Unmarried Or Considered Unmarried

To be eligible for the head of household filing status, a taxpayer must be unmarried or “considered unmarried”. A person is unmarried as long as they are not legally married on the last day of the tax year. People who were legally married on the last day of the tax year can still be eligible for the head of household filing status if they satisfy several requirements that enable them to be “considered unmarried”. To be considered unmarried, all of the following conditions must be met:

A taxpayer may also be considered unmarried for head of household purposes if their spouse is a nonresident alien and the taxpayer does not elect to treat the spouse as a resident alien. In that case, the taxpayer can file as a head of household while still being considered married for purposes of the earned income tax credit.

Does My Child Qualify For The Eitc

If you claim children as part of your EITC, they must pass three tests to be a qualifying child:

What Is The Difference Between Single And Head Of Household On Taxes

Filing single and filing as head of household come with different standard deductions, qualifications and tax brackets. You qualify as single if youre unmarried, while you qualify as head of household if you have a qualifying child or relative living with you and you pay more than half the costs of your home.

Don’t Miss: How To Know If You Owe Taxes

What Is The Head Of Household Tax Bracket

Head of household tax brackets are often misunderstood. The head of household bracket is the same as it is for

The head of household tax bracket is generally lower than the tax bracket for married taxpayers filing jointly.

This is because head of household taxpayers are typically single parents who bear the brunt of the financial responsibility for their children

When Are You Considered ‘unmarried’

Well if you’ve never been married, you’re considered unmarried. You did it!

The nuances come when you are recently divorced or separated from your spouse. At what point do you become an unmarried person in the eyes of the IRS?

Your status as an unmarried person is determined on the final day of the tax year. You’ll need to be divorced or separated by then. If still technically married, you can count as unmarried if you lived in your home separately from your spouse for at least the last six months of the tax year. Don’t try to use this as a work-around if you plan on staying married, though: your spouse is still considered as living with you if they’re out of the house at that time for work, school, vacation or military service.

In being considered unmarried, you will have to file separately from your spouse even if still legally married, though this alone won’t get you head of the household status.

You May Like: What Is Form 5498 For Taxes

Assertion In Bankruptcy Of Eitc And Head Of Household

The intersection of the EITC and head of household status comes into play generally as a confirmationissue or objection to IRS proofs of claim in chapter 13 cases. In chapter 7 cases, EITCs are contested as to whether arefund based on an EITC is property of the estate.

For example, in In re Cobb, 216 B.R. 676 , the debtors were required to file taxreturns in accordance with local rules that required them to file all state and federal tax returns as a condition ofconfirmation. The debtors responded to the court’s order requiring them to file their delinquent returns by arguingthat the IRS had not proven the debtors were required to file the returns. Id. Although entitlement to EITC or headof household was not the issue in Cobb, preparation of the tax returns was. In the context of a plan confirmationhearing, submission of tax returns that assert EITC or head of household status as a condition of confirmation7 willsubject the returns to higher scrutiny now that the IRS has made a focal point of tax compliance properdocumentation of EITC and head of household status.

Children Born Or Newly Added To Your Family In 2021

Last years monthly Child Tax Credit payments were based on your 2019 or 2020 tax returns, which did not include any children born or newly added to your family in 2021.

However, a child born or added to your family in 2021 can be a qualifying child for the full 2021 Child Tax Credit, even if you did not receive monthly Child Tax Credit payments in 2021. You will receive the full amount of the Child Tax Credit that you are eligible for when you file your 2021 tax return.

Read Also: Is Gross Before Taxes Or After

Can I File As Head Of Household If I Live With My Significant Other

If you both are unmarried and have children from previous relationships, each of you can file as heads of household as long as youre adhering to the IRS guidelines .

If you have a child together, only one of you can claim HOH status with that child in mind

In the case where only one of you has a child from a previous relationship, the biological parent can claim HOH status and the other can claim single status. But if the biological parent doesnt work outside the home, the earning partner could claim HOH status. In order to claim both the child and non-earning partner as qualifying dependents, the following would have to be true:

- You provided more than half of their total support for the year.

- They lived with you legally as members of your household for the entire year.

- Neither had a gross income that exceeds $4,300.

- Neither is someones qualifying child.

When You Will Get Your Refund

The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Where’s My Refund? or the IRS2Go mobile app to check your refund status.

Also Check: How To Avoid Paying Taxes On Crypto

Single Vs Head Of Household

If youre unmarried and have a dependent child, you may file as head of household. This gets you a lower tax rate and a higher standard deduction than if you file as single.

To qualify, you must have paid more than half the cost of maintaining your home for the year. This includes rent or mortgage payments, property taxes, insurance, utilities, and other expenses.

You must also have had a dependent child living with you for at least half the year. The child can be your biological child, stepchild, foster child, sibling, or any other relative who meets the IRS definition of a dependent.

If you dont meet the criteria for head of household, youll have to file as single.

How Do I Claim The Eitc

To claim the EITC, you must file a tax return. If you are claiming a child for the EITC, you also need to submit Schedule EIC.

Going to a paid tax preparer is expensive and reduces the amount of your tax refund. Luckily, there are free options available. You can visit a Volunteer Income Tax Assistance site or GetYourRefund.org to have IRS-certified volunteers accurately file your taxes for free. You can also visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

You May Like: Do I Need To Report Cryptocurrency On My Taxes

Earned Income And Earned Income Tax Credit Tables

To claim the Earned Income Tax Credit , you must have what qualifies as and meet certain adjusted gross income and credit limits for the current, previous and upcoming tax years.

Use the to look up maximum credit amounts by tax year.

If you are unsure if you can claim the EITC, use the EITC Qualification Assistant.

Tax Brackets For Head Of Household

One of the biggest tax perks for those who qualify for head of the household status is that you get a significant change in the first couple of tax brackets. This greatly impacts how much you pay in taxes for how much you make.

Someone filing as a single person after 2019 in the lowest tax bracket would be taxed 10% on taxable income of $0-$9,700. But if you’ve qualified for head of household, the income is $0-$13,850.

The second bracket, which gets taxed 12%, goes up to $52,850 for the head of household. In doing this, those with dependents are rewarded with lower taxes than someone without a dependent. A single person making $60,000 a year would pay $9,058.16 in taxes in a given year. The head of the household on that salary would pay $7,637.66.

Here are all the most relevant federal tax brackets for the head of the household for you, ie the tax rates for taxes due on April 15, 2020:

| Tax Rate< br> |

|---|

|

$518,401+ |

Also Check: What States Don T Have Sales Tax

How To Determine Whether A Child Qualifies

Most children under the age of 18 are qualifying children for the 2021 Child Tax Credit. This means that a parent or guardian is eligible to claim them for purposes of the Child Tax Credit.

For your children to qualify you for a Child Tax Credit, they must:

The IRS has provided detailed information on other, less common factors that may impact whether a child is a qualifying child for the Child Tax Credit.

Who Is A Qualified Dependent

You must have a dependent to qualify for head of the household status, but not every dependent allows you to qualify.

Biological children, stepchildren, adopted children, foster children, grandchildren, siblings, step-siblings, and half-siblings can all fall under the umbrella of children that are qualified dependents. They’ll also need to be younger than you unless they have a permanent total disability. They are also qualified if they are 19 or younger at the end of the tax year, or 24 and under if they are a student. They must have lived with you for more than half of the year, provided less than half of their own financial support that year, and are unable to file a joint return that year.

In addition, if your child is married and you are eligible for an exemption for them, you could also qualify.

What about qualified relatives who aren’t children? Your children may be considered a qualified relative if they aren’t a qualifying child. A non-student over the age of 19 or your child over 24 can still qualify if other standards are met. Other relatives, from siblings to parents to grandparents, can be qualified relatives as well, and some aren’t even required to live with you.

For them to be a qualified relative, you need to provide more than half of their support per what the IRS considers support, and as of 2019, their gross income cannot exceed $4,200.

Also Check: H& r Block Tax Identity Shield

Tax Rate Changes Indexed For Inflation

| If the Missouri taxable income is… | The tax is… |

| At least $112 but not over $1,121 | 1.5% of the Missouri taxable income |

| Over $1,121 but not over $2,242 | $17 plus 2.0% of excess over $1,121 |

| Over $2,242 but not over $3,363 | $39 plus 2.5% of excess over $2,242 |

| Over $3,363 but not over $4,484 | $67 plus 3.0% of excess over $3,363 |

| Over $4,484 but not over $5,605 | $101 plus 3.5% of excess over $4,484 |

| Over $5,605 but not over $6,726 | $140 plus 4.0% of excess over $5,605 |

| Over $6,726 but not over $7,847 | $185 plus 4.5% of excess over $6,726 |

| Over $7,847 but not over $8,968 | $235 plus 5.0% of excess over $7,847 |

| Over $8,968 | $291 plus 5.3% of excess over $8,968 |

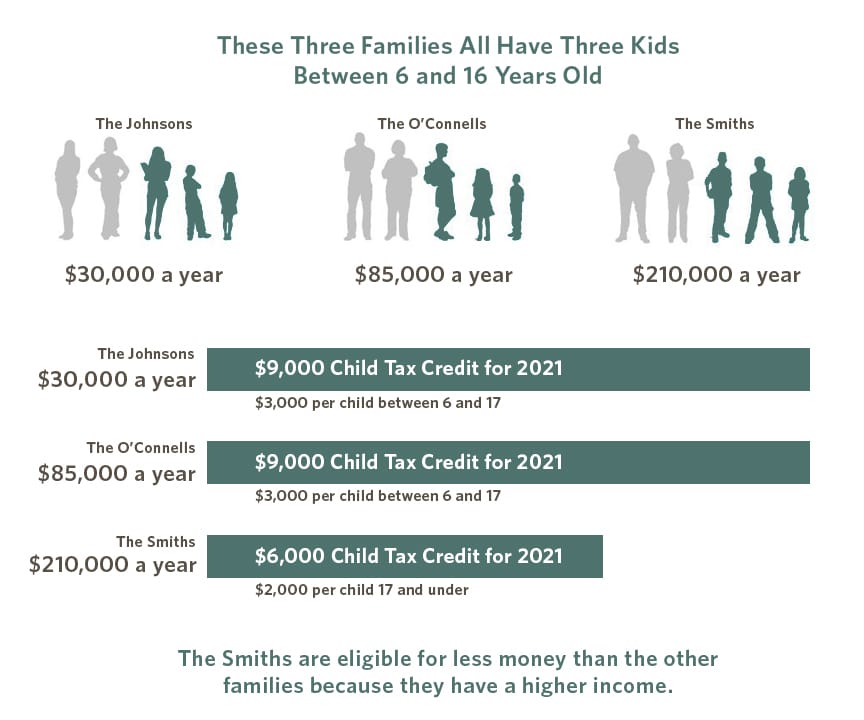

The Child Tax Credit: What’s Changing In 2022

For the 2021 tax year, parents got some extra help from the government in the form of an enhanced child tax credit that expanded eligibility for the credit along with the maximum amount people could receive.

Now that the tax season is behind us, you might be wondering whatâs happening with the child tax credit in 2022. The enhanced child tax credit expired at the end of December. Unless Congress takes action, the 2020 tax credit rules apply in 2022. Hereâs an overview of what to know.

Read Also: How To Pay Doordash Tax

A Better Tax Rate And Higher Deductions Are Two Benefits

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

There is no tax filing status that confuses taxpayers more than the one called “head of household.” When you hear the term, what comes to mind? The breadwinner? The main source of household income? To the Internal Revenue Service , it’s not that simple. To qualify for head of household, you must pay for more than 50% of household expenses, be unmarried, and live with a dependent, whom you support for more than half the year.

What Are The Qualifications For Filing As Head Of Household

Filing as head of household gives you a higher standard deduction and lower tax rate than filing as a single person or as married filing separately, so naturally some qualifications must be met:

- You must be single or have been separated for at least the last half the year.

- You must have a qualifying dependent living with you at least half the year .

- You must have paid more than half the maintenance costs for the home where you and the dependent lived.

The qualifying dependent can be a child or relative, and if its your parent, he or she doesnt have to live with you for you to claim the head of household status. See Claiming a Parent as a Dependent.

Also Check: What Percentage Is Self Employment Tax

Residents Of Puerto Rico

Because of the American Rescue Plan signed by President Biden in March 2021, bona fide residents of Puerto Rico are eligible to receive the same expanded Child Tax Credit as residents of the 50 States or the District of Columbia$3,600 per qualifying child under age 6 and $3,000 per qualifying child age 6 to 17. This change removed the previous requirement that a resident of Puerto Rico have at least three qualifying children to be eligible for the Child Tax Credit. Bona fide residents of Puerto Rico now need only one qualifying child to claim the Child Tax Credit.

Residents of Puerto Rico were not eligible to receive advance monthly payments of the Child Tax Credit in 2021. Instead, residents will be able to receive the full amount of Child Tax Credit they are eligible for by filing a 2021 U.S. federal income tax return during the 2022 tax filing season.

Guide To Filing Taxes As Head Of Household

OVERVIEW

The Head of Household Filing Status typically allows for a more generous tax situation to unmarried taxpayers who maintain a home for a qualifying person, such as a child or family relative.

Apple Podcasts | Spotify | iHeartRadio

|

Key Takeaways Head of Household filing status offers more generous tax brackets and standard deduction than filing single when maintaining a home for a qualifying person Qualifying persons can include a child or other dependent who meets certain eligibility criteria Heads of Household must pay more than half of the cost of keeping up a household and be considered unmarried on the last day of the year Can provide for higher income limits for certain tax credits |

Don’t Miss: How Much In Taxes Do I Owe