When Are Taxes Due This Year

Federal tax returns for 2021 are due this year on Friday, April 18, 2022. Residents of Massachusetts and Maine get an extra day — their tax returns are due April 19 because they celebrate Patriots’ Day on April 18.

Some taxpayers in Colorado, Kentucky, Illinois and Tennessee who live in areas affected by natural disasters have an extended tax filing deadline of May 16. You can see which counties are included in the extension on the IRS disaster relief page.

Unlike last year, filing deadlines were not extended in 2022 due to the COVID-19 pandemic. We’ll keep you updated if tax deadlines change at all this year.

Is It Worth It

For those who qualify for free filing, H& R Block Online deserves to be on the shortlist. It is a premium software, but the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors and gig workers.However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

Fantastic Service Quick Efficient Quality And Reassuring

This app is extremely user friendly. It walks you through literally every scenario. If you don’t understand something, you can click on a link below what you’re looking at for more information. If you still have questions there is another section of frequently asked questions. If you Still need assistance there is a chat available with many options, as well as chatting with a live person. Beyond that if you still have questions you’re able to email, message, chat with or speak with a live Professional Tax Return representative. The customer service is amazing, efficient, friendly, professional and prompt service.The price is affordable and fair. I saved a ton of time, money and stress by being able to use this app and self service but with the Peace of Mind knowing that not only the system looked over my work, but that it was double checked by a live human being. And I have the reassurance of knowing H& R Block has my back if any issues arise or if there’s any type of IRS audit. Just an overall exceptional service.

Recommended Reading: Payroll Tax Deposit Due Dates 2022

Is It Safe And Secure

Tax Prep companies are valuable targets for hackers seeking personal information. H& R Block uses encryption, multi-factor authentication, and web-browsing encryption to keep users financial information safe. However, the company is not perfect. In 2019, the company suffered a data breach in which some customer information was leaked.

What If Im Under 18 And Want To Take The Course

You must be at least 18 years of age at the time of enrollment of the H& R Block Income Tax Course.

You May Like: What Is Tax Filing Deadline

Does H& r Block Make Tax Filing Easy In 2022

H& R Block uses sensible workflows to help filers complete their tax returns with minimal pain. The questionnaires, guided software, and navigation bars all help users understand what theyve done, and how much more remains. The built-in calculators, simple language, and robust import options make tax filing straightforward for most filers.Claiming common credits like the Earned Income Tax Credit , the Child Tax Credit, and the American Opportunity Tax Credit was all easy to do. The software also made it easy to square away pre-refunded credits and pre-paid taxes .Testing revealed only a few drawbacks. First, self-employed people need to determine their maximum retirement account contributions on their own. Second, the limited brokerage and crypto integrations make the software somewhat difficult to use for active traders.

File Your Taxes For Free

If you use tax software or a tax program online, you have the option to file your taxes for free. There are many programs offered by companies like H& R Block that provide this option alongside their other services.

You should always file electronically because its the only way you can file without paying a fee. Paper filing incurs a fee from the IRS, which rises most years.

Filing electronically also means your tax return is likely to be accepted faster. But before you get to this stage, you need to go through the process of filing your taxes.

Read Also: Small Business Income Tax Calculator

Local Nonprofit Partner: Cash Oregon

Through our Safety Net Fund we partner with local nonprofits to help provide free tax preparation services for families throughout our region. For free tax preparation services in Oregon, connect with Metropolitan Family Services CASH Oregon.Program requirements include:

- Your household income is below $57,500

- You dont own rental properties.

- Adjustments on education expenses

- Self-employed income with any of the following ($35K in expenses, a loss for the year, invetory, employees, depreciation or amortization or business use of the home.

File A Tax Return Without Paying A Dime

If you have a simple tax return, H& R Block has a service that allows you to file both a federal and state tax return at no cost. The free software also allows you to file Schedules 1 and 3 with your 1040.

As a quick refresher, Form 1040 is the individual tax return form filers use. Schedule 1, meanwhile, allows taxpayers to report adjustments to income that cant be entered directly on Form 1040 , while Schedule 3 lets you claim additional tax credits and payments.

The latter is important, because this year, a lot of people may seek to claim tax credits like the Earned Income Tax Credit or Child Tax Credit. While the Child Tax Credit was partially paid in monthly installments last year, recipients will need to claim the remainder this year.

Recommended Reading: Sc State Tax Refund Status

Don’t Miss: Credit Karma Tax Return 2020

About H& r Block Tax Service

Founded in 1955, H& R Block has grown to become one of the largest retail tax firms in the U.S. and has completed more than 800 million tax returns in its existence. The company employs more than 60,000 tax professionals who must take at least 60 hours of training and pass a rigorous certification program. The typical H& R Block tax pro has about 10 years of experience and can help customers either online or at one of the companys retail locations in all 50 states and U.S. territories, and on U.S. military bases around the world. For no-contact help, you can drop off your tax information at one of its offices without making an appointment.

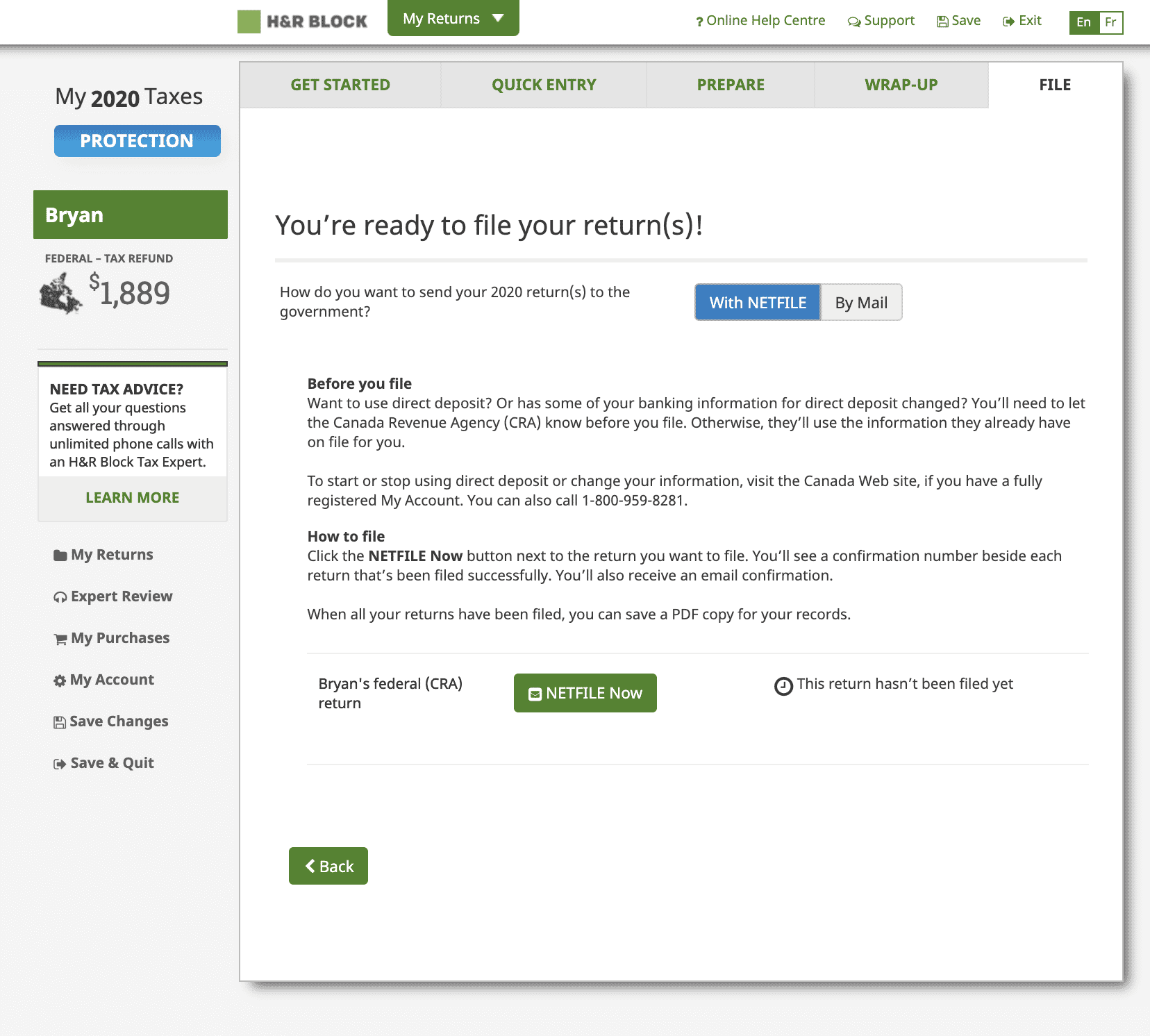

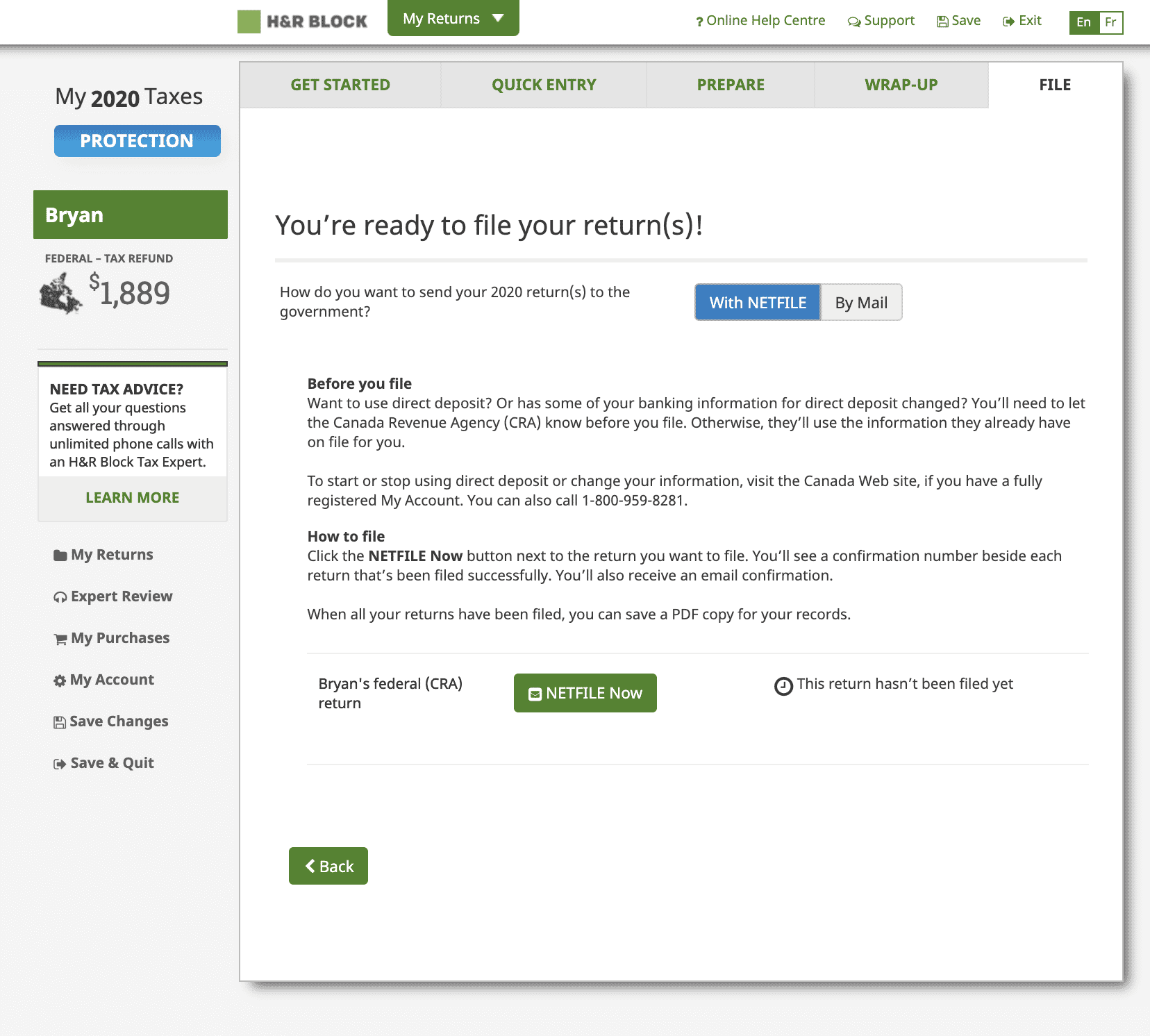

Taxpayers can also prepare returns by logging in online or downloading tax-prep software. Each of the four online-filing programs walk you through a simple interview-style interface, where you answer questions about your tax situation. The program enters your information on the appropriate tax forms accordingly.

What Are The Course Attendance Policies

Our general attendance requirements state that participants cannot miss or fail to complete more than 8 hours of any of the instructor-led sessions. All self-study online training sessions must be completed to complete the course successfully. The class attendance requirement may vary based on the specific state where the class is held.

Don’t Miss: File Taxes With Credit Karma

Diy Tax Options For Expats

Last tax season, H& R Block debuted a package designed specifically for US citizens living abroad.

A federal return covering simple employment income costs $99, and a federal return covering investment and self-employment income runs $149. State returns are an additional $99 each. Reporting of non-US bank and financial accounts is an extra $49.

There’s also an option to file with a tax advisor, starting at $199 per federal return.

H& R Block may be most recognized for its offices scattered throughout the US, but the company offers online filing and downloadable computer software, too. If you choose an online package, you can work on your taxes with the mobile app for Android and iOS devices.

H& R Block caters to the vast majority of tax filers with a modern and easy-to-navigate interface. Like other tax-preparation services, the platform walks users through a series of questions about their household, income, and opportunities for deductions and .

In addition to answering these questions, you’ll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or inbox.

If you’re concerned about making mistakes, missing deductions, or getting lost amidst the tax forms, H& R Block can connect you with a professional in its network for an additional fee.

Can I File My Taxes For Free What’s The Catch

There are two main ways to file your taxes for free. The first is through the IRS’ “File Free” program, which includes private companies that provide their services for free in partnership with the IRS. To qualify, you need to earn less than $72,000 in adjusted gross income.

The second is through the free programs of non-alliance members, like Intuit’s TurboTax and H& R Block. These private services offer free products for those with simple filing situations, and as long as you don’t have complications like investment income or rental property income, you can stick with the free products all the way through filing.

Note, however, that Intuit and other companies will often try to upsell you on other products throughout the process. Before signing up for a higher-tier product you hadn’t planned on, make sure you really need it.

You May Like: Do You Have To Pay Taxes On Life Insurance

What Are H& R Blocks Different Products

H& R Block offers four different online products: Free Online, Deluxe, Premium and Self-Employed, which range from $0 to $85. The decision on which is best for you depends mostly on the deductions and tax credits you want to claim.

Free in-person audit support is offered with all H& R Block tax plans, and enhanced Worry-Free Audit Support, including IRS communication and in-person audit representation, can be added to any plan for $20. H& R Blocks Online Assist feature additional virtual support with live assistance and screen-sharing can also be purchased on top of any of the plans for either $40 more for Basic or Deluxe, or $60 for Premium or Self-Employed. Tax Identity Shield proactive protection against tax identity theft can be added to any plan for another $20.

Recommended Reading: Wheres My Tax Credit

Will H& r Block’s Free Service Work For You

H& R Block’s free software is suitable for a lot of people. If you don’t have income to report outside of your salary, then you should be all set to opt for the free version. This holds true even if you have some tax credits to claim or reconcile.

But once your tax situation gets more complex, the free software becomes less viable. You may need to upgrade to a tax-filing software package that will cost you if any of these things apply to you:

- You want to itemize your deductions on your tax return rather than claim the standard deduction .

- You worked as a freelancer and have numerous business expenses to report and deduct.

- You own income properties and have rental income and expenses to reconcile.

- You own a small business.

- You had a lot of activity in your brokerage account, such as if you sold stocks or cryptocurrency.

- You contributed to a health savings account in 2021.

Another thing you should know is H& R Block’s free software will not give you access to live help. If you need support filing your taxes, you’ll need to prepare to upgrade to a different software.

But that doesn’t necessarily mean you’ll pay a fortune. H& R Block offers its Deluxe Online software starting at $29.99, and it provides many capabilities its free version doesn’t.

Also Check: Best Place To Do Your Taxes

No Matter How You File Block Has Your Back

What You Get From H& r Block’s Free Version

Like the free tax software from most of its competitors, H& R Block Free lets you file Form 1040, take the earned income tax credit and reconcile your advanced child tax credit. It can handle unemployment income and help you to claim a missing stimulus payment.

H& R Blocks free version also lets you file schedules 1 and 3 of Form 1040, which is a big bonus because many taxpayers need to file those forms to report things such as deductible student loan interest, certain retirement contributions, alimony, the lifetime learning credit and the savers credit. You may need to upgrade if you don’t know how much to claim for those things and want the software to calculate it for you.

While H& R Block’s free version has expanded capabilities, if you plan to itemize deductions, were a landlord, freelanced, sold cryptocurrency, contributed to an HSA, ran a small business or had any other situations going on, youll probably need to upgrade to one of H& R Blocks paid packages.

Read Also: Where Cani Get Tax Forms

Products Offered By H& r Block

H& R Block offers four online tax-filing options: Free Online, Deluxe, Premium and Self-Employed.

- Free Online: Like other major tax-filing services, H& R Blocks Free Online version allows you to file a basic Form 1040 and take several common tax breaks such as the standard deduction, earned income tax credit, education credits and additional child tax credit. But H& R Blocks free version is better than most because it can also handle unemployment income, bank interest and dividends income, student loan interest, and schedules 1 and 3 for a total of 39 tax forms in all.

- Deluxe: You may need to upgrade to the Deluxe version if you want to itemize deductions on Schedule A, you contributed to a health savings account in 2021, or you had child and dependent care expenses.

- Premium: The Premium version which includes everything in Deluxe is a good choice for investors and landlords who need to file a Schedule D or E or have K-1s.

- Self-Employed: Freelancers and gig workers can report self-employment income on Schedule C using the Deluxe or Premium editions. However, small-business owners will need to upgrade to the Self-Employed version if they want to claim business expenses and report all business deductions and asset depreciation.

How H& r Block Compares

Promotion: NerdWallet users get 25% off federal and state filing costs. |

|

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Recommended Reading: File State And Federal Taxes For Free