its sale are not chargeable to tax. For details on what defines an agricultural land in a rural area, see above.

b. Do you hold agricultural land as stock-in-trade? If you are into buying and selling land regularly or in the course of your business, in such a case, any gains from its sale are taxable under the head Business and Profession.

c. Capital gains on compensation received for compulsory acquisition of urban agricultural land are tax exempt under Section 10 of the Income Tax Act.

If your agricultural land wasnt sold in any of the above cases, you can seek exemption under Section 54B.

You May Like: Tax On Ira Withdrawal After 59 1/2

Chapter 5 Capital Losses

You have a capital loss when you sell, or are considered to have sold, a capital property for less than its adjusted cost base plus the outlays and expenses involved in selling the property. This chapter explains how to:

- determine your adjustment factor

- report your 2021 net capital losses

- apply your unused 2021 net capital losses against your taxable capital gains of other years

- apply your unused net capital losses of other years against your 2021 taxable capital gains

It also explains the special rules that apply to listed personal property losses, superficial losses, restricted farm losses, and allowable business investment losses.

You will find a summary of the loss application rules.

Generally, if you had an allowable capital loss in a year, you have to apply it against your taxable capital gain for that year. If you still have a loss, it becomes part of the computation of your net capital loss for the year. You can use a net capital loss to reduce your taxable capital gain in any of the three preceding years or in any future year.

Do I Have To Report The Sale Of My Home To The Irs

It is possible that you are not required to report the sale of your home if none of the following is true:

- You have non-excludable, taxable gain from the sale of your home .

- You were issued a Form 1099-S, reporting proceeds from real estate transactions.

- You want to report the gain as taxable, even if all or a portion falls within the exclusionary guidelines.

Don’t Miss: Local County Tax Assessor Collector Office

Guide To Obtain Capital Gains Statement From Paytm Money And Import The Data On Cleartax

Instead of manually entering the details you can simply upload a Realised Gain statement that is a consolidation of your investment performance, capital gains and income for the current and last financial years across Paytm Money serviced funds

ClearTax has now directly integrated with various platforms like 5Paisa, ICICI Direct, Paytm Money, Zerodha, etc. It will help you to import 1000s of capital gains transactions via a single click login.

How To File A Tax Return For Capitalgains

You must file a tax return on all disposals.

When you dispose of an asset, you must file a return by 31 October of thefollowing year.

For example, if you dispose of an asset between 1 January and 30 November,payment is due by 15 December. Your return will be due by 31 October of thenext year.

Though you may file your return the following year, you must pay the CapitalGains Tax in the same year as the disposal of the asset, unless you dispose ofthe asset in December.

If you assess yourself for tax purposes you should make atax return on Form11 .

If you are a PAYE taxpayer you should make a return on Form 12 .

Trusts and Estates should make the return on Form 1 .

If you are not required to make an income tax return you must send a CG1Form to Revenue. See the CG1form Helpsheet .

You can use ROS to file your Income TaxReturn , Form 1 or Form CT1. You can post the Form CG1 or Income TaxReturn to your Revenueoffice.

Recommended Reading: States That Are Tax Free

Do You Pay Capital Gains Taxes When You Sell A Second Home

Because the IRS allows exemptions from capital gains taxes only on a principal residence, its difficult to avoid capital gains taxes on the sale of a second home without converting that home to your principal residence. This involves conforming to the two-in-five-year rule . Put simply, you can prove that you spent enough time in one home that it qualifies as your principal residence.

If one of the homes was primarily an investment, its not set up to be the exemption-eligible home.

The demarcation between investment property and vacation property goes like this: Its investment property if the taxpayer has owned the property for two full years, it has been rented to someone for a fair rental rate for at least 14 days in each of the previous two years, and it cannot have been used for personal use for 14 days or 10% of the time that it was otherwise rented, whichever is greater, for the previous 12 months.

If you or your family use the home for more than two weeks a year, its likely to be considered personal property, not investment property. This makes it subject to taxes on capital gains, as would any other asset other than your principal residence.

Section 54ec: Old Asset: Any Asset New Asset: Specified Bonds

Gains arising from the transfer of any long term capital asset are exempt under section 54EC if the assessee has within a period of 6 months after the due date of such transfer invested the capital gain in long term specified bonds as notified by the Govt. for a minimum period of 3 years.

In case where the long term specified asset is transferred or converted into money at any time within a period of 3 years from the date of its acquisition, the amount of capital gain exempt u/s 54EC, shall be deemed to be long term capital gain of the previous year in which the long term specified asset is transferred or converted into money.

If the Assessee even takes a loan or advance on the security of such long term specified asset, he shall be deemed to have converted such long term specified asset into money on the date on which such loan or advance is taken.

These specified binds are usually issued by REC and NHAI and the Interest Rate offered is approx. 5.25%. Tax on the Interest earned is also liable to be paid as the Interest is not tax-free. These are Capital Gain Bonds and not Tax-Free Bonds. The Principal invested becomes tax free after the lock-in period but the interest continues to remain taxable.

You May Like: How To Calculate Property Tax In Texas

Section 54ec: Exemption On Sale Of House Property On Reinvesting In Specific Bonds

Exemption is available under Section 54EC when capital gains from sale of the first property are reinvested into specific bonds.

- If you are not keen to reinvest your profit from the sale of your first property into another one, then you can invest them in bonds for up to Rs. 50 lakhs issued by National Highway Authority of India or Rural Electrification Corporation .

- The money invested can be redeemed after 5 years, but they cannot be sold before the lapse of 5 years from the date of sale.

- The homeowner has six months time to invest the profit in these bonds. But to be able to claim this exemption, you will have to invest before the tax filing deadline.

Establishing The Rental As Primary Residence

You might find that an investment property you rent and plan to sell has spiked in value. It may be a good idea to move into the rental for at least two years to convert it into a primary residence to avoid capital gains. However, you wont be able to exclude the portion you depreciated while renting the property.

Youll lose primary residency status on your main home, but it can always be gained later by moving back in after the sale of the rental property. As long as you dont plan to sell the main home for at least two years, you can re-establish primary residency and qualify for the capital gains exclusion later.

Recommended Reading: H& r Block Online Tax

Section : Old Asset: Residential Property New Asset: Residential Property

Under Section 54 Any Long Term Capital Gain, arising to an Individual or HUF, from the Sale of a Residential Property shall be exempt to the extent such capital gains is invested in the

Provided that the new Residential House Property purchased or constructed is not transferred within a period of 3 years from the date of acquisition. If the new property is sold within a period of 3 years from the date of its acquisition, then, for the purpose of computing the capital gains on this transfer, the cost of acquisition of this house property shall be reduced by the amount of capital gain exempt under section 54 earlier. The capital gain arising from this transfer will always be a short term capital gain.

Classification Of Inherited Capital Asset

In case an asset is acquired by gift, will, succession or inheritance, the period for which the asset was held by the previous owner is also included when determining whether its a short term or a long-term capital asset. In the case of bonus shares or rights shares, the period of holding is counted from the date of allotment of bonus shares or rights shares respectively.

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

Section 54b: Exemption On Capital Gains From Transfer Of Land Used For Agricultural Purpose

When you make short-term or long-term capital gains from transfer of land used for agricultural purposes by an individual or the individuals parents or Hindu Undivided Family for 2 years before the sale, exemption is available under Section 54B. The exempted amount is the investment in a new asset or capital gain, whichever is lower. You must reinvest into a new agricultural land within 2 years from the date of transfer.

The new agricultural land, which is purchased to claim capital gains exemption, should not be sold within a period of 3 years from the date of its purchase. In case you are not able to purchase agricultural land before the date of furnishing of your income tax return, the amount of capital gains must be deposited before the date of filing of return in the deposit account in any branch of a public sector bank or IDBI Bank according to the Capital Gains Account Scheme, 1988.

Exemption can be claimed for the amount which is deposited. If the amount which was deposited as per Capital Gains Account Scheme was not used for the purchase of agricultural land, it shall be treated as capital gains of the year in which the period of 2 years from the date of sale of land expires. If you wish to know more about investment choices with good capital gains potential, please invest with ClearTax Invest. Our handpicked plans can help you build a portfolio that is best suited to your financial goals and risk profile.

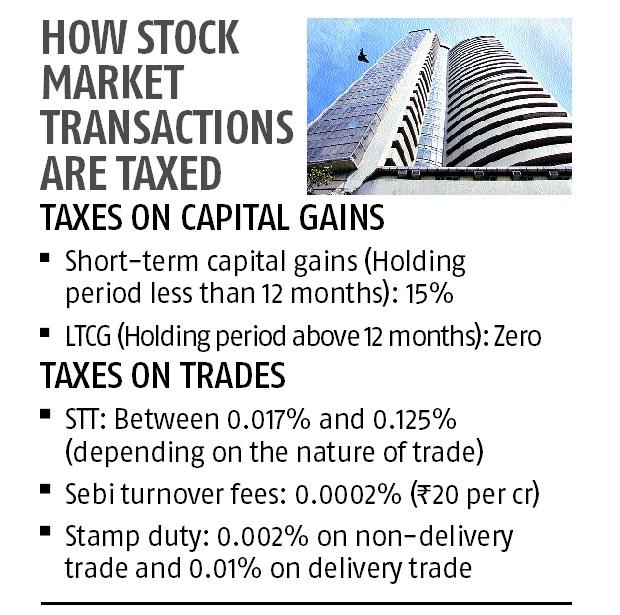

Long Term Capital Gains Tax

Capital gains tax is levied whenever an individual earns a profit by selling capital assets such as residential plots, vehicle, stocks, bonds, and even collectables such as artwork. It is primarily categorised into 2 types: short-term and long-term capital gains tax. Transactions involving any such capital asset is taxable under the Income Tax Act of India, as well as cess and any other surcharge that may be applicable on the sale.

These taxes are applicable on both movable and immovable assets, including residential properties, vacant plots, as well as assets like shares debentures, units of equity-oriented mutual funds, Government securities, UTI, Zero-coupon bonds, etc. These can attract long-term capital gains tax in India after 12 months to 36 months of ownership .

You May Like: When Do We Get Tax Returns 2022

Sections Under Income Tax Act Stating Capital Gains Exemption

The Income Tax Act 1961 has laid specific provisions for tax exemptions under capital gains. Such provisions assure tax deduction to individuals with total or partial exemptions.

The list below entails the sections of the Income Tax Act that discuss exemptions under capital gains.

- Section 54 of the Income Tax Act

- Sections 54 E, EA and EB

How Do I Avoid Paying Taxes When I Sell My House

There are several ways to avoid paying taxes on the sale of your house. Here are a few:

- Offset your capital gains with capital losses. Capital losses from previous years can be carried forward to offset gains in future years.

- Use the Internal Revenue Service primary residence exclusion, if you qualify. For single taxpayers, you may exclude up to $250,000 of the capital gains, and for married taxpayers filing jointly, you may exclude up to $500,000 of the capital gains .

- If the home is a rental or investment property, use a 1031 exchange to roll the proceeds from the sale of that property into a like investment within 180 days.

Read Also: Are Funeral Expenses Tax Deductable

How To Use The 50% Cgt Discount

For example, if an individual sells an asset that they have held for more than 12 months and makes a capital gain of $10,000, they would be eligible for the 50% CGT discount.

The discount would be applied to the capital gain, reducing it to $5,000.

If the individual’s marginal tax rate is 34.5% , the tax payable on the capital gain would be $1,725 .

Convert Your Second Home Into Your Principal Residence

Capital gains exclusions are attractive to many homeowners, so much so that they may try to maximize its use throughout their lifetime. Because gains on non-principal residences and rental properties do not have the same exclusions, people have sought for ways to reduce their capital gains tax on the sale of their properties. One way to accomplish this is to convert a second home or rental property to a principal residence.

A homeowner can make their second home into their principal residence for two years before selling and take advantage of the IRS capital gains tax exclusion. However, stipulations apply. Deductions for depreciation on gains earned prior to May 6, 1997, will not be considered in the exclusion.

According to the Housing Assistance Tax Act of 2008, a rental property converted to a primary residence can only have the capital gains exclusion during the term when the property was used as a principal residence. The capital gains are allocated to the entire period of ownership. While serving as a rental property, the allocated portion falls under non-qualifying use and is not eligible for the exclusion.

You May Like: How To Check If Your Taxes Were Filed