Sales Tax Payment And Filing Date:

Based on your tax liability, determine your filing frequency either, quarterly, quarterly prepaid, or annual :

Annual or Fiscal Annual $0 to $100Quarterly $101.00 to $1200.00Quarterly Prepaid $1,200.01 and up

Returns are due on the last day of the month following the reporting period. If the filing due date falls on a weekend or holiday, sales tax is due the next day.

Some high-volume dealers file on a quarterly basis but make monthly sales tax prepayments. If this applies to you, you will have monthly prepayments due the 24th of the month following every month in which you do not have a sales tax filing and payment due.

- Late Filing Penalty 10% of sales tax incurred

- Late Payment Penalty 10% of sales tax incurred

Builders Of New Or Substantially

Certain builders must file their GST/HST returns using GST/HST NETFILE only. Other builders may have to file their GST/HST returns using another electronic method. To find out if you must file electronically and which method you must use, see GST/HST Info Sheet GI-099, Builders and Electronic Filing Requirements.

If you must use GST/HST NETFILE only, follow the instructions in GST/HST Info Sheet GI-118, Builders and GST/HST NETFILE, to complete your return instead of the instructions on this web page.

What States Dont Have State Income Tax

States that do not tax income include Alaska, Florida, Nevada, South Dakota, and Texas. Washington and Wyoming are also low-income, Hawaii and Illinois, for example, are leaving some qualified private pensions.

Charitable remainder trustWhat is a Charitable Remainder Trust and how does it work? The remaining charitable trust allows the donor to transfer assets to a separately administered trust that provides the beneficiaries on behalf of the donor with a payment for life or for a period of several years. The settlor determines the amount of the trust fund payment after consultation with the trustees of their choice.What is a charitable trust

Recommended Reading: Do You Claim Plasma Donation On Taxes

Don’t Miss: How To Add Sales Tax On Square

Collecting Sales Tax In California

Once you’ve successfully registered to collect California sales tax, you’ll need to apply the correct rate to all taxable sales, remit sales tax, file timely returns with the CDTFA, and keep excellent records. Heres what you need to know to keep everything organized and in check.

How you collect California sales tax is influenced by how you sell your goods:

- Brick-and-mortar store: Have a physical store? Brick-and-mortar point-of-sale solutions allow users to set the sales tax rate associated with the store location. New tax groups can then be created to allow for specific product tax rules.

- Hosted store: Hosted store solutions like Shopify and Squarespace offer integrated sales tax rate determination and collection. Hosted stores offer sellers a dashboard environment where California sales tax collection can be managed.

- : Marketplaces like Amazon and Etsy offer integrated sales tax rate determination and collection, usually for a fee. As with hosted stores, you can set things up from your seller dashboard and let your marketplace provider do most of the heavy lifting.

- Mobile point of sale: Mobile point-of-sale systems like Square rely on GPS to determine sale location. The appropriate tax rate is then determined and applied to the order. Specific tax rules can be set within the system to allow for specific product tax rules.

Software And California Sales And Use Tax

Editor: Mark G. Cook, CPA, MBA

State& Local Taxes

The taxability of software for sales and use tax purposes has been a point of persistent debate among states for several years. Many states, including California, have applied sales tax to software based on the form in which it is sold and delivered to consumers. In general, the taxability of software depends on its classification as either canned or custom software, as well as how the program is delivered .

With the downturn in the economy, states have been attempting to revise their tax laws to broaden the overall tax base subject to sales and use tax, thereby increasing revenues to the state. Recently, California courts decided two cases, Microsoft Corp. v. Franchise Tax Board, No. CGC-08-471260 , and Nortel Networks, Inc. v. State Board of Equalization, 119 Cal. Rptr. 3d 905 , that have had and will continue to have an important impact on software transactions. This item addresses the sales and use tax implications of canned software under both cases in light of Californias current statutory scheme. It also comments on the states trend in broadening the tax base with respect to such transactions.

California Sales and Use Taxability of Software

TheMicrosoft Case

Electronically Delivered Software

Historically, California has exempted electronically delivered software from sales and use tax. CA Code Regs. Title 18, Section 1502, provides that

TheNortel Case

Read Also: Payroll Tax Vs Income Tax

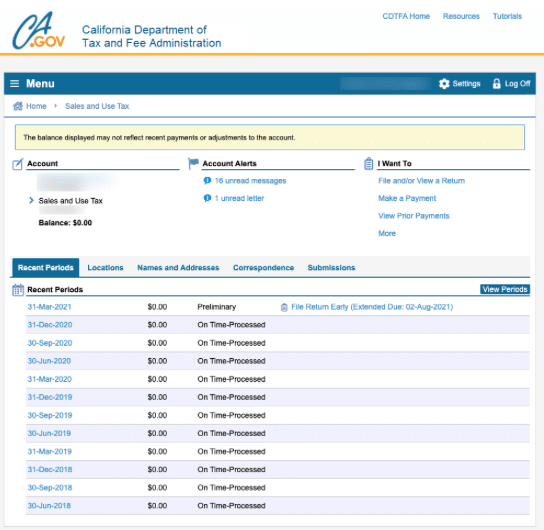

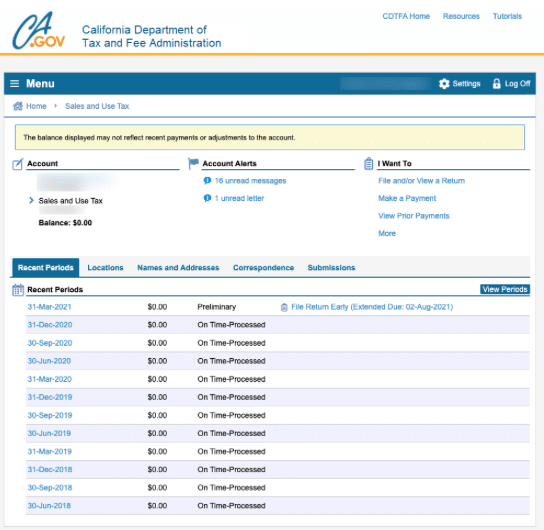

Filing Sales Tax Returns In California

You’re registered with the California Department of Tax and Fee Administration and you’ve begun collecting sales tax. Remember, those tax dollars don’t belong to you. As an agent of the state of California, your role is that of intermediary to transfer tax dollars from consumers to the tax authorities.

Your California Sales Tax Filing Requirements

If your monthly tax liability is over $10,000, you must file online via the California Board of Equalization’s web portal. Otherwise, you also have the option to file on paper with Form BOE-401-EZ. You will need to report your gross sales for the month, deduct any nontaxible transactions, and then calculate the total amount of sales tax due.Be aware that there are late-filing penalties, and late-payment penalties, of 10% of the sales tax owed . If you have no sales tax liabilities any given filing period, you will still be required to file a “zeroed-out” tax return. Failure to file a return can result in your sales tax license being revoked.

Read Also: Property Taxes In Austin Texas

California Sales Tax Guide

Welcome to 1StopVATs guide on sales tax for California. By reading the information below, you will learn what is the sales tax rate in California, how you can get California sales tax permit, and how to submit returns for California sales tax online.

California state sales tax in a nutshell

A sales tax is a tax that is paid on the sale of goods or services and falls on the end-consumer. Once a business establishes a nexus in California, it is held responsible for collecting the right amount of sales tax and submitting it to the state of California. The total sales tax rates California based businesses have to charge vary based on the district of origin and the district where the customers are based. In addition to the sales tax, California has also established transaction taxes called the sellers and consumer use tax, respectively. The seller use tax has to be collected by the sales tax in California exempt businesses, whenever no sales tax was collected on sale that qualifies for the tax and a business in California stores or uses taxable items that were bought tax-free. Consumer use tax comes in place whenever the seller fails to collect the sales tax. In such a scenario, the consumer can report, file, and remit the use tax on the annual tax return.

Do you need to collect California sales tax?

Businesses must collect the correct California sales tax percentage if they meet three criteria:

Do you have a nexus in California?

Taxable goods and services in California

Cigarette And Tobacco Products

If you are registered with the California Department of Tax and Fee Administration as a cigarette and/or tobacco products consumer, your purchases of cigarette and tobacco products may not be reported on your sales and use tax return. If you need additional information, contact our Customer Service Center at 1-800-400-7115 .

Read Also: California State Capital Gains Tax

How Much Is The Sales Tax In California

The statewide California sales tax rate is 7.25 %. However, you should not calculate California sales and use tax by considering this number only. To determine whats the sales tax in California that should be applied to you, you should look at the district where your customers are located and also the district of your business. This model is called a hybrid-origin collection. If you are located outside of California, you should add only the district California tax sales of your buyer. Local jurisdictions in California usually have district taxes that range from 0.1% to 3.25% and need to be added to the sales tax. To identify the sales tax rate California districts have, you can either consult with 1StopVATs team or use our Sales Tax Calculator. Keep in mind that some areas can have more than one district rate added to theCalifornia state sales tax rate.

Filing When Your Business Has Collected No Sales Tax

Once you have a California seller’s permit, youre required to file returns at the completion of each assigned collection period whether or not any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Also Check: How To Amend Tax Return Turbotax

How To Collect Sales Tax In California

If you have an in-state location in California, you are required to collect both state and district sales taxes. District sales taxes vary between 0.10% and 1.00%, and in some cases more than one district tax will apply to any given location.If you have a single location, in-state buyers who are buying from outside your district will only be charged the state sales tax .If you have multiple locations, you must also collect district sales taxes from any buyer who resides in a district in which you have nexus .

How To File A California Sales Tax Return

Once youve collected sales tax, youre required to remit it to the CDTFA by a certain date. The CDTFA will then distribute it to state and local tax agencies where appropriate.

Filing a California sales tax return is a two-step process comprised of submitting the required sales data and remitting the collected tax dollars to CDTFA. The filing process forces you to detail your total sales in the state, the amount of sales tax collected, and the location of each sale.

Filing sales tax online is generally recommended, but businesses may also submit the State, Local, and District Sales and Use Tax Return paper form . This form replaces the CABOE-401-A2. Taxpayers can file and pay returns online through the California Taxpayers Services Portal.

You May Like: How To Check My Tax Refund Status

Online Sales And Taxes

We tax residents on all income, regardless of source, within and outside of the U.S. This includes income earned from making online sales.

As a part-year resident, we tax you on all income received while a California resident, including income earned from making online sales.

Visit Part-year resident and nonresident for more information.

Income from online activities may be taxable, even if you do not receive a tax form.

Are Your Goods Taxable

Generally, services in California are not taxable. For example, a plumber does not have to worry about sales tax. However, if you have a manufacturing business that also operates as a retailer, then you will have to collect sales tax.

Tangible property is taxable in California, with a few exceptions. For example, groceries, prescription drugs, and medical equipment are exceptions to the sales tax in California.

Therefore, if your job is being a freelance writer, you do not have to collect sales tax. If you are selling collectible action figures to consumers, then you must collect sales tax.

Also Check: Filing For An Extension On Taxes 2022

Pay By Check Or Money Order

Our offices do not accept cash as a method of payment . You may contact your local CDTFA office to request an exemption if you must pay your taxes in cash.

NOTE: If you are a mandatory EFT participant and you use another means of payment , your payment will be subject to a penalty.

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Annual filing: If your business collects less than $100.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $100.00 and $1200.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $1200.00 in sales tax per month then your business should file returns on a monthly basis.

Note: California requires you to file a sales tax return even if you have no sales tax to report.

Also Check: How To File Taxes Yourself

Exemptions And Exclusions From Sales And Use Taxes

There are a number of exemptions to the obligation to remit sales and use taxes. Some of these exemptions exist in an attempt to promote certain types of industry or consumer choices. An example is the current such exemption on fresh, but not prepared, foodstuffs.

Other exemptions exist to avoid burdening certain organizations with the obligation to collect sales tax, and so many nonprofit or veterans organizations are wholly exempt. Other exemptions are in place so that the same item does not give rise to two sales tax charges. Thus, items purchased for resale, or to various out-of-state entities or which are in transit to an overseas destination, are exempt.

Other examples of exempt sales include sales of certain food plants and seeds, sales to the U.S. Government and sales of prescription medicine. The list of exemptions is long and detailed, so if you are not sure if your business falls under those headings, you may wish to clarify with the DOE. A comprehensive list is available as Publication 61.

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

If you are a reseller, you may also apply for a California Resale Certificate, which allows you to buy goods within California for resale without paying sales tax on those goods.

Sales And Use Tax Review

Currently, the base tax rate for the state sales tax is 7.5 percent. Local jurisdictions may add onto that. This tax is imposed on all California retailers and applies to all retail sales of merchandise within the state. All retailers must have a sellers permit and pay sales tax to the California California Department of Tax and Fee Administration.

Retailers are allowed to collect the sales tax from customers but are not required to do so. Most retailers do. In all cases, they are liable for sales tax on anything they sell, whether the tax is collected from customers or not.

Use tax is levied on consumers of merchandise used, consumed or stored in the State of California. It does not matter where it was purchased. If you buy something from an online source that is not registered to collect California sales tax or else does not collect it, you are on the hook for paying the tax, which is the same rate as the sales tax.

Use tax is also imposed on leased merchandise such as cars, boats and planes. If you make a purchase in a foreign country and hand-carry it through U.S. customs into California, you must pay the use tax.

Sales and use taxes are mutually exclusive. You cannot be required to pay both sales tax and use tax for the same merchandise.

Read Also: When Is The Last Day To Turn In Taxes

Don’t Miss: How Much Property Tax In California

Line 105 Total Gst/hst And Adjustments For Period

Line 105 before RITC reconciliation is calculated automatically based on the information you provided on Schedule A, if applicable.

If Schedule A does not apply, enter the total amount of GST/HST you were required to charge during this reporting period and any adjustments that increase your net tax for the reporting period.

Only include amounts for the current reporting period. Do not include amounts for the fiscal year being reconciled.

Dont Miss: Www Aztaxes Net

What Is The Highest Tax Bracket In The Us Is

The highest possible taxable category is the 35 percent category, which includes jointly rated couples with incomes greater than $388,350 and individuals with incomes greater than $388,350.

Taxes on lottery winningsHow much tax you will pay on your lottery winnings? Most articles about taxes on lottery winnings emphasize that winners withhold 25% federal income tax. But thats not really the top federal income tax rate. Instead, large boats are taxed.What percentage of lottery winnings are taxed?Lottery winnings of $600 or less are not reported to the IRS. Income over $5,000 is subject to a 25 percent fe

You May Like: Protesting Harris County Property Tax

Also Check: Self Employed Tax Deductions Worksheet