How Early Can I File My Taxes For 2023

You can get a jump-start on preparing your tax return by gathering key information such as your W-2 or 1099 forms. And you may be able to submit your taxes early through some third-party tax services, but they’ll wait in the system until the IRS begins accepting returns for processing.

Your employer is required to send you your W-2 by Jan. 31. Most 1099 forms are due by the end of January as well.

When does IRS Free File open?

The IRS hasn’t announced when its Free File system will open.

IRS Free File lets you file your federal taxes at no extra cost either through electronic fillable forms or through IRS partnerships with private tax preparation services.

Depending on your adjusted gross income for 2022, you may be able to qualify for free guided tax preparation services. The IRS has not announced what the AGI thresholds are for the 2022 tax year but last year the threshold was an AGI of $73,000 or less in 2021.

IRS Free File generally opens before the IRS begins accepting and processing returns. For instance, last year it opened on Jan. 14. Be sure to regularly check this page for the latest information on IRS Free File.

This 2023 tax credit could help:Interested in purchasing an electric car?

Most Refunds Issued In Less Than 21 Days Eitc Refunds For Many Available Starting February 28

The IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically, if they choose direct deposit and there are no issues with their tax return. Taxpayers should check Where’s My Refund? on IRS.gov for their personalized refund status.

While the IRS will begin accepting returns January 23, the IRS cannot issue a refund that includes the Earned Income Tax Credit or Additional Child Tax Credit before mid-February. This is due to the 2015 PATH Act law passed by Congress, which provides this additional time to help the IRS stop fraudulent refunds from being issued.

Where’s My Refund? should show an updated status by February 18 for most early EITC/ACTC filers. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by February 28 if taxpayers chose direct deposit and there are no other issues with their tax return.

Free Tax Estimate Excel Spreadsheet For

Category: Estimated Income TaxTaxable Income Taxable Income Federal TaxState TaxSocial Security TaxMedicare TaxChild Tax CreditEffective Federal Tax RateEffective State Tax Rate

Adjusted Gross Income Estimated Income Tax Taxable Income Taxable Income Federal Tax State Tax Social Security Tax Medicare Tax Child Tax Credit Effective Federal Tax Rate Effective State Tax RateReviews:Estimated Reading Time:

You May Like: How Does Income Tax Work

Irs Says Tax Day Will Be Different This Year Put These Important Tax Dates On Your Calendar

Its not too early to start thinking about your 2022 income-tax return, if you can bear the thought.

Thats because the tax-filing season is scheduled to start on Monday, Jan. 23, the Internal Revenue Service announced Thursday. Thats less than two weeks away.

The IRS is expecting more than 168 million individual tax returns this year, it said.

Most households come away with a refund, making for a major financial event during the year. Two-thirds of individual taxpayers came away with a refund last year averaging around $3,200, according to IRS data through late October.

This year, refunds will be arriving in a time of high inflation and potential recession worries and experts caution theres a good chance many refunds could be smaller, now that pandemic-era increases to certain tax credits have vanished.

Maximizing an income-tax refund starts by staying organized and knowing when to be on the lookout for the tax forms that pour in from employers, banks, brokers, mortgage lenders and others.

Hurrying too soon, a person might overlook a credit, deduction or piece of paperwork to back a claim. The same goes if theyre rushing at the last minute. An error could snag a refund and hold up a return inside the IRS, as it runs another tax season while cutting a backlog.

While much work remains after several difficult years, we expect people to experience improvements this tax season, he said in a statement.

Extra Tax Refunds From Irs: How To See If You Overpaid Taxes In 2020

Americans who paid too much taxes on unemployment benefits are receiving nearly $15 billion back.

Though the early months of the COVID-19 pandemic were almost three years ago, the Internal Revenue Service continues to deal with the effects of the new coronavirus on the US economy and tax system in 2020.

The IRS announced last week that it has completed its corrections of 14 million tax returns of filers who had overpaid taxes on unemployment compensation in 2020, when COVID-related legislation excluded up to $10,200 from taxable income calculations per individual. The corrections resulted in nearly 12 million refunds averaging $1,232 each, for a total of $14.8 billion.

Although the IRS said it finished its review of taxes from 2020, there may be taxpayers who filed their returns before the law was enacted in spring 2021 who didn’t receive an automatic correction but are still eligible for a refund.

If you overpaid taxes on unemployment compensation received in 2020, you’ll now need to file an amended tax return for 2020 to claim the money the IRS owes you.

Learn more about why the IRS issued unemployment refunds, how you can see if you are eligible for one and how to claim the taxes you overpaid.

For more tax tips, learn when income taxes are due in 2023 and all the tax breaks you can get if you own a home.

You May Like: Local County Tax Assessor Collector Office

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

How Can I See If I Overpaid Taxes On Unemployment Benefits In 2020

The best way to check your tax return from 2020 is by using an online IRS account. It takes a few minutes to register, but after you’re set up, you can access all sorts of useful information, like your current adjusted gross income, your payment history and transcripts of your old tax returns, including 2020.

After you receive your 2020 tax transcript, check Form 1040 Schedule 1 Line 8 to see if you included the unemployment compensation exclusion. If you received jobless benefits and didn’t enter an exclusion, use the “Unemployment Compensation Exclusion Worksheet” in the instructions for the 2020 version of Schedule 1 to calculate the amount.

If you received unemployment income in 2020 and did not claim the exclusion even though you were eligible, you could get additional tax refund money from the IRS by filing an amended return.

If you didn’t receive any jobless benefits in 2020 or included the exclusion in your tax return for that year, you’re not eligible for any additional refund related to unemployment.

Don’t Miss: Where Do Federal Taxes Go

Tips To Help People With The 2023 Tax Season

The IRS recommends several things for people to keep in mind for a smooth filing experience this year:

Have the right information before filing. The IRS encourages individuals to have all the information they need before filing a complete and accurate return. Organize and gather 2022 tax records including Social Security numbers, Individual Taxpayer Identification Numbers, Adoption Taxpayer Identification Numbers and this year’s Identity Protection Personal Identification Numbers valid for calendar year 2023.

Filing an accurate tax return can help taxpayers avoid delays or later IRS notices. Sometimes this means waiting to make sure individuals have accounted for all their income and the related documents. This is especially important for people who may receive one of the various Forms 1099 from banks or other payers reporting unemployment compensation, dividends, pension, annuity or retirement plan distributions.

People should also remember that most income is taxable, including unemployment income, interest received or money earned from the gig economy or digital assets. Individuals should make sure they report the correct amount on their tax return to avoid processing delays.

Visit IRS.gov first for questions. The IRS reminds people to visit IRS.gov first for common questions and also to check on the status of their refunds. IRS.gov has much of the same information that IRS phone assistors have.

Can I Still File My 2021 Taxes

Yes, you can still file a 2021 tax return. You generally have up to three years to claim a federal income tax refund. After three years the IRS simply won’t pay you the refund. If you are owed a refund, you will not be charged a late filing penalty.

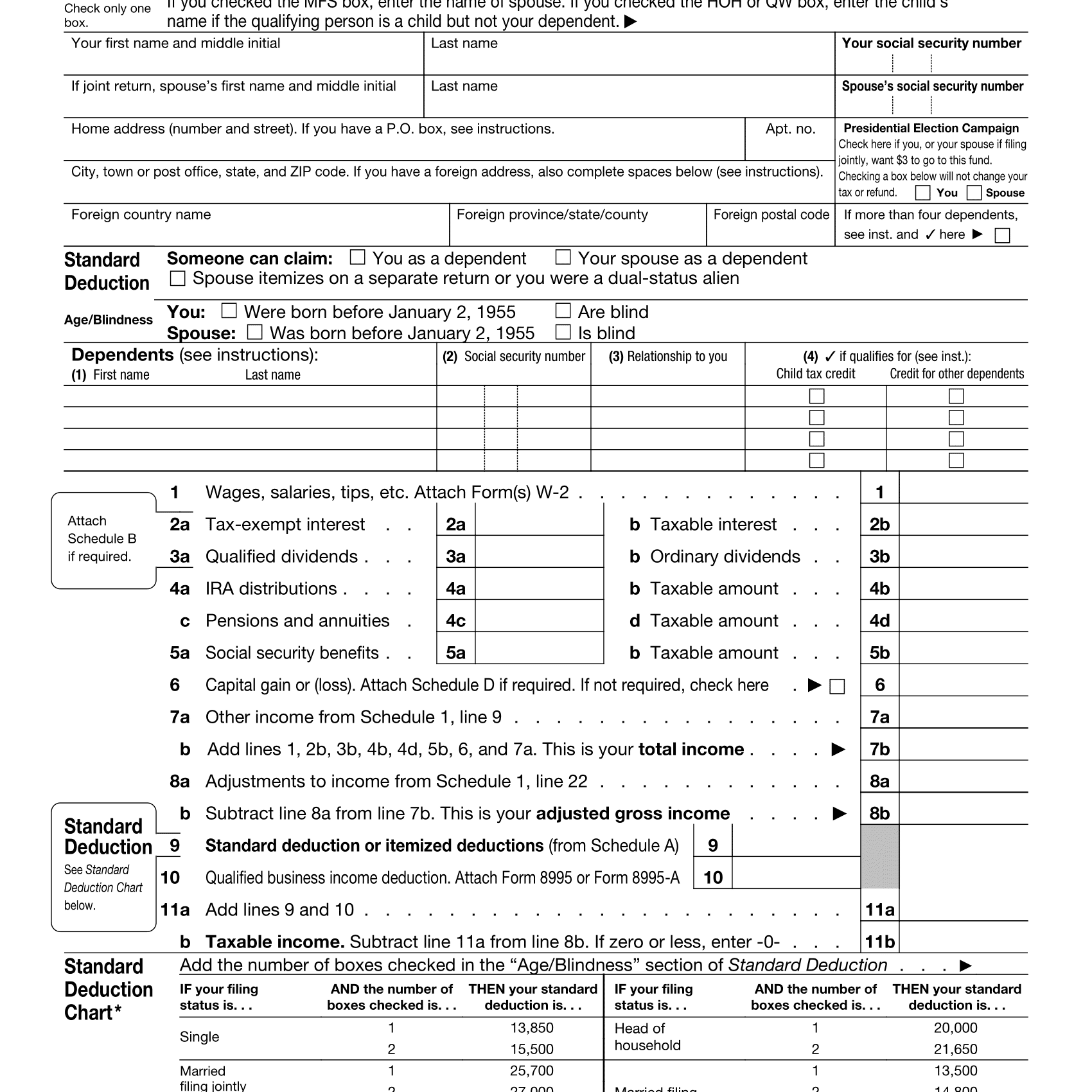

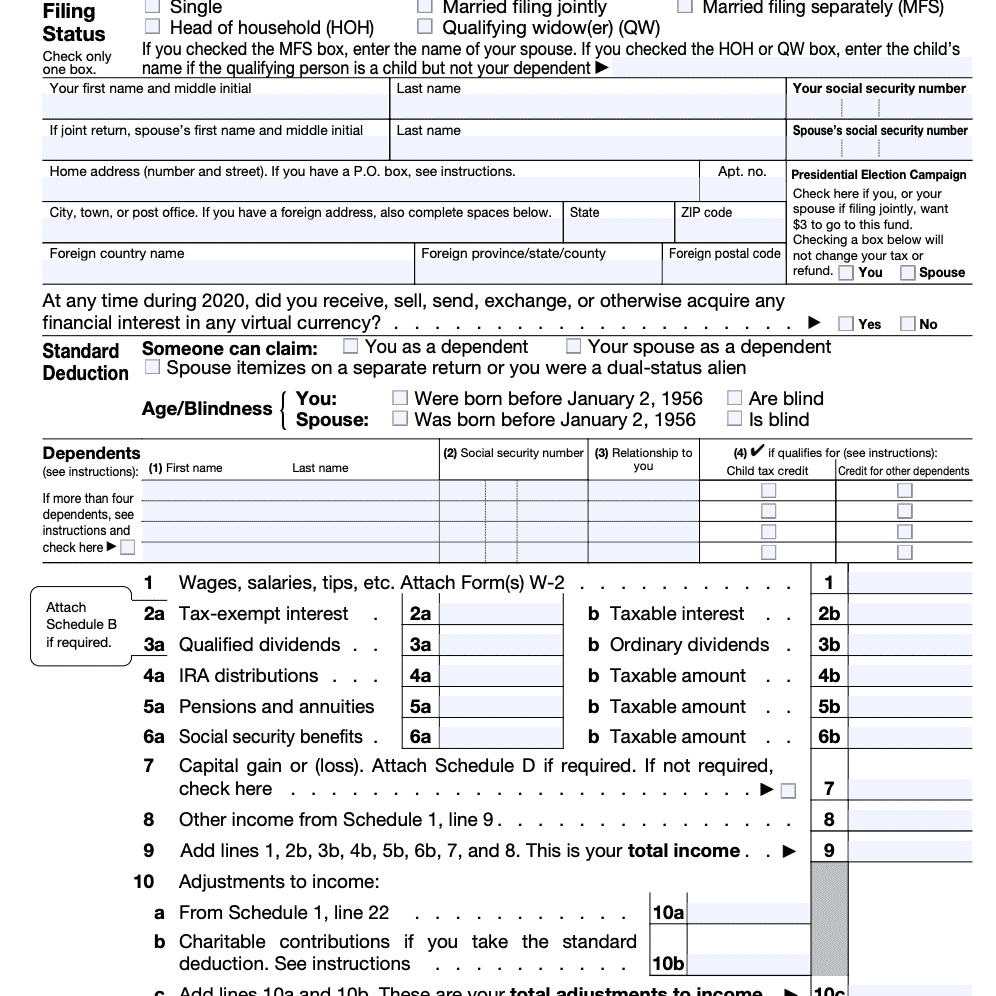

If you can’t afford to pay the back taxes you owe, ask the IRS for a reduction due to a hardship and create a payment schedule. See the 2021 Form 1040 instructions booklet below for more information about late filing penalties and how to request a payment schedule.

Also Check: Is Mortgage Interest Tax Deductible

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

A Additional Tax To Enter

Enter the amount of additional federal income tax paid during 2021 for tax year 2020 and any other years before 2020. The amount of additional federal income tax paid is deductible only if Iowa income tax returns were required to be filed for the year for which the additional federal income tax was paid.

Include only the actual federal tax payments made in 2021, but DO NOT include the following:

Federal income tax includes the net investment income tax on federal form 8960 and any payments made in 2020 associated with federal section 965 net tax liability.

Taxpayers can deduct their entire additional federal tax paid amount on line 31. However, certain amounts must be added back on line 28, including the following:

Additional Medicare tax withholding from line 24 of federal form 8959, net investment income tax from federal form 8960, and federal section 965 net tax liability payments are not added back on line 28.

If a taxpayer has elected to pay federal section 965 net tax liability in installments for federal purposes, that taxpayer may only include the actual amount of the federal installment payment paid in 2021 in calculating the Iowa deduction for 2021. See Iowa Tax Reform Guidance: Deemed Repatriation of Deferred Foreign Income.

Refundable Credits

Refundable credits on the federal 1040 may be included on IA 1040, line 31, to the extent federal income tax was paid by applying the federal refundable credits, including:

Read Also: Filing Taxes Online For Free

Irs Changes In Play For 2022 Tax Season

- Publish date: Jan 11, 2023 2:30 PM EST

The 2023 tax filing deadline is Tuesday, April 18, 2023, which gives the public about 100 days to meet their tax obligations for 2022 and hopefully, keep more of their money in their pocket at the same time.

Working with a professional accountant is the best way to curb Uncle Sams share of your 2022 income. Past that, staying on top of the Internal Revenue Service’s new rules and policy changes can help turn the tide when the tax bill comes due for 2022.

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000 and starting with tax year 2022, $50,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

Read Also: States With No Estate Tax

Which 2021 Tax Forms Do I File

If you don’t know which federal tax forms to file, start by downloading the 2021 Form 1040 and the 2021 1040 Instructions. The instructions will tell you if you need to file, and, when you need to download additional forms. In general, you will skip the line items that do not apply to you.

Any US resident taxpayer can file Form 1040 for tax year 2021. The short Form 1040A and easy Form 1040EZ have been discontinued by the IRS. Nonresident taxpayers will file the 2021 Form 1040-NR. Commonwealth residents will file either Form 1040-SS or Form 1040-PR.

If you need to amend a federal income tax return, file Form 1040X.

Irs Sets January 23 As Official Start To 2023 Tax Filing Season More Help Available For Taxpayers This Year

IR-2023-05, January 12, 2023

WASHINGTON The Internal Revenue Service today announced Monday, January 23,2023, as the beginning of the nation’s 2023 tax season when the agency will begin accepting and processing 2022 tax year returns.

More than 168 million individual tax returns are expected to be filed, with the vast majority of those coming before the April 18 tax deadline. People have three extra days to file this year due to the calendar.

With the three previous tax seasons dramatically impacted by the pandemic, the IRS has taken additional steps for 2023 to improve service for taxpayers. As part of the August passage of the Inflation Reduction Act, the IRS has hired more than 5,000 new telephone assistors and added more in-person staff to help support taxpayers.

These steps took place as the IRS worked for months to prepare for the 2023 tax season. The January 23 start date for individual tax return filers allows the IRS time to perform annual updates and readiness work that are critical to ensuring IRS systems run smoothly. This is the date IRS systems officially begin accepting tax returns. Many software providers and tax professionals are already accepting tax returns they will transmit those returns to the IRS when the agency begins accepting tax returns on January 23.

Don’t Miss: How To Get My 2020 Tax Return

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Other Forms Individuals May Need

|

Form Title |

|

|---|---|

|

2022 Nebraska Nonresident Income Tax Agreement |

|

|

Nebraska Change Request for Individual Income Tax Use Only |

|

|

Nebraska Advantage Act Incentive Computation |

312N |

|

Nebraska Employment and Investment Growth Act Credit Computation |

775N |

|

Nebraska Extension of Statute of Limitations Agreement |

872N |

|

2021 Nebraska Individual Income Tax Payment Voucher |

1040N-V |

|

Purchase of a Nebraska Residence in a DesignatedExtremely Blighted Area Credit |

1040N-EB |

|

Statement of Person Claiming Refund Due a Deceased Taxpayer |

1310N |

|

2021 Individual Underpayment of Estimated Tax |

2210N |

|

Nebraska Child and Dependent Care Expenses |

2441N |

|

Nebraska Incentives Credit Computation for All Tax Years |

3800N |

|

2021 Special Capital Gains Election and Computation |

4797N |

|

Nebraska Application for Extension of Time |

4868N |

|

2021 Nebraska Community Development Assistance Act Credit Computation |

|

|

Nebraska Net Operating Loss Worksheet Tax Years After 2020 |

|

|

Employer’s Credit for Expenses Incurred for TANF Recipients |

TANF |

Don’t Miss: Wv State Tax Department Phone Number

Effective From Fy 2020

Recommend

The Union Government has approved the grant of a non-productivity linked bonus for the accounting year 2021-22 for central government employees in Group C and all non-gazetted employees in Group B22

Return on assets for foreign banks in India at 5.8 per cent in 2021-22, though lower than previous years 6.6 per cent, it was higher than that for overseas branches of Indian banks at 1.6 per cent in 2021-22, according to the results of 2021-22 round of the survey on International Trade in Banking Services24

If you have missed the deadline of filing income tax return for FY 2021-22 i.e., July 31, 2022, then an individual has an option to file the belated ITR25

The last date for filing income tax return for FY 2021-22 is July 31, 202220

The last date for filing income tax return for FY 2021-22 is July 31, 2022