What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Filing A State Return

TaxACTs state modules are not standalone applications. They require the federal software to run.TaxACT allows you to prepare your state return, but first you need to prepare your federal return. All the data that flows to the state return originates from the federal return. The State Q& A interview section then prompts you for additional information that is specific to your state. Depending on your state, your filing options may be limited if you have already filed your federal return . If you are in a Piggy Back state , you will be required to print and mail your return if not submitting it along with the Federal return. For all other states you can electronically file by selecting State Only when going through the filing steps.

State Only Filing: To file only your state return, click on the blue Filing tab and select E-File My Return. Select the state-only return you wish to submit and then complete the filing steps.

If you do not see the option to file only your state return when going through the filing steps, please follow the instructions below:

Also Check: Do You Have To Pay Taxes On Life Insurance

Filing Taxes Online For Free

If you have a simple tax return with just W-2s and/or unemployment income, youll likely be eligible to file your taxes for free. Still, its important to do your research before you choose which tax filing software to use. Not all tax filing services are created the same, and not all of them allow you to file both state and federal returns for free.

Heres a quick breakdown of what you need to know about the most popular free tax filing services available this year:

| Yes | No | Filers with simple tax returns including W-2s, unemployment and/or retirement income who are claiming Child Tax Credit or Earned Income Credit |

Youll find more information on each service below to help you decide which software is best for you.

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But its still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Read Also: When Will I Get My Federal Tax Refund

Read Also: How Old Do You Have To Be To File Taxes

Whats The Difference Between Turbotaxs Free Guaranteed And Irs Free File Delivered By Turbotax

TurboTax Free Edition is not always free. It has only been free for tax returns that the company defines as simple. That often means people with student loans and freelance income actually have to pay to file. Look for Intuits IRS Free File Program delivered by TurboTax. This year, you are eligible if you:

- Make less than $39,000 a year, OR

- Make less than $72,000 a year and serve in the military.

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

Also Check: How To Amend Tax Return Turbotax

What To Do If You Made More Than $73000

If your gross adjusted income was more than $73,000 in 2021, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option.

What Are The Objectives Of The Free File Agreement

- Provide greater access to free, online tax filing options with trusted partners only through IRS.gov

- Make federal tax preparation and filing easier for and reduce burden on individual taxpayers, and

- Continue to focus free governmental services for those least able to pay for tax preparation services

You May Like: Can I Still File My 2017 Taxes Electronically In 2021

We Provide Qualified Tax Support

E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If youve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a help request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Also Check: How To Avoid Taxes On Lump Sum Payout

No Matter How You File Block Has Your Back

Read Also: How To File Taxes Without W2 Or Paystub

How Is Cash App Taxes Different From Other Services

Not only is it fast and easy to file with us, it’s completely free from start to finishno hidden fees, charges, or surprises.

Some filing services guarantee that your taxes will be 100% accurate, and we do too!¹

Whether your tax situation is simple or complex, we make sure everything looks good the whole way through to help you max out your refund.

Also, if you deposit your refund into Cash App, you can get it up to 5 days faster compared to many banks.

¹Learn about our Accurate Calculations Guarantee.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

Dont Miss: How To File Va State Tax Extension

Also Check: Tax On Food In Virginia

Who Is Eligible For Irs Free File

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. IRS Free File provides access to free tax preparation software from several tax-prep companies, including major brands. You must have an adjusted gross income of $73,000 or less to qualify for IRS Free File . IRS Free File providers include providers such as TaxAct and TaxSlayer.

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Read Also: Sc State Tax Refund Status

Here’s How Free File Works:

How To File State And Federal Taxes For Free In New York

A calculator and tax books

ALBANY, N.Y. – There are eight tax services that participate in the IRSs Free File program allowing people who make up to $73,000 to e-file their taxes for free. Depending on where in the country people live, if they are planning to file state taxes, not all the eight programs allow people to file both federal and state taxes.

Three options exist for New Yorkers who file federal and state returns: OnLine Taxes , TaxAct, and FreeTaxUSA, according to the Internal Revenue Service and the New York State Department of Tax and Finance . Still, each of the services has its own limitations. Below are the guidelines for each:

| Service | |||

| Yes, if AGI criterion is met. | Yes | ||

| Up to $65K | Up to 56-years-old | Yes, if AGI criterion is met. | Yes |

| Yes, if AGI criterion is met. | Yes |

The NYSDTF said tax season opens on January 24 but companies offering free tax services could make software available as early as Jan. 14. They have a list of documents New Yorkers will need to file their taxes online and videos to help people choose the service thats right for them.

Copyright 2022 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Recommended Reading: Morgan Stanley Tax Documents 2021

Top 5 Reasons To File Your Taxes Early

OVERVIEW

Every year, many taxpayers wait until the last minute to file their federal income tax returns. Despite this tendency, there are many reasons to file your taxes early. If you will receive a refund, you may want to submit your return as quickly as possible. Additionally, there are benefits to filing early for those taxpayers who have a balance due.

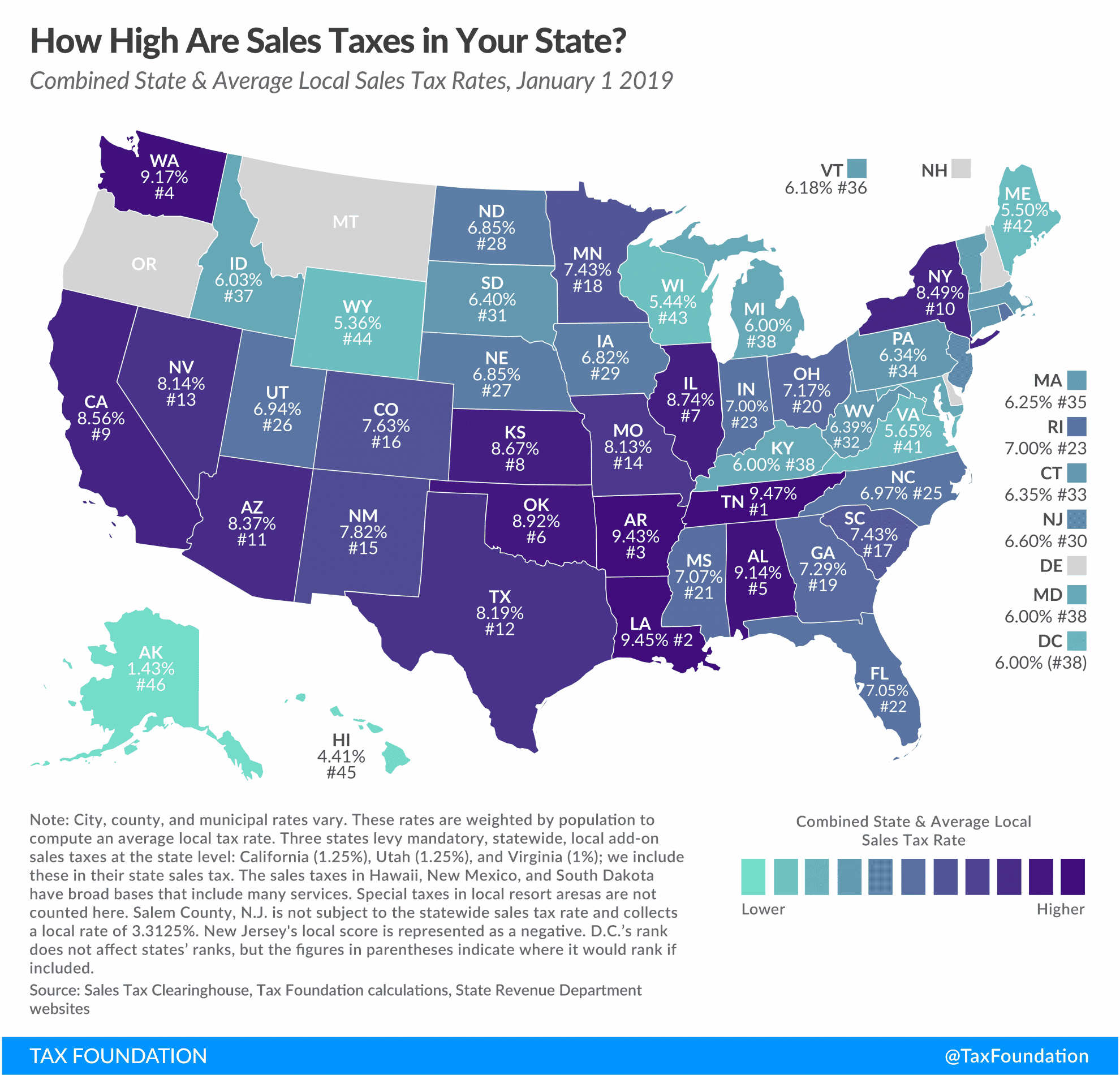

Dont Miss: What Is The Sales Tax In Mississippi

Some Private Sector Firms Have Offered Free E

IRS Free File program is a multi-year agreement between IRS and the Free File Alliance to provide free service to more taxpayers. To be true IRS Free File, the services must be accessed through IRS.gov.

With IRS Free File, taxpayers have easy access to IRS.gov/freefile, which offers a list of the participating free offerings on a single web page. Under our agreement, Free File Alliance companies offer both free preparation and free e-filing services. There is no cost for a federal tax return to qualifying taxpayers.

Note: The IRS does not endorse any individual Free File Alliance company. While the IRS manages the content of the IRS Free File pages accessible on IRS.gov/freefile, the IRS does not retain any taxpayer information entered on the Free File site.

Read Also: Is Auto Insurance Tax Deductible

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.