Dont Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

How To Calculate Your Paid Family And Medical Leave Withholding

To calculate the amount of Paid Family Medical Leave withheld from your paycheck, multiply your gross wages by .6%. You pay 73.22% of that 0.6%.

Note that premiums are capped at the 2022 Social Security Wage Base of $147,000 the maximum premium paid for PFML is $649.32.

You can also visit the Premiums Calculator page on the Washington State Paid Family and Medical Leave website for more information.

Also Check: Can Home Improvement Be Tax Deductible

Read Also: Can You Pay Taxes With Credit Card

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last years federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result in you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Estimate Your Tax Liability

Now that you know your projected withholding, the next step is to estimate how much youll owe in taxes for this year.

The IRS provides worksheets to walk you through the process, which is basically like completing a pretend tax return.

If youre married and filing jointly, for example, and your taxable income is around $107,000 for the 2021 tax year, that puts you in the 22% tax bracket. But you actually wont pay 22% on your entire income because the United States has a progressive tax system. After deductions, your tax liability, or what you owe in taxes, will be about $9,600.

Remember, federal taxes arent automatically deducted from self-employment income. If you have a side business or do freelance work, its especially important to factor that income into your tax equation to make sure you dont end up with a big tax bill at the end of the year.

Recommended Reading: How Much Do I Have To Make To File Taxes

How Is Federal Income Tax Calculated

The more taxable income you have, the higher tax rate you are subject to. This calculation process can be complex, so PaycheckCityâs free calculators can do it for you!

The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

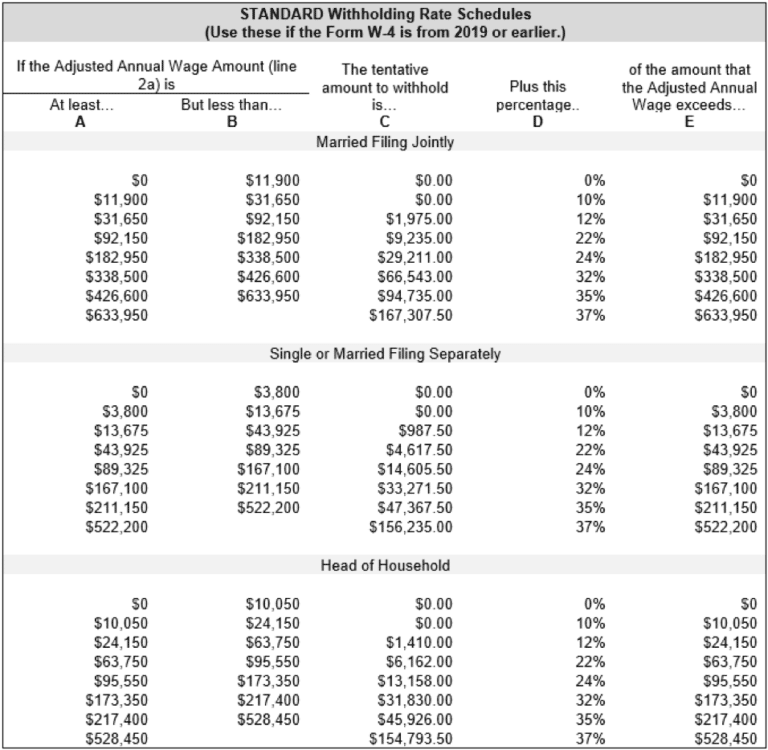

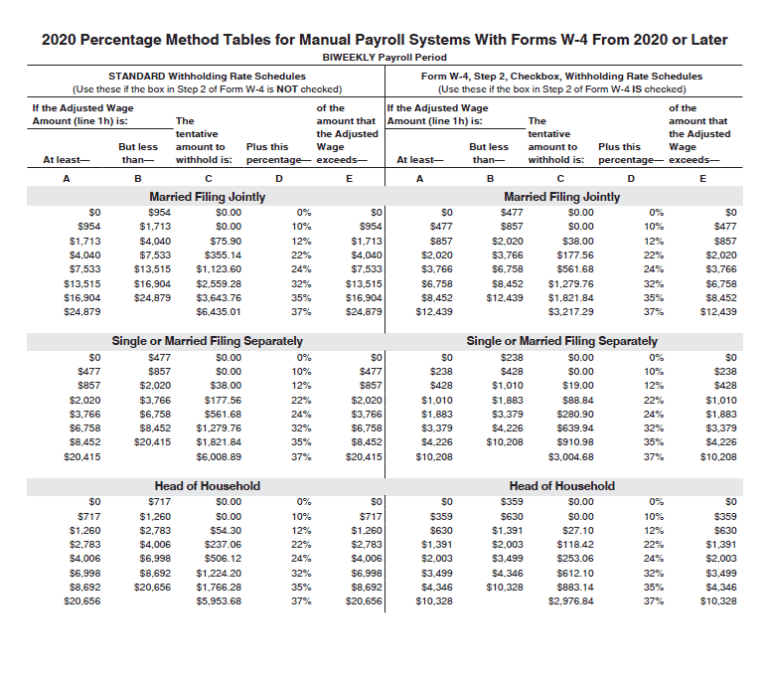

For each payroll, federal income tax is calculated based on the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication 15-T. The current tax rates are 0%, 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Again, the percentage chosen is based on the paycheck amount and your W4 answers.

Standard Vs Itemized Deductions

To visualize the difference between standard and itemized deductions, take the example of a restaurant with two options for a meal. The first is the a la carte, which is similar to an itemized deduction, and allows the consolidation of a number of items, culminating in a final price. The second option is the standard fixed-price dinner, which is similar to the standard deduction in that most items are already preselected for convenience. Although it isn’t as simple as it is portrayed here, this is a general comparison of itemized and standard deductions.

Most people that choose to itemize do so because the total of their itemized deductions is greater than the standard deduction the higher the deduction, the lower the taxes paid. However, this is generally more tedious and requires saving a lot of receipts. Instead of painstakingly itemizing many of the possible deductions listed above, there is an option for all taxpayers to choose the standard deduction – which the majority of the population opts to do. Some people go for the standard deduction mainly because it is the least complicated and saves time. The annual standard deduction is a static amount determined by Congress. In 2022, it is $12,950 for single taxpayers and $25,900 for married taxpayers filing jointly, slightly increased from 2021 .

Read Also: Can I Amend My 2021 Tax Return

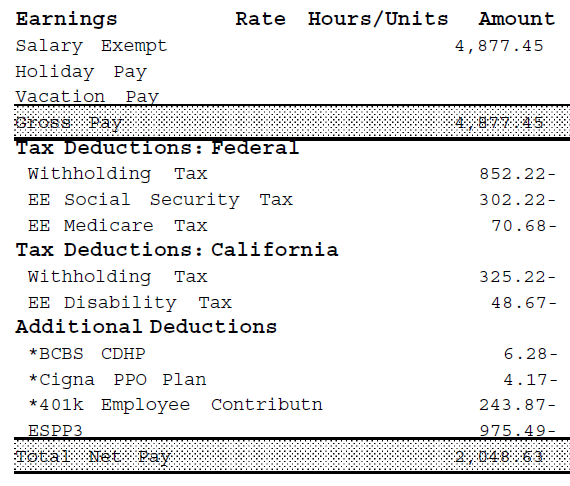

Federal Withholding Term Definitions

Before we get into calculations, lets define a couple of key terms related to federal withholding tax tables:

Gross pay: The full amount of your salary before deductions, withholdings, and contributions are taken out of it

Net pay: Your take-home pay, once deductions, withholdings, and contributions are removed from your gross pay

Withholdings: The amount taken out of an employees paycheck to pay their income taxes during that pay period

Deductions: The amount taken out of an employees paycheck to pay for specific benefits/donations the employee has chosen, such as retirement or health care

These are all common terms that have to do with withholding tax, so it is important to understand these definitions as an employer.

Read Also: What Is The Last Day To File Taxes In Texas

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year , your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

You May Like: Sales Tax Rate In Chicago Il

Tax As % Of Income : 000

Did you know that you may not pay the same tax rate onall your income? The higher rates only apply to theupper portions of your income.

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 12/02/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Refund Transfer: Refund Transfers are fee- based products offered by Republic Bank & Trust Company, Member FDIC. A Refund Transfer Fee and all other authorized amounts will be deducted from the taxpayers tax refund.

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2012 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Read Also: Still Haven’t Received My Tax Refund 2022

Employees Guide To Income Tax Withholding

When your employer drafts your paycheque, they automatically withhold your Employment Insurance premiums, Canada Pension Plan contributions, and income tax, and they remit those payments to the Canada Revenue Agency .

The CRA calculates CPP and EI payments in a fairly straightforward manner, applying a set percentage to a certain range of earnings. The formula applied to income tax, however, is more complex. In some cases, you may end up either owing money or receiving a refund due to the amount of income tax your employer has withheld. Its important to understand how it all works.

Read Also: How Does Property Tax Work

You Can Make Sure Youre Having Enough Withheld

The reason for the withholding calculator is to figure out your tax withholding from your wages. This will ensure that youve saved enough from your paycheck to pay off your tax bill when the time comes.

When you use the calculator, youll be able to protect against not having enough of your paycheck withheld for tax purposes. Youll avoid being hit by a sudden and surprising tax bill that you cant afford to pay all at once.

On the other hand, you may be able to ask that less tax is withheld upfront because you can claim a large tax refund, due to your circumstances.

Employees can use the calculator to figure out whether they need to submit a brand-new Form W-4 to their employer. Youll also need the results from the calculator to fill in this form in the first place, so that you can adjust your withholding.

If you happen to have an income from a pension fund, you will need the calculator to complete Form W-4P, which will be submitted to the organization paying you.

Read Also: New York State Tax Refund Number

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, youll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

Don’t Miss: How To Amend Tax Return Turbotax

Federal Income Tax: 1099 Employees

Independent contractors, unlike W-2 employees, will not have any federal tax deducted from their pay. This means that because they are not considered employees, they are responsible for their own federal payroll taxes .

Both 1099 workers and W-2 employees must pay FICA taxes for Social Security and Medicare. But, whereas W-2 employees split the combined FICA tax rate of 15.3% with their employers, 1099 workers are responsible for the entire amount.

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Gross Wages For Nonexempt Employees Paid On A Per

Calculating gross wages for hourly, nonexempt employees requires a method of tracking time and attendance and strict adherence to the Fair Labor Standards Act , which among other things, governs minimum wage and overtime. Under this federal law, eligible, nonexempt employees are entitled to minimum wage and no less than one and a half times their regular rate of pay for each hour worked over 40 in a workweek. So, if an employee is classified as nonexempt under the FLSA, is paid $13.00 per hour and works 45 hours in a workweek, the individuals gross wages for the week would be + = $617.50. Note: state laws regarding overtime may vary.

Don’t Miss: The Pharisee And Tax Collector

How Much Tax Is Taken Out Of A Paycheck

This varies from person to person and location to location. For example, the more money you earn, the more you pay in taxes. Additionally, state income tax rates vary.

Take these steps to determine how much tax is taken out of a paycheck:

- Review current tax brackets to calculate federal income tax.

- Calculate Federal Insurance Contribution Act taxes using this years Medicare.

- Determine if state income tax and local income tax apply.

- Divide the sum of all taxes by your gross pay.

These steps will leave you with the percentage of taxes deducted from your paycheck.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year and most pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Below, well take a closer look at the most important IRS tax rules to help you understand howyour taxes are calculated.

Also Check: Comparison Of Taxes By State

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

What Was Updated In The Federal W4 In 2020

In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. The redesigned Form W4 makes it easier for your withholding to match your tax liability. Hereâs how to answer the new questions:

- Step 2: check the box if you have more than one job or you and your spouse both have jobs. This will increase withholding.

- Step 3: enter an amount for dependents.The old W4 used to ask for the number of dependents. The new W4 asks for a dollar amount. Hereâs how to calculate it: If your total income will be $200k or less multiply the number of children under 17 by $2,000 and other dependents by $500. Add up the total.

- Step 4a: extra income from outside of your job, such as dividends or interest, that usually don’t have withholding taken out of them. By entering it here you will withhold for this extra income so you don’t owe tax later when filing your tax return.

- Step 4b: any additional withholding you want taken out. Any other estimated tax to withhold can be entered here. The more is withheld, the bigger your refund may be and youâll avoid owing penalties.

If your W4 on file is in the old format , toggle “Use new Form W-4” to change the questions back to the previous form. Employees are currently not required to update it. However if you do need to update it for any reason, you must now use the new Form W-4.

Also Check: What Date Do You Have To File Your Taxes By