Service In A Combat Zone

The April 18 due date for filing your tax return is automatically extended if you serve in a combat zone. There’s a two-step process for figuring the length of a combat zone extension. First, your deadline is extended for 180 days after the last day you’re in a combat zone or the last day the area qualifies as a combat zone, or the last day of any continuous hospitalization for an injury from service in the combat zone. Use whichever of these two dates is the latest.

Second, your tax extension deadline is pushed back beyond the first 180 days by the number of days you had left to take action with the IRS when you entered the combat zone. For example, you had 3½ months to file your tax return this year. Any days left in this period when you entered the combat zone are added to the 180 days.

The combat zone extension isn’t just for military personnel, either. It can be claimed by merchant marines on ships under the Department of Defense’s control, Red Cross personnel, war correspondents and civilians supporting the military.

Can’t Pay Still File For A Tax Extension

Even if you can’t pay the tax, file for an extension. The combined penalty for failure to file taxes and failure to pay taxes is 5 percent of the amount you owe. The penalty for late payment is just 0.5 percent of the amount you owe per month, plus interest on the amount you owe.

If you’re unable to pay taxes because of financial hardship, you can ask the IRS for an installment payment plan. In most cases, you can arrange one online with the Online Payment Application tool.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

We Follow Irs Rules For Extensions Of Time For Filing A Return

If you have obtained a Federal Automatic Extension, you do not need to submit an Application for Extension of Time to File. It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows.

An extension of time to file your return does NOT extend the time to pay. If tax is due, interest accrues from the original due date of the tax. If you expect to owe tax when you file your return, the best policy is to make a payment. For income taxes use an extension payment voucher.

If you wish to request an extension of time for filing a return, submit formRPD-41096, Application for Extension of Time to File.

Latest News

You May Like: Does The Post Office Have Tax Forms

When To File And Pay

You must file your return and pay any tax due:

Note: The due date may change if the IRS changes the due date of the federal return.

You must pay all Utah income taxes for the tax year by the due date. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. See

Utah does not require quarterly estimated tax payments. You can prepay at any time at tap.utah.gov, or by mailing your payment with form TC-546, Individual Income Tax Prepayment Coupon.

What If I Dont File By October 17

People who fail to file their return by the extended tax deadline will face harsher penalties. The IRS charges 5% of the unpaid taxes for each month that a tax return is late or 10 times more than the underpayment penalty. It caps the penalty at 25% of your unpaid taxes. The tax agency also charges interest on the penalty.

You May Like: How Is Property Tax Paid

Also Check: Federal Small Business Tax Rate

No Form 8606 To Verify Nondeductible Ira Contributions

Another common oversight is skipping Form 8606 for nondeductible IRA contributions, said Marianela Collado, a CFP and certified public accountant at Tobias Financial Advisors in Plantation, Florida.

That’s an issue because you may need this paperwork to verify contributions for so-called Roth conversions, a move that bypasses the income limits for Roth IRA deposits, allowing future tax-free growth. Without proof of the original deposits, you may get taxed on the same income twice.

Why Did So Many People Request A 2022 Tax Filing Extension

Every year, a group of people just naturally drag their feet past April and file Form 4868 to request the automatic six-month extension. By filing that form, you get more time to file a completed tax return, not more time to pay your tax bill. You want to pay any amount due or pay as much as you can by the April deadline to avoid interest and penalties on what is owed.

This year, the numbers filing for extensions exploded to record levels as some taxpayers hoped the IRS would extend the deadline. Others worried that some last-minute tax changes could be around the corner from Congress. And many weren’t sure how to calculate the child tax credit or the recovery rebate credit.

What’s inflation? Inflation eased to 8.2% but remained high in September.

“COVID really changed things as far as how people file, the pace at which they’re doing it,” Fuller said. “It just changed the nature of the tax law, too, because so many credits became available.”

In typical years before the pandemic, he said, 9 million to 10 million people would request an extension each year.

Nearly 11.6 million taxpayers filed Form 4868 in 2020, and an estimated 13.56 million filed for an extension in 2021.

The IRS said its latest figures through Sept. 23 showed that 18.95 million extension requests were filed in 2022, including nearly 16.4 million that were electronically filed.

Read Also: Ny State Tax Payment Online

Need To Use A Credit Card To Pay Taxes Owed

If you’ve e-filed or mailed Form 4868 and need to pay by credit card, you can use one of several IRS approved Electronic Payment Methods. You can pay with your debit or credit card online or by phone. File your complete return by October 16, 2023.

Cautions

- If the IRS thinks your estimate of the amount of tax you owe is unreasonable, it may disallow your extension and assess a late-filing penalty.

- If you underestimate the amount of tax you owe, you’ll likely have to pay interest and perhaps penalty on whatever amount you fail to pay by the original filing deadline.

- If you pay less than 90% of the tax you owe, you’ll end up owing a penalty of 0.5% of the underpayment every month until you pay the remaining balance. For example, if you pay $600 by the original filing deadline, but discover when you complete your return that you really owe $1,000, you will usually owe 0.5% per month on the $400 that is overdue, or about $2 a month, until you pay the full amount owed.

How To File An Individual Tax Extension Online

Use to extend the individual tax forms 1040, 1040A, 1040-EZ, 1040NR, 1040NR-EZ, 1040-PR or 1040-SS filing deadline to October 17, 2022.

Get automatic extension up to 6 months by choosing ExpressExtension as your e-file IRS service provider. The total filing process will be quick and easy.

Just follow the below steps to complete your :

- Choose the extension type you would like to file

- Enter your personal details such as Name, Address, SSN

- Enter your tax payment details if you owe any taxes

- Review your Form

- Transmit your Form 4868 to the IRS.

Once you are transmitting the return, you will get instant approval from the IRS.

Also Check: How To Calculate Taxes For Payroll

Most Taxpayers Who Requested An Extension To File Their 2021 Tax Return Must File By Oct 17

COVID Tax Tip 2022-156, October 12, 2022

Time is running out. The October 17 filing extension deadline is just days away. Most taxpayers who requested an extension of time to file their 2021 tax return must file by Monday to avoid the penalty for filing late. This year, the IRS received about 19 million requests for extensions to file until October 17 and urges people to file electronically.

Extension filers who owe taxes should pay as much as possible to reduce interest and penalties. Those who have yet to file a 2021 tax return, owe tax, and did not request an extension, can generally avoid additional penalties and interest by filing the return and paying any taxes owed as soon as possible.

Irs Reminds Taxpayers Of Upcoming Filing Extension Deadline Free File Remains Open Until Nov 17

IR-2022-179, October 14, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday, October 17. IRS Free File remains open until November 17 for those who still need to file their 2021 tax returns. This includes those who qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 tax return to claim them.

IRS Free File is a public-private partnership between the IRS and tax preparation software industry leaders who provide their brand-name products for free. There are eight Free File products available in English and two in Spanish.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

- IRS Partner Sites. Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Individual taxpayers whose adjusted gross income is $73,000 or less qualify for any IRS Free File partner offers. Free File lets individuals electronically prepare and file their federal income tax online using guided tax preparation.

Recommended Reading: Highest Sales Tax By State

Why Should I File A Tax Extension

- You’ve got a few things left to organize before you can file

- A sudden change in your life that needs your full attention

- You’re still waiting for tax forms or documents

- Your W-2 or other forms need to be replaced

- Extreme weather or another event delays your tax filing

- Filing later has tax planning advantages

- You want to avoid late filing penalties

Volunteer Income Tax Assistance

The IRS’s Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if there’s a community-based site staffed by IRS-trained and certified volunteers still open near them.

Recommended Reading: Pre Tax Or Roth 401k

Do I Get Penalized For Filing Taxes Late If I Owe Nothing

The fine for filing up to 60 days late can be as much as 5% of your unpaid taxes each month or part of a month that you are late, up to 25%. After 60 days, the IRS imposes a minimum penalty of $435 or 100% of the unpaid tax, whichever is less. Taxpayers owed a refund won’t be charged a fee for filing late.

What Happens When You E

Your Personal tax extension Form 4868 gets reviewed for any errors and is transmitted securely through our IRS-authorized, e-filing network.

Depending on the filing capacity, the IRS could get back with you within the hour. Our email notifications will keep you updated on your filing status. If your gets rejected, we immediately point out the issue and allow you to correct any mistakes and retransmit for free. No worries, our forms are simple for quick approvals!

Read Also: Check The Status Of Tax Refund

Recommended Reading: Can You File Taxes On April 18

Use Tax Software To Handle Your Tax Matters

If you’re feeling anxious about filing your tax return, help is available.

Some tax preparation companies also offer additional paid resources like live, online help from tax professionals, or in-person tax support if you need extra assistance.

Check out our best tax software list to find the right tax software for your needs.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Recommended Reading: 1 Year Tax Return Mortgage

How Do I Print My 4868 Extension Form After E

If youre using TurboTax Online to prepare your 2021 return:

Recommended Reading: Tax Loopholes For Small Business

Federal Tax Deadline Extensions

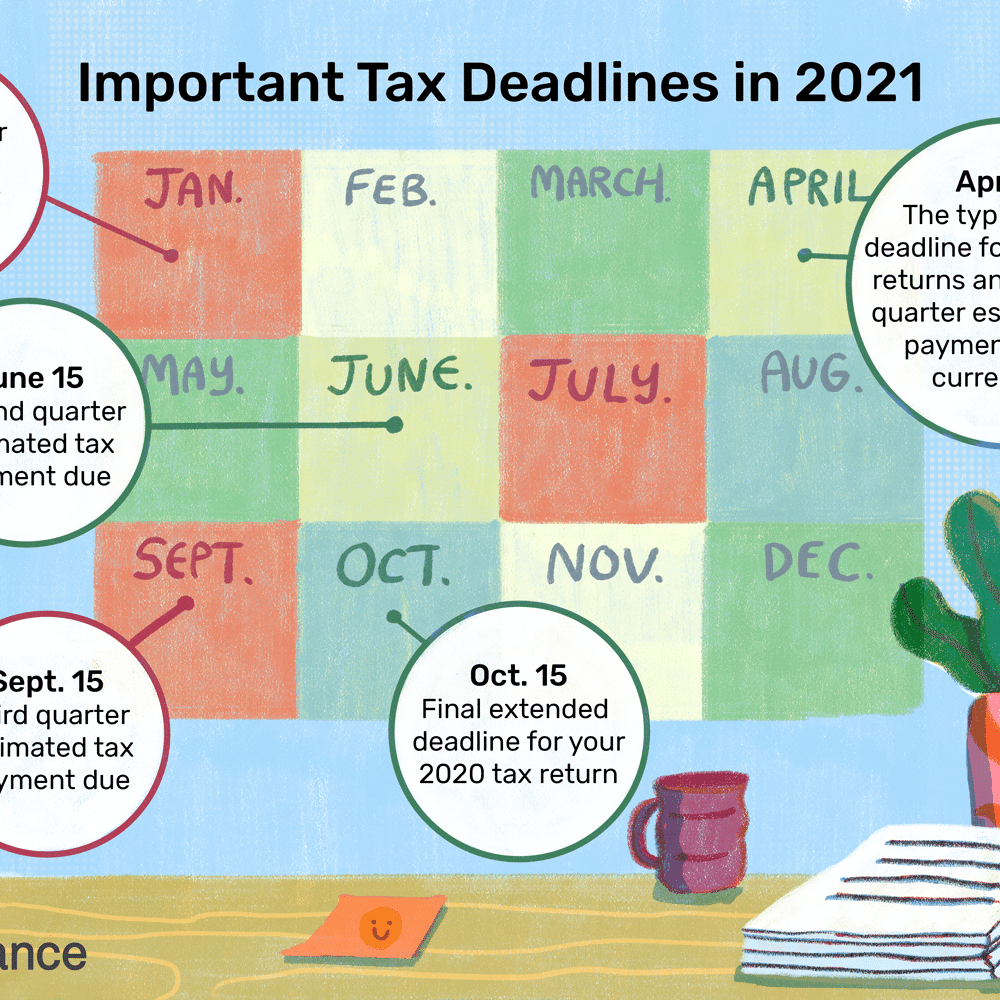

The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021. Due to severe winter storms, the IRS has also extended the tax deadline for residents of Texas, Oklahoma and Louisiana to June 15, 2021.

This extension also applies to 2020 tax payments. Individual taxpayers may defer tax payments until the new filing deadline, interest and penalty free. The new federal tax filing deadline is automatic, so you don’t need to file for an extension unless you need more time to file after May 17, 2021.

If you file for an extension, you’ll have until October 15, 2021 to file your taxes. But, you’ll still need to pay any taxes you owe by May 17.

The new federal tax filing deadline doesn’t apply to 2021 estimated tax payments. First and second quarter estimated tax payment deadlines are still April 15, 2021 and June 15, 2021.

Also Check: What Is Mass Sales Tax

Can I File 2021 If I Didn’t File 2020

Some had wondered early on if they should wait to file 2021 federal income tax return until the 2020 moved through the IRS pipeline. No, the IRS said, you do not have to wait to have your 2020 return processed before you file the 2021 return. But you must take some extra steps if you want to file electronically.

Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

Don’t Miss: What States Do Not Have Sales Taxes

Extensions Of Time To File Tax Returns Some Taxpayers Instantly Qualify

IR-2022-88, April 18, 2022

WASHINGTON Taxpayers requesting an extension will have until Monday, Oct. 17, 2022, to file a return. Not everyone has to ask for more time, however. Disaster victims, taxpayers serving in combat zones and those living abroad automatically have longer to file.

An extension of time to file will also automatically process when taxpayers pay all or part of their taxes electronically by this year’s original due date of April 18, 2022. Although taxpayers can file up to six months later when they have an extension, taxes are still owed by the original due date.

Here’s more about those who get automatic extensions:

What Happens If You Miss The Oct 15 Tax Deadline

Don’t try to go past the Oct. 17 deadline which is technically Oct. 15 but delayed until Oct. 17 this year because the 15th is a Saturday.

If you filed an extension and you dont file your return, your penalty and interest calculations are grandfathered back to the original April 18 due date,” Steber said.

At this point, documents should be in taxpayers’ hands, including W2, 1099s, K-1s for investments in partnerships. Double-check your numbers and information.

Any missing information or mismatched information on IRS systems can be expected to trigger trouble, including the delay of any refund.

Some tax filers figure they can come close to a number, say what they think they received in stimulus cash, and imagine that the IRS will fix it if necessary. But that’s not a good bet, given all the problems the IRS has been facing.

Steber calls some tax troubles “self-inflicted delay” when tax filers don’t provide exact numbers or information.

The IRS noted that taxpayers who are filing now want to avoid mistakes when claiming the earned income tax credit, the child and dependent care credit, the child tax credit and the recovery rebate credit.

“In 2022, the message is clear: You need to be accurate,” Steber said. “There are no simple tax returns in the pandemic.”

Contact Susan Tompor: . Follow her on Twitter tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

Read Also: State Of North Carolina Taxes