Who Must File Taxes

Whether you need to file a tax return comes down to your tax filing status. Your tax filing status takes into account your income, age, marital status and whether you qualify as a head of household.

If you earned an income over the past year, its likely youll have to file a tax return, even if you dont end up owing any taxes. But especially if youre a first-time filer, its good to confirm whether you need to file.

You may not need to file a tax return if your income was below a certain threshold. For 2017, use the chart below to see if you need to file.

| Filing status | |

|---|---|

| 65 or older | $18,000 |

There are a few caveats, so if you have any questions, consult a tax professional or take a look at IRS Publication 17.

As a first-time filer, you may also want to check whether anyone is claiming you as a dependent on their tax return. If a parent is claiming you as a dependent, you still may need to file taxes, but you will not be able to claim your own personal exemption.

How Do I Contact Cash App Taxes Support

When using a completely free tax software, you’ll typically need to be willing to make a few compromises. And in the case of Cash App Taxes, one of those compromises is that you’ll have limited support options.

Cash App does have a new dedicated Help Center for Cash App Taxes. But unlike premium tax software companies, you won’t have the option to upgrade to tiers that include access to tax pros.

If you have a technical problem with the app, you can call the company’s main customer service number at 1-800-969-1940. But if you want the ability to ask tax-related questions to experts, you’ll likely want to choose a different tax software.

Basics To Know About Filing State Taxes For Free

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance.

You May Like: How Does Tax Write Off Work

Minimize Penalties And Interest

The IRS can penalize you if you dont file a return or pay any tax you owe by the deadline. Generally, the penalty for not filing is more than the penalty for not paying. You may also be charged interest on any unpaid tax balance.

Filing your back taxes and paying anything you owe may help limit the amount of interest and penalties youre subject to for missing the deadline.

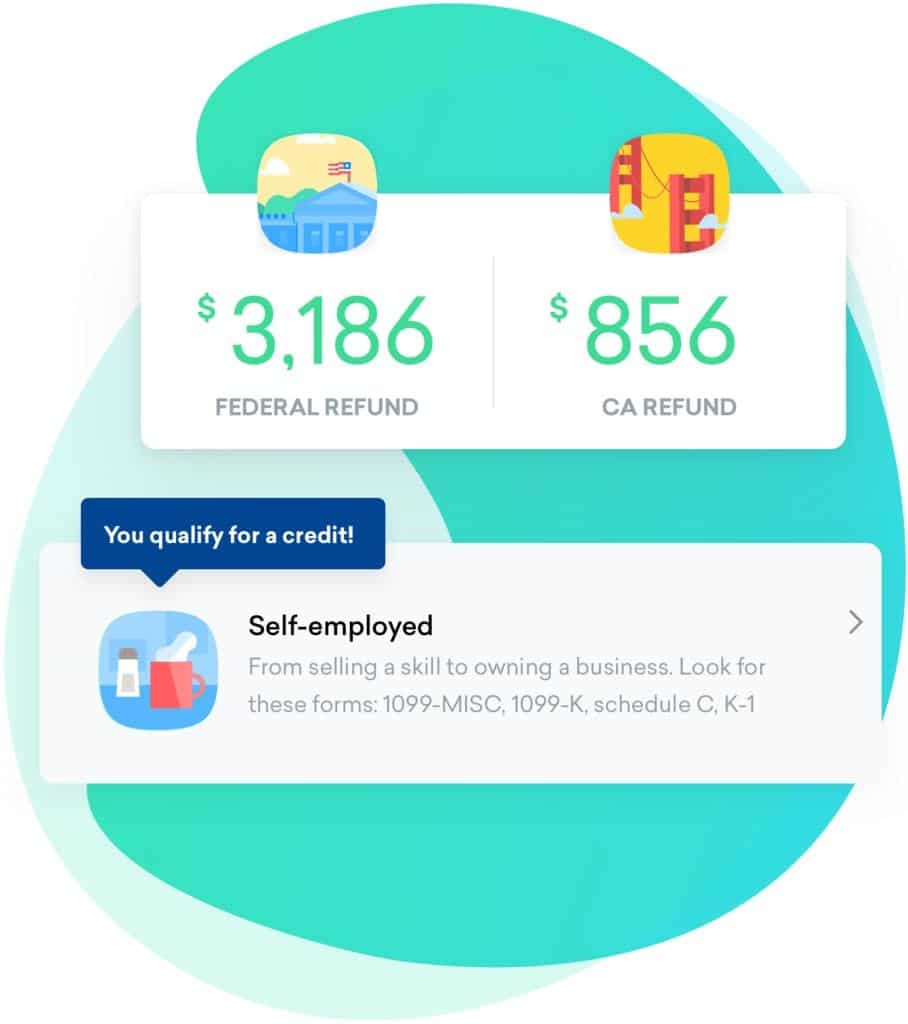

Streamlined Onboarding For An Intuitive Experience

As you begin your return with Credit Karma Tax, youll be asked a series of comprehensive questions used to map to applicable tax forms. Each answer is used to develop a personalized dashboard to help you file your taxes efficiently, and you will only fill out the forms required for your particular situation.

Read Also: States With The Lowest Sales Tax

Alright Whats The Catch

While I wish that there was truly a perfect free tax software, Credit Karma Tax does have a few limitations.

First, you will have to sign up for a Credit Karma account to get access to Credit Karma Tax, which may be a turnoff for you.

Second, Credit Karma Tax is not available everywhere.

And if you have a super complex tax situation, Credit Karma Tax is probably not for you.

Good News: All Tax Situations Are Free

Credit Karma Tax is now called Cash App Taxes, and it offers free tax filing no matter what your tax situation is.

You may already use Credit Karma to track everything related to personal finance such as your budgets, spending, and credit score, so might as well use it to file your taxes, too.

Credit Karma Tax is now called Cash App Taxes, and it offers free tax filing no matter what your tax situation is. That means regardless if you have a simple tax return or one that involves business or rental income, you pay zero fees .

Don’t Miss: Irs File Taxes For Free

Other Notable Features In Cash App Taxes

Cash App offers two guarantees: Accurate Calculations and Maximum Refund. The Accurate Calculations Guarantee will pay up to $1,000 if Cash App Taxes makes an error that results in IRS penalties.

Cash App Taxes also provides one year of audit defense for free. If you decide to file with Cash App again in 2023, the audit defense protection extends to three years.

Taxpayers can file digitally or print their returns to file through the mail. Cash App Taxes recommends using the desktop version for printing forms. Tax refunds can be added to your Cash App account, put into your bank with direct deposit or delivered via check in the mail.

Cash App Taxes’s live chat feature is staffed by humans and available 12 hours every day, from 8 a.m to 8 p.m. PT . There’s a wait time to chat live with a Cash App Taxes representative, but in several tries, our longest wait was less than 2 minutes. That wait time could increase greatly as April 18 gets closer.

What Is Credit Karma

is best known for its consumer credit offerings. You can see estimates of your credit score, monitor aspects of your finances, and apply for credit cards and other loans.

This is the fourth year Credit Karma has offered tax preparation services, now called Cash App Taxes. Its an attractive offer, with the company seen as a fairly popular tax preparer in the United States.

On top of helping you prepare and file your federal tax return, Cash App Taxes will also help you with your state filing for free. All you have to do is answer a few questions about your situation, and the online or mobile app will help you determine the best way to approach your taxes, including helping you determine what your filing status should be.

You May Like: How To Get My Tax Return From Last Year

Is It Worth It

Cash App Taxes offers a free product that is more robust than most paid products on the market today. It doesnt rival premium services , but it’s serviceable for most filers who dont actively trade stocks or crypto. Given the ease of use, were recommending Cash App Taxes as a top free tax filing option for this year.

Let’s answer a few of the most common questions that people ask about Cash App Taxes.

Can Cash App Taxes help me file my crypto investments?

If you traded one or two tokens, you may want to use Cash App Taxes to file your taxes. Figuring out the cost basis on these trades wont be too difficult. However, active traders will have to manually enter dozens or hundreds of transactions. This is too time-consuming to be worthwhile. Users should instead consider TaxAct or TurboTax Premier to cut down on the time spent filing.

Can I request my stimulus check through Cash App Taxes?

Tax filers who didnt receive all of their stimulus money can correct the error through Cash App Taxes. The software has an entire section devoted to the Rebate Recovery Credit.

I didnt receive the full amount for Advanced Child Tax Credit Payments. Can Cash App Taxes help me get the rest?

Cash App Taxes ensures that all parents receive the right amount for the Child Tax Credits. Any amount that you did not receive will be added to your annual refund check.

Can Cash App Taxes help me with state filing in multiple states?

Do I have to pay if I had a side hustle?

You Can Fall Behind On Your Taxes If You Dont File A Federal Income Tax Return Or Dont Pay Any Tax You Owe By The Due Date Generally April 15 For Most People

Owing back taxes can feel overwhelming. The prospect of facing penalties and interest, or just the sheer work of filing a past-due return, may tempt you to keep putting things off.

But we cant stress enough that being proactive is the way to go when it comes to dealing with the IRS. As soon as you realize you may owe back taxes, or youve missed a filing deadline, its important to file and pay those outstanding taxes as soon as possible to help minimize the consequences of falling behind.

Lets look at some things to know when you have to pay or file back taxes.

Also Check: Rental Property Income Tax Calculator

Is Credit Karma Tax Really Free

Most tax preparation companies make money by charging you a fee to download the app or submit your taxes. Credit Karma Tax is really free. There is no charge for filing a federal or state return regardless of your income.

The company also offers , a high-yield account with no monthly fees or minimum balance and a competitive APY. Filers who use Credit Karma Tax can choose to deposit their refund directly into an existing Credit Karma Savings account or open a new one.

How Do You Log In To Cash App Taxes

Filers who want to use Cash App Taxes may be confused by the login process. To create a tax account you’ll need to download the Cash App on your own. Next, you’ll need to select the “Free Tax Filing” option from the “Banking” menu.

From there, you’ll have the option to immediately start filing your return. Or you can choose to let Cash App Taxes estimate your refund instead.

If you choose to start filing, you’ll be asked tor provide an email address. You’ll then be sent a confirmation code to that email address and then another one to your phone. Once both have been verified, you can begin to fill out your personal information.

Note that you won’t have to complete your entire return on your phone. Once you’ve logged in using the app, you’ll have the option to scan a QR code to finish completing your return on a computer.

Recommended Reading: Where Cani Get Tax Forms

How Is Cash App Taxes Different From Other Services

Not only is it fast and easy to file with us, it’s completely free from start to finishno hidden fees, charges, or surprises.

Some filing services guarantee that your taxes will be 100% accurate, and we do too!¹

Whether your tax situation is simple or complex, we make sure everything looks good the whole way through to help you max out your refund.

Also, if you deposit your refund into Cash App, you can get it up to 5 days faster compared to many banks.

¹Learn about our Accurate Calculations Guarantee.

How Does Credit Karma Tax Work

You can also jump around from form to form on your own as you go through your stack of paper and digital tax forms for the year.

While a few less-common circumstances are not covered by Credit Karma Tax, most filers are able to use the online tool to prepare and submit federal and state tax returns for free. Unlike other services, which may offer some level of free preparation depending on your income or tax situation, Credit Karma Tax is always free.

Outside of a limited list of unsupported forms, you can find just about any tax form with a few clicks. The income, deductions, and credits sections at both the federal and state levels are intuitive and easy to navigate. If you have a form in hand and don’t know where it goes, you can just type the form name into the search bar for example, 1099-INT or W-2 and navigate to that form with just a click.

Recommended Reading: How To File Free Taxes

Cash App Taxes Review

Advertiser Disclosure: Opinions, reviews, analyses & recommendations are the authors alone. This article may contain links from our advertisers. For more information, please see our .

Cash App Taxes acquired Credit Karma Tax in 2020. Credit Karma was founded in 2007 to help people monitor and improve their finances. Credit Karma began offering Credit Karma Tax in 2016.

When Cash App Taxes took over Credit Karma Tax, they promised to keep the same features at the same price free. Their tax preparation and filing services are completely free all the time with no hidden fees or up-sold features.

One key change is that you need to download the Cash App and create a free account in order to use Cash App Taxes.

How Can I Get Past Tax Returns That Were Filed With Credit Karma Tax

If you filed with Credit Karma Tax before, we can help you get your past tax returns. Starting in January 2022, youll be able to get your previous tax returns that you filed with Credit Karma Tax within Cash App Taxes.

If you need your tax returns before then, visit Cash App Taxes Support for step-by-step instructions.

You May Like: 6 Months And Still No Tax Refund 2021

Who Can Use Credit Karma Tax In 2019

In 2019 supports filing for more forms/schedules than they did in previous years.

Which is great news!

The software is now an option for a larger pool of the tax filing population. If you make money with side hustles throughout the year youll be glad to know that self-employed 1099 forms are now available for use.

Plus:

All of the Federally recognized filing statues, such as joint filing, are supported, as well.

In essence they support most common tax forms, see the full list here.

But:

The only reason you wouldnt be able to use their online services would be if you fall into one of the unsupported situations, like having multiple state returns.

Check out which forms and situations Credit Karma Tax does not support by visiting this page.

How Do I Get Started

Its simple, if you have more questions please call our toll free number to set up an appointment with one of our account managers today. If you are ready to purchase please click the purchase now button. You will then receive a link to download the software and an account manager will call you to get the required information to setup your account. If you would simply like more information then fill out the request information form to keep up to date on all new developments with Sigma 1040-DR!

You May Like: How Are Social Security Taxes Calculated

Is Cash App Taxes Really Free

Yes, Cash App Taxes is free. In fact, there’s no opportunity to pay for the service or upgrade for premium support. The product earns money through targeted advertising for other financial services.

Cash App Taxes also generates users for the payment service Cash App, which makes money in a variety of ways, such as retailer hardware fees, transaction fees, selling bitcoin and net interest lending.

How To Sign Up

Signing up for Credit Karma Tax only takes a few minutes. Theres nothing to download, and if you already have a Credit Karma account, the process is even faster.

You May Like: Tax Deduction For Charitable Donations

You Can Keep Filing Taxes Through Credit Karmabut Its No Longer Completely Free

Credit Karma Tax is now Cash App Taxes, but Credit Karma isnt out of the tax game just yet.

The company recently announced it will still offer tax filing through TurboTaxanother product provided by Credit Karmas new parent company, Intuit.

TurboTax is one of the easiest to use tax software platformsbut unlike Credit Karma Tax, which was completely free for all users, you may have to pay a fee to file your taxes. And in some cases, you may not be able to file your taxes through Credit Karma at all.

Who Should Use Credit Karma Tax

Filers who crave simplicity and want to save money on tax preparation will get the most out of Credit Karma Tax.

Because the platform doesn’t have separate packages for specific tax situations, like self-employment or investment income, it relies on the user to find the tax forms they need beyond the most basic ones. It’s a true do-it-yourself experience. That said, the interface is clear and easy to navigate, even for novices.

Read Also: How To Calculate Taxes On Tips

Can I Use Credit Karma Tax On My Mobile Phone

Yes! Most filers can complete their entire tax return on a mobile device. We support importing your W-2 by taking a photo directly from your mobile device.

If you do run into a situation where youd feel more comfortable working on your tax return on your computer, you can log in to your account on to pick up where you left off.

Does Cash App Taxes Make Tax Filing Easy In 2022

Cash App Taxes makes tax filing relatively easy for most users. It doesnt support imports, but it has decent calculators and a good user interface. However, active traders will have to manually enter each trade .

Additionally, we found one issue associated with over-contributions to self-employed 401 plans. That said, these limitations wont apply to most users. Cash App Taxes is an excellent software for almost all tax filers.

Read Also: Do I Pay Taxes On Social Security