Helpful Hints For Using The Mycpa Login And The New Sales Tax Webfile

We appreciate your patience as we work to improve your experience with our online filing systems.

Thank you,

More Help With State And Federal Taxes

Its important to avoid state tax issues and potential financial liability. If you need help navigating your state tax obligations, get help with H& R Block Virtual! With this service, well match you with a tax pro with Texas tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your TX taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Texas state tax expertise with all of our ways to file taxes.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Filing When There Are No Sales

Once you have a Texas seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.Failure to submit a zero return can result in penalties and interest charges.

Recommended Reading: Penalty For Missing Tax Deadline

How To Register For A Texas Sellers Permit

You can register for a Texas Business Tax License online through the Texas Comptroller of Public Accounts. To apply, youll need to provide the Texas Comptroller with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

Does The Signature On My Document Need To Be Notarized

In most cases, documents submitted to the Secretary of State for filing are not required to be notarized. The Business Organizations Code does not require the notarization of signatures on filing instruments. However, documents governed by codes or statutes other than the BOC might need to be notarized. For example, each organizer of an entity created under certain parts of the Local Government Code must sign and verify the formation document. A verification is formal swearing to or affirming the truth of the statements in a document before a notary public or other person authorized to administer oaths. If you are submitting a document for an entity created under a code or statute other than the BOC, you should check the requirements of that code or statute to determine whether the document needs to be notarized.

Also note that while assumed name certificates filed with the county clerk must be notarized, assumed name certificates that are filed with the secretary of state do not need to be notarized.

Don’t Miss: Are Lawyer Fees Tax Deductible

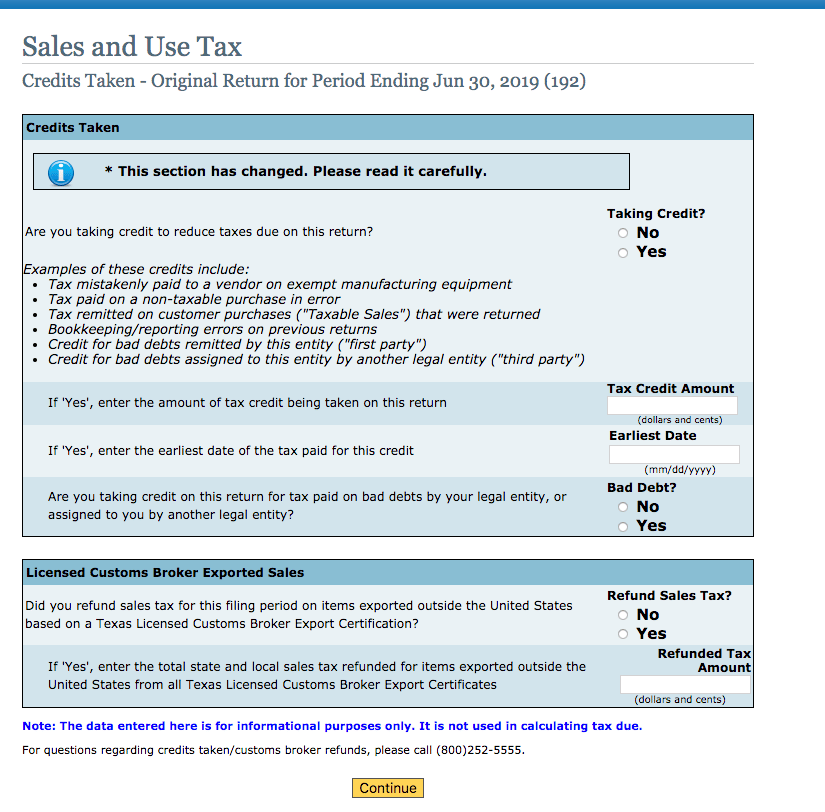

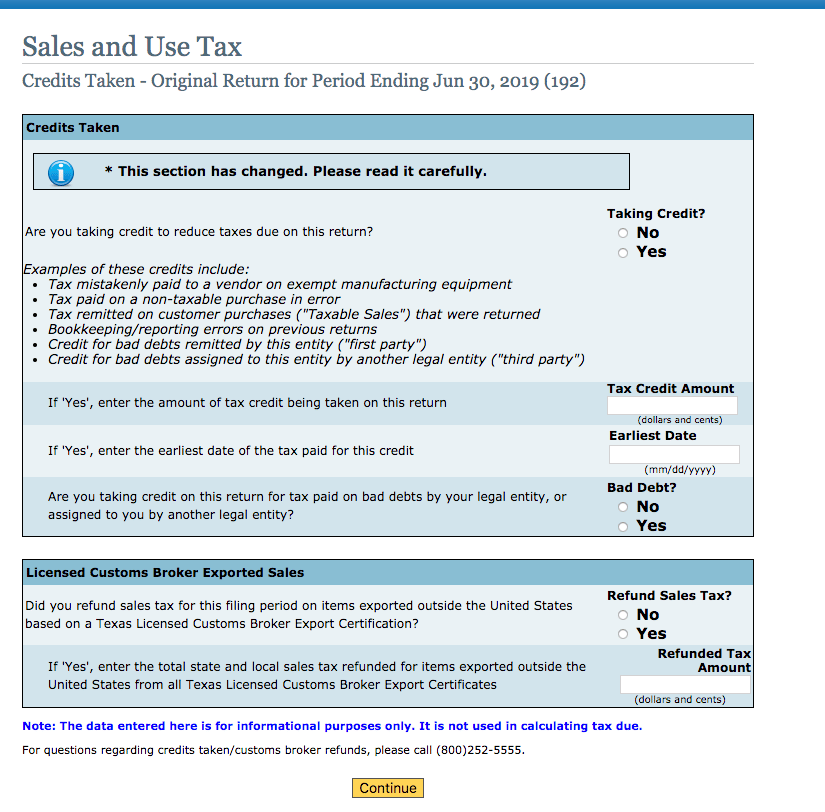

How To File A Texas Sales Tax Return

Whether youve never filed a Texas sales tax return before, or are looking for a quicker way to take care of this obligation, TaxJar has you covered.

If youd rather not spend time filing a Texas sales tax return ever again, enroll in TaxJar AutoFile and let us handle it. Never worry about missing a due dates or remember your state login and password again! Learn how TaxJar AutoFile can solve your sales tax headaches.

This step-by-step video will walk you through logging in at the Texas Comptrollers website, getting started, and using your Texas state report from TaxJar to quickly and easily finish your Texas sales tax filing before your deadline.

What Is The Interest Rate On Late Sales Tax Payments

The Texas Comptroller charges interest when your sales tax payment is 61 days or more late. The interest applies to your late sales tax and the penalties on your account. The interest rate changes annually, and it is the annual prime rate plus one. For instance, if the annual prime rate is 4.25%, Texas will charge you 5.25% annual interest on your late sales tax bill.

If you overpay and request a refund, the Texas Comptroller will also pay you interest. For instance, say that a bookkeeping error caused you to pay $1,000 in extra sales tax. When you fill out the refund request, the state will apply interest to this amount so you will get back a bit more than the $1,000.

Recommended Reading: Earned Income Tax Credit Table

Online Sales Tax Guide By State For Ecommerce Sellers

Determining economic nexus in each state is complicated and overwhelming for many sellers, but our sales tax guide can help demystify the topic, and offer step by step guidelines for sellers to check their requirements.

Please note, nothing in this article should be construed as legal or tax advice.The contents of this website are intended to convey general information only and not to provide legal advice or opinions. For specific advice contact Ecom CPA.

So you started an ecommerce business and its growing! As your sales grow, its important to be sure that youre legally compliant with the states youre operating and selling in. One area you need to pay attention to is internet sales tax.

If youre a blogger, taxes is straight forward. For ecommerce sellers, sales tax can be intimidating, since every state and territory sets their own rules. But sales tax doesnt have to be that scary. Heres our rundown of what you need to know as an ecommerce seller, and what options you have for ensuring that your sales tax is handled.

Sales Tax Directory: By State

Failure To Pay Sales Tax

If a merchant fails to pay sales tax when they should have, theyre likely to eventually receive an assessment letter, which requires that the merchant submit past-due sales tax returns and pay them. Penalties and interest for late filing often amount to 30% of the overdue tax.

If the state believes your intent was to defraud them , criminal penalties can apply as well.

You May Like: Exemption From Capital Gains Tax

Texas Sales Tax Rates

Texas sales tax varies by location. There is a statewide sales tax of 6.25%. In addition, local taxing jurisdictions such as counties, cities, special purpose districts, and transit authorities can impose a sales tax of up to 2%, for maximum tax rate of 8.25%.

Texas has a few transit authorities, departments, and districts that impose their own sales and use tax. Find those rates and districts here.

Texas is an origin-based state for in-state retailers, meaning that a retailer should charge its local rate on all in-state orders. Out-of-state sellers are expected to use the tax rate at the destination of the order, which makes the calculation more difficult due to the variety of taxes and rates across the state.

What Is The Normal Processing Time For Documents Is Expedited Service Available

The office normally processes non-expedited documents within 5-7 business days. Expedited service is available for an additional $25 per document and expedited documents are generally processed by close of business the first business day following the date of receipt. Please note that these timeframes are estimates and are subject to change based on staffing, resources, and workload. NOTE: Due to increased demand for SOS services, non-expedited documents sent by mail or fax are being processed within 70-72 business days. Expedited documents sent by mail or fax are being processed within 12-14 business days. Electronic documents sent through SOSUpload are being processed within 13-15 business days. Electronic documents sent through SOSDirect are being processed within 10-12 business days.

You May Like: Sales Tax Exempt Form Ny

What Taxes Can I File With Edi

- Sales and Use/Direct Pay

- Natural Gas and Crude Oil

- International Fuel Tax Agreement

You must download the forms and use Adobe Reader to fill them out. Print and mail or return them to one of our offices.

Filing/Reporting Due Dates

- Returns filed with Webfile must be submitted by 11:59 p.m. Central Time on the due date.

- Paper returns must be postmarked on or before the due date to be considered timely.

- Late returns may be assessed a $50 late filing penalty.

- If you are required to report electronically, there is an additional 5% penalty for failure to do so.

There are a number of ways to pay:

With Webfile, you can file your return early and post-date the electronic check payment by changing the payment effective date.

Collecting Sales Tax In Texas: An Overview For Small Business Owners

Mr. Freeman is the founding member of Freeman Law, PLLC. He is a dual-credentialed attorney-CPA, author, law professor, and trial attorney.

Mr. Freeman has been named by Chambers & Partners as among the leading tax and litigation attorneys in the United States and to U.S. News and World Reports Best Lawyers in America list. He is a former recipient of the American Bar Associations On the Rise Top 40 Young Lawyers in America award. Mr. Freeman was named the Leading Tax Controversy Litigation Attorney of the Year for the State of Texas for 2019 and 2020 by AI.

Mr. Freeman has been recognized multiple times by D Magazine , a D Magazine Partner service, as one of the Best Lawyers in Dallas, and as a Super Lawyer by Super Lawyers, a Thomson Reuters service. He has previously been recognized by Super Lawyers as a Top 100 Up-And-Coming Attorney in Texas.

Mr. Freeman currently serves as the chairman of the Texas Society of CPAs . He is a former chairman of the Dallas Society of CPAs . Mr. Freeman also served multiple terms as the President of the North Texas chapter of the American Academy of Attorney-CPAs. He has been previously recognized as the Young CPA of the Year in the State of Texas .

Read Also: What Are The Taxes In Florida

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

What Taxes Can I Pay With Webfile

- Boat and Motor Boat Sales and Use

- Cement Production

- Compressed Natural Gas/Liquefied Natural Gas Dealer

- CNG/LNG Interstate Trucker

- Direct Pay Sales and Use

- International Fuel Tax Agreement

- Loan Administration Fee

- Manufactured Housing Sales and Use

- Maquiladora Export

- Mixed Beverage Sales and Gross Receipts

- Motor Vehicle Sales and Use

- Motor Vehicle Seller-Financed

- Oil and Gas Well Servicing

Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year are required to pay using TEXNET.

Paying by credit card will incur a non-refundable processing fee:

| Amount Paid |

|---|

| 2.25% of the amount plus a $0.25 processing fee |

Payment Deadlines

- TEXNET ACH Debit payment of $1,000,000 or less, must be scheduled by 10:00 a.m. on the due date. Payments above $1,000,000 must be initiated in the TEXNET system by 8:00 p.m. the business day before the due date.

- Late payments are subject to penalties and loss of timely filing and/or prepayment discounts.

- If you are required to pay electronically, there is an additional 5% penalty for failure to do so.

Read Also: Do I Need Letter 6475 To File Taxes

What Are The Penalties For Paying Sales Tax Late In Texas

If you pay the sales tax one to 30 days late, the late payment penalty is 5% of the tax due. The penalty is 10% for payments that are more than 30 days late. Keep in mind that the online payment channels have specific cut-off times. If you make your sales tax payment on the due date, it may not be credited until the next day if you make it after the cut-off time.

If the state sends you a notice of tax or fee due, you will also incur an additional 10% penalty. This brings your total penalty for late sales tax to 20% of the tax owed.

Origin Versus Destination Sales Tax

In calculating your sales tax youll deal with the important difference of destination states versus origin states. Although in the past most states have tended to be destination-based, the rise of ecommerce has seen a shift to origin-based sales tax, which allows the state the product is shipped from to retain more of the tax revenue collected by businesses operating in that state.

Recommended Reading: H & R Block Tax Estimator

How Do I Get Help With Texas Sales Tax Issues

Texas sales tax is a very specific part of the tax code. If you need help with Texas sales tax issues, you should contact a local tax pro who has experience with Texas sales tax. Texas tax pros can help you file delinquent sales tax returns, apply for penalty abatement, deal with Texas sales tax audits, and apply for voluntary disclosure.

To find a Texas sales tax professional, use TaxCure to search for local Texas tax pros. Then, narrow down your search based on your unique tax problem. Once you have a list of results, you can review their profiles and reach out to the tax pro who looks like the best fit for you.

Most tax pros offer free consultations. You get a chance to talk about your sales tax issue, and they give you an idea of your options and the best resolution path in your situation.

Experienced Texas Sales Tax Lawyers For Local And Online Sellers

Not every business offering products or services in Texas is required to collect and remit sales tax. The seller must have a sufficient nexus to the State of Texas. Out-of-state sellers, however, often satisfy this requirement. Navigating sales tax regulations in each of the 50 states can put a significant burden on small business owners. Fortunately, the tax attorneys at Freeman Law are available to help with Texas sales tax compliance. Call us today at 984-3410 or contact us online for a free sales tax consultation.

You May Like: Taxes On Self Employment Calculator

May I File Now And Make My Filing Effective At A Later Date And/or Time

Certain filings may be made effective on a date and/or time after the date of receipt. The delayed effective date may be no more than days from the date the instrument is signed. A time also may be provided along with the delayed effective date however, the time may not be specified as midnight, noon, 12:00 a.m. or 12:00 p.m. The time provided will always be entered into our computer system using Central Time even if the document specifies time from another time zone.

Where permitted, the secretary of state forms explain delayed effectiveness in greater detail. A delayed effectiveness provision must be stated within a document instructions relating to the effectiveness in a cover letter are insufficient.

Delayed effectiveness is not permitted for:

In addition, there is no provision in Chapter 71 of the Business & Commerce Code for delayed effectiveness for an assumed name certificates or an abandonment of assumed name certificate.

Below Economic Nexus Thresholds

If youre collecting sales tax in your home state, but youre sure you havent hit economic nexus anywhere else, youre in a great position to set up systems before you need to start collecting.

Track

To do this, make sure you have a system in place to track sales. During times of growth, periodically review your sales by state, as outlined above . Most platforms have some way of downloading sales data, and knowing a few basic spreadsheet formulas can save you tons of time adding them up.

Research

Starting to watch and listen for companies and software solutions will give you a head start when you do reach that point of needing them. If you know other ecommerce sellers, ask for reviews and recommendations on solutions to use.

Prepare for a Nexus Study

As your business grows, be prepared to commission a professional nexus study which will tell you where youve hit nexus and need to register.

Also Check: When Are Virginia State Taxes Due