Pensions Can Affect How Much Of Your Social Security Is Taxable

Even if pensions dont affect the amount of Social Security benefits you will receive, they do have an impact when it comes to income taxes on those benefits.

For federal income tax purposes, the taxability of Social Security benefits is determined by your income level. According to the Social Security Administration, benefits are taxable as follows:

- If you file as single on your federal income tax return and your combined income is:

- Between $25,000 and $34,000, you may have to pay income tax on up to 50% of your Social Security benefits

- More than $34,000, up to 85% of your Social Security benefits may be taxable.

- If you file as married filing jointly, and you and your spouse have a combined income of:

- Between $32,000 and $44,000, you may have to pay income tax on up to 50% of your Social Security benefits

- More than $44,000, up to 85% of your Social Security benefits may be taxable.

- If you are married and file a separate return, youll probably pay taxes on your benefits.

There are two bits of good news here. First, your Social Security benefits will not be taxable if your combined income is below the minimum numbers above. And second, the maximum amount of your Social Security benefits that will be taxable under the worst case scenario is 85%.

Now Ive bolded the term combined income, and theres a specific reason for that. In order to determine the amount of your Social Security benefits that will be taxable, you have to calculate this number.

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Arizona Taxes On Retirees

- Our Ranking: Most tax-friendly.

- State Income Tax Range: 2.55% 2.98% .

- Average Combined State and Local Sales Tax Rate: 8.4%.

- Median Property Tax Rate: $644 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

Sunshine, sunshine, sunshine and low taxes. The Grand Canyon State exempts Social Security benefits from state income taxes, plus up to $2,500 of income from federal and Arizona government retirement plans. Military retirement income is tax-free in Arizona, too. While plenty of other states have more generous exemptions, Arizona’s low income tax rates for most people keep the net burden down.

Sales taxes are above average in the state the average combined rate is 8.4% . One retiree we spoke with mentioned how he would cross county lines to shop because of lower sales taxes. However, Arizona does not have an estate or inheritance tax, which makes it a more attractive retirement destination for wealthier seniors.

Don’t Miss: H& r Block Tax Identity Shield

Dont Forget Social Security Benefits May Be Taxable

Tax Tip 2020-76, June 25, 2020

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include supplemental security income payments, which aren’t taxable.

The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

The Taxable Amount On My 1099

If Box 2.a is marked Unknown, this means that OPM didn’t calculate the tax-free portion of your annuity. The most common reasons for not calculating the tax-free portion of your annuity is because of one or more of the following:

- Your case is a disability retirement

- You retired prior to November 19, 1996

- You have voluntary contributions, and an apportionment was paid to your former spouse

- Your case hasn’t been finalized and you are in interim pay status

- You have survivor benefits payable

- Your case is an Office of Workers Compensation case

You May Like: What Is Federal Excise Tax

Federal Tax Withholding Information

When you retired, we sent you a W-4P form so you could choose the tax withholding status that was right for you. NYSLRS calculates the amount withheld from your monthly pension payment based on the information you provide on the W-4P form.

Beginning in December 2022, if you retire and do not submit W-4P form, we will apply the IRS default withholding status of single with no adjustments.

How Much In Taxes Should I Withhold From My Pension

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

When you start a pension, you can choose to have federal and state taxes withheld from your monthly checks. The goal is to withhold enough taxes that you won’t owe much money when you file your tax return. You don’t want to get a large refund, either, unless you like lending money to Uncle Sam.

If you choose not to have any taxes withheld and you underpay your taxes, you could end up owing taxes plus an underpayment penalty. To avoid those fates, you’ll want to estimate your income for the year and set your tax withholding appropriately.

Also Check: Is Mortgage Interest Tax Deductible

Kansas Taxes On Retirees

- Our Ranking: Least tax-friendly.

- State Income Tax Range: 3.1% 5.7% .

- Average Combined State and Local Sales Tax Rate: 8.7%.

- Median Property Tax Rate: $1,411 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

While there’s no place like home, maybe Dorothy should think about returning to Oz when she retires to avoid Kansas’ high taxes. Its all there in black and white: Distributions from private retirement plans plans) and out-of-state public pensions are fully taxed. Kansas also taxes Social Security benefits received by residents with a federal adjusted gross income of $75,000 or more. Military, federal government and in-state public pensions are exempt from state income taxes, though.

Shopping in Kansas can be expensive, too. The Sunflower State’s average combined state and local sales tax rate is the ninth-highest in the U.S. at 8.7%.

Property taxes are above the national average as well, though some breaks are available for seniors.

- State Income Tax Range: Flat 5%.

- Average Combined State and Local Sales Tax Rate: 6%.

- Median Property Tax Rate: $851 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Inheritance tax.

A modest 6% sales tax is imposed at the state level, and localities can’t add to it. Kentucky’s median property tax rate is below the national average, too. All this adds up to a fairly “average” tax burden on seniors.

What’s not to like? Kentucky’s inheritance tax.

How Do I File My Pension Tax Return

Report pension income in ITR

Don’t Miss: Penalty For Missing Tax Deadline

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

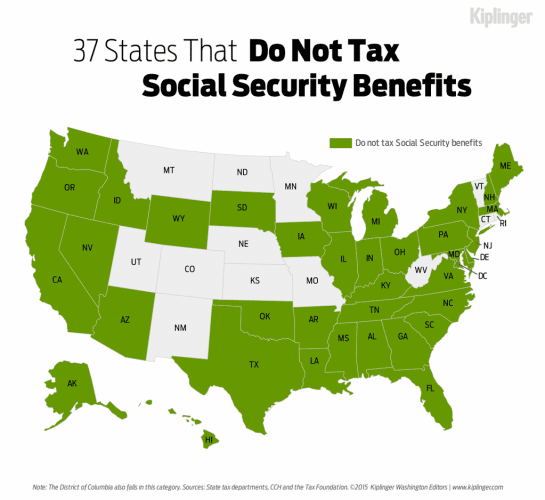

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

District Of Columbia Taxes On Retirees

- Our Ranking: Most tax-friendly.

- State Income Tax Range: 4% 10.75% .

- Average Combined State and Local Sales Tax Rate: 6%.

- Median Property Tax Rate: $575 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Estate tax.

From a tax standpoint, Washington, D.C., is a good place to retire . This is especially true for middle- and lower-income retirees. Although the District exempts Social Security income, most other forms of retirement income are taxed by the city. But many senior homeowners can get a substantial income tax credit based on the property taxes they pay.

And speaking of property taxes, the median property tax rate in D.C. are the eighth-lowest in the country. The city also offers property tax breaks designed just for seniors. Sales taxes in the Nation’s Capital are modest, too.

The District of Columbia does impose an estate tax, though.

- State Income Tax Range: None.

- Average Combined State and Local Sales Tax Rate: 7.01%.

- Median Property Tax Rate: $859 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

The Sunshine State is the quintessential retirement state. Theres no getting around its very popular with retirees, not just because of its forgiving climate but also because it has no state income tax. Sales taxes, though, can go as high as 8.5%, depending on where you live. The average combined state and local sales tax rate is 7.01%, which is about average.

Also Check: What Percentage Of Tax Should I Withhold

No Matter How You File Block Has Your Back

Additional 10% Tax On Early Distributions

If you receive pension or annuity payments before age 59½, you may be subject to an additional 10% tax on early distributions, unless the distribution qualifies for an exception. The additional tax generally doesn’t apply to any part of a distribution that’s tax-free or to any of the following types of distributions:

- Distributions made as a part of a series of substantially equal periodic payments that begins after your separation from service.

- Distributions made because you’re totally and permanently disabled.

- Distributions made on or after the death of the plan participant or contract holder.

- Distributions made after your separation from service and in or after the year you reached age 55.

- Distributions up to $5,000 made within a year of the birth or adoption of your child to cover birth or adoption expenses.

For other exceptions to the additional 10% tax, refer to Publication 575, Pension and Annuity Income and Instructions for Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts.

Don’t Miss: How To File Taxes Free

Ohio Taxes On Retirees

- Our Ranking: Not tax-friendly.

- State Income Tax Range: 2.765% 3.99% .

- Average Combined State and Local Sales Tax Rate: 7.22%.

- Median Property Tax Rate: $1,532 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

As with many states, lower-income retirees in the Buckeye State don’t pay much in income taxes. But that isn’t always true with higher-income seniors. Ohio exempts Social Security benefits from state income taxes for everyone. However, the slate of tax credits for other types of retirement income don’t apply if your base income exceeds $100,000. Localities and some school districts may levy their own income taxes, too.

Property taxes are well above average in Ohio as well. Residents 65 and older may be able to exempt some of their home’s value from Ohio’s steep property taxes. However, there’s an income threshold for this property tax break, too.

Sales taxes in the state are relatively modest. That helps keep Ohio out of the “least tax-friendly” category. And there are no estate or inheritance taxes to worry about.

Hawaii Taxes On Retirees

- Our Ranking: Most tax-friendly.

- State Income Tax Range: 1.4% 11% .

- Average Combined State and Local Sales Tax Rate: 4.44%.

- Median Property Tax Rate: $281 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Estate tax.

The Aloha State is known for its high cost of living, but it can be a tax paradise for retirees. It exempts Social Security benefits as well as most pension income from state income taxes. But if you have other sources of income, Hawaii will tax that income at rates up to 11%. Thats a lot of pineapples.

The property tax situation is unusual: The statewide median tax rate is the lowest in the country, and seniors can also get big-dollar exemptions from property taxes . But keep in mind that Hawaiian property values are sky-high.

Sales taxes are low in Hawaii, too. The average combined state and local rate is only 4.44%, which is the seventh-lowest in the U.S. .

Read Also: File Taxes With Credit Karma

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

Idaho Taxes On Retirees

- Our Ranking: Tax-friendly.

- State Income Tax Range: 1% 6.5% .

- Average Combined State and Local Sales Tax Rate: 6.02%.

- Median Property Tax Rate: $659 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

At first blush, the Gem State might not look like a tax-friendly state for retirees. Idaho taxes are no small potatoes: the state taxes all income, except Social Security and Railroad Retirement benefits, and its current top tax rate of 6% kicks in at a relatively low level. While there is a generous retirement-benefits deduction, it’s only available to retirees with qualifying public pensions.

But, if you dig a little deeper, retirees will see some good news on taxes. First, beginning in 2023, a flat 5.8% income tax will apply to taxable income over $2,500 . Sales taxes aren’t too bad in Idaho, either. Also, since groceries are taxable, the state offers a tax credit of $100 per person to offset these and raises it to $120 if you’re over 65 . The state’s median property tax rate is well below average, too. Plus, Idaho doesn’t have an estate tax or inheritance tax.

- State Income Tax Range: Flat 4.95%.

- Average Combined State and Local Sales Tax Rate: 8.81%.

- Median Property Tax Rate: $2,241 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Estate tax.

Don’t Miss: Tax Preparation Services Springfield Il

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income besides your Social Security, you wont owe taxes on it. However, if youre an individual filer with at least $25,000 in gross income, including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more , then up to 85% may be taxable.

How Can I Receive A Direct Rollover

You can open an individual retirement account to receive a direct rollover. You must contact the individual retirement account sponsor to find out how to have your payment made to your account. If you are unsure of how to invest your money, you may want to temporarily establish an account to receive the payment. However, you may want to consider whether or not you may move any or all of the monies to another account at a later date without penalties or limitations.

If you choose to have the payment made to you and it is over $200, it is subject to the 20 percent federal income tax withholding. The payment is taxed in the year in which it is received unless within 60 days after receiving it you roll it over to an individual retirement account or retirement plan that accepts rollovers.

You can roll over up to 100 percent of the eligible distribution, including the 20 percent withholding. To do so, you must replace the 20 percent withholding within the 60 day period. You will be taxed on any amount that you do not roll over. For example, if you roll over only the 80 percent of the distribution, you will be taxed on the remaining 20 percent.

You can find more information about the taxation of payments from qualified retirement plans from the following IRS publications:

We won’t withhold any amount for federal income tax if your total taxable lump sum is less than $200. We will request a rollover election when you are eligible for a payment of $200 or more.

Also Check: Tax Deduction For Charitable Donations