How 2022 Sales Taxes Are Calculated In Florida

The state general sales tax rate of Florida is 6%. Florida cities and/or municipalities don’t have a city sales tax.Every 2022 combined rates mentioned above are the results of Florida state rate , the county rate . There is no city sale tax for the Florida cities. There is no special rate for Florida.The Florida’s tax rate may change depending of the type of purchase. Some of the Florida tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Florida website for more sales taxes information.

Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

Daytona Beach Florida Sales Tax Rate

daytona beach Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Daytona Beach, Florida?

The minimum combined 2022 sales tax rate for Daytona Beach, Florida is . This is the total of state, county and city sales tax rates. The Florida sales tax rate is currently %. The County sales tax rate is %. The Daytona Beach sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Florida?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Florida, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Daytona Beach?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Daytona Beach. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Recommended Reading: Montgomery County Texas Tax Office

Florida Sales Tax Nexus

Businesses that operate in the state of Florida have nexus for the purposes of their sales tax returns, and are required to collect sales tax on purchases and file and remit those to the Florida DOR.

An out-of-state business may also create a nexus if it meets any of the following criteria:

- It has one or more employees, agents, or independent contractors who conduct sales or other business activities within the state.

- It has an office or other place of business in Florida.

- It makes sales at retail locations operating in Florida.

- If repairs or alterations are made to any physical property in the state.

- It assembles, installs, or services and repairs products within the state.

- It owns or leases real property, or tangible personal property, within the state.

- It delivers goods to Florida customers via its own truck . Note that this doesnt include freight or common carrier shipments.

- If goods are imported from any other state or country to be sold in Florida.

Out of state businesses who use a drop-shipper who has Florida nexus will find that the drop-shipper is required to collect sales tax. That cost may be passed along to the seller. Check with your drop-shipping companies ahead of time to know how they plan to handle this situation.

Important Information For Pasco Residents

Sales tax is collected by the Florida Department of Revenue and NOT the local tax collector’s office. Pasco County’s sales tax is 7%. Therefore, if you live in Pasco County, your sales tax rate is 7%. If you are unsure of what county you live in, the Department of Revenue has an online tool to help. Please see the link below.

Sales tax has many important purchase implications based on where a person physically lives, especially with the purchase and registration of a vehicle. We at the Pasco Tax Collector’s Office want to be sure you are being charged correctly.

Don’t Miss: When Will I Get My Tax Return

Mobile Homes Travel Trailers And Park Models

Mobile homes – real property

If you own the mobile home and the land, the mobile home is classified as “real property.” If you purchase a mobile home that has already been classified as real property, you are exempt from paying sales tax. If the mobile home has not already been classified as real property, you must pay sales tax on the purchase price. In addition, if you purchase a real property mobile home and remove it from the land, the classification changes to “rental property,” and you must pay sales tax on the purchase price.

Mobile homes – rental property

If you own the mobile home but rent or lease the land, the mobile home is classified as “rental property.” If you purchase a mobile home that sits on rental property, you must pay sales tax on the purchase price. Depending on the circumstances of your purchase, you may be able to reduce the amount of sales tax by completing an Itemized Invoice Affidavit. If you purchased through a licensed dealer, broker, or real estate agent, you must pay sales tax on the full purchase price and cannot use the affidavit.

Travel trailers and park models

If you purchase a travel trailer or park model and rent the land it sits on, you may be able to reduce your sales tax amount by completing an Itemized Invoice Affidavit. The same limitations apply as described above for mobile homes on rental property.

Orlando Florida Sales Tax Rate

orlando Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Orlando, Florida?

The minimum combined 2022 sales tax rate for Orlando, Florida is . This is the total of state, county and city sales tax rates. The Florida sales tax rate is currently %. The County sales tax rate is %. The Orlando sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Florida?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Florida, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Orlando?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Orlando. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Florida and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

You May Like: Sale Of Second Home Tax Treatment

Sales Taxes In The United States

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states do not levy a statewide sales tax.California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the value added tax, a sales tax is imposed only at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.

Texas Local Sales Taxes Part I Vital Services For Two Pennies More

Some of the best things in life arent free. Ask any local government. Many of the services we tend to take for granted police and fire protection, public libraries, weekly trash collection and bus service come at a price, and local sales taxes pay much of the tab.

According to the Advisory Commission on Intergovernmental Relations, the first local sales taxes were enacted in New York City in 1934. Today, 38 states allow these taxes.

Nine of the 10 most populous states have authorized local sales taxes . Among those with local taxes, only Floridas maximum local rate is lower than Texas. The highest local rates typically are levied in major metropolitan areas.

Recommended Reading: Short-term Rental Tax Loophole

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Car Sales Tax For Trade

The value of your trade-in vehicle is not subject to sales tax. Imagine that you receive $7,000 for your trade-in. You then apply the $7,000 credit to a $14,000 new car purchase. The trade-in credit reduces the cost of your new car to $7,000. In this case, you then pay sales tax on the $7,000 new vehicle price.

Recommended Reading: California Tax On Capital Gains

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Recommended Reading: Which States Do Not Tax Pension

Polk County Florida Sales Tax Rate 2022up To 75%

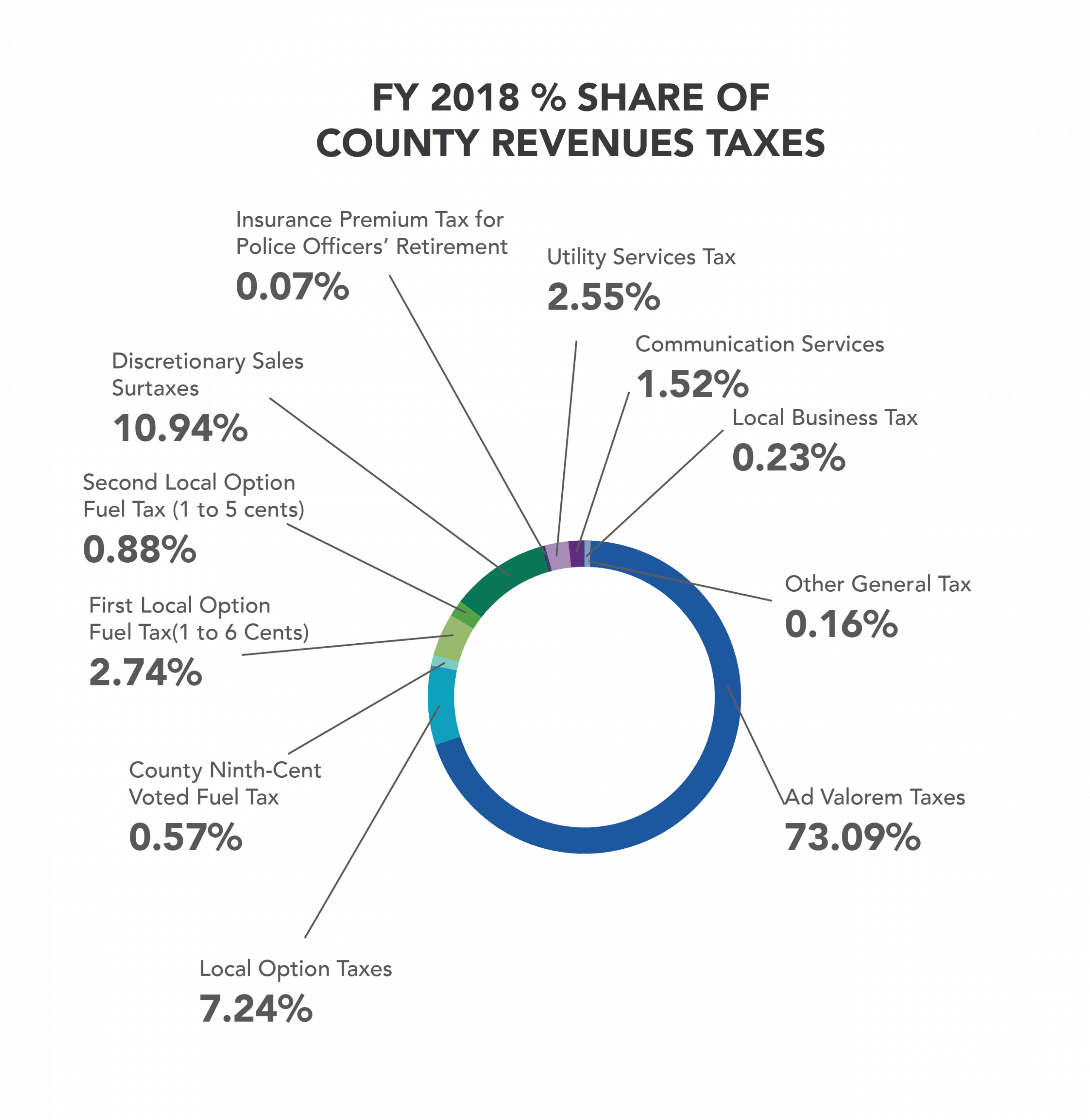

A county-wide sales tax rate of 1% is applicable to localities in Polk County, in addition to the 6% Florida sales tax.

Here’s how Polk County’s maximum sales tax rate of 7.5% compares to other counties around the United States:

- Higher maximum sales tax thanany otherFlorida counties

- Higher maximum sales tax than53% ofcounties nationwide

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

Read Also: File My State Taxes For Free

Improve Accuracy With Rates Based On Address

Look up the current rate for a specific address using the same technology that powers the Avalara AvaTax rate calculation engine.

Why can’t I just use the ZIP code?

- There are often multiple sales tax rates per ZIP code, county, and city.

- ZIP codes often overlap, or become subsets of other ZIP codes, or represent no geographic region at all.

- ZIP codes aren’t stable. In any given year, the USPS makes numerous boundary changes to ZIP code areas.

For the most accurate sales tax rate, use an exact street address.

Tax Rates By City In Orange County Florida

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Florida has a 6% sales tax and Orange County collects an additional 0.5%, so the minimum sales tax rate in Orange County is 6.5% . This table shows the total sales tax rates for all cities and towns in Orange County, including all local taxes.

| City |

|---|

Don’t Miss: States With Highest Sales Tax

Other Taxes & Fees For Florida

Car buyers will pay other taxes and fees in addition to the sales tax in Florida. The other fees and taxes are collected by the Department of Motor Vehicles. Other car-buying fees for Florida include:

- DMV Fee: The average DMV fee for a new car purchase in Florida is $181. The DMV fees include the following:

- Plate Transfer Fee: $7.85

- Registration Fee: $1.60 to $91.20.

Taxes In Florida Explained

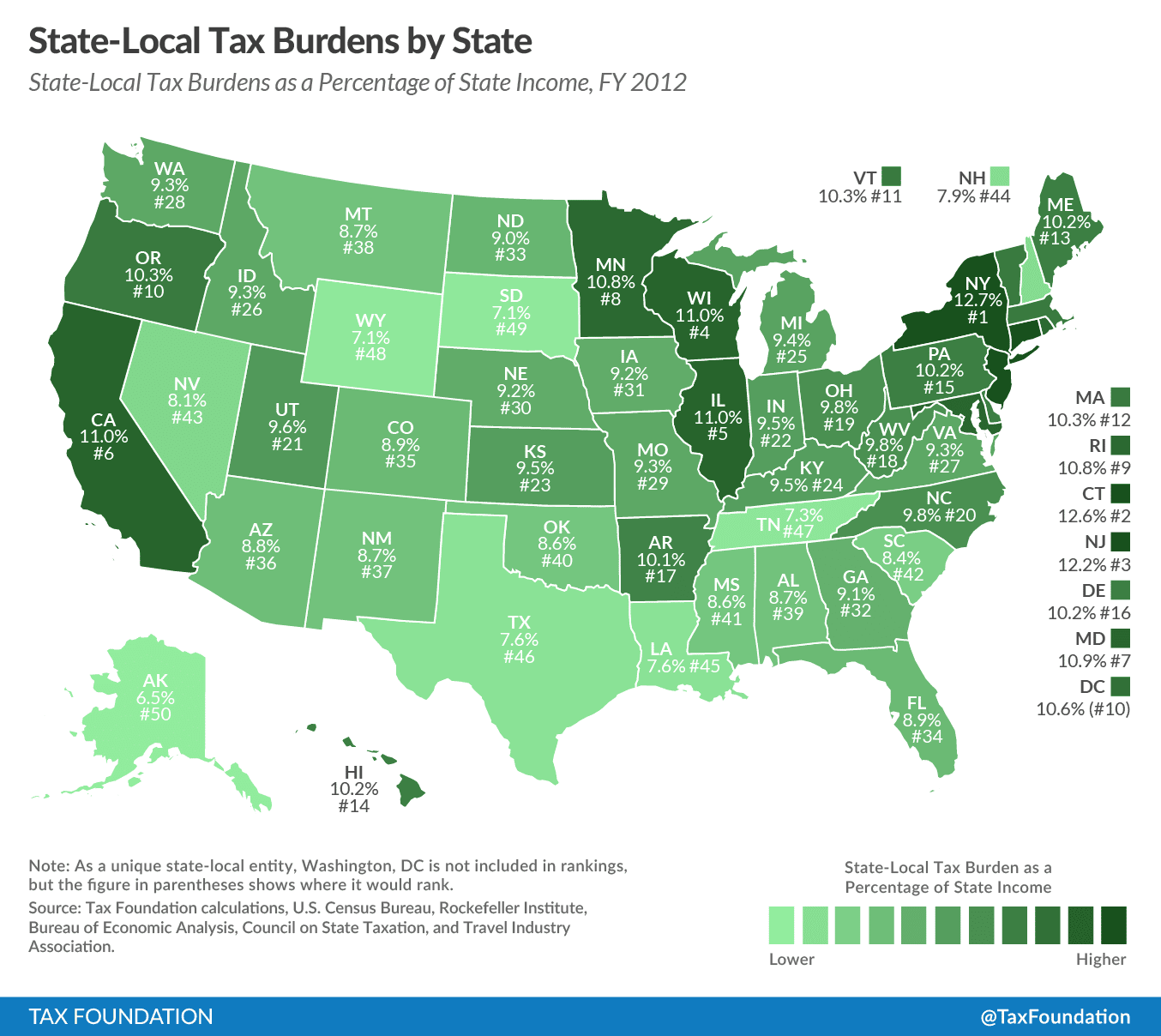

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

You May Like: Look Up State Tax Id Number

Florida Sales Tax Rates By City

The state sales tax rate in Florida is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 7.500%.

Florida has recent rate changes .

Select the Florida city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Florida was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Florida Sales Tax Deadlines

Monthly: Due on the 1st day of the month and late after the 20th day of the month following the collection period. For example, if the sale took place during January, then tax is due on the 1st of February and late after the 20th.

Quarterly: Due on the 1st and late after the 20th day of the month following the collection period. For example, if the sale took place during April, then tax is due on the 1st of July and late after the 20th.

Semiannually: Due on the 1st and late after the 20th day of the month following the collection period. For example, if the sale took place during April, then tax is due on the 1st of July and late after the 20th.

Annually: Due on the 1st and late after the 20th day of the month following the collection period. For example, if the sale took place during April, then tax is due on the 1st of January of the following year and late after the 20th.

All electronic payments must be submitted by 5:00PM on day of collection, which allows for 1-2 days processing time. Note that this is BEFORE the due date.

If the 20th falls on a weekend or federal or state holiday, then returns will be considered late as of the next business day.

Recommended Reading: When Are Llc Taxes Due

How To Calculate Florida Sales Tax On A Car

Find the sales tax percentage for your location, as this may increase the total sales tax fee to over the base amount of 6%. Then, youll multiply the cost of the vehicle by the sales tax percentage.

Lets say in your location the sales tax is at the base of 6%. Imagine you purchased a vehicle from a trade-in. The full price was $30,000, but you received a trade-in value of $5,000, a manufacturers rebate of $500, and a dealer incentive of $1,000. You would pay $23,500 for the vehicle.

In this case, Florida collects a 6% sales tax on $24,000. $24,000 is the advertised price minus the dealer incentive and trade-in allowance. This price does not factor in the manufacturers rebate. Based on this example, you would need to pay $1,440 in sales tax.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.